Brazil Liquefied Petroleum Gas Market Size, Share, By Transportation (Ship, Railways, Intermodal ISO Tank Containers, Pipelines, Reticulated Gas System, And Others), By Distribution (Bottled LPG, Retail Bulk Supply, And Pipeline), And Brazil Liquefied Petroleum Gas Market Insights, Industry Trend, Forecasts to 2035

Industry: Specialty & Fine ChemicalsBrazil Liquefied Petroleum Gas Market Insights Forecasts to 2035

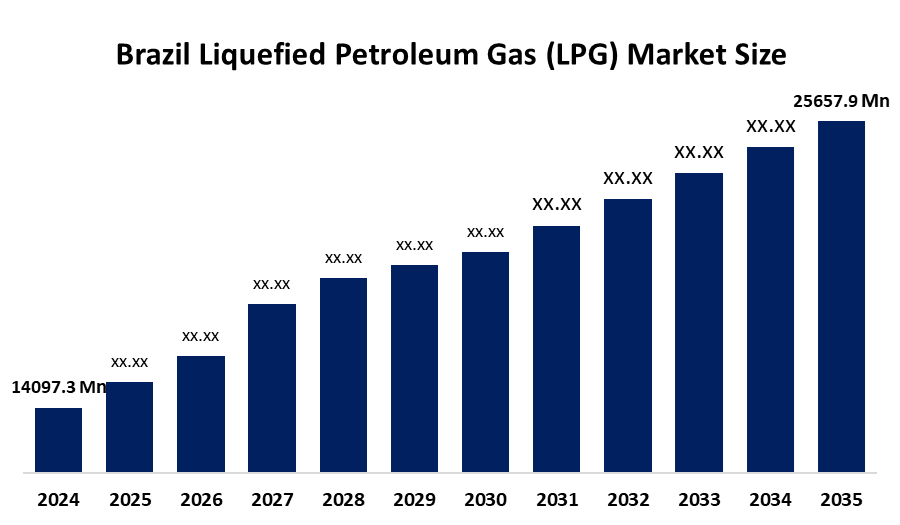

- Brazil Liquefied Petroleum Gas Market Size 2024: USD 14097.3 Million

- Brazil Liquefied Petroleum Gas Market Size 2035: USD 25657.9 Million

- Brazil Liquefied Petroleum Gas Market CAGR 2024: 5.6%

- Brazil Liquefied Petroleum Gas Market Segments: Transportation and Distribution

Get more details on this report -

Brazil liquefied petroleum gas (LPG) market refers to the parts of Brazil's energy sector encompasses the production, distribution, and use of LPG, an adaptable hydrocarbon fuel that is most frequently consumed for cooking in homes and also used as a heating source for industrial processes or as an energy source for commercial growth. In Brazil, LPG is often called kitchen gas and has an important and unique role in society because of its broad utility and dependence on bottled gas by the majority of homes that use LPG. The LPG sector has an extensive distribution network and local facilities that manufacture LPG cylinders, providing convenient access to LPG within large areas and even in sparsely populated areas.

The liquefied petroleum gas in Brazil is backed by government support, including the Programa Gas do Povo (People’s Gas Program), a social energy policy designed to guarantee access to cooking LPG for low-income families. Under this initiative, Brazil provides vouchers or subsidies for LPG purchases to qualifying households, aiming to reduce dependence on traditional fuels like firewood and charcoal and improve public health and environmental outcomes.

As technology advances, Brazilian liquefied petroleum gas providers are now using bio-LPG, a renewable form of LPG derived from vegetable oils and other biological materials, which has just been granted government approval for commercial production and sale by the appropriate national authority. These renewable LPG fuels will have significantly lower carbon emissions over their life cycle than the non-renewable versions, thereby helping Brazil achieve its goals regarding energy transitions. Other advances in technology include digital solutions for tracking and managing the logistics of cylinder distribution to improve the safety of transporting gas, reduce losses from the supply chain, and improve the efficiency of operations.

Market Dynamics of the Brazil Liquefied Petroleum Gas Market:

The Brazil liquefied petroleum gas market is driven by strong residential demand, supportive government policies and subsidies, cost effective LPG affordable for low-income populations, extensive distribution network that ensures reliable supply nationwide, increased industrial applications for heating and processing, continued infrastructure investments, and Brazil’s natural gas reserves support enhancing energy security and reducing complete dependence on imports further propel the market growth.

The Brazil liquefied petroleum gas market is restrained by the regulatory and pricing pressures, heavy import reliance, regulatory overhaul to improve competition and lower consumer prices, increased concerns about high LPG prices, and stringent environmental policies pushing for further decarbonization.

