Brazil Healthcare Third-party Logistics Market Size, Share, By Supply Chain (Cold Chain Logistics, Non-cold Chain Logistics), By Services Type (Transportation, Air Freight, Sea Freight, Overland, Warehousing and Storage, and Other Services), Brazil Healthcare Third-party Logistics Market Insights, Industry Trends, Forecasts to 2035

Industry: HealthcareBrazil Healthcare Third-party Logistics Market Insights Forecasts to 2035

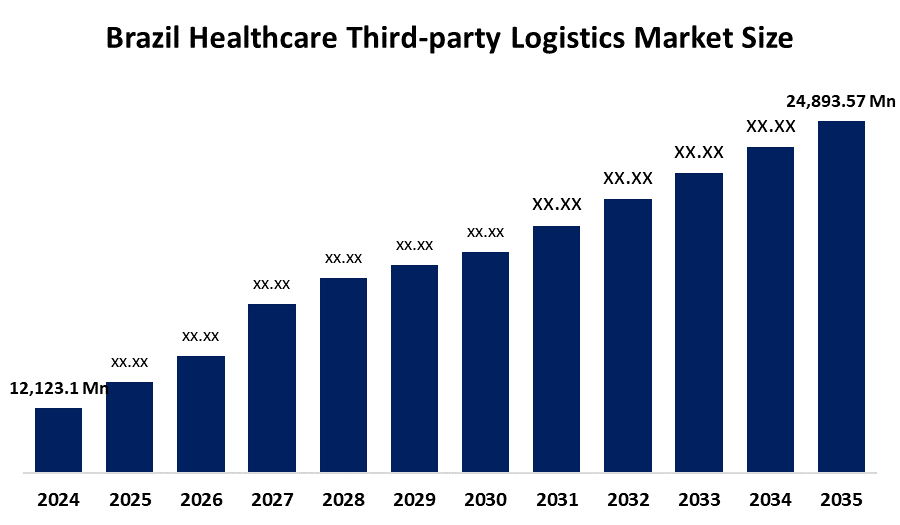

- Brazil Healthcare Third-party Logistics Market Size 2024: USD 12,123.1 Mn

- Brazil Healthcare Third-party Logistics Market Size 2035: USD 24,893.57 Mn

- Brazil Healthcare Third-party Logistics Market Size CAGR (2025–2035): 6.76%

- Brazil Healthcare Third-party Logistics Market Size Segments: Supply Chain and Services Type

Get more details on this report -

Third-Party Logistics (3PL) In The Healthcare Industry Refers To An Entity That Provides Various Logistical Services; these logistics may include transportation, warehousing, management of inventory, and other logistical activities within the cold chain service. Some characteristics of this marketplace are; temperature controls, required regulations for the industry, the capability to trace, and manage risk. There are some major trends that are occurring within the Brazilian healthcare logistics marketplace, which include, the increased usage of cold chain logistics, demand for last mile delivery, and integration of end-to-end logistics services for pharmaceutical and medical products.

Government And Private Initiatives Are Important Factors Within The Brazilian Healthcare Logistics Marketplace. Brazil’s Health Authority is responsible for enforcing regulations for the storage and distribution of pharmaceutical products, therefore as the demand for pharmaceuticals increases so too must the healthcare logistics marketplace. Private investment by both logistics companies and healthcare companies into warehouse space, cold storage infrastructure, and distribution networks throughout the nation, provide additional support to healthcare logistics given the rapid growth of demand from the healthcare industry.

Technological Advances Have Significantly Improved The Logistics Operations Of Healthcare In Brazil. Real-time tracking systems, warehouse management systems (WMS), temperature monitoring sensors, automating processes, and data analytics have all contributed to better visibility of the supply chain, reduced product loss, and increased compliance. Additionally, digital platforms combined with integrated logistics management have also provided further efficiencies throughout the healthcare supply chain.

Brazil Healthcare Third-party Logistics Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | 12,123.1 Million |

| Forecast Period: | 2020-2023 |

| Forecast Period CAGR 2020-2023 : | 6.76% |

| 2023 Value Projection: | 24,893.57 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 250 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Supply Chain By Services Type |

| Companies covered:: | DHL Supply Chain Brazil, Kuehne + Nagel Brazil, FedEx Brazil, UPS Brazil, CEVA Logistics Brazil, JSL Logistica, Braspress, Correios Logística Integrada, Grupo SADA, RTE Rodonaves, and Others Key Players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Market Dynamics of the Brazil Healthcare Third-party Logistics Market

The Brazil Healthcare Third-Party Logistics Market Size Is Driven By The Growth In Pharmaceutical Production, increased vaccine and biologics distribution, and the need for cold chain logistics support. To provide an expanded environment for private health care providers, increasing governmental regulation in Latin America has increased the expectations of patients; thus, requiring a low-cost solution to provide for their needs. Furthermore, rapid technological advancements in logistics, increasing international shipments, and the increasing use of specialty medications requiring specific temperature-controlled shipping practices continue to fuel the growth of this industry within Brazil.

