Brazil Food Additives Market Size, Share, By Type (Preservatives, Sweeteners and Sugar Substitutes, Emulsifiers, Enzymes, Hydrocolloids, Food Flavours and Colorants, and Others), By Application (Bakery, Confectionery, Dairy, Beverages, Meat, Poultry and Sea Foods, and Others), Brazil Food Additives Market Insights, Industry Trend, Forecasts to 2035

Industry: Food & BeveragesBrazil Food Additives Market Insights Forecasts to 2035

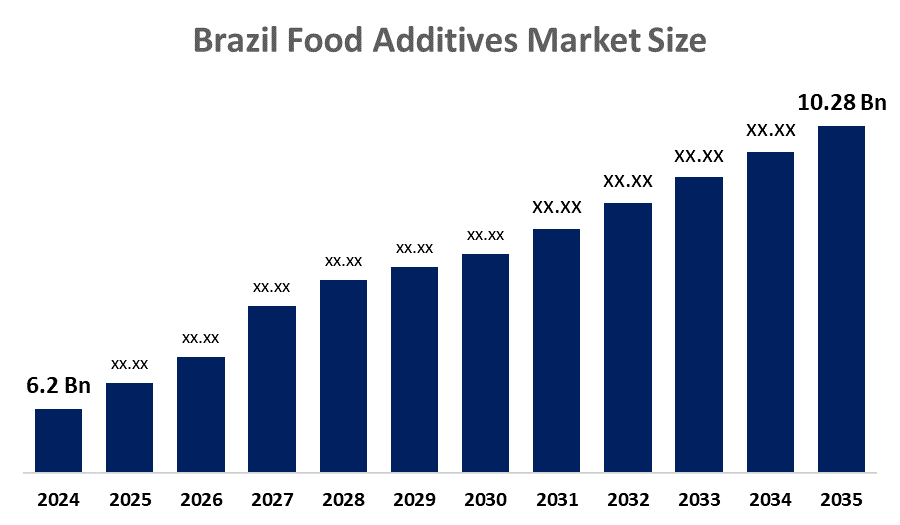

- Brazil Food Additives Market Size 2024: USD 6.2 Bn

- Brazil Food Additives Market Size 2035: USD 10.28 Bn

- Brazil Food Additives Market CAGR 2024: 4.7%

- Brazil Food Additives Market Segments: Type and Application.

Get more details on this report -

Food additives are substances intentionally added to food to enhance its safety, taste, appearance, texture, or shelf life. They include preservatives, colorants, flavor enhancers, stabilizers, and sweeteners. While some occur naturally, many are synthetic. Food additives help maintain quality, prevent spoilage, improve nutritional value, and ensure consistency in processed and packaged foods, supporting both consumer appeal and food safety. Furthermore, The Brazil food additives market is growing due to increasing demand for processed and convenience foods, rising consumer preference for natural and clean-label additives, urbanization, higher disposable incomes, and stringent food safety regulations. Continuous innovation by manufacturers further drives market expansion and adoption.

Technological advancements in food processing, such as encapsulation, emulsification, and microencapsulation, are enabling the development of food additives with enhanced functionalities and stability. Furthermore, sustainability and regulatory pressure are becoming a major priority in Brazil, with both customers and authorities stressing environmentally friendly industrial techniques. There is growing pressure on food producers to limit the environmental effects of their additives, increasing plant-based and sustainable alternatives. Furthermore, stricter requirements from Brazilian health authorities are driving firms to stress openness in ingredient labeling and guarantee that additives are safe and ethically sourced.

As Brazilians become more health-conscious, there is an increasing desire for natural, clean-label components in food goods. This has resulted in a growth in demand for natural preservatives, colorants, and taste enhancers produced from plant sources. Beetroot powder and natural antioxidants are gaining popularity as people seek goods devoid of artificial additives and chemicals.

Brazil Food Additives Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 6.2 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 4.7% |

| 2035 Value Projection: | USD 10.28 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 190 |

| Tables, Charts & Figures: | 106 |

| Segments covered: | By Type, By Application |

| Companies covered:: | BASF SE, Cargill, Incorporated, DuPont de Nemours, Inc., Ingredion Incorporated, Kerry Group plc, Archer Daniels Midland Company, Tate & Lyle plc, Corbion NV, Givaudan SA, and other key players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Market Dynamics of the Brazil Food Additives Market:

The Brazil food additives market is driven by increasing demand for processed, convenience, and ready-to-eat foods, fueled by urbanization and rising disposable incomes. Consumers are increasingly seeking natural, clean-label, and health-promoting additives, boosting market growth. Expansion of the food and beverage processing industry further accelerates adoption. Stringent food safety regulations and continuous innovation in additive technologies encourage reformulation and broader usage. Additionally, trends like fortified foods, functional ingredients, and sustainable sourcing support long-term market expansion, making the sector highly dynamic and growth-oriented.

