Brazil Pouch Packaging Market Size, Share, By Material (Plastic, Paper, Aluminium), By Product (Flat (Pillow & Side-Seal), Stand-up), By End-User Industry (Food, Beverage, Medical and Pharmaceutical, Personal Care and Household Care, Other), Brazil Pouch Packaging Market Insights, Industry Trend, Forecasts to 2035

Industry: Consumer GoodsBrazil Pouch Packaging Market Size Insights Forecasts to 2035

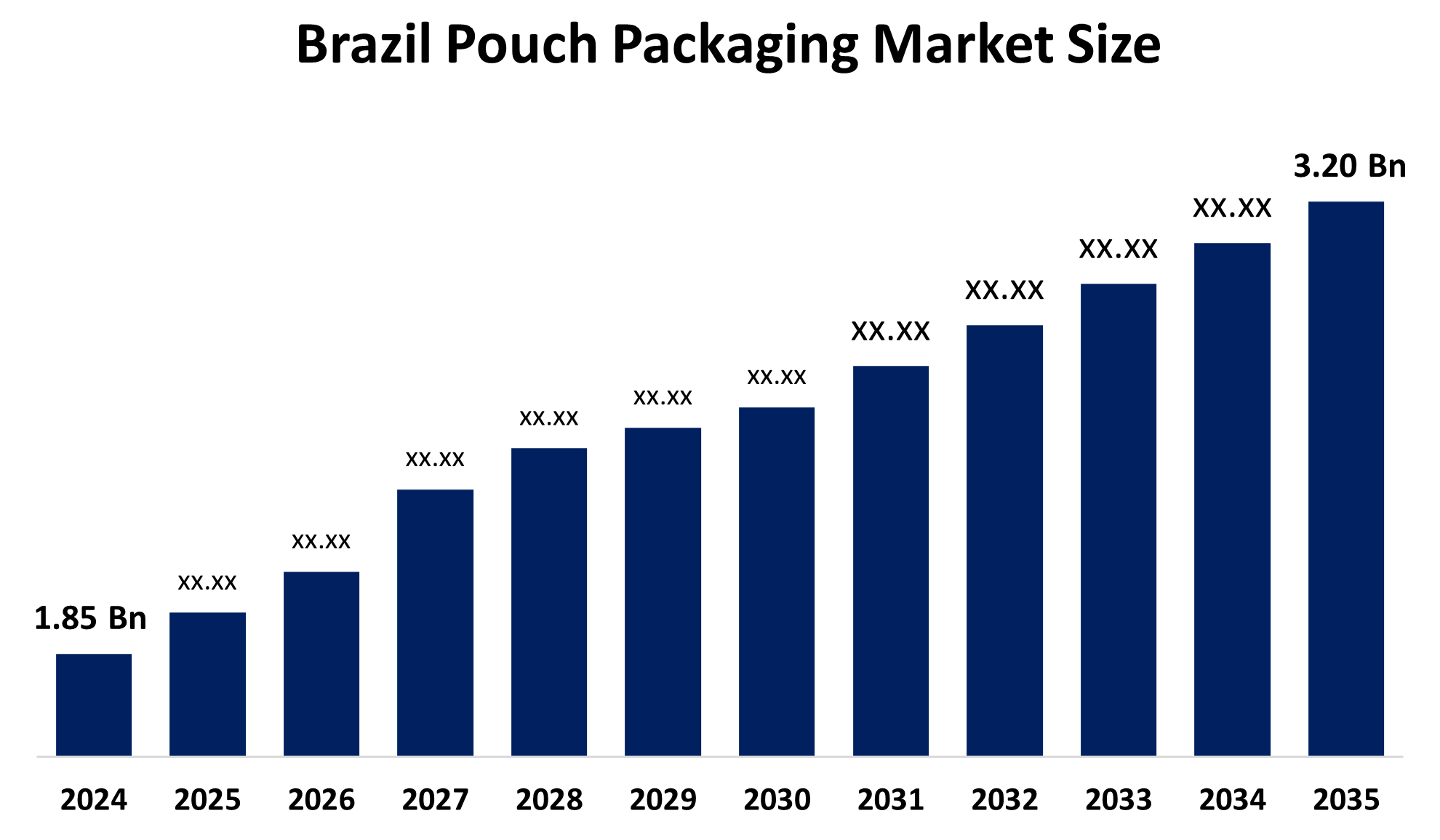

- Brazil Pouch Packaging Market Size 2024: USD 1.85 Bn

- Brazil Pouch Packaging Market Size 2035: USD 3.20 Bn

- Brazil Pouch Packaging Market CAGR 2024: 5.11%

- Brazil Pouch Packaging Market Segments: Material, Product, and End User Industry.

