Brazil Furniture Market Size, Share, By Type (Metal, Wood, Plastic, Glass, Others), By End Use (Residential, Commercial, Hospitality, Others), and Brazil Furniture Market Insights, Industry Trend, Forecasts to 2035

Industry: Consumer GoodsBrazil Furniture Market Insights Forecasts to 2035

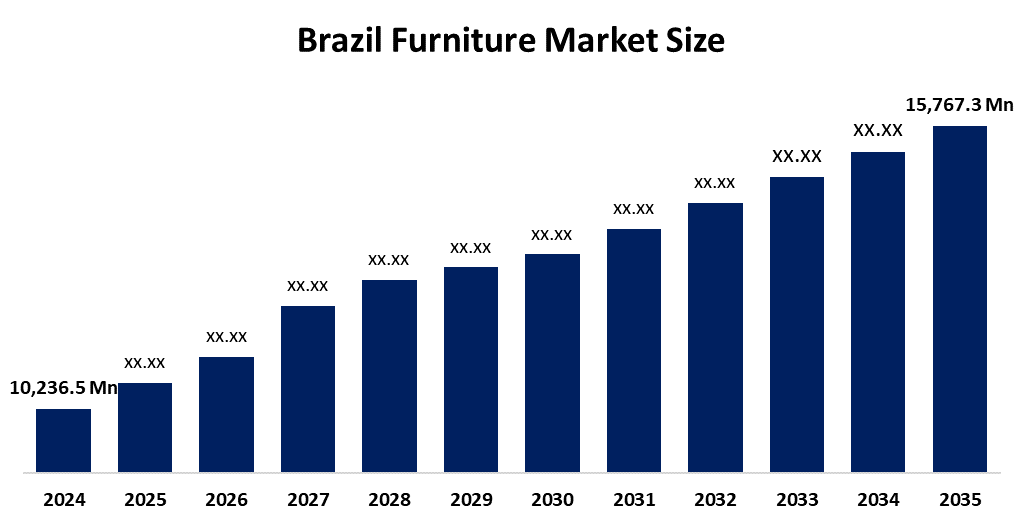

- Brazil Furniture Market Size 2024: USD 10,236.5 Million

- Brazil Furniture Market Size 2035: USD 15,767.3 Million

- Brazil Furniture Market CAGR 2024: 4.01%

- Brazil Furniture Market Segments: Type and End Use

Get more details on this report -

The Brazilian Furniture Sector consists of both household and office furniture, made from a combination of wood, metal, plastic, glass, and other materials, and designed with functional, aesthetic, and comfort qualities in mind. Growth in this sector is driven by Urban development, increased investment in real estate and construction activities, increased disposable income, as well as the growing preference for modern and Multitask sustainable Furniture.

The government and private sector initiatives are playing an important role in the development of Brazil furniture industry by improving the capacity of Brazil to produce furniture in Brazil; promoting sustainable forestry, and increasing Brazil’s export capabilities. Investments in industrial clusters, as well as the provision of incentives for using certified wood, have enabled manufacturers to produce furniture more efficiently and competitively in the global marketplace. Private investment in retail infrastructure and design innovation is expected to continue expanding access to furniture products in both urban and semi-urban markets across Brazil.

The technological developments in Brazil are impacting the country's furniture industry in several ways, including increasing the use of automated production techniques, the introduction of computer-controlled machinery (CNC), the growth of modular design options, and the creation of digital technologies that allow customers to create customized designs for their products. eCommerce, augmented reality (AR) visualizations, and smart logistics systems are enabling companies to better engage with their consumers and to improve operational efficiencies, by allowing them to produce furniture in a shorter amount of time and to make use of less material by creating customized pieces in response to the diverse tastes and preferences of consumers, which are constantly changing over time.

Brazil Furniture Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 10,236.5 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 4.01% |

| 2035 Value Projection: | USD 15,767.3 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 113 |

| Segments covered: | By Type, By End Use |

| Companies covered:: | Nitori Holdings Co., Ltd., Panasonic Housing Solutions Co., Ltd., TOTO Ltd., LIXIL Corporation, KOKUYO Co., Ltd., Okamura Corporation, Itoki Corporation, Karimoku Furniture Inc., HNI Japan, MUJI, Others key players. |

| Pitfalls & Challenges: | Covid 19 Impact Challanges, Future, Growth and Analysis |

Get more details on this report -

Market Dynamics of the Brazil Furniture Market:

The Brazil furniture market is driven by the rapid urban growth, capability in the development of residential housing projects, and a growing preference for attractive and compact furniture. Renovation activities, expanding hospitality commercial infrastructure and an increased consumer preference for environmentally friendly and durable material contribute to growth. Opportunities provided by organized retail, online furniture stores, and a broad range of customized solutions increase the ability to easily purchase furniture and provide additional assistance to the continued expansion of the Brazil marketplace.