The Brazil food additives market faces restraints due to growing consumer concerns over synthetic additives and potential health risks, which may limit demand. Strict regulatory requirements, high production costs, and challenges in sourcing natural ingredients also hinder market growth. Additionally, fluctuations in raw material prices and increasing competition from alternative natural preservation methods pose challenges to market expansion.

The Brazil food additives market presents significant opportunities driven by rising consumer demand for natural, clean-label, and functional ingredients that enhance health and wellness. Growing processed and convenience food consumption, coupled with increasing awareness of fortified and nutritionally enriched products, encourages innovation in additive formulations. Expanding the use of plant-based, organic, and sustainable additives offers new growth avenues. Additionally, advancements in food technology, e-commerce distribution channels, and export potential provide manufacturers with opportunities to diversify offerings, reach wider markets, and cater to evolving consumer preferences.

Market Segmentation

The Brazil Food Additives Market share is classified into type and application.

By Type:

The Brazil food additives market is divided by type into preservatives, sweeteners and sugar substitutes, emulsifiers, enzymes, hydrocolloids, food flavours, colorants, and others. Among these, the preservatives segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. Preservatives dominate because the country’s expanding processed and convenience food sector requires a longer shelf life and maintained quality. Urbanization and increasing disposable incomes drive higher consumption of packaged foods, which depend on preservatives to prevent microbial growth and spoilage. Both synthetic and natural preservatives are widely used to meet regulatory standards and consumer safety expectations. While other additives like sweeteners, colorants, and flavors support taste and appearance, preservatives are essential for product stability, making this segment the largest.

By Application:

The Brazil food additives market is divided by application into bakery, confectionery, dairy, beverages, meat, poultry, seafood, and others. Among these, the bakery segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. The bakery segment dominates because baked goods like bread, cakes, and pastries are widely consumed across the country. Additives such as preservatives, emulsifiers, and enzymes are essential to maintain freshness, improve texture, and extend shelf life. Rising urbanization and demand for packaged, ready-to-eat bakery products in supermarkets and convenience stores further drive additive usage. While other segments like dairy and beverages also use additives, the sheer volume and variety of bakery products make this segment the largest contributor to the market.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the Brazil food additives market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in Brazil Food Additives Market:

- BASF SE

- Cargill, Incorporated

- DuPont de Nemours, Inc.

- Ingredion Incorporated

- Kerry Group plc

- Archer Daniels Midland Company

- Tate & Lyle plc

- Corbion NV

- Givaudan SA

- Others

Recent Developments in Brazil Food Additives Market:

In October 2023, Cargill announced the expansion of its food ingredients production facility in Brazil, investing $50 million. To boost capacity and provide new specialty additives and emulsifiers for the expanding Brazilian food and beverage industry

In October 2023, Ingredion Incorporated announced the development of its food additives production plant there to satisfy the rising demand for specialty ingredients in Brazil's food and beverage sector

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the Brazil, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Brazil food additives market based on the below-mentioned segments:

Brazil Food Additives Market, By Type

- Preservatives

- Sweeteners and Sugar Substitutes

- Emulsifiers

- Enzymes

- Hydrocolloids

- Food Flavours and Colorants

- Others

Brazil Food Additives Market, By Application

- Bakery

- Confectionery

- Dairy

- Beverages

- Meat

- Poultry and Sea Foods

- Others

Frequently Asked Questions (FAQ)

-

Q1: What are food additives?Substances added to food to enhance shelf life, taste, texture, color, or safety, including preservatives, sweeteners, emulsifiers, enzymes, colorants, and flavors.

-

Q2: Which type segment dominates the Brazil food additives market?Preservatives dominate due to high demand in processed and packaged foods for extending shelf life and ensuring safety.

-

Q3: Which application segment is the largest?Bakery dominates as baked goods like bread, cakes, and pastries heavily rely on additives to maintain freshness, texture, and quality.

-

Q4: What are the key growth factors?Rising processed and convenience food consumption, urbanization, higher disposable income, preference for natural/clean-label additives, and innovation in additive technologies.

-

Q5: What restrains the market?Consumer health concerns about synthetic additives, strict regulations, high production costs, and raw material price fluctuations.

-

Q6: What are the opportunities?Growing demand for natural, clean-label, fortified, functional, and sustainable additives, along with technological advancements and wider distribution channels.

Need help to buy this report?