Get more details on this report -

Pouch packaging is one of the flexible packaging solutions, which can be made of such materials as plastic, paper, aluminium foil, or laminates and be used for packing liquids, powders, and solid products. It is a light, cheap, and space-saving pack that provides excellent barrier protection. Tagged with features like resealable zippers and spouts, the pouch packaging gains in convenience, product safety, shelf appeal, and shelf-life extension. Besides that, the Brazil Pouch Packaging Market Size is expanding due to factors such as rising demand for convenient food and beverage packaging, growing e-commerce, busy urban lifestyles, preference for lightweight and cheap packs, longer shelf-life benefits, improved product visibility, and an increasing adoption of sustainable and recyclable packaging solutions.

Introduction of new technologies in printing and design is a great factor in the attractiveness of pouch packaging. In Brazil, companies are opting more and more for advanced digital printing, attractive graphics, bright colors, and interactive designs to get noticed on the shelf. Personalized and short-run printing allows fast startups of seasonal or limited-edition products. Moreover, better printing technologies give a way to less production waste, thus supporting the environment, while at the same time, they provide more room for creativity in packaging and stronger customer relationships.

The food and beverage sector in Brazil is one of the major sources of pouch packaging. Flexible pouches are popular for snack foods, dairy products, frozen foods, sauces, and juices. Consumer consumption of products in pouches is being preferred to that in rigid packaging by the addition of convenience features such as zippers, spouts, and resealable closures. Besides this, pouches provide longer shelf life and excellent product protection and hence are appropriate for various food categories, thus being the reason for the market demand increase.

The fast development of e-commerce in Brazil is positively impacting the demand for lightweight and durable packaging formats such as pouches. Flexible pouches are a good way of lowering the shipping costs since they are small in size and light in weight. At the same time, these pouches are quite strong and reliable in protecting the products against tampering and contamination during delivery. Consequently, companies are embracing pouches as a means to enhance their environmental credentials, reduce logistics costs, and enable the smooth running of contemporary supply chains.

Market Dynamics of the Brazil Pouch Packaging Market:

The Brazil Pouch Packaging Market Size is driven by rising demand for convenient and portable packaging, especially in the food and beverage sector. The growth of e-commerce is increasing the need for lightweight, durable, and cost-effective packaging solutions. Changing consumer lifestyles, urbanization, and preference for resealable and easy-to-use packs support market growth. Technological advancements in printing and pouch design enhance shelf appeal and branding. In addition, increasing focus on sustainability, material reduction, and recyclable packaging formats is encouraging manufacturers to adopt flexible pouch packaging across multiple industries.

The Brazil Pouch Packaging Market Size faces restraints due to environmental concerns related to plastic waste and limited recycling infrastructure for multilayer pouches. Fluctuating raw material prices increase production costs for manufacturers. In addition, strict regulations on food packaging materials and competition from traditional rigid packaging can slow market adoption and expansion.

The Brazil Pouch Packaging Market Size presents strong opportunities driven by growing demand for sustainable and recyclable packaging solutions. Rising adoption of mono-material pouches and bio-based materials can help address environmental concerns. Expansion of e-commerce and ready-to-eat food consumption creates demand for lightweight, durable, and convenient packaging. Technological advancements in digital printing enable product customization and brand differentiation. Additionally, increasing use of pouches in pharmaceuticals, personal care, and household products offers new growth avenues for manufacturers across Brazil.

Brazil Pouch Packaging Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 1.85 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 5.11% |

| 2035 Value Projection: | USD 3.20 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 195 |

| Tables, Charts & Figures: | 102 |

| Segments covered: | By Material, By Product |

| Companies covered:: | Amcor Group GmbH, Sonoco Products Company, Gualapack SpA, Plaszom Industria De Plasticos Ltda, Parnaplast Industria de Plasticos Ltda, Suprema Flexo, Sealed Air Corporation, and Other Key Players |

| Pitfalls & Challenges: | and COVID-19 Impact Analysis |

Get more details on this report -

Market Segmentation

The Brazil Pouch Packaging Market share is classified into material, product, and end-user industry.

