Brazil LNG Market Size, Share, and COVID-19 Impact Analysis, By Infrastructure (LNG Liquefaction Plants, LNG Regasification Facilities, LNG Shipping), By Application (Transportation Fuel, Power Generation), and Brazil LNG Market Insights, Industry Trend, Forecasts to 2035

Industry: Energy & PowerBrazil LNG Market Insights Forecasts to 2035

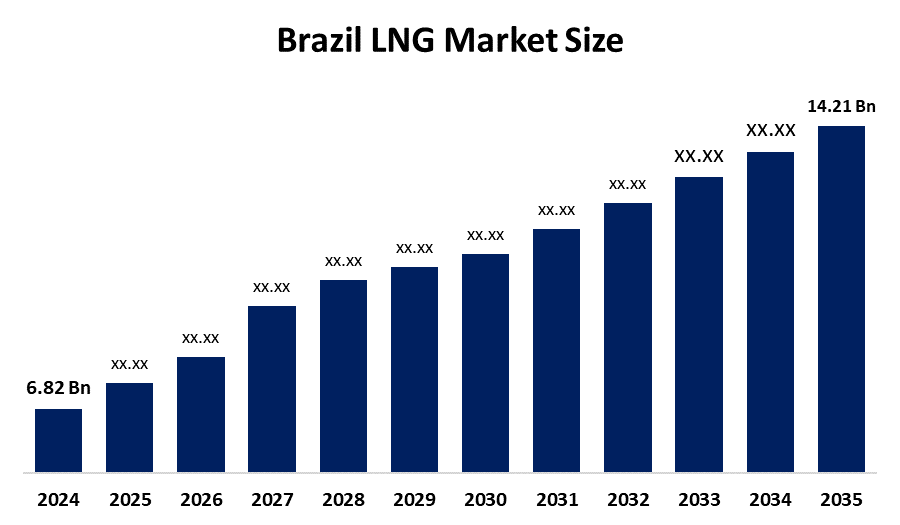

- The Brazil LNG Market Size Was Estimated at USD 6.82 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of Around 6.9% from 2025 to 2035

- The Brazil LNG Market Size is Expected to Reach USD 14.21 Billion by 2035

Get more details on this report -

According to a Research Report Published by Spherical Insights & Consulting, The Brazil LNG market Size is Anticipated to Reach USD 14.21 Billion by 2035, Growing at a CAGR of 6.9% from 2025 to 2035. The Brazil LNG market is driven by rising natural gas demand for power generation, declining domestic gas production, energy transition goals, diversification away from hydropower during droughts, expanding LNG import terminals, and supportive government policies promoting gas market liberalization.

Market Overview

Liquefied natural gas (LNG) is natural gas that is cooled to very low temperatures until it becomes a liquid. This process reduces its volume, making storage and transportation easier. LNG is widely used for electricity generation, industrial operations, and energy supply, offering a cleaner alternative to traditional fossil fuels like coal and oil. Furthermore, A key growing factor in the Brazil LNG market is increasing demand for reliable power generation during hydropower shortages, along with expansion of LNG import terminals, rising industrial gas consumption, and government efforts to diversify energy sources and ensure energy security.

The Brazilian government launched the Novo Mercado de Gas (New Gas Market) program, which aims to revitalize the Brazilian gas market to attract new investment in the sector by removing tax barriers and simplifying legislation. This is aimed at improving the natural gas flow, processing, transport, and distribution infrastructure. The new gas market program is expected to streamline investments in this sector and drive the market. Hence, owing to the above-mentioned factors, the demand for the LNG market is likely to grow and significantly drive the market during the forecast period.

The growing demand for LNG in the power generation sector is a major trend shaping the Brazilian LNG Market. As the country transitions towards cleaner energy sources, LNG emerges as a cost-effective and environmentally friendly option. Additionally, the surge in LNG-powered vehicles, coupled with government initiatives to reduce carbon emissions, has expanded the transportation fuel segment of the market.

Report Coverage

This research report categorizes the market for the Brazil LNG Market Size based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Brazil LNG market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Brazil LNG market.

Brazil LNG Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 6.82 Billion |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | CAGR of 6.9% |

| 2035 Value Projection: | USD 14.21 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 140 |

| Tables, Charts & Figures: | 100 |

| Segments covered: | By Infrastructure, By Application |

| Companies covered:: | Petrobras, Shell, TotalEnergies, ENGIE Brasil Energia, New Fortress Energy, Excelerate Energy, Equinor, BP, ExxonMobil, and Other Key Players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The Brazil LNG Market Size is driven by rising electricity demand and the need to balance hydropower generation during seasonal droughts. Limited domestic natural gas supply and declining offshore production increase reliance on LNG imports. Government initiatives to liberalize the gas market, expand LNG import infrastructure, and promote cleaner energy sources further support LNG adoption across power generation, industrial, and commercial sectors.

