Brazil Kitchen Appliances Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Refrigerator, Cooking Appliances, Dishwashers, and others), By Application (Residential and Commercial), Distribution Channel (Online and Offline), and Brazil Kitchen Appliances Market Insights, Industry Trend, Forecasts to 2035

Industry: Consumer GoodsBrazil Kitchen Appliances Market Insights Forecasts to 2035

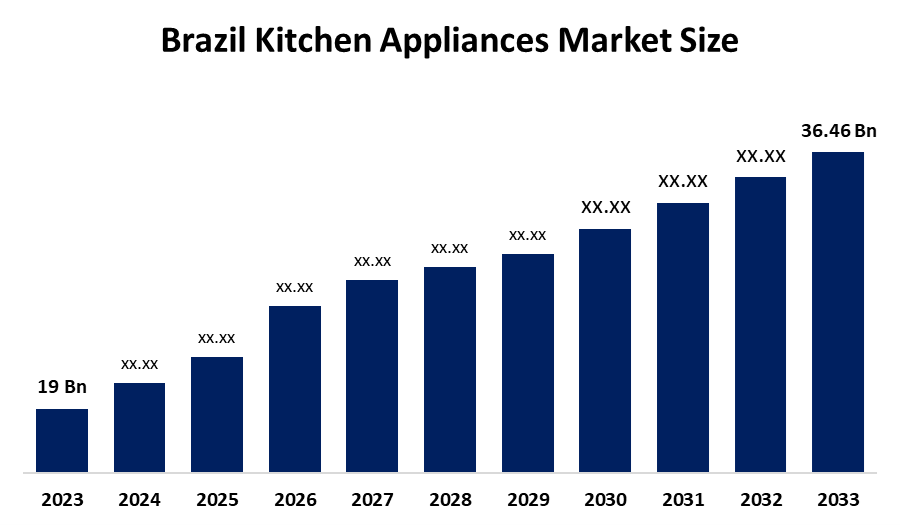

- The Brazil Kitchen Appliances Market Size Was Estimated at USD 19 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of Around 6.1% from 2025 to 2035

- The Brazil Kitchen Appliances Market Size is Expected to Reach USD 36.46 Billion by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the Brazil Kitchen Appliances Market size is anticipated to reach USD 36.46 billion by 2035, growing at a CAGR of 6.1% from 2025 to 2035. The Brazil kitchen appliances market is driven by rising urbanization, increasing disposable income, growing consumer preference for smart and energy-efficient appliances, expanding e-commerce, and a surge in home cooking trends, boosting demand for modern and convenient kitchen solutions.

Market Overview

Kitchen appliances refer to a wide range of electric or mechanical devices that help with food preparation and cooking, as well as food storage and food waste disposal in a user-friendly manner. It includes refrigerators, ovens, microwaves, and blenders, to name a few. All of which allow users to make better use of their time by providing faster, safer alternatives to conventional methods in the kitchen, as well as helping to create an overall better cooking experience. The growth of the kitchen appliance market in Brazil continues to benefit from an increase in population density, an increase in disposable income, a shift toward smart and energy-efficient kitchen appliances, greater access to e-commerce, a growing trend towards cooking at home, and the desire for modern, convenient, and time-saving kitchen equipment.

The Brazilian kitchen appliance industry is experiencing trends such as increased demand for smart connected appliances, eco-friendly/energy-efficient products, a move toward compact appliance designs to accommodate the needs of urban dwellers, and the increasing presence of multi-purpose appliances. In addition, the Brazilian market continues to benefit from an increase in e-commerce and an increased emphasis on premium kitchen equipment, as well as other kitchen appliances that promote healthy lifestyles.

Report Coverage

This research report categorizes the market for the Brazil kitchen appliances market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Brazil kitchen appliances market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Brazil kitchen appliances market.

Driving Factors

Brazil Kitchen Appliances Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 19 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 6.1% |

| 2035 Value Projection: | USD 36.46 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 90 |

| Segments covered: | By Product Type, By Application |

| Companies covered:: | Tramontina, Mondial, Britânia Eletrodomésticos, Cadence, Mabe, Whirlpool (Brastemp, Consul), Electrolux, LG Electronics, Samsung, Panasonic, and Other key players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

The Brazil kitchen appliances market is driven by several factors. Rising disposable income and urbanization are enabling more consumers to invest in modern appliances. Increasing demand for smart, energy-efficient, and multifunctional devices is reshaping purchasing behavior. The growing trend of home cooking, health-conscious lifestyles, and convenience-focused products is boosting sales. Additionally, the expansion of e-commerce platforms and the availability of a wide product range at competitive prices make kitchen appliances more accessible, fueling market growth.

