Brazil Infrastructure Construction Market Size, Share, By Type (Energy Construction And Utilities Infrastructure Construction), By Application (Civil Use And Military Use), And Brazil Infrastructure Construction Market, Industry Trend, Forecasts to 2035.

Industry: Construction & ManufacturingBrazil Infrastructure Construction Market Insights Forecasts to 2035

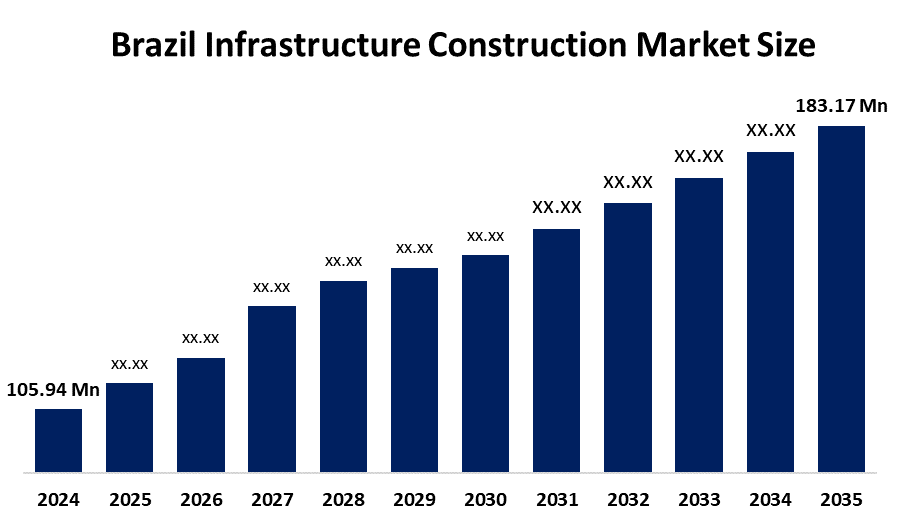

- Brazil Infrastructure Construction Market Size 2024: USD 105.94 Mn

- Brazil Infrastructure Construction Market Size 2035: USD 183.17 Mn

- Brazil Infrastructure Construction Market CAGR 2024: 5.1%

- Brazil Infrastructure Construction Market Segments: Type and Application

Get more details on this report -

The Brazil infrastructure construction market refers to the sector of the Brazilian economy that involves the construction and improvement of the basic physical systems that support national economic activities and public services, such as transportation (roads and railways, airports), energy (power plants and electrical grid), water and sanitation systems and utility projects. This construction market is a key contributor to the Brazilian infrastructure construction industry and is driven by the need for long-term development solutions from both the public and private sectors.

The infrastructure construction in Brazil are backed by government support, including the New Growth Acceleration Program (PAC), which comprises tens of thousands of infrastructure projects across transportation, energy, and sanitation sectors, with government commitments totaling hundreds of billions of BRL to be deployed by 2026. By mid-2025, infrastructure investment under PAC was expected to reach BRL 277.9 billion, equating to about 2.2% of GDP, with a pipeline of over 23,000 projects in various stages of development.

As technology advances, Brazil’s infrastructure construction providers are now using Building Information Modeling (BIM), automation, prefabricated approaches, and digital project management applications to create a more efficient process, minimize the generation of waste, and enhance the accuracy of scheduling. Technology is driving improvements in broad-based infrastructure technologies such as renewable energy installations and transportation systems. Growing awareness of sustainable construction materials and practices and the adoption of sustainable design techniques have paved the way for meeting worldwide expectations and requirements concerning the reduction of carbon footprints of constructing new buildings.

Market Dynamics of the Brazil Infrastructure Construction Market:

The Brazil infrastructure construction market is driven by the expanding transportation networks, urbanization and economic development, strong government-led programs, expanded concession frameworks, improvements in project finance through blended funding instruments, increased private sector participation stimulate new construction activity, strategic emphasis on renewable energy infrastructure and digital connectivity supports demand for modern power and data transmission systems.

The Brazil infrastructure construction market is restrained by the bureaucratic delays, complex regulatory processes, supply chain constraints, increasing cost risks, elevated interest rates, labor shortages and escalating material costs can temper the pace of infrastructure expansion.

