Brazil Phenol Market Size, Share, By End Use (Bisphenol A, Phenolic Resins, Caprolactam, Alkyl Phenyls, and Others), Brazil Phenol Market Insights, Industry Trend, Forecasts to 2035

Industry: Chemicals & MaterialsBrazil Phenol Market Insights Forecasts to 2035

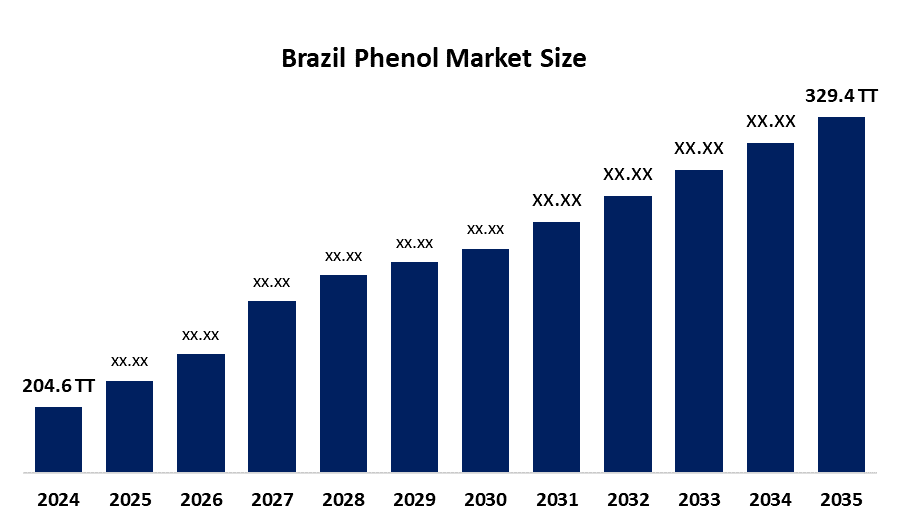

- Brazil Phenol Market Size 2024: 204.6 Thousand Tonnes

- Brazil Phenol Market Size 2035: 329.4 Thousand Tonnes

- Brazil Phenol Market CAGR 2024: 4.42%

- Brazil Phenol Market Segments: End-Use

Get more details on this report -

The Brazil phenol market refers to the production, distribution, and consumption of phenol in Brazil, which serves as the main raw material for producing resins and plastics, adhesives and laminates and pharmaceuticals and chemicals used in automotive, construction and industrial applications.

Worldwide phenol market participants have developed innovative phenol-based resins and their derivatives, which include heat-resistant phenol resins designed for electric vehicle battery enclosures and antimicrobial phenol coatings that find use in medicine and equipment manufacturing. These innovations permit phenol to enter into expanding high-demand business markets.

The federal government launched Nova Industrial Brazil, an industrial policy aimed at revitalizing and modernizing Brazil’s manufacturing, including chemicals, by boosting investments, improving industrial competitiveness, and increasing self-sufficiency in key sectors through to 2033. The new initiative provides additional pathways for producing phenol and its derivatives within the country.

The Brazil phenol market provides strong growth prospects through increasing demand for phenolic resins, construction expansion, automotive sector recovery, sustainable material development and the upcoming rise of domestic chemical production that industrial support policies will enable.

Brazil Phenol Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | 204.6 Thousand Tonnes |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 4.42% |

| 2035 Value Projection: | 329.4 Thousand Tonnes |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 107 |

| Segments covered: | By End Use |

| Companies covered:: | Braskem S.A., Solvay S.A., INEOS Phenol, Shell Chemicals, Lyondellbasell, Bioresin Brazil, Greenchem, Mitsui Chemicals, SABIC, Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Market Dynamics of the Brazil Phenol Market:

The Brazil phenol market is driven by the strong demand from construction, automotive, and wood panel industries, rising use of phenolic resins and bisphenol-A, infrastructure development, growing plastics consumption, and government support for domestic chemical manufacturing and industrial modernization.

The Brazil phenol market is restrained by the volatile crude oil prices, dependence on imports, strict environmental and safety regulations, high production costs, and limited domestic phenol manufacturing capacity compared to global producers.

The future of Brazil phenol market is bright and promising, with the rising demand for phenolic resins, growth in construction and automotive sectors, increasing focus on sustainable chemicals, and supportive government initiatives strengthening domestic chemical production.

Market Segmentation

The Brazil phenol market share is classified into end-use.

By End-Use:

The Brazil phenol market is divided by end-use bisphenol A, phenolic resins, caprolactam, alkyl phenyls, and others. Among these, the bisphenol A segment accounted for the largest market share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. BPA is extensively utilized in the manufacturing of epoxy resins and polycarbonate polymers, which are necessary for use in the construction, automotive, and electronics sectors.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the Brazil Phenol market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in Brazil Phenol Market:

- Braskem S.A.

- Solvay S.A.

- INEOS Phenol

- Shell Chemicals

- Lyondellbasell

- Bioresin Brazil

- Greenchem

- Mitsui Chemicals

- SABIC

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the India, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Brazil phenol market based on the below-mentioned segments:

Brazil Phenol Market, By End Use

- Bisphenol A

- Phenolic Resins

- Caprolactam

- Alkyl Phenyls

- Others

Frequently Asked Questions (FAQ)

-

Q: What is the Brazil phenol market size?A: Brazil phenol market is expected to grow from 204.6 thousand tonnes in 2024 329.4 thousand tonnes by 2035, growing at a CAGR of 4.42% during the forecast period 2025-2035.

-

Q: What are the key growth drivers of the market?A: Market growth is driven by the strong demand from construction, automotive, and wood panel industries, rising use of phenolic resins and bisphenol-A, infrastructure development, growing plastics consumption, and government support for domestic chemical manufacturing and industrial modernization.

-

Q: What factors restrain the Brazil phenol market?A: Constraints include the volatile crude oil prices, dependence on imports, strict environmental and safety regulations, high production costs, and limited domestic phenol manufacturing capacity compared to global producers.

-

Q: How is the market segmented by end use?A: The market is segmented into Bisphenol A, Phenolic Resins, Caprolactam, Alkyl Phenyls, and Others.

-

Q: Who are the key players in the Brazil phenol market?A: Key companies include Braskem S.A., Solvay S.A., INEOS Phenol, Shell Chemicals, LyondellBasell, Bioresin Brazil, Greenchem, Mitsui Chemicals, SABIC, and Others.

-

Q: Who are the target audiences for this market report?A: The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Need help to buy this report?