Restraining Factors

The Brazil kitchen appliances market faces restraints such as high import duties and fluctuating currency rates, which increase product costs. Limited consumer awareness about advanced and energy-efficient appliances, along with economic uncertainties, can reduce purchasing power. Additionally, intense competition, reliance on imported components, and infrastructure challenges in rural areas may hinder market expansion and slow the adoption of modern kitchen appliances.

Market Segmentation

The Brazil kitchen appliances market share is categorized by product type, application, and distribution channel.

- The refrigerators segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Brazil kitchen appliances market is segmented by product type into refrigerators, cooking appliances, dishwashers, and others. Among these, the refrigerators segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is driven by their essential role in food preservation, high household penetration, and continuous demand driven by urbanization and rising disposable incomes. Consumers prioritize refrigerators as a long-term investment, and the increasing preference for energy-efficient and smart models further strengthens this segment’s market leadership

.

- The residential segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

The Brazil kitchen appliances market is segmented by application into residential and commercial. Among these, the residential segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The growth of the segment is due to rising disposable incomes, urbanization, and lifestyle changes that encourage investment in modern, convenient appliances. Growing home cooking trends, health-conscious eating, and demand for energy-efficient and smart devices further boost residential demand. Additionally, the expansion of e-commerce and easy access to a wide range of products make purchasing appliances simpler for households. In comparison, commercial demand remains limited due to specialized equipment needs and higher costs.

- The offline segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

The Brazil kitchen appliances market is segmented by distribution channel into online and offline. Among these, the offline segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The growth of the segment is due to consumers prefer physically examine products before purchase, ensuring quality and suitability. Established retail networks, including specialty stores, supermarkets, and appliance showrooms, provide personalized customer service, product demonstrations, and immediate availability, enhancing buyer confidence. Additionally, many consumers in Brazil are accustomed to traditional shopping methods and may face trust or logistics concerns with online purchases. These factors collectively make offline channels the primary choice despite the rise of e-commerce.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Brazil kitchen appliances market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Tramontina

- Mondial

- Britânia Eletrodomésticos

- Cadence

- Mabe

- Whirlpool (Brastemp, Consul)

- Electrolux

- LG Electronics

- Samsung

- Panasonic

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

In June 2023, Whirlpool Brazil launched a new line of smart refrigerators featuring AI-powered technology and advanced energy-saving features. The move aligns with the growing consumer demand for energy-efficient, smart home appliances and supports Brazil's sustainability efforts.

In April 2023, Electrolux Brazil introduced a new range of sustainable washing machines that use 50% less water and energy compared to traditional models. This innovation is part of the company's commitment to eco-friendly manufacturing practices, responding to the increasing demand for environmentally conscious appliances.

Market Segment

This study forecasts revenue at the Brazil, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Brazil kitchen appliances market based on the below-mentioned segments:

Brazil Kitchen Appliances Market, By Product Type

- Refrigerator

- Cooking Appliances

- Dishwashers

- others

Brazil Kitchen Appliances Market, By Application

- Residential

- Commercial

Brazil Kitchen Appliances Market, By Distribution Channel

- Online

- Offline

Frequently Asked Questions (FAQ)

-

What types of kitchen appliances are popular in Brazil? Common appliances include refrigerators, ovens, microwaves, dishwashers, blenders, and other small cooking devices

-

Who primarily uses kitchen appliances in Brazil? The residential segment dominates, as households increasingly seek convenience, smart features, and energy-efficient solutions

-

How do consumers buy appliances? Most purchases happen through offline retail stores, although online shopping is steadily growing

-

What is fueling the market’s expansion? Factors include higher disposable income, urban lifestyles, home cooking trends, and the popularity of smart appliances.

-

What challenges slow market growth? Challenges include high import taxes, limited awareness of advanced products, and supply chain or rural accessibility issues.

-

Which companies are leading the market? Key players are Tramontina, Mondial, Britânia, Cadence, Mabe, Whirlpool, Electrolux, LG, Samsung, Panasonic, Midea, and Philips

-

What are the emerging consumer preferences? Consumers prefer multifunctional, compact, energy-efficient, and connected appliances that make cooking faster and more convenient

Need help to buy this report?