By Material:

The Brazil Pouch Packaging Market Size is divided by material into plastic, paper, and aluminium. Among these, the plastic segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. The plastic segment dominates because it offers a strong balance of cost efficiency, durability, and flexibility. Plastic pouches provide excellent barrier protection against moisture, oxygen, and contamination, helping extend product shelf life. They are lightweight, easy to transport, and suitable for various pouch formats such as stand-up and spouted pouches. Additionally, plastics support advanced printing and resealable features, making them ideal for food, beverage, and personal care applications.

By Product:

The Brazil Pouch Packaging Market Size is divided by product into flat (pillow & side-seal) and stand-up. Among these, the stand-up segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. The stand-up pouch segment dominates because it offers better shelf presence and branding opportunities compared to flat pouches. Its ability to stand upright improves product visibility in retail stores. Stand-up pouches also support convenience features such as resealable zippers and spouts, enhancing user experience. They provide strong barrier protection, efficient storage, and lower transportation costs, making them highly suitable for food, beverages, and personal care products.

By End-User Industry:

The Brazil Pouch Packaging Market Size is divided by end user industry into food, beverage, medical and pharmaceutical, personal care, household care, and other. Among these, the food segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. The food industry segment dominates due to the growing demand for convenient, portable, and ready-to-eat products. Flexible pouches offer extended shelf life, strong product protection, and easy-to-use features like resealable zippers and spouts, making them ideal for snacks, dairy, frozen foods, sauces, and beverages. Rising urbanization, busy lifestyles, and increased consumption of packaged food products further drive adoption. Additionally, pouches enhance shelf appeal and reduce storage and transportation costs, boosting their preference in the food sector.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the Brazil Pouch Packaging Market Size, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in Brazil Pouch Packaging Market:

- Amcor Group GmbH

- Sonoco Products Company

- Gualapack SpA

- Plaszom Industria De Plasticos Ltda

- Parnaplast Industria de Plasticos Ltda

- Suprema Flexo

- Sealed Air Corporation

- Others

Recent News in Brazil Pouch Packaging Market:

- In May 2024, Gualapack SpA, an Italian packaging company with operations in Brazil, showcased its advanced, flexible packaging solutions at the Vitafoods 2024 Expo in Geneva, Switzerland.

- In April 2023, Amcor Group, an Australian packaging company, proudly announced that its Brazilian manufacturing facility became the inaugural Amcor plant in Latin America to secure the prestigious International Sustainability and Carbon Certification Plus (ISCC Plus) accolade.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the Brazil, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Brazil Pouch Packaging Market Size based on the below-mentioned segments:

Brazil Pouch Packaging Market, By Material

- Plastic

- Paper

- Aluminium

Brazil Pouch Packaging Market, By Product

- Flat (Pillow & Side-Seal)

- Stand-up

Brazil Pouch Packaging Market, By End-User Industry

- Food

- Beverage

- Medical and Pharmaceutical

- Personal Care and Household Care

- Other

Frequently Asked Questions (FAQ)

-

Q1: What is pouch packaging?Pouch packaging is a flexible packaging format made from materials like plastic, paper, or aluminum, used for liquids, powders, and solid products, offering convenience, durability, and extended shelf life.

-

Q2: Which material dominates the Brazil pouch packaging market?Plastic is the dominant material due to its cost-effectiveness, durability, flexibility, and strong barrier properties.

-

Q3: Which pouch type is most popular in Brazil?Stand-up pouches dominate because of better shelf visibility, convenience features, and efficient storage.

-

Q4: Which industry is the largest end user?The food industry leads the market, driven by demand for snacks, dairy, frozen foods, sauces, and ready-to-eat meals.

-

Q5: What factors are driving market growth?Growth is driven by convenience, e-commerce expansion, technological innovations in printing, urban lifestyles, and sustainable packaging adoption.

-

Q6: What are the market restraints?Challenges include environmental concerns over plastic waste, limited recycling infrastructure, fluctuating raw material prices, and competition from rigid packaging.

-

Q7: What opportunities exist in the market?Opportunities include the adoption of sustainable materials, mono-material and bio-based pouches, technological advancements in printing, and growth in pharmaceuticals, personal care, and household sectors.

Need help to buy this report?