Brazil Forklift Market Size, Share, By Class (Class 1, Class 2, Class 3, Class 4, Class 5 and Others), By Load Type (3. 5 Tons, 10 Tons, and Above 10 Tons), By End-Use (Construction, Automotive, Aerospace & Defense, Warehouse & Logistics, and Others), Brazil Forklift Market Insights, Industry Trend, Forecasts to 2035

Industry: Automotive & TransportationBrazil Forklift Market Insights Forecasts to 2035

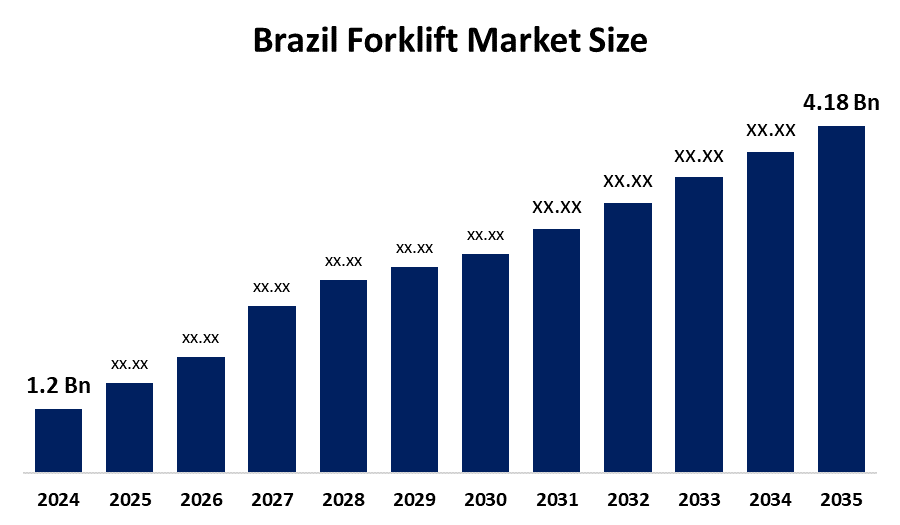

- Brazil Forklift Market Size 2024: USD 1.2 Billion

- Brazil Forklift Market Size 2035: USD 4.18 Billion

- Brazil Forklift Market CAGR 2024: 12%

- Brazil Forklift Market Segments: Class, Load type, End User

Get more details on this report -

A forklift is a machine used in industries to lift, carry, stack, and move heavy loads for a short distance. In general, forklifts are used in warehouses, manufacturing plants, ports, and construction sites, where they handle pallets and materials efficiently, thus reducing manual labor, increasing productivity, and making safer material handling operations possible in all industries. Besides, the forklift market is fueled by the rise of warehousing, e-commerce, industrial automation, and construction activities. The demand for efficient material handling, better workplace safety, and the use of electric forklifts are the factors that contribute to the market growth all over the world.

The Brazilian government is putting into effect policies that encourage sustainable practices in the industrial sector. Among the electric vehicle incentives, the one for electric forklifts is the most effective in convincing businesses to go for the green option. On the other hand, carbon reduction regulations and energy-saving measures are changing the way people make their purchases and are setting the pace in the market.

One of the most important changes witnessed by the market is the trend towards electric forklifts powered by reasons such as their being environmentally friendly and less costly in operations. The rise of e-commerce has put great pressure on the material handling industry to come up with advanced equipment, thus leading to the increased use of electric forklifts. Besides, technology improvements such as automation and IoT integration are contributing to operational efficiency. Also, the rise of smart warehouses and the preference for sustainable solutions are some of the factors that are determining the market trends.

Brazil Forklift Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 1.2 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 12% |

| 2035 Value Projection: | USD 4.18 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 207 |

| Tables, Charts & Figures: | 111 |

| Segments covered: | By Class, By Load Type, By End-Use |

| Companies covered:: | Toyota Material Handling, Hyster Yale Group, Crown Equipment Corporation, Komatsu, Caterpillar (Mitsubishi Caterpillar Forklift Brasil), Jungheinrich Brazil, Still (KION Group), Heli Brasil (Anhui Heli), Others key players |

| Pitfalls & Challenges: | Covid 19 Impact Challanges, Future, Growth and Analysis |

Get more details on this report -

Market Dynamics of the Brazil Forklift Market:

The Brazil forklift market is driven by industrialization and urban development, which results in a higher need for efficient material movement. The establishment of warehouses and distribution centers, along with the rise of retail and e-commerce sectors, is pushing the demand for forklifts. To save energy, lower emissions, and enhance safety, companies are switching to electric and automated forklifts. The incorporation of telematics and smart monitoring systems is also upgrading fleet performance. Besides that, government infrastructure projects and the modern logistics network investments are some of the factors that are facilitating the use of forklifts everywhere in Brazil.

