Brazil Phenolic Resins Market Size, Share, By Product (Novolac, Resol, and Others), By Application (Wood Adhesives, Molding, Insulations, Laminates, Paper Impregnation, Coatings, and Others), Brazil Phenolic Resins Market Insights, Industry Trend, Forecasts to 2035

Industry: Chemicals & MaterialsBrazil Phenolic Resins Market Insights Forecasts to 2035

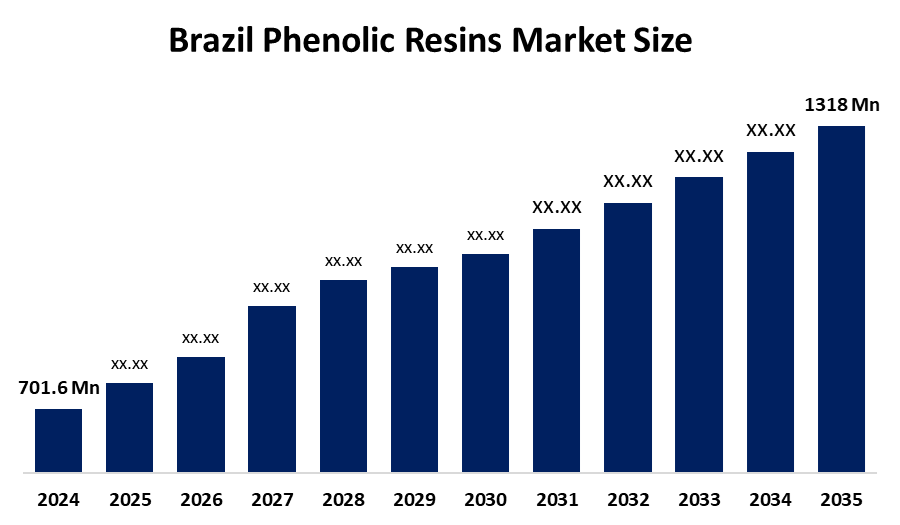

- Brazil Phenolic Resins Market Size 2024: USD 701.6 Mn

- Brazil Phenolic Resins Market Size 2035: USD 1318.6Mn

- Brazil Phenolic Resins Market CAGR 2024: 5.9%

- Brazil Phenolic Resins Market Segments: Product and Application

Get more details on this report -

The Brazil phenolic resins market measures both production and consumption of heat-resistant phenolic resins, which exhibit durability and are used in automotive, construction, electronics, and industrial fields throughout Brazil.

Hexion Inc. and other global resin manufacturers have developed low-emission phenolic resins that emit less formaldehyde than their previous products, enabling better compliance with stricter environmental and indoor air quality requirements. The Brazilian market will experience effects from these products because the country follows the same regulatory patterns and the increasing demand for sustainable adhesive and composite materials.

The Brazilian Ministry of Development, Industry, Trade and Services, MDIC/SECEX, has officially started an anti-dumping investigation to assess phenolic resin imports from China because it wants to safeguard domestic production against unfair import pricing. If duties are enacted at the end of the investigation process, they will impact trade routes and market prices, and competitive forces within the Brazilian phenolic resins industry.

The Brazil phenolic resins market will experience strong future growth because demand for eco-friendly, low-emission resin solutions and rising requirements in the automotive, construction, insulation, and renewable energy sectors continue to increase.

Market Dynamics of the Brazil Phenolic Resins Market:

The Brazil phenolic resins market is driven by the increasing demand from the automotive, construction, electrical, and wood panel industries, as well as increased infrastructure development, the use of heat-resistant materials, and an increasing emphasis on long-lasting, reasonably priced, and fire-resistant resin solutions, are driving the Brazil Phenolic Resins market.

The Brazil phenolic resins market is restrained by the volatile raw material prices, stringent formaldehyde emission laws, high production costs, and increasing competition from eco-friendly substitute materials and alternative resins.

The future of Brazil phenolic resins market is bright and promising, with the country's growing infrastructure projects, growing automobile industry, growing electrical applications, and growing industry acceptance of high-performance, low-emission, and sustainable resin technologies.

Brazil Phenolic Resins Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 701.6 Million |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | CAGR of 5.9% |

| 2035 Value Projection: | USD 1318.6 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 90 |

| Segments covered: | By Application |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Market Segmentation

The Brazil phenolic resins market share is classified into product and application.

By Product:

The Brazil phenolic resins market is divided by product into novolac, resol, and others. Among these, the resol segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. Because of its extensive use in wood adhesives, insulation foams, laminates, and molding compounds, which depend on its ability to cure quickly and deliver excellent thermal properties.

By Application:

The Brazil phenolic resins market is divided by application into wood adhesives, molding, insulations, laminates, paper impregnation, coatings, and others. Among these, the wood adhesives segment accounted for the largest market share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. Because they provide strong bonding ability, moisture protection and long-la sting performance at an economical price.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the Brazil phenolic resins market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in Brazil Phenolic Resins Market:

- SI Group

- Bakelite Synthetics

- Sumitomo Bakelite

- BASF

- Allnex

- Ashland

- DIC Corporation

- Hexcel Corporation

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the Brazil, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the Brazil phenolic resins market based on the below-mentioned segments:

Brazil Phenolic Resins Market, By Product

- Novolac

- Resol

- other

Brazil Phenolic Resins Market, By Application

- Wood Adhesives

- Molding

- Insulations

- Laminates

- Paper Impregnation

- Coatings

- Others

Frequently Asked Questions (FAQ)

-

What is the Brazil phenolic resins market size?Brazil phenolic resins market is expected to grow from USD 701.6 million in 2024 to USD 1318.6 million by 2035, growing at a CAGR of 5.9% during the forecast period 2025-2035.

-

What are the key growth drivers of the market?Market growth is driven by the increasing demand from the automotive, construction, electrical, and wood panel industries, as well as increased infrastructure development, the use of heat-resistant materials, and an increasing emphasis on long-lasting, reasonably priced, and fire-resistant resin solutions, are driving the Brazil Phenolic Resins market.

-

What factors restrain the Brazil phenolic resins market?Constraints include the volatile raw material prices, stringent formaldehyde emission laws, high production costs, and increasing competition from eco-friendly substitute materials and alternative resins.

-

Who are the key players in the Brazil phenolic resins market?Key companies include SI Group, Bakelite Synthetics, Sumitomo Bakelite, BASF, Allnex, Ashland, DIC Corporation, Hexcel Corporation, and Others.

-

Who are the target audiences for this market report?The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Need help to buy this report?