Restraining Factors

The Brazil LNG Market Size faces restraints from high LNG import costs and price volatility in global markets, which impact affordability. Limited pipeline connectivity, infrastructure bottlenecks, and dependence on imported LNG increase supply risks. Environmental concerns, regulatory delays, and competition from renewable energy sources also limit faster LNG market growth.

Market Segmentation

The Brazil LNG Market share is classified into infrastructure and application.

- The LNG regasification facilities segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Brazil LNG Market Size is segmented by infrastructure into LNG liquefaction plants, LNG regasification facilities, and LNG shipping. Among these, the LNG regasification facilities segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. LNG regasification facilities dominate because the country depends largely on imported LNG rather than domestic liquefaction. Frequent droughts reduce hydropower generation, increasing the need for gas-fired power plants supported by regasification terminals. Brazil has invested in floating storage and regasification units along its coastline to ensure supply flexibility and energy security. In contrast, LNG liquefaction capacity is limited, and LNG shipping is mostly managed by global players.

- The power generation segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Brazil LNG Market Size is segmented by application into transportation fuel and power generation. Among these, the power generation segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. Power generation dominates because LNG is widely used to support electricity supply during periods of low hydropower availability caused by droughts. Gas-fired power plants rely on LNG imports to ensure grid stability and meet peak demand. Brazil’s energy mix prioritizes reliable and flexible power sources, making LNG essential for backup and base-load generation. In comparison, LNG use as a transportation fuel remains limited due to lower infrastructure adoption and higher costs.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Brazil LNG Market Size,along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Petrobras

- Shell

- TotalEnergies

- ENGIE Brasil Energia

- New Fortress Energy

- Excelerate Energy

- Equinor

- BP

- ExxonMobil

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the Brazil, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Brazil LNG market based on the below-mentioned segments:

Brazil LNG Market, By Infrastructure

- LNG Liquefaction Plants

- LNG Regasification Facilities

- LNG Shipping

Brazil LNG Market, By Application

- Transportation Fuel

- Power Generation

Frequently Asked Questions (FAQ)

-

Why is Brazil importing LNG despite domestic gas reserves?Brazil imports LNG because domestic gas production cannot meet rising electricity demand, hydropower shortages, and industrial requirements, making imported LNG essential to maintain energy security and support the national grid consistently.

-

How does LNG support Brazil’s power generation?LNG provides flexible fuel for gas-fired power plants, stabilizing electricity supply during hydropower deficits, especially in drought seasons, ensuring reliable energy distribution across residential, commercial, and industrial sectors.

-

What role do regasification terminals play in Brazil?Regasification terminals convert imported LNG back into gas, supplying power plants and industries efficiently. Floating and onshore terminals provide supply flexibility, mitigating risks from pipeline limitations and domestic gas shortages.

-

Can LNG reduce Brazil’s reliance on hydropower?Yes, LNG diversifies the energy mix, supplying electricity when hydropower output is low due to droughts, reducing overdependence on a single energy source, and improving overall grid stability.

-

Which companies operate LNG terminals in Brazil?Key operators include Petrobras, Shell, TotalEnergies, ENGIE Brasil Energia, New Fortress Energy, and Excelerate Energy, managing imports, regasification, and distribution to support industrial and power generation needs.

-

What challenges limit LNG expansion in Brazil?High global LNG prices, infrastructure bottlenecks, limited pipeline connectivity, and competition from renewables restrain growth, while regulatory approvals and import logistics can delay new terminal projects.

-

How does LNG contribute to Brazil’s energy transition?LNG offers a cleaner alternative to coal and oil, reducing greenhouse gas emissions and supporting Brazil’s transition to a lower-carbon, diversified energy mix while ensuring a reliable electricity supply.

-

Is LNG used for transportation in Brazil?LNG use as transportation fuel is minimal due to limited refueling infrastructure and higher costs, with power generation remaining the primary application in Brazil’s energy sector.

-

What factors are driving LNG imports in Brazil?Seasonal hydropower variability, rising industrial energy consumption, declining domestic gas output, and government policies promoting energy security are the main factors encouraging increased LNG imports.

-

What is the future outlook for Brazil LNG?Brazil’s LNG market is expected to grow with new import terminals, expanding gas-fired power plants, supportive regulations, and increasing demand from industry, ensuring a stable, diversified, and cleaner energy supply.

Need help to buy this report?