Brazil Organic Beverages Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Non Dairy Beveragers, Fruit Beverages, Coffee & Tea, Beer & Wine, And Other Product), By Distribution Channel (Offline, and Online), and Brazil Organic Beverages Market Insights, Industry Trend, Forecasts to 2035

Industry: Food & BeveragesBrazil Organic Beverages Market Insights Forecasts to 2035

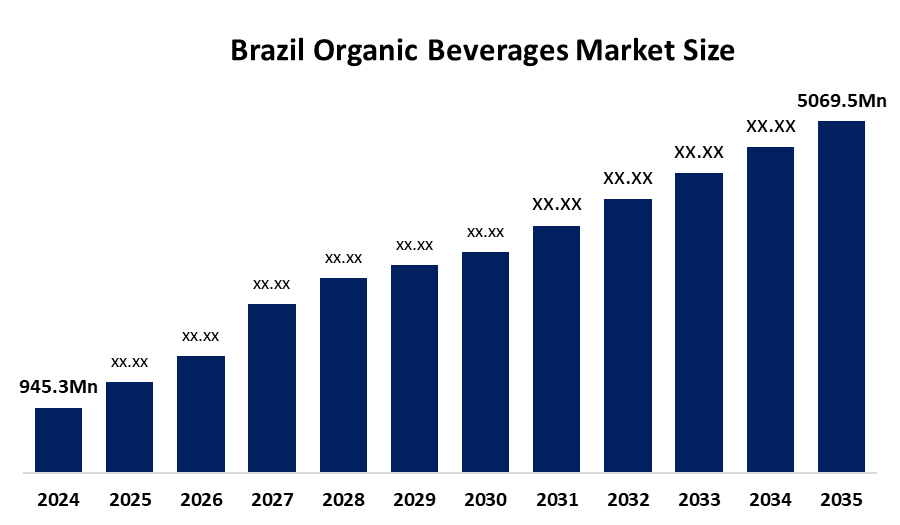

- The Brazil Organic Beverages Market Size Was Estimated at USD 945.3 Million in 2024

- The Market Size is Expected to Grow at a CAGR of Around 16.5% from 2025 to 2035

- The Brazil Organic Beverages Market Size is Expected to Reach USD 5069.5 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the Brazil Organic Beverages Market size is anticipated to reach USD 5069.5 million by 2035, growing at a CAGR of 16.5% from 2025 to 2035. The organic beverages market in Brazil is driven by rising health consciousness, increasing demand for clean-label and chemical free drinks, growing adoption of plant-based and functional beverages, supportive government initiatives for organic farming, expanding retail and ecommerce channels, and heightened environmental sustainability awareness among consumers.

Market Overview

The Brazil organic beverages market is made with ingredients certified as organic, produced under conditions free from synthetic chemicals, pesticides, GMOs, or artificial additives, and following the Brazilian organic standards. Organic beverages are the natural substitutes to conventional drinks, providing consumers with the hydration, nutritional intake, and functional health benefits of daily use. Among all these benefits, digestion support, immunity boost, detoxification promotion, and maintenance of overall wellness are the most common reasons for their consumption.

The trend of organic and clean labels that is reflected in the increased use of natural and botanical flavors in beverages is one of the factors driving the governments' actions, which are providing technical support, facilitating access to markets, and offering certification and production incentives for organic farming, especially for small family farmers through programs like PRONAF (financial support) and public procurement policies that prefer organic products. Furthermore, the Ministry of Agriculture organizes national awareness campaigns to promote organic products and attract more consumers, thus creating a stronger demand for organic products and making the impact of sustainable agricultural practices more visible.

The organic beverage market is likely to witness a healthy growth rate along with the other driving factors, including the demand for healthy living and clean-label products, and the increased consumption of plant-based and functional drinks.

Report Coverage

This research report categorizes the market for the Brazil organic beverages market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Brazil organic beverages market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Brazil organic beverages market.