The Market Size Is Restrained By Cost Of Doing Business, difficulties related to finding employees, complicated government regulations and laws, and Issues associated with keeping frozen goods at desirable temperatures while shipping over long distances. Inadequate numbers of trained logistics professionals may also have a restraining effect on the growth of the market due to these factors.

The Future Growing Demand For The Need To Develop New Biopharmaceuticals Will Create Excellent Opportunities For Use Of Logistics Methods Between Brazil's Desired Third-Party Logistics Market Size. In addition, growth in demand for e-commerce pharmaceuticals, improved logistics capabilities due to the investments being made in Smart Warehousing, as well as the increase use of automated and Ai-based logistics planning technologies and Integrated Digital Platforms will further enable 3rd Party Logistics to provide value for clients while creating additional channels of growth in the future.

Market Segmentation

The Brazil Healthcare Third-party Logistics Market share is classified into supply chain and services type.

By Supply Chain:

The Brazil Healthcare Third-Party Logistics Market Size Is Divided Into Cold Chain Logistics And Non-Cold Chain Logistics. Among these, cold chain logistics dominated the market share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. This dominance is attributed to rising demand for biologics and vaccines, stricter regulatory compliance, expanding immunization programs, pharmaceutical production, and a broader healthcare infrastructure will continue to drive the Cold Chain Logistics in Brazil. These factors cause an increase in the need to facilitate temperature-sensitive pharmaceuticals, which have high value and require temperature-controlled storage and transportation.

By Services Type:

The Brazil Healthcare Third-Party Logistics Market Size Is Divided Into Transportation, Air Freight, Sea Freight, Overland, Warehousing And Storage, And Other Services. Among these, the transportation segment accounted for the highest share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. The dominance of this segment is due to constant flow of pharmaceuticals, vaccines, and medical devices throughout Brazil. The transportation segment ensures that these products are delivered on time, that the products remain within the required temperature range during shipment, and that they can meet growing needs for healthcare services from all types of providers across the entire country.

Competitive Analysis

The Report Provides An In-Depth Analysis Of Key Organizations Operating In The Brazil Healthcare Third-Party Logistics Market Size, including comparative evaluation based on service portfolio, business overview, geographic presence, strategic initiatives, segment market share, and SWOT analysis. It also highlights recent developments such as infrastructure expansion, technology adoption, partnerships, and strategic investments, offering a clear view of the competitive landscape.

Top Key Companies in Brazil Healthcare Third-party Logistics Market

- DHL Supply Chain Brazil

- Kuehne + Nagel Brazil

- FedEx Brazil

- UPS Brazil

- CEVA Logistics Brazil

- JSL Logistica

- Braspress

- Correios Logística Integrada

- Grupo SADA

- RTE Rodonaves

Recent Developments in Brazil Healthcare Third-party Logistics Market

In April 2024, DHL Supply Chain Brazil expanded its healthcare-focused warehousing and cold chain infrastructure to support pharmaceutical and vaccine distribution.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firms

- Venture Capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the Brazil, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Brazil healthcare third-party logistics market based on the following segments:

Brazil Healthcare Third-party Logistics Market, By Supply Chain

- Cold Chain Logistics

- Non-cold Chain Logistics

Brazil Healthcare Third-party Logistics Market, By Services Type

- Transportation

- Air Freight

- Sea Freight

- Overland

- Warehousing and Storage

- Other Services

Frequently Asked Questions (FAQ)

-

What is the Brazil healthcare third-party logistics market size?The market is expected to grow from USD 12,123.1 million in 2024 to USD 24,893.57 million by 2035, at a CAGR of 6.76%.

-

What are the key growth drivers of the market?Growth is driven by rising pharmaceutical production, increasing demand for cold chain logistics, regulatory compliance requirements, and outsourcing of logistics operations.

-

What factors restrain the market?High operational costs, infrastructure gaps, regulatory complexity, and transportation challenges restrain market growth.

-

Who are the target audiences for this report?Market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Need help to buy this report?