Brazil Compound Feed Market Size, Share, and COVID-19 Impact Analysis, By Animal Type (Ruminants, Poultry, Swine, Aquaculture, and Others), By Ingredients (Cereal, Cakes & Meals, By-Products, and Supplements), and Brazil Compound Feed Market Insights, Industry Trend, Forecasts to 2035

Industry: Food & BeveragesBrazil Compound Feed Market Insights Forecasts to 2035

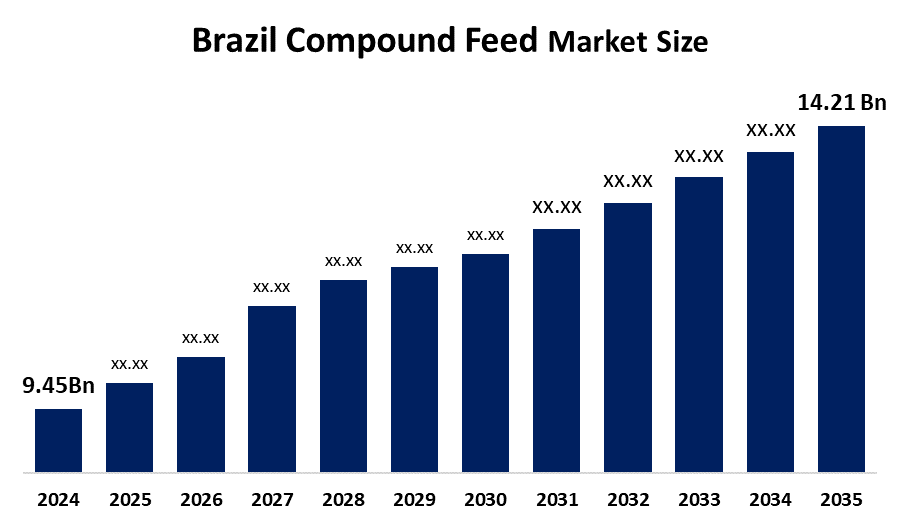

- The Brazil Compound Feed Market Size Was Estimated at USD 9.45 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of Around 3.78% from 2025 to 2035

- The Brazil Compound Feed Market Size is Expected to Reach USD 14.21 Billion by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, The Brazil Compound Feed Market Size Is Anticipated To Reach USD 14.21 Billion by 2035, Growing at a CAGR of 3.78% from 2025 to 2035. The market growth is driven by growing livestock production as well as the increased demand for animal protein. The increase of commercial farming methods used throughout Brazil, aided by improved production efficiencies and feed formulations, is anticipated to positively contribute to growth in the livestock feed market across Brazil.

Market Overview

The term compound feed refers to all the feedstuffs, supplements, and additives used for animals. The importance of this animal feed production industry in Brazil cannot be overstated. The Brazil Compound Feed Industry has had a profound effect on the improvement of both animal health and productivity and on the establishment of large-scale, small-scale, and compact agricultural systems that produce efficiently meat, milk, and eggs. There is a vast majority of cereal-based compound feed available in Brazil, and due to the importance of the integration of the livestock sector and compound feed businesses, there is a growing trend toward the adoption of nutritionally balanced feeding solutions. Like other compound feed markets, the Brazilian compound feed marketplace is experiencing increased adoption of functional feed additives, precision nutrition, and sustainable feed ingredients to improve feed conversion efficiency and reduce the negative social and environmental impacts of feed production. Brazil is one of the world's top producers and exporters of meat and a growing consumption of animal proteins domestically and substantial investment in modern Animal Husbandry Practices are fuelling growth in the Brazilian compound feed market.

In support of the development of the Brazilian Livestock and Feed Industry, the Brazilian Government has established various agricultural development programs to help develop agri-businesses. Examples include government-sponsored programs that provide credit to farmers and help to establish feed quality standards, create food security, and promote sustainable agriculture.

Report Coverage

This research report categorizes the market for the Brazil Compound Feed Market Size based on various segments and regions and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Brazil compound feed market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Brazil compound feed market.

Brazil Compound Feed Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 9.45 Billion |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | CAGR of 3.78% |

| 2035 Value Projection: | USD 14.21 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 90 |

| Segments covered: | By Product Type, By Application |

| Companies covered:: | BRF S.A., Cargill Brazil, ADM do Brasil, JBS S.A., Nutreco Brazil, DSM Nutritional Products Brazil, Evonik Brazil, Alltech Brazil, Copagril, Cooperativa Aurora Alimentos, and Other Players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The Brazil Compound Feed Market Size is driven by the increasing popularity of poultry and livestock farming, coupled with the increasing demand for high-quality sources of protein from animals. Awareness of the need for a balanced diet for animals has also contributed to this growth. The development of improved ways to formulate feeds, the increased use of commercially made feeds instead of conventional feeds, and the continued expansion of Brazil's major exporting meat industry all contribute to increased productivity and efficiency in animal production systems and therefore, the compound feed market.

Restraining Factors

The Brazil Compound Feed Market Size is restrained by the cereal and oilseed meal prices are volatile, making it difficult for markets and supply chains to operate effectively. Due to their dependence on weather, feed manufacturers will also see lower profit margins considering increasing production costs.

Market Segmentation

The Brazil compound feed market share is categorized by animal type and ingredients.

- The poultry segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Brazil Compound Feed Market Size is segmented by animal type into poultry, swine, aquaculture, