Brazil Mattress Market Size, Share, and COVID-19 Impact Analysis, By Product (Spring Mattress, Foam Mattress, Latex Mattress, and Other), By Distribution Channel (Offline, Online), By End-User (Residential, Commercial), and Brazil Mattress Market Insights, Industry Trend, Forecasts to 2035

Industry: Consumer GoodsBrazil Mattress Market Insights Forecasts to 2035

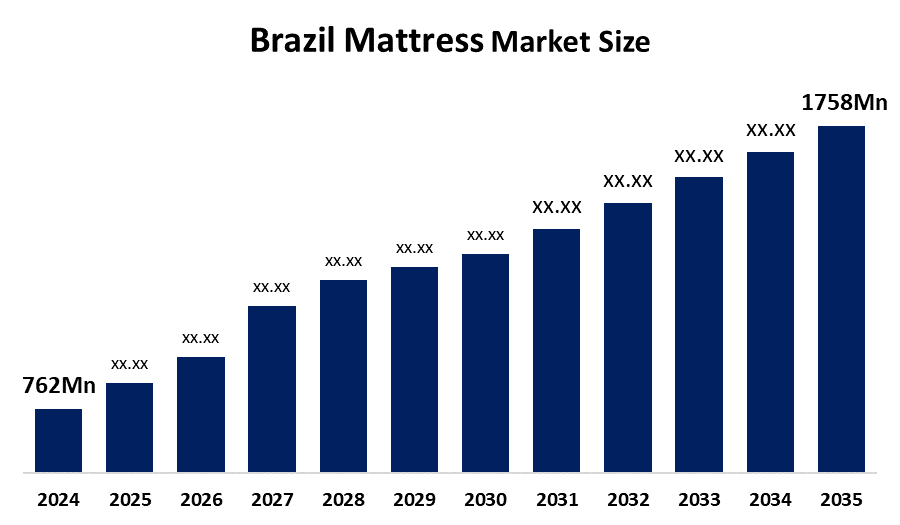

- The Brazil Mattress Market Size Was Estimated at USD 762 Million in 2024

- The Market Size is Expected to Grow at a CAGR of Around 7.9% from 2025 to 2035

- The Brazil Mattress Market Size is Expected to Reach USD 1758 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the Brazil Mattress Market Size is Anticipated to Reach USD 1758 Million by 2035, Growing at a CAGR of 7.9% from 2025 to 2035. The Brazil mattress market is driven by rising urbanization, increasing disposable income, growing awareness of sleep health, expanding e-commerce sales, demand for premium and memory foam mattresses, and a surge in residential construction and hospitality sector development.

Market Overview

A mattress is a soft, padded surface that is typically used for sleeping or resting. A mattress may be constructed from foam, springs, latex, or even a combination of these materials. Mattresses make life comfortable, provide bodily support, help maintain good posture, and increase sleep quality; hence, they are the basis of good health and relaxation. Furthermore, the Brazil mattress market expansion is largely attributable to factors such as rising urbanization, increasing disposable income, growing consciousness of sleep health, demand for premium and memory foam mattresses, the development of e-commerce channels, and the rise in residential construction and the hospitality sector. Moreover, rising residential projects, increasing hotel construction, and the modernization of healthcare facilities, which in turn are driving the demand for high-quality mattresses, are some of the factors positively influencing market growth. Besides that, the rising middle-class population, which makes it easier to invest in premium, ergonomically designed mattresses, is a key factor behind market growth.

The innovation of new technologies in the manufacturing process, for example, three-dimensional (3D) knitting and the incorporation of smart technology for sleep tracking, is giving the market a surge in growth. Besides that, market expansion is also supported by the adoption of advanced materials such as gel-infused memory foam and natural latex, which cater to a health-conscious consumer base. Furthermore, the rise of e-commerce, which provides a broad platform for manufacturers to extend product accessibility, is also enhancing market expansion. Consistent with this, the extensive use of online selling platforms, which enable direct-to-consumer models, is making it easier for foreign brands to enter the market and is expected to be a key driver of market growth. Moreover, hotel renovations and expansions are expected to be major factors driving the Brazilian mattress market. The Brazilian Hotel Operators Association (FOHB) forecasted that 158 new hotels would be inaugurated in 2023, creating a need for about 45,000 new mattresses. Realizing this demand, existing hotels spent R$890 million on repair works, out of which 35% was allocated to upgrading bedroom furnishings and mattresses, reflecting strong institutional demand. This hotel boom, in terms of new developments and improvements, is generating demand for high-quality mattresses to meet hospitality standards, thereby stimulating the growth of the mattress market.

Report Coverage

This research report categorizes the market for the Brazil mattress market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Brazil mattress market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Brazil mattress market.

Brazil Mattress Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 762 Million |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | CAGR of 7.9% |

| 2035 Value Projection: | USD 1758 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 90 |

| Segments covered: | By Product Type, By Application |

| Companies covered:: | Anjos Colchões Tempur Sealy International, Inc. Ecus Sleep Number Colchão Inteligente Ortobom Castor CBP Brasil Plumatex Colchões and Other key players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The Brazil Mattress Market Size is driven by multiple factors. Rising urbanization and increasing disposable incomes enable consumers to spend more on quality sleep products. Growing awareness of sleep health and wellness encourages investment in comfortable, supportive mattresses. Demand for premium, memory foam, and hybrid mattresses is rising, while e-commerce growth makes purchases easier and more convenient. Additionally, expansion in residential construction, hotels, and the hospitality sector fuels mattress demand. Innovations in materials and ergonomic designs further boost market growth

Restraining Factors

The Brazil Mattress Market Size faces restraints such as high prices of premium and memory foam mattresses, which limit affordability for many consumers. Intense competition among local and international brands challenges market share. Economic fluctuations and inflation can reduce consumer spending. Additionally, a lack of awareness about advanced mattress technologies in rural areas and a preference for traditional bedding options slow market growth.

Market Segmentation

The Brazil mattress market share is categorized by product, distribution channel, and end user.

- The foam mattresses segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Brazil Mattress Market Size is segmented by product into spring mattresses, foam mattresses, latex mattresses, and others. Among these, the foam mattresses segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is driven by their affordability, wide availability, comfort, and adaptability to various body types. Foam mattresses, including memory foam, offer better pressure relief and support compared to traditional spring mattresses, making them increasingly popular among consumers seeking improved sleep quality. Additionally, rising awareness of sleep health and growing urban middle-class demand contribute to foam mattresses’ dominance.

- The offline segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

The Brazil Mattress Market Size is segmented by distribution channel into offline and online. Among these, the offline segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The growth of the segment is due to the consumers' preference for physically testing mattresses for comfort, firmness, and quality before buying, which online platforms cannot fully replicate. Traditional retail stores and specialty outlets also provide personalized guidance and after-sales services, enhancing trust. Many consumers associate in-store purchases with reliability and warranty support. Additionally, limited awareness and trust in online mattress purchases, coupled with logistical challenges in delivering large products, further reinforce the preference for offline buying in Brazil.

- The residential segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

The Brazil Mattress Market Size is segmented by end user into residential and commercial. Among these, the residential segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The growth of the segment is due to rising urbanization, growing disposable incomes, increasing awareness of sleep health, and the expansion of middle-class households. Consumers prioritize investing in comfortable and supportive mattresses for personal use, making residential demand consistently higher than commercial demand.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Brazil mattress market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Anjos Colchões

- Tempur Sealy International, Inc.

- Ecus

- Sleep Number

- Colchão Inteligente

- Ortobom

- Castor

- CBP Brasil

- Plumatex Colchões

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

In February 2024, Orthopedical, a renowned Brazilian mattress maker, has launched a new line of memory foam mattresses designed to improve sleep quality and support. This unique invention intends to meet the growing demand for premium mattresses in the Brazilian market, particularly among the elderly seeking orthopedic solutions.

In March 2024, Simmons Brasile announced a cooperation with a local hospital network to provide senior residents with special rates on orthopedic mattresses. This program aims to meet the growing demand for customized mattresses among Brazil's older population while also encouraging improved sleep health.

Market Segment

This study forecasts revenue at the Brazil, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Brazil mattress market based on the below-mentioned segments:

Brazil Mattress Market, By Product

- Spring Mattress

- Foam Mattress

- Latex Mattress

- Other

Brazil Mattress Market, ByDistribution Channel

- Offline

- Online

Brazil Mattress Market, By End-User

- Residential

- Commercial

Frequently Asked Questions (FAQ)

-

Why are foam mattresses preferred in Brazil?Foam mattresses are lightweight, adaptable to body shape, and provide better pressure relief, making them a practical choice for many households.

-

How do consumers usually buy mattresses in Brazil?Most consumers buy through physical stores to test comfort and firmness, ensuring satisfaction before purchase.

-

Are international brands popular in Brazil?Yes, brands like Tempur Sealy and Sleep Number are gaining popularity, especially in the premium segment

-

Is the commercial sector a big buyer of mattresses?No, commercial demand is smaller and mainly linked to hotels and guest accommodations.

-

What trends are shaping mattress preferences in Brazil?Increased interest in memory foam, hybrid designs, ergonomic support, and eco-friendly materials is shaping consumer choices

-

What challenges affect mattress sales in rural areas?Limited awareness of advanced mattress technologies and preference for traditional bedding slow market penetration in rural regions.

Need help to buy this report?