The Brazil furniture market is restrained by the factors including changes in raw material costs, high costs of logistics and transportation, and fluctuations in the economy. Furthermore, due to the level of competition from unorganised markets, the dependence on imported raw materials by some manufacturers, and the limited use of advanced technologies for manufacturing by smaller manufacturers, the market's profitability and growth could be affected.

A significant opportunity for the Brazil furniture market is expected to develop because of growing interest in sustainable products, increasing acceptance of the concept of smart homes, and increasing usage of multifunctional furniture design. Additionally, as online sales channels continue to expand, new business models utilizing recycled materials will also support growth opportunities. Additionally, the unique characteristics of ergonomic furniture and efficient use of space will open additional avenues for a growing number of companies in Brazil, especially with the possibility of exporting to Latin America and the global marketplace.

Market Segmentation

The Brazil Furniture Market share is classified into type and end use.

By Type:

The Brazil furniture market is segmented by type into metal, wood, plastic, glass, and others. Among these, the wood segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. The wood segment dominates because Brazil’s numerous natural forests provide wood for furniture that can last longer and look better than other materials, as well as being manufactured by a small number of businesses located in areas with high concentrations of manufacturers producing wood furniture. The existence of a concentration of manufacturers producing wood furniture in Brazil contributes significantly to the growth in exports and production of eco-certified and solid wood products.

By End Use:

The Brazil furniture market is segmented by end use into residential, commercial, hospitality, and others. Among these, the residential segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. The residential segment dominates because increase in residential construction projects and the increase in the amount of renovation activities happening across the country, along with the growing desire for modern and modular-style furniture, as well as growing renovations, remodels, and custom furniture made available through a combination of brick-and-mortar and online retailers.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the Brazil furniture market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in Japan Clinical Trials Support Services Market:

- Nitori Holdings Co., Ltd.

- Panasonic Housing Solutions Co., Ltd.

- TOTO Ltd.

- LIXIL Corporation

- KOKUYO Co., Ltd.

- Okamura Corporation

- Itoki Corporation

- Karimoku Furniture Inc.

- HNI Japan

- MUJI

- Others

Recent Developments in Japan Clinical Trials Support Services Market:

In March 2025, Nitori Holdings expanded its private-label furniture sourcing network in Brazil to strengthen supply chain efficiency and improve product availability across Latin American markets.

In November 2024, LIXIL Corporation partnered with Brazilian distributors to promote sustainable furniture and interior solutions using eco-certified materials.

In August 2024, Okamura Corporation introduced ergonomic office furniture solutions in Brazil targeting corporate and co-working spaces, supporting the growing demand for flexible work environments.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at Brazil, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Brazil furniture market based on the following segments:

Brazil Furniture Market, By Type

- Metal

- Wood

- Plastic

- Glass

- Others

Brazil Furniture Market, By End Use

- Residential

- Commercial

- Hospitality

- Others

Frequently Asked Questions (FAQ)

-

Q: What is the Brazil furniture market size?A: Brazil Furniture Market is expected to grow from USD 10,236.5 million in 2024 to USD 15,767.3 million by 2035, growing at a CAGR of 4.01% during the forecast period 2025–2035.

-

Q: What are the key growth drivers of the market?A: Growth is driven by urbanization, residential construction, rising disposable income, demand for modern and sustainable furniture, and expansion of organized retail and online sales channels.

-

Q: What factors restrain the Brazil furniture market?A: Market restraints include volatile raw material prices, high logistics costs, economic fluctuations, and competition from unorganized players.

-

Q: How is the market segmented?A: The market is segmented by type, end use, and distribution channel.

-

Q: Who are the key players in the Brazil furniture market?A: Key players include Nitori Holdings, LIXIL Corporation, Okamura Corporation, KOKUYO, Itoki, Karimoku Furniture, and others.

-

Q: Who are the target audiences for this report?A: The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Need help to buy this report?