Brazil Hydrogen Peroxide Market Size, Share, By End Use (Paper & Pulp, Textiles, Waste Water Treatment, Food Processing, Electronic & Semiconductors, Pharmaceuticals, And Others), By Sales Channel (Direct Sales And Indirect Sales), And Brazil Hydrogen Peroxide Market Insights, Industry Trend, Forecasts to 2035

Industry: Chemicals & MaterialsBrazil Hydrogen Peroxide Market Insights Forecasts to 2035

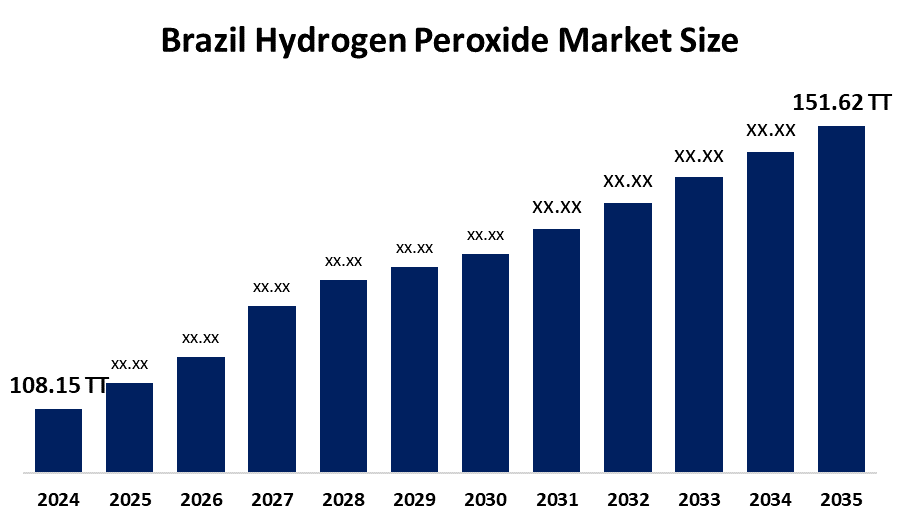

- Brazil Hydrogen Peroxide Market 2024: 108.15 Thousand Tonnes

- Brazil Hydrogen Peroxide Market Size 2035: 151.62 Thousand Tonnes

- Brazil Hydrogen Peroxide Market CAGR 2024: 3.12%

- Brazil Hydrogen Peroxide Market Segments: End Use and Sales Channel

Get more details on this report -

The Brazil Hydrogen Peroxide Market includes any manufacturing, distribution, sale or usage of hydrogen peroxide which is an oxidizer that can be used in many different sectors of the economy such as paper production, water treatment, mining, textiles, plastic production, electronics, disinfection in hospitals and food processing.

The hydrogen peroxide in Brazil are backed by government support, including the Brazil’s broader chemical industry sustainability and modernization support program known as Presiq, which was advanced by the lower house of Congress with expected incentives of around R15 billion over five years. This program is designed to support sustainable practices and investment across the chemical sector, including hydrogen peroxide.

As technology advances, Brazilian hydrogen peroxide providers are now using new ways to manufacture products as well as creating new methods for managing the flow of materials to improve both the efficiency and sustainability of global production systems. Innovations results in lower transportation costs, more reliable sources of supply, and lower greenhouse gas emissions from logistics. Modern automation and process integration in new plants also contribute to increased operational efficiency and enhanced product quality. Furthermore, new analytic technologies such as AI monitoring systems are also being used to improve process control and dosages accuracy in industrial applications.

Brazil Hydrogen Peroxide Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | 108.15 Thousand Tonnes |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 3.12% |

| 2035 Value Projection: | 151.62 Thousand Tonnes |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 111 |

| Segments covered: | By End Use, By Sales Channel |

| Companies covered:: | Peroxidos do Brasil, Evonik Industries AG, Arkema, Produtos Quimicos Makay, Nouryon, Mitsubishi Gas Chemical Company, BASF SE, Makeni Chemicals, Barentz, CJ Chemicals, Aditya Birla Chemicals, Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Market Dynamics of the Brazil Hydrogen Peroxide Market:

The Brazil hydrogen peroxide market is driven by the robust demand from the pulp and paper industry, increasing requirements for water and wastewater treatment, rapid urbanization, strict environmental regulation, growth in textiles and electronics sectors, rising healthcare and food processing needs for sterilization and disinfection applications, increased environmentally compatible decomposition into water and oxygen, and increased investment in analytics, automation, and digital monitoring.

