Brazil Forage Seed Market Size, Share, By Breeding Technology (Hybrids, Open-Pollinated Varieties, and Hybrid Derivatives), By Crop (Alfalfa, Forage Corn, Forage Sorghum, Other Forage Crops), Brazil Forage Seed Market Insights, Industry Trend, Forecasts to 2035

Industry: AgricultureBrazil Forage Seed Market Insights Forecasts to 2035

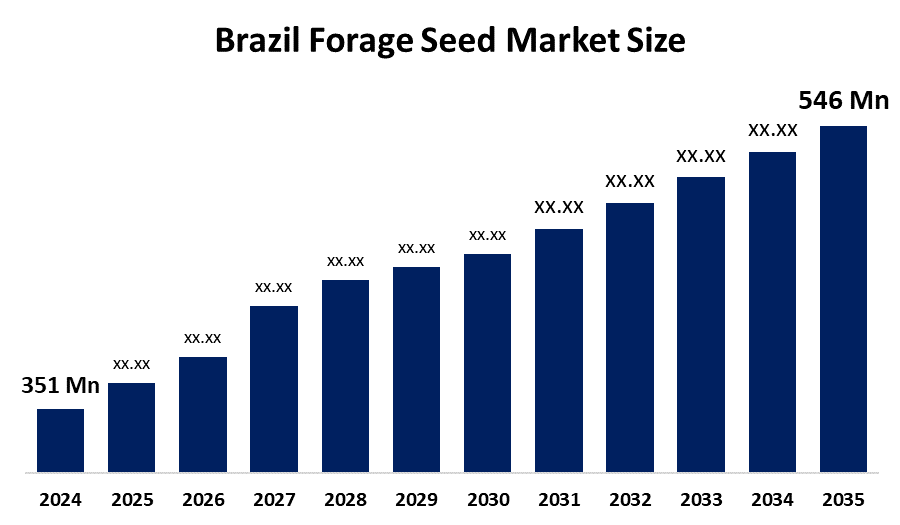

- Brazil Forage Seed Market Size 2024: USD 351 Mn

- Brazil Forage Seed Market Size 2035: USD 546 Mn

- Brazil Forage Seed Market Size CAGR 2024: 4.1%

- Brazil Forage Seed Market Segments: Breeding Technology, Crop.

f

f

Get more details on this report -

Forage seeds are seeds of plants specifically grown to provide feed for livestock, including grasses, legumes, and herbaceous plants. These seeds are cultivated for pastures, hay, or silage, ensuring a nutritious and sustainable food source for animals. High-quality forage seeds improve soil health, support animal growth, and contribute to efficient livestock farming practices. Furthermore, the Brazil forage seed market is growing due to rising livestock production, increasing demand for high-quality feed, adoption of drought-resistant and high-yield seed varieties, advancements in seed technology, and government initiatives promoting sustainable pasture management and soil improvement, driving overall market expansion and profitability.

The government policies promoting pasture rehabilitation and sustainable grazing systems are supporting the market size expansion. For instance, in 2024, the Brazilian government unveiled a record R$475.5 billion (US$88.2 billion) Crop Plan for the 2024/25 season, aiming to support sustainable farming practices. Besides this, climate challenges are prompting the adoption of drought-resistant and high-yielding forage varieties, ensuring better resilience and productivity, thus providing an impetus to the market. Furthermore, continuous advancements in biotechnology, including genetically improved seeds and enhanced seed treatment technologies, are improving germination rates and crop performance, which is impelling the market demand.

The rising uptake of climate-resilient forage varieties is influencing The Brazil Forage Seed Market Size Trends. This adoption helps the farmers to counter unpredictable weather patterns, particularly drought and soil degradation. In addition, farmers require constant pasture access throughout the year to minimize their feed supplement expenses. Moreover, two improved grass types, namely Brachiaria and Panicum, display better drought resistance properties and deliver elevated nutritional content and stronger regrowth potential. Moreover, the expansion of integrated crop-livestock systems is enhancing the Brazil forage seed market outlook, as farmers seek to optimize land use, improve soil fertility, and increase overall agricultural efficiency.

Brazil Forage Seed Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | 351 Million |

| Forecast Period: | 2020-2023 |

| Forecast Period CAGR 2020-2023 : | 4.1% |

| 2023 Value Projection: | 546 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 180 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Breeding Technology By Crop |

| Companies covered:: | OESP Sementes, Sementes Pontal Brasil, Palmeira Pastos, Barenbrug do Brasil, Advanta Seeds (UPL Brazil), Wolf Sementes, Germisul Seeds Ltd., Sementes Nogueira Ltda., and Others Key Players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Market Dynamics of the Brazil Forage Seed Market:

The Brazil Forage Seed Market Size is primarily driven by the country’s robust livestock industry, which fuels consistent demand for high-quality animal feed. Increasing awareness among farmers about the benefits of improved pasture productivity and soil health encourages the adoption of superior forage seed varieties. Technological advancements in seed genetics and the development of drought-resistant, high-yield seeds further enhance market growth. Additionally, government initiatives supporting sustainable agriculture, pasture restoration programs, and investment in modern farming practices contribute significantly. Rising demand for meat and dairy products also reinforces the market’s expansion.