The Brazil forklift market is restrained by the high cost of the first investment for electric and technologically advanced forklifts, which may prevent the adoption of such products by small and medium enterprises. Besides that, the cost of maintenance, shortage of skilled operators, and safety issues are some of the factors that limit market growth. Situations such as economic fluctuations and import dependency for advanced models are some of the factors that make it difficult for the widespread use of forklifts across different industries in Brazil.

The Brazil forklift market presents significant opportunities due to the rapid growth of e-commerce, warehousing, and logistics, which require efficient material handling solutions. Increasing industrialization, construction projects, and agricultural modernization create additional demand. Adoption of electric and automated forklifts offers potential for cost savings, energy efficiency, and reduced environmental impact. Integration of smart technologies, IoT, and telematics for fleet management can further enhance productivity. Supportive government initiatives and infrastructure development programs also provide opportunities for market expansion across Brazil.

Market Segmentation

The Brazil Forklift Market share is classified into class, load type, and end-user.

By Class:

The Brazil Forklift market is divided by class into class 1, class 2, class 3, class 4, class 5, and others. Among these, the class 1 segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. Class 1 forklifts dominate the Brazil market because they are ideal for indoor operations, such as warehouses, distribution centers, and manufacturing facilities, which are expanding rapidly due to e-commerce and industrial growth. Their electric operation ensures low emissions, quiet performance, and reduced maintenance costs compared to internal combustion forklifts. Additionally, they are compact and maneuverable, making them suitable for tight spaces. The increasing focus on sustainability and energy efficiency further drives the adoption of Class 1 forklifts over other classes in Brazil.

By Load Type:

The Brazil Forklift market is divided by load type into 3-5 tons, 10 tons, and above 10 tons. Among these, the 3-5 tons segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. The 3–5 tons forklift segment dominates the Brazil market because it meets the majority of material handling requirements in warehouses, distribution centers, and small-to-medium manufacturing facilities. These forklifts offer a balance of efficiency, maneuverability, and affordability, making them suitable for everyday operations. Higher-capacity forklifts, like 10 tons or above, are only needed in heavy industries, limiting their adoption. Additionally, the growing e-commerce, logistics, and industrial sectors prefer versatile and cost-effective 3–5 tons forklifts for standard material movement tasks.

By End User:

The Brazil Forklift market is divided by end user into construction, automotive, aerospace & defense, warehouse & logistics, and others. Among these, the warehouse & logistics segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. The warehouse & logistics segment dominates due to the rapid expansion of e-commerce, retail distribution, and third-party logistics services, which require efficient material handling solutions. Forklifts in this segment are essential for lifting, stacking, and transporting goods within warehouses and distribution centers, ensuring faster operations and reduced labor costs. Compared to construction, automotive, or aerospace industries, the logistics sector has higher forklift utilization, driving consistent demand and making it the leading end-user segment in the Brazilian market

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the Brazil forklift market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in Brazil Forklift Market:

- Toyota Matrial Handling

- Hyster Yale Group

- Crown euepment Corporation

- Komatsu

- Caterpillar

- Jungheinrich Brazil

- Still(KION Group

- Others)

Recent Developments in Brazil Forklift Market:

In July 2022, TMH (Toyota Material Handling) recently revealed its acquisition of PennWest Toyota Lift, a forklift dealership headquartered in Pennsylvania. This acquisition encompasses multiple locations, including Mount Pleasant, Pittsburgh, and Erie. In the United States, TMH is the proud owner of the Hoist Liftruck series, which includes container handlers, marina trucks, and FLTs. Additionally, TMH offers a wide range of medium and heavy-duty forklifts in its product portfolio.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the Brazil, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Brazil forklift market based on the below-mentioned segments:

Brazil Forklift Market, By Class

- Class 1

- Class 2

- Class 3

- Class 4

- Class 5

- Others

Brazil Forklift Market, By Load Type

- 3. 5 Tons

- 10 Tons

- Above 10 Tons

Brazil Forklift Market, By End-Use

- Construction

- Automotive

- Aerospace & Defense

- Warehouse & Logistics, and Others

Frequently Asked Questions (FAQ)

-

Q1: What is a forklift?A forklift is an industrial vehicle used to lift, move, and stack heavy loads in warehouses, factories, and construction sites.

-

Q2: Which forklift type is most popular in Brazil?Class 1 electric forklifts are most popular due to their efficiency, low emissions, and suitability for indoor operations.

-

Q3: What load capacity dominates the market?Forklifts with 3–5 tons load capacity dominate, as they are versatile and suitable for most warehouse and logistics needs.

-

Q4: Which end-user segment leads the market?The warehouse & logistics segment leads, driven by e-commerce, retail distribution, and third-party logistics growth.

-

Q5: What factors are driving market growth?Key drivers include e-commerce expansion, industrial growth, adoption of electric forklifts, automation, and government infrastructure support.

-

Q6: What restrains the market?High initial costs, maintenance expenses, lack of skilled operators, and economic fluctuations limit market growth.

Need help to buy this report?