Brazil Methanol Market Size, Share, By Additives (Polyethylene, Solvents, Gasoline, MTO/MTP, Ethylene Oxide, And Others), By Feedstock (Natural Gas, Coal, Bio-Based, And Others), And Brazil Methanol Market Size Insights, Industry Trend, Forecasts to 2035

Industry: Specialty & Fine ChemicalsBrazil Methanol Market Size Insights Forecasts to 2035

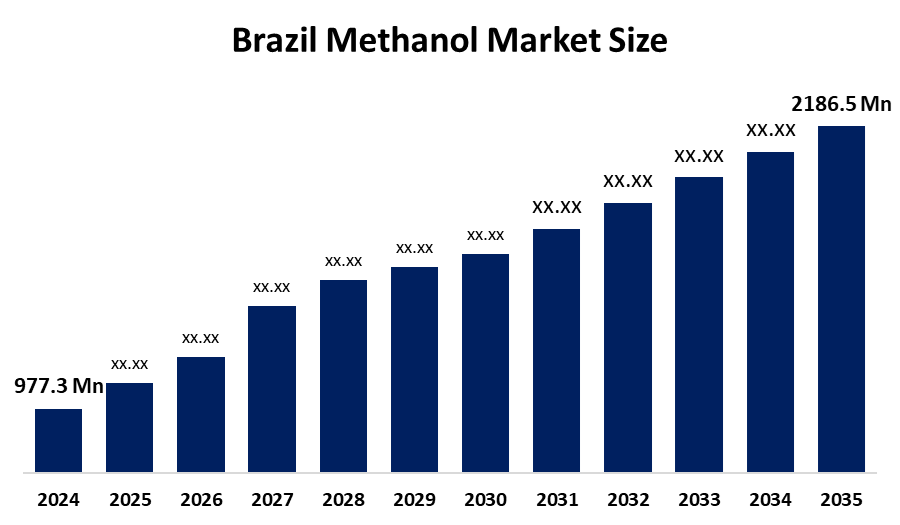

- Brazil Methanol Market Size 2024: USD 977.3 Mn

- Brazil Methanol Market Size 2035: USD 2186.5 Mn

- Brazil Methanol Market Size CAGR 2024: 7.6%

- Brazil Methanol Market Size Segments: Additives and Feedstock

Get more details on this report -

The Brazil Methanol Market Size includes all phases from production to import, distribution and consumption of methanol. It is an alcohol with many functional uses as a chemical feedstock and fuel. Methanol has wide-ranging applications within Brazil, such as being used for the production of formaldehyde and acetic acid, plastics and adhesives, biodiesel trans-esterification, marine fuel and possibly as part of a cleaner energy solution. Brazil is the largest consumer of methanol within Latin America and consumes about 50% of the total amount used in the region.

The methanol in Brazil is backed by government support, including the issuance of a preliminary environmental license for the country’s first large-scale e-methanol (green methanol) plant at the Suape Industrial Complex in Pernambuco. This project, backed by state authorities, represents a significant push toward decarbonizing fuel production and highlights governmental support for cleaner energy transition projects that use renewable energy and biomass feedstocks to produce methanol with lower carbon intensity.

As technology advances, Brazilian methanol providers are now using combining biomass and green manufacturing technologies with existing methods to produce additional value from conventional means and improve the overall efficiency of the chemical industry. The innovative developments in biomass-to-methanol conversion processes will reduce production costs and provide greater competitiveness with conventional methanol production processes to meet environmental objectives. New automation developments and advancements in digital control systems will lead to increased yields and overall operational safety in existing methanol production facilities, helping producers meet the growing demands of industry with lower environmental impact than before.

Brazil Methanol Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 977.3 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 7.6% |

| 2035 Value Projection: | USD 2186.5 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 230 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Additives, By Feedstock |

| Companies covered:: | Petrobras, Methanex Corporation, GPC Quimica, Proman AG, European Energy, SABIC, OCI N.V., Univar Solutions, Celanese Corporation, BASF SE, Methanol Holdings Limited, and other key players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Market Dynamics of the Brazil Methanol Market Size:

The Brazil Methanol Market Size is driven by high traditional industrial demand and emerging energy transition priorities, widely used as a feedstock for downstream chemical industries, supported by the growth of Brazil’s broader chemicals sector, massive use in biodiesel production, Brazil’s long-standing biofuel policies, increasing interest in cleaner fuels, well-established agricultural base, and increased capacity for bio-based feedstocks and renewable energy generation in Brazil.