The Brazil hydrogen peroxide market is restrained by the high production and handling costs, strict environmental and safety regulations, increase compliance costs for manufacturers, expanding production capacity can create supply bottlenecks, limited infrastructure, and global economic conditions and fluctuations.

The future of Brazil hydrogen peroxide market is bright and promising, with versatile opportunities emerging from the expanding cleaner production solutions and satellite plant models provides for more localized supply and a reduction in transportation barriers. An increasing focus on the global move to sustainable chemistry, as well as the increasing environmental standards across end-use industries, should further encourage the adoption of hydrogen peroxide as an environmentally friendly and sustainable alternative. Technological advancements in high purity grades will provide additional opportunities for niche markets with higher margins. The increased investment in analytics, automation, and digital monitoring will further improve operational efficiencies and create opportunities for advanced services to the supply chain.

Market Segmentation

The Brazil hydrogen peroxide market share is classified into end use and sales channel.

By End Use:

The Brazil hydrogen peroxide market is divided by end use into paper & pulp, textiles, waste water treatment, food processing, electronics & semiconductors, pharmaceuticals, and others. Among these, the pulp & paper segment held the largest revenue market share in 2024 and is predicted to grow at a remarkable CAGR during the forecast period. Massive pulp production sector, widely used as a primary and environmentally friendly bleaching agent, high demand for sustainable products, and growth in e-commerce platform all contribute to the pulp & paper segment’s largest share and higher spending on hydrogen peroxide segment when compared to other end use.

By Sales Channel:

The Brazil hydrogen peroxide market is divided by sales channel into direct sales and indirect sales. Among these, the direct sales dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. The direct sales dominates because of high demand from pulp & paper industries, massive share of the supply for eco-friendly bleaching, favouring direct and bulk supply contracts with producers, and eliminates logistical challenges through direct contact with consumers.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the Brazil hydrogen peroxide market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in Brazil Hydrogen Peroxide Market:

- Peroxidos do Brasil

- Evonik Industries AG

- Arkema

- Produtos Quimicos Makay

- Nouryon

- Mitsubishi Gas Chemical Company

- BASF SE

- Makeni Chemicals

- Barentz

- CJ Chemicals

- Aditya Birla Chemicals

- Others

Recent Developments in Brazil Hydrogen Peroxide Market:

In October 2025, Peroxidos do Brasil announced new on site satellite hydrogen peroxide plant, using proprietary technology. The plant located at Arauco’s Sucuriu Project mill, with a capacity to produce 25000 tons of hydrogen peroxide per year to serve the pulp, paper, and regional markets.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the Brazil, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Brazil hydrogen peroxide market based on the below-mentioned segments:

Brazil Hydrogen Peroxide Market, By End Use

- Pulp & Paper

- Textiles

- Waste Water Treatment

- Food Processing

- Electronics & Semiconductors

- Pharmaceuticals

- Others

Brazil Hydrogen Peroxide Market, By Sales Channel

- Direct Sales

- Indirect Sales

Frequently Asked Questions (FAQ)

-

Q: What is the Brazil hydrogen peroxide market size?A: Brazil hydrogen peroxide market is expected to grow from 108.15 thousand tonnes in 2024 to 151.62 thousand tonnes by 2035, growing at a CAGR of 3.12% during the forecast period 2025-2035.

-

Q: What are the key growth drivers of the market?A: Market growth is driven by the robust demand from the pulp and paper industry, increasing requirements for water and wastewater treatment, rapid urbanization, strict environmental regulation, growth in textiles and electronics sectors, rising healthcare and food processing needs for sterilization and disinfection applications, increased environmentally compatible decomposition into water and oxygen, and increased investment in analytics, automation, and digital monitoring.

-

Q: What factors restrain the Brazil hydrogen peroxide market?A: Constraints include the high production and handling costs, strict environmental and safety regulations, increase compliance costs for manufacturers, expanding production capacity can create supply bottlenecks, limited infrastructure, and global economic conditions and fluctuations.

-

Q: How is the market segmented by end use?A: The market is segmented into paper & pulp, textiles, waste water treatment, food processing, electronics & semiconductors, pharmaceuticals, and others.

-

Q: Who are the key players in the Brazil hydrogen peroxide market?A: Key companies include Peroxidos do Brasil, Evonik Industries AG, Arkema, Produtos Quimicos Makay, Nouryon, Mitsubishi Gas Chemical Company, BASF SE, Makeni Chemicals, Barentz, CJ Chemicals, Aditya Birla Chemicals, and Others.

-

Q: Who are the target audiences for this market report?A: The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Need help to buy this report?