The future of Brazil infrastructure construction market is bright and promising, with versatile opportunities emerging from the infrastructure for smart cities along with installations of renewable energy sources and construction of data centers as the country continues to position itself for greater competitive advantages in the global market. The establishment of rail corridors and urban mobility projects through the creation of modern logistics hubs will provide an opportunity for a more efficient transport process for both goods and people. Furthermore, the increasing interest of foreign direct investment in Brazil along with improving the Public-Private Partnership (PPP) framework will create opportunities for large-scale projects to be financed with International capital and expertise.

Brazil Infrastructure Construction Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 105.94 Million |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | CAGR of 5.1% |

| 2035 Value Projection: | USD 183.17 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 115 |

| Segments covered: | By Type, By Application |

| Companies covered:: | CCR S.A., Ecorodovias, Rumo Logistica, Aegea Saneamento, Novonor, Andrade Gutierrez, Camargo Correa, Queirozv Galvao, Construcap, Racional Engenharia, Mendes Junior, Via Engenharia, AECOM, Skanska Brasil, BrookField Incorporadora, Others, and Key Players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Market Segmentation

The Brazil Infrastructure Construction Market share is classified into type and application.

By Type:

The Brazil infrastructure construction market is divided by type into energy construction and utilities infrastructure construction. Among these, the energy construction segment held the largest revenue market share in 2024 and is predicted to grow at a remarkable CAGR during the forecast period. Massive investment in grid modernization, renewable expansion, need to replace aging hydropower, strong government initiatives, and huge demand for generation, transmission, and storage projects all contribute to the energy construction segment's largest share and higher spending on infrastructure construction when compared to other type.

By Application:

The Brazil infrastructure construction market is divided by application into civil use and military use. Among these, the civil use segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. The civil use segment dominates because of massive needs in housing, sanitation, and transportation, increase in urbanization, strong government programs, and large population, with significant public investment fueling projects like roads, railways, and urban development.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the Brazil infrastructure construction market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in Brazil Infrastructure Construction Market:

- CCR S.A.

- Ecorodovias

- Rumo Logistica

- Aegea Saneamento

- Novonor

- Andrade Gutierrez

- Camargo Correa

- Queirozv Galvao

- Construcap

- Racional Engenharia

- Mendes Junior

- Via Engenharia

- AECOM

- Skanska Brasil

- BrookField Incorporadora

- Others

Recent Developments in Brazil Infrastructure Construction Market:

In January 2026, Petrobras awarded contracts totaling R$2.8 billion for the construction of five LPG carriers, 18 barges, and 18 pushboats. All vessels will be built in Brazilian shipyards to support domestic logistics.

In December 2025, ICTSI unit Celia Puso Alegra expanded its logistics center in Rio Grande, adding a 30,000 square meter bonded area, to create the new Rio Mina multimodal corridor.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the Brazil, regional, and country levels from 2020 to 2035. Spherical Insight has segmented the Brazil infrastructure construction market based on the below-mentioned segments:

Brazil Infrastructure Construction Market, By Type

- Energy Construction

- Utilities Infrastructure Construction

Brazil Infrastructure Construction Market, By Application

- Civil Use

- Military Use

Frequently Asked Questions (FAQ)

-

Q: What is the Brazil infrastructure construction market size?A: Brazil infrastructure construction market is expected to grow from USD 105.94 million in 2024 to USD 183.17 million by 2035, growing at a CAGR of 5.1% during the forecast period 2025-2035.

-

Q: What are the key growth drivers of the market?A: Market growth is driven by the expanding transportation networks, urbanization and economic development, strong government-led programs, expanded concession frameworks, improvements in project finance through blended funding instruments, increased private sector participation stimulate new construction activity, strategic emphasis on renewable energy infrastructure and digital connectivity supports demand for modern power and data transmission systems.

-

Q: What factors restrain the Brazil infrastructure construction market?A: Constraints include the bureaucratic delays, complex regulatory processes, supply chain constraints, increasing cost risks, elevated interest rates, labor shortages and escalating material costs can temper the pace of infrastructure expansion.

-

Q: How is the market segmented by type?A: The market is segmented into energy construction and utilities infrastructure construction.

-

Q: Who are the key players in the Brazil infrastructure construction market?A: Key companies include CCR S.A., Ecorodovias, Rumo Logistica, Aegea Saneamento, Novonor, Andrade Gutierrez, Camargo Correa, Queirozv Galvao, Construcap, Racional Engenharia, Mendes Junior, Via Engenharia, AECOM, Skanska Brasil, BrookField Incorporadora, and Others.

-

Q: Who are the target audiences for this market report?A: The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Need help to buy this report?