The Brazil Methanol Market Size is restrained by the volatility in feedstock costs, high production economics and price stability, competition from Brazil’s dominant bioethanol industry, limited methanol’s penetration as a fuel alternative, global supply chain uncertainties and currency fluctuations, and slow adoption in the absence of strong policy incentives.

The future of Brazil Methanol Market Size is bright and promising, with versatile opportunities emerging from the increased global and local interest in alternative sources of fuel and materials increasing investment in bio-derived and green methanol products. Furthermore, as demand for electric fuels increases there will be an increased need for using methanol within the marine industry. The use of methanol as a hydrogen-based fuel source also creates new opportunity in hydrogen storage and energy production systems through utilising Brazil's renewable energy resources. The combination of additional policies that support renewable energy and cleaner processes, along with technological developments aimed at decreasing the startup costs of green methanol, will create more opportunities for future market expansion.

Market Segmentation

The Brazil Methanol Market Size share is classified into additives and feedstock.

By Additives:

The Brazil Methanol Market Size is divided by additives into polyethylene, solvents, gasoline, MTO/MTP, ethylene oxide, and others. Among these, the MTO/MTP segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. Increasing demand for high value olefins, expanding petrochemical sector, offering an alternative to traditional naphtha cracking, and versatile applications with highest growth rate all contribute to the MTO/MTP segment's largest share and higher spending on methanol when compared to other additives.

By Feedstock:

The Brazil Methanol Market Size is divided by feedstock into natural gas, coal, bio-based, and others. Among these, the natural gas segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. The natural gas segment dominates because of cost effectiveness, high output efficiency, provides foundation for domestic production, emits less carbon aligning with cleaner production goals, and well established infrastructure for methanol production in Brazil.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the Brazil Methanol Market Size, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in Brazil Methanol Market Size:

- Petrobras

- Methanex Corporation

- GPC Quimica

- Proman AG

- European Energy

- SABIC

- OCI N.V.

- Univar Solutions

- Celanese Corporation

- BASF SE

- Methanol Holdings Limited

- Others

Recent Developments in Brazil Methanol Market Size:

In November 2024, European Energy & Petrobras signed a Heads of Agreement to develop a commercial-scale green methanol production plant in the state of Pernambucco. This builds on a previous MoU from 2023.

In October 2024, European Energy announced the construction of Brazil’s first e-mathanol plant in the Suape Industrial and Port Complex, with plans to produce 100,000 tons annually by 2028.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the Brazil, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Brazil Methanol Market Size based on the below-mentioned segments:

Brazil Methanol Market Size, By Additives

- Polyethylene

- Solvents

- Gasoline

- MTO/MTP

- Ethylene Oxide

- Others

Brazil Methanol Market Size, By Feedstock

- Natural Gas

- Coal

- Bio-Based

- Others

Frequently Asked Questions (FAQ)

-

What is the Brazil Methanol Market Size?Brazil Methanol Market Size is expected to grow from USD 977.3 million in 2024 to USD 2186.5 million by 2035, growing at a CAGR of 7.6% during the forecast period 2025-2035.

-

What are the key growth drivers of the market?Market growth is driven by the high traditional industrial demand and emerging energy transition priorities, widely used as a feedstock for downstream chemical industries, supported by the growth of Brazil’s broader chemicals sector, massive use in biodiesel production, Brazil’s long-standing biofuel policies, increasing interest in cleaner fuels, well-established agricultural base, and increased capacity for bio-based feedstocks and renewable energy generation in Brazil.

-

What factors restrain the Brazil Methanol Market Size?Constraints include the volatility in feedstock costs, high production economics and price stability, competition from Brazil’s dominant bioethanol industry, limited methanol’s penetration as a fuel alternative, global supply chain uncertainties and currency fluctuations, and slow adoption in the absence of strong policy incentives.

-

How is the market segmented by additives?The market is segmented into polyethylene, solvents, gasoline, MTO/MTP, ethylene oxide, and others.

-

Who are the key players in the Brazil Methanol Market Size?Key companies include Petrobras, Methanex Corporation, GPC Quimica, Proman AG, European Energy, SABIC, OCI N.V., Univar Solutions, Celanese Corporation, BASF SE, Methanol Holdings Limited, and Others.

-

Who are the target audiences for this market report?The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Need help to buy this report?