The future of Brazil liquefied petroleum gas market is bright and promising, with versatile opportunities emerging from the expanding the production of bio-LPG gives us a clear opportunity to integrate renewable energy into the LPG market and appeal to environmentally minded consumers and policymakers. Industrial growth in LPG use, potential regulatory changes allowing for wider application and utilizing digital technologies to transform logistics and distribution could provide further opportunities for growth. Furthermore, the continued support of the governmental sector in the form of social programs and infrastructure investment can continue to support and grow the use of LPG, especially where access to alternative energy sources is limited.

Brazil Liquefied Petroleum Gas (LPG) Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 14097.3 Million |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | CAGR of 5.6% |

| 2035 Value Projection: | USD 25657.9 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 90 |

| Segments covered: | By Transportation |

| Companies covered:: | Copa Energia, Ultragaz, Supergasbras, Nacional Gas, Petrobras, Acelen, Galp Energia, Bahia Gas, and Other key players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Market Segmentation

The Brazil Liquefied Petroleum Gas Market share is classified into transportation and distribution.

By Transportation:

The Brazil liquefied petroleum gas market is divided by transportation into ship, railways, intermodal ISO tank containers, pipelines, reticulated gas system, and others. Among these, the intermodal ISO tank containers segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. Unmatched flexibility, ensures safety, cost effectiveness due to country’s underdeveloped pipeline infrastructure, and enabling seamless and efficient transport across sea, rail, and road all contribute to the intermodal ISO tank containers segment's largest share and higher spending on liquefied petroleum gas when compared to other transportation.

By Distribution:

The Brazil liquefied petroleum gas market is divided by distribution into bottled LPG, retail bulk supply, and pipeline. Among these, the bottled LPG segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. The bottled LPG segment dominates because of extensive household usage as a primary cooking fuel, limited infrastructure creating high reliance, high accessibility, and government program support by providing subsidies for low income families.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the Brazil liquefied petroleum gas market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in Brazil Liquefied Petroleum Gas Market:

- Copa Energia

- Ultragaz

- Supergasbras

- Nacional Gas

- Petrobras

- Acelen

- Galp Energia

- Bahia Gas

- Others

Recent Developments in Brazil Liquefied Petroleum Gas Market:

In January 2026, Petrobras announced the signing of contracts for the construction of five new LPG carriers and 18 barges, with an investment of R$2.8 billion to bolster domestic logistics as part of the “Mar Aberto” program.

In November 2025, the Brazilian federal government launched “Gas do Povo” Program to provide free LPG cylinders to 15.5 million low-income households, increasing total beneficiaries to 21 million and driving a projected 5-8% increase in demand.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the Brazil, regional, and country levels from 2020 to 2035. Spherical Insight shas segmented the Brazil liquefied petroleum gas market based on the below-mentioned segments:

Brazil Liquefied Petroleum Gas Market, By Transportation

- Ship

- Railways

- Intermodal ISO Tank Containers

- Pipelines

- Reticulated Gas System

- Others

Brazil Liquefied Petroleum Gas Market, By Distribution

- Bottled LPG

- Retail Bulk Supply

- Pipeline

Frequently Asked Questions (FAQ)

-

What is the Brazil liquefied petroleum gas market size?Brazil liquefied petroleum gas market is expected to grow from USD 14097.3 million in 2024 to USD 25657.9 million by 2035, growing at a CAGR of 5.6% during the forecast period 2025-2035.

-

What are the key growth drivers of the market?Market growth is driven by the strong residential demand, supportive government policies and subsidies, cost effective LPG affordable for low-income populations, extensive distribution network that ensures reliable supply nationwide, increased industrial applications for heating and processing, continued infrastructure investments, and Brazil’s natural gas reserves support enhancing energy security and reducing complete dependence on imports further propel the market growth

-

What factors restrain the Brazil liquefied petroleum gas market?Constraints include the regulatory and pricing pressures, heavy import reliance, regulatory overhaul to improve competition and lower consumer prices, increased concerns about high LPG prices, and stringent environmental policies pushing for further decarbonization.

-

How is the market segmented by transportation?The market is segmented into ship, railways, intermodal ISO tank containers, pipelines, reticulated gas system, and others

-

Who are the key players in the Brazil liquefied petroleum gas market?Key companies include Copa Energia, Ultragaz, Supergasbras, Nacional Gas, Petrobras, Acelen, Galp Energia, Bahia Gas, and Others

-

Who are the target audiences for this market report?The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Need help to buy this report?