The Brazil Forage Seed Market Size faces restraints due to high initial costs of quality seeds and advanced farming technologies, which may limit adoption among small-scale farmers. Additionally, unpredictable climatic conditions, such as droughts and floods, can negatively impact seed yield and pasture productivity. Limited awareness about modern forage practices and inadequate distribution infrastructure also hinders market growth.

The Brazil Forage Seed Market Size presents significant opportunities driven by increasing demand for sustainable livestock farming and high-quality animal feed. Rising adoption of advanced seed varieties, such as drought-resistant and high-yielding cultivars, offers potential for market expansion. Investment in precision agriculture, seed treatment technologies, and research for genetically improved forage seeds can further enhance productivity. Moreover, government initiatives promoting pasture restoration, soil health, and sustainable grazing practices provide growth avenues. Export potential of superior forage seeds to other South American countries also opens new revenue streams for market players.

Market Segmentation

The Brazil Forage Seed Market share is classified into breeding technology and crop.

By Breeding Technology:

The Brazil Forage Seed Market Size is divided by breeding technology into hybrids, open-pollinated varieties, and hybrid derivatives. Among these, the hybrids segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. Hybrids dominate because they deliver superior yield and uniform growth compared to open-pollinated varieties. They are more resistant to pests, diseases, and adverse climatic conditions, ensuring reliable pasture productivity. Livestock farmers prefer hybrids for their higher nutritional content, which improves animal growth and milk or meat production. Additionally, hybrids support sustainable farming practices by optimizing land use and reducing input losses. These advantages make hybrids the preferred choice, driving their dominance in Brazil’s forage seed market.

By Crop:

The Brazil Forage Seed Market Size is divided by crop into alfalfa, forage corn, forage sorghum, and other forage crops. Among these, the forage corn segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. Forage corn dominates because it offers high biomass yield, rapid growth, and superior digestibility, making it ideal for silage and livestock feed. Its adaptability to diverse climatic conditions across Brazil allows consistent production, while its nutrient-rich profile supports better animal growth and milk or meat output. Additionally, forage corn’s efficient land utilization and compatibility with mechanized farming make it more attractive than alfalfa, forage sorghum, and other forage crops, driving its widespread adoption and market dominance.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the Brazil forage seed market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in Brazil Forage Seed Market:

- OESP Sementes

- Sementes Pontal Brasil

- Palmeira Pastos

- Barenbrug do Brasil

- Advanta Seeds (UPL Brazil)

- Wolf Sementes

- Germisul Seeds Ltd.

- Sementes Nogueira Ltda.

- Others

Recent Developments in Brazil Forage Seed Market:

In June 2024, Frazier Healthcare Partners acquired BioMatrix Specialty Infusion Pharmacy, enhancing resources and innovation in specialty infusion services. This investment drives market growth by expanding advanced healthcare solutions, improving patient access, and fostering technological advancements in pharmaceutical care and distribution.

In March 2024, Corteva launched new seed technologies at Expodireto 2024, including Brevant’s Conkesta E3 soybean for pest control, Pioneer’s 95R70CE soybean and P3016VYHR corn for disease resistance, and Cordius’ C2550E soybean with Enlist E3 for improved weed management and resilience.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the Brazil, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Brazil forage seed market based on the below-mentioned segments:

Brazil Forage Seed Market, By Breeding Technology

- Hybrids

- Open-Pollinated Varieties

- Hybrid Derivatives

Brazil Forage Seed Market, By Crop

- Alfalfa

- Forage Corn

- Forage Sorghum

- Forage Crops

Frequently Asked Questions (FAQ)

-

What are forage seeds?Forage seeds are seeds of plants like grasses, legumes, and other crops cultivated to provide feed for livestock, either through grazing, hay, or silage.

-

Which crop dominates the Brazil forage seed market?Forage corn dominates due to its high yield, fast growth, and excellent nutritional value for livestock.

-

Which breeding technology is most used in Brazil?Hybrid seeds are most widely adopted because of higher yield, disease resistance, and better adaptability.

-

What are the key market drivers?Growth in livestock farming, adoption of high-yield and drought-resistant seeds, technological advances, and government support for sustainable pastures.

-

What restrains the market?High costs of quality seeds, climatic uncertainties, limited awareness among small farmers, and inadequate distribution infrastructure.

-

What opportunities exist in this market?Expansion through advanced seed varieties, precision agriculture, pasture restoration programs, and potential exports to other countries.

Need help to buy this report?