Brazil Medical Nutrition Market Size, Share, and COVID-19 Impact Analysis, By Nutrition Type (Proteins, Carbohydrates, Multivitamins & Antioxidants, Amino Acids, Fibers, Minerals, Others), By Patient Type (Infant Nutrition, Adult Nutrition, Geriatric Nutrition), and Brazil Medical Nutrition Market Insights, Industry Trend, Forecasts to 2035

Industry: HealthcareBrazil Medical Nutrition Market Insights Forecasts to 2035

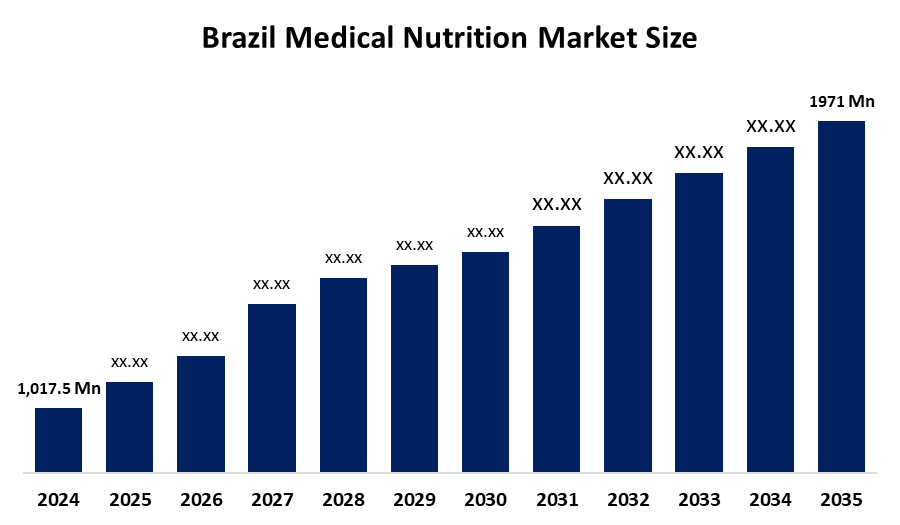

- The Brazil Medical Nutrition Market Size Was Estimated at USD 1,017.5 Million in 2024

- The Market Size is Expected to Grow at a CAGR of Around 6.1% from 2025 to 2035

- The Brazil Medical Nutrition Market Size is Expected to Reach USD 1971 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the Brazil Medical Nutrition Market size is anticipated to reach USD 1971 Million by 2035, growing at a CAGR of 6.1% from 2025 to 2035. The Brazil medical nutrition market is driven by increasing prevalence of chronic diseases, rising geriatric population, growing awareness about clinical nutrition, expansion of healthcare infrastructure, and adoption of specialized nutritional products for disease management and postoperative recovery.

Market Overview

Medical nutrition refers to specially formulated foods or supplements designed to support individuals who are ill, recovering from medical conditions, or undergoing surgical procedures. These products provide essential nutrients required by the body to promote healing, manage chronic diseases such as diabetes and cancer, and improve overall patient health. Medical nutrition is typically consumed under the supervision of healthcare professionals, including doctors and dietitians.

The Brazil medical nutrition market is experiencing steady growth, driven by the rising prevalence of chronic diseases, an increasing elderly population, growing awareness of clinical nutrition, expansion of healthcare facilities, and rising demand for specialized dietary products. Additionally, advancements in nutritional formulation technologies and strong recommendations from healthcare professionals are encouraging greater adoption of medical nutrition products.

Government agencies and healthcare organizations in Brazil are actively addressing malnutrition, which is a key factor supporting market growth. Malnutrition remains a public health concern in the country, particularly affecting children, pregnant women, and low-income populations. According to the Global Hunger Index (GHI), approximately 3.9% of Brazil’s population was malnourished between 2021 and 2023. To address this issue, the government has implemented healthcare and nutrition programs aimed at improving access to medically safe nutritional solutions for vulnerable groups, thereby supporting the consumption of medical nutrition products.

Current trends in the Brazil medical nutrition market include rising demand for disease-specific and protein-rich supplements, increased use of enteral and parenteral nutrition, a growing focus on elderly care and post-surgical recovery, integration of digital healthcare solutions, and the introduction of innovative, convenient nutritional products.

Report Coverage

This research report categorizes the market for the Brazil medical nutrition market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Brazil medical nutrition market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Brazil medical nutrition market.

Brazil Medical Nutrition Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 1,017.5 Million |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | CAGR of 6.1% |

| 2035 Value Projection: | USD 1971 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 90 |

| Segments covered: | By Patient Type |

| Companies covered:: | Prodiet Medical Nutrition, Vitafor, Oceandrop, Nutrimed, Neutral, Nvtro, Eurofarma, and other players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The Brazil medical nutrition market is driven by multiple factors. The rising prevalence of chronic diseases such as diabetes, cancer, and cardiovascular disorders increases demand for specialized nutritional products. An aging population with higher nutritional needs fuels market growth. Expanding healthcare infrastructure and hospitals promote the adoption of clinical nutrition. Growing awareness among patients and healthcare professionals about the benefits of medical nutrition, coupled with innovations in protein-rich, disease-specific, and convenient formulations, further accelerates market expansion across the country.

Restraining Factors

The Brazil medical nutrition market faces restraints such as high product costs, limited reimbursement and insurance coverage, and low awareness in rural areas. Regulatory challenges, strict quality standards, and a lack of trained healthcare professionals to recommend and administer specialized nutrition also hinder market growth. Additionally, patient reluctance and preference for regular diets can limit the adoption of medical nutrition products.

Market Segmentation

The Brazil medical nutrition market share is categorized by nutrition type and patient types.

- The proteins segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Brazil medical nutrition market is segmented by nutrition type into proteins, carbohydrates, multivitamins & antioxidants, amino acids, fibers, minerals, and others. Among these, the protein segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is driven by its critical role in maintaining muscle mass, supporting immune function, and aiding recovery after illness or surgery. Patients with chronic diseases, elderly individuals, and post-operative patients have higher protein requirements. Hospitals and healthcare providers increasingly recommend protein-rich supplements to prevent malnutrition, improve treatment outcomes, and enhance overall patient recovery. Convenience, availability in various formulations, and strong clinical backing further drive the segment’s widespread adoption.

- The geriatric nutrition segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

The Brazil medical nutrition market is segmented by patient type into infant nutrition, adult nutrition, and geriatric nutrition. Among these, the geriatric nutrition segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The growth of the segment is due to the country’s rapidly aging population and the rising incidence of chronic diseases among elderly individuals. Older adults often face malnutrition, muscle loss, and weakened immunity, creating a high demand for specialized nutritional products. Hospitals, clinics, and home care services increasingly recommend tailored diets and supplements to support recovery, enhance quality of life, and manage age-related health issues. Convenience, clinical effectiveness, and growing awareness further boost adoption in this segment.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Brazil medical nutrition market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Prodiet Medical Nutrition

- Vitafor

- Oceandrop

- Nutrimed

- Neutral

- Nvtro

- Eurofarma

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

In April 2024, ANVISA, the Brazilian regulatory body, initiated ‘Call No. 1’, focused on promoting the creation of phytotherapeutic medications, new synthetic drugs, and biological products relevant to healthcare services by medical startups. Acknowledging the urgent demand for novel drugs and the significance of nurturing innovation in Brazil’s healthcare environment, Anvisa created this initiative tailored for Brazilian medical startups.

In March 2024, ANVISA issued a new resolution and normative instruction, which established guidelines for the regularization of food and packaging within the scope of the National Health Surveillance System (SNVS) aimed at distribution in the national territory. The formulas for infants, young children, or individuals with specific dietary requirements, like enteral nutrition formulas and dietary products for metabolic disorders, must be registered before their sale to ensure safety.

Market Segment

This study forecasts revenue at the Brazil, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Brazil medical nutrition market based on the below-mentioned segments:

Brazil Medical Nutrition Market, By Nutrition Type

- Proteins

- Carbohydrates

- Multivitamins & Antioxidants

- Amino Acids

- Fibers

- Minerals

- Others

Brazil Medical Nutrition Market, By Patient Type

- Infant Nutrition

- Adult Nutrition

- Geriatric Nutrition

Frequently Asked Questions (FAQ)

-

What makes Brazil’s medical nutrition market unique? Brazil combines a large aging population with a high prevalence of chronic diseases and expanding healthcare access, creating specific demand for tailored nutritional products like protein-rich and disease-specific supplements.

-

How is technology influencing medical nutrition in Brazil? Advances in formulation technology, personalized nutrition tracking, and digital health tools are improving product efficacy, patient adherence, and remote nutritional monitoring.

-

Are local companies significant in Brazil’s medical nutrition market? Yes. Companies like Prodiet, Vitafor, Oceandrop, Nutrimed, Nuteral, Nvtro, and Eurofarma provide region-specific solutions alongside global players, helping address local healthcare needs

-

Which healthcare settings contribute most to product adoption? Hospitals, specialized clinics, rehabilitation centers, and home care services drive adoption, particularly for geriatric, post-surgical, and chronic disease patients

-

What trends are shaping future growth? Rising awareness of preventive nutrition, demand for convenience-oriented products, and integration of clinical nutrition with wellness programs are key trends shaping market growth

Need help to buy this report?