Brazil Confectionery Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Hard-boiled Sweets, Mints, Gums and Jellies, Chocolate, Caramels and Toffees, Medicated Confectionery, Fine Bakery Wares, and Others), By Distribution Channel (Supermarkets and Hypermarkets, Convenience Stores, Pharmaceutical and Drug Stores, Online Stores, and Others) By Price Point (Economy, Mid-range, Luxury), and Brazil Confectionery Market Insights, Industry Trend, Forecasts to 2035

Industry: Food & BeveragesBrazil Confectionery Market Insights Forecasts to 2035

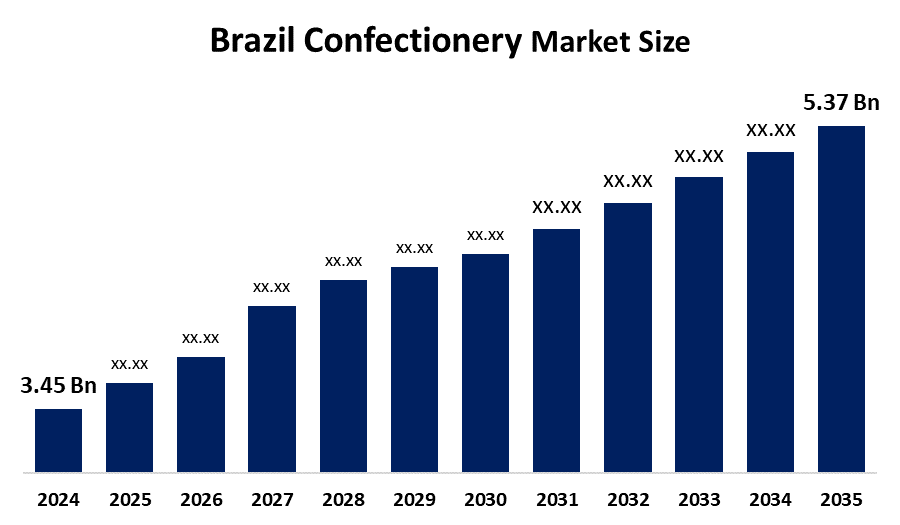

- The Brazil Confectionery Market Size Was Estimated at USD 3.45 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of Around 4.1% from 2025 to 2035

- The Brazil Confectionery Market Size is Expected to Reach USD 5.37 Billion by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, The Brazil Confectionery Market Size is Anticipated To Reach USD 5.37 Billion By 2035, Growing At a CAGR of 4.1% from 2025 to 2035. The Brazil Confectionery Market Size is driven by rising disposable incomes, growing urbanization, increasing demand for premium and innovative products, expansion of retail and e-commerce channels, and changing consumer preferences toward indulgent, convenient, and on-the-go sweet treats.

Market Overview

The term "confectionery" refers to sweet treats created primarily from sugar, chocolate, and other types of sweeteners (i.e., honey), and some have additional ingredients such as nuts, fruits, and flavorings added to them. These treats include candies, chocolates, gummies, and baked confections, generally eaten for pleasure/entertainment/or as a special treat rather than as staples of the diet. Through increased disposable income and the growth of urbanization, changes in consumer preferences to premium and innovative products, increased consumer consumption of indulgent products, increased retailing/e-commerce, and increased availability of chocolate in these markets, the growth of Brazil's confectionery sector is continuing to rise. The Brazilian government has developed several initiatives to assist the growth of the Confectionery Sector. First is the Tax Incentives (maximum 25%) given to companies investing in R&D in the Food Sector. This encourages the development of new and innovative products, which are then sold in the market and lead to the continued growth of the market. Second is the Agroindustry Plan of Brazil, which promotes exports. This allows confectionery brands from Brazil to expand their reach into other countries of the world, resulting in additional growth. Third, companies exporting from Brazil also receive tax benefits, resulting in motivation to expand into Global Markets. This also drives additional growth. Lastly, policies relating to sustainable Cocoa Production provide stability of supply to the industry and promote stability for the continued growth of the industry. Collectively, these initiatives create a strong foundation for the On-going Growth of the Confectionery Market in Brazil.

The premiumization trend continues to gain traction within the confectionery industry in Brazil. Consumers are starting to place a lot more emphasis on indulgent, high-quality products made from whatever is perceived to be superior goods as an example of premiumisation. Thus, the increase in the demand for premium chocolate, Artisanal candies, and higher-end sweets produced with the best ingredients represents the phenomenon. The next trend within the Brazilian confections is the need for products that use ethical sourcing in the production of their ingredients, such as fair trade certified cocoa, organic sugar, and sustainable palm oil; this meets the growing demand of today's consumer to be responsible in how they purchase products.

Report Coverage

This research report categorizes the market for the Brazil Confectionery Market Size based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Brazil confectionery market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Brazil confectionery market.

Brazil Confectionery Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 3.45 Billion |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | CAGR Of 4.1% |

| 2035 Value Projection: | USD 5.37 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 90 |

| Segments covered: | By Product Type, By Application |

| Companies covered:: | Mondelez Brasil Ltda Nestlé Brasil Arcor Ferrero S.p.A. Mars Incorporated Cacau Show Riclan S.A. Perfetti Van Melle Brasil Fini Chocolates Garoto S.A. and Other Key Players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The Brazil Confectionery Market Size is driven by several key factors. Rising disposable incomes and urbanization increase consumer spending on indulgent and premium sweets. Changing lifestyles and a growing preference for on-the-go, convenient treats boost demand. Innovation in flavors, packaging, and product formats attracts consumers, while expanding retail and e-commerce channels enhances accessibility. Government initiatives, including tax incentives for R&D, export support, and sustainable cocoa production policies, further stimulate growth. Additionally, increasing awareness of quality and branded products encourages consumption, collectively fueling the steady expansion of the Brazil confectionery market.