Brazil Organic Beverages Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 945.3 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 16.5% |

| 2035 Value Projection: | USD 5069.5 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 90 |

| Segments covered: | By Product Type, By Distribution |

| Companies covered:: | Leorganic, Organic Way, BrasilBev, Vitta Fresh, Qualitá Brasil, Timbaúba S.A., Triunfo do Brasil, Organicô Bebidas, and Viton 44 and other key players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The Brazil organic beverages market is driven by increasing health consciousness and changing lifestyles among consumers, which is also the case of the growing trend for natural, chemical-free, and clean-label products. The increasing acceptance of the negative impact of synthetic additives, pesticides, and GMOs is propelling consumers to turn to organic drinks. Another factor that is driving demand is the emergence of plant based and functional beverages, notably organic juices, herbal teas, and probiotic drinks. Moreover, the government is taking steps to support organic farming through policy measures that lead to better certification systems and improve access for consumers through modern retail and e-commerce. Environmental sustainability issues as well as increased income levels, are also influencing the switch to organic beverages.

Restraining Factors

Brazil organic beverage market is subject to various constraints, one being the higher prices for the goods that originate from the expensive organic farming and certification processes. Besides, the shortage of certified organic raw materials, inefficiencies in the supply chain, and the short lifespan of organic products compared to conventional ones can also be pointed out as factors slowing down the market. Consumer awareness in rural areas is limited, and the price sensitivity of the middle and low income consumers are other major factors that keep the adoption not so wide.

Market Segmentation

The Brazil organic beverages market share is categorized into product type and distribution channel.

- The fruit beverages segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Brazil organic beverages market is segmented by product type into non dairy beveragers, fruit beveragers, coffee & tea, beer & wine and other product. Among these, the fruit beveragers segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is driven by growing health consciousness and demand for clean label, natural drinks. Additionally, wider availability through supermarkets, speciality stores, and e-commerce platforms supports increased adoption across all product types.

- The offline segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

The Brazil organic beverages market is segmented by distribution channel into offline and online. Among these, the exterior segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The growth of the segment is dominated by offline channels, as consumers prefer inspecting fresh organic products in store and rely on supermarkets and speciality stores for trustworthy quality and immediate availability. Limited e-commerce reach for perishable beverages further reinforces offline preference.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the Brazil organic beverages market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

-

Leorganic

-

Organic Way

-

BrasilBev

-

Vitta Fresh

-

Qualitá Brasil

-

Timbaúba S.A.

-

Triunfo do Brasil

-

Organicô Bebidas

-

Viton 44

-

Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In December 2025, Ambev launched a new lemon-flavored beer with almost no bitterness in three Brazilian states.

Market Segment

This study forecasts revenue at the Brazil, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Brazil Organic Beverages market based on the following segments:

Brazil Organic Beverages Market, By Product Type

- Non dairy Beveragers

- Fruit Beveragers

- Coffee & Tea

- Beer & Wine

- Other Product

Brazil Organic Beverages Market, By Distribution Channel

- Offline

- Online

Frequently Asked Questions (FAQ)

-

What is the Brazil organic beverages market size?Brazil Organic Beverages Market size is expected to grow from USD 945.3 million in 2024 to USD 5069.5 million by 2035, growing at a CAGR of 16.5% during the forecast period 2025-2035

-

What are the key growth drivers of the market?The organic beverages market in Brazil is driven by rising health consciousness, increasing demand for clean-label and chemical free drinks, growing adoption of plant-based and functional beverages, supportive government initiatives for organic farming, expanding retail and ecommerce channels, and heightened environmental sustainability awareness among consumers.

-

What factors restrain the Brazil organic beverages market?The organic beverages market in Brazil is mostly constrained by Brazil organic beverages market is subject to various constraints, one being the higher prices for the goods that originate from the expensive organic farming and certification processes. Besides, the shortage of certified organic raw materials and inefficiencies in the supply chain

-

How is the market segmented by type?The market is segmented into non dairy beveragers, fruit beveragers, coffee & tea, beer & wine and other product.

-

Who are the key players in the Brazil organic beverages market?Key companies include leorganic, organic way, brasilbev, vitta fresh, qualitá brasil, timbaúba s.a., triunfo do brasil, organicô bebidas, viton 44, and others

-

Who are the target audiences for this market report?The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Need help to buy this report?