Restraining Factors

The Brazil Confectionery Market Size faces restraints from health concerns and growing awareness of sugar-related issues, leading to reduced consumption. High production costs, fluctuating raw material prices, and dependency on imported ingredients challenge profitability. Additionally, intense competition, regulatory compliance requirements, and economic uncertainties may limit market expansion, affecting smaller manufacturers more significantly than established brands.

Market Segmentation

The Brazil confectionery market share is categorized by product type, distribution channel, and price point.

- The chocolate segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Brazil Confectionery Market Size is segmented by product type into hard-boiled sweets, mints, gums and Jellies, chocolate, caramels and toffees, medicated confectionery, fine bakery wares, and others. Among these, the chocolate segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is driven by it appeals to a wide range of consumers, from children to adults, and is deeply ingrained in local culture, festivals, and gifting traditions. The segment benefits from continuous product innovation, including flavored, filled, and premium varieties, which attract diverse consumer preferences. Strong brand presence, extensive retail availability, and marketing campaigns further boost consumption. Additionally, rising disposable incomes allow consumers to spend more on indulgent treats, reinforcing chocolate’s leading position in the market.

- The supermarkets and hypermarkets segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

The Brazil Confectionery Market Size is segmented by distribution channel into supermarkets and hypermarkets, convenience stores, pharmaceutical and drug stores, online stores, and others. Among these, the supermarkets and hypermarkets segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The growth of the segment is due to their extensive product variety, competitive pricing, and one-stop shopping convenience, which attract a broad consumer base. They provide easy access to both mass-market and premium confectionery products, supported by frequent promotions and attractive displays that encourage impulse purchases. Bulk buying options further appeal to families and regular shoppers. Additionally, their wide geographic presence and established supply chains ensure consistent product availability, making them the preferred distribution channel over convenience or online stores.

- The mid-range segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

The Brazil Confectionery Market Size is segmented by price point into economy, mid-range, and luxury. Among these, the mid-range segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The growth of the segment is due to it strikes a balance between quality and affordability, appealing to a wide consumer base. It allows consumers to enjoy indulgent treats without the high cost of luxury products, making it suitable for everyday consumption. Strong distribution through supermarkets, hypermarkets, and convenience stores, along with attractive promotions and packaging, enhances accessibility and visibility. This combination of value, availability, and consumer preference ensures the mid-range segment consistently leads in market share over economy and luxury offerings.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Brazil Confectionery Market Size, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Mondelez Brasil Ltda

- Nestlé Brasil

- Arcor

- Ferrero S.p.A.

- Mars Incorporated

- Cacau Show

- Riclan S.A.

- Perfetti Van Melle Brasil

- Fini

- Chocolates Garoto S.A.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent News

In September 2024, Mix, the flagship brand of Duas Rodas Group, introduced 39 new products in the market of confectionery in Brazil. The new range of products contains powdered chocolates, homemade ice cream blends, toppings, fillings, and creative packaging suitable for small families, supporting Mix in its mission of assisting Brazilian confectioners with convenient and adaptable solutions.

In September 2024, Ferrero Rocher introduced chocolate bars in Brazil, with white, milk, and dark chocolate (55% cocoa) products. This new packaging format is designed to increase the size of the brand's consumer base by providing a less formal and cheaper option for daily consumption, alongside its classic special occasion chocolates.

Market Segment

This study forecasts revenue at the Brazil, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Brazil confectionery market based on the below-mentioned segments:

Brazil Confectionery Market, By Product Type

- Hard-boiled Sweets

- Mints, Gums, and Jellies

- Chocolate

- Caramels and Toffees

- Medicated Confectionery

- Fine Bakery Wares

- Others

Brazil Confectionery Market, By Distribution Channel

- Supermarkets and Hypermarkets

- Convenience Stores

- Pharmaceutical and Drug Stores

- Online Stores

- Others

Brazil Confectionery Market, By Price Point

- Economy

- Mid-range

- Luxury

Frequently Asked Questions (FAQ)

-

What factors are boosting the Brazil confectionery market?Rising disposable income, urban lifestyle changes, growing preference for indulgent snacks, product innovation, e-commerce growth, and government support for exports and sustainable cocoa farming are key drivers.

-

Which confectionery type leads the market?Chocolate dominates due to its widespread popularity, cultural significance, and continuous introduction of new flavors and premium variants.

-

How do consumers mainly buy confectionery in Brazil?Most purchases occur through supermarkets and hypermarkets because of product variety, convenience, and promotional offers

-

What price segment performs best?The mid-range segment leads, offering a balance between quality and affordability for daily consumption

-

Who are the main companies in Brazil’s confectionery sector?Mondelez Brasil, Nestlé Brasil, Arcor, Ferrero, Mars, Cacau Show, Riclan, Perfetti Van Melle, Fini, Chocolates Garoto

-

What challenges affect market growth?Health concerns about sugar, fluctuating raw material costs, intense competition, and strict regulatory standards restrain expansion.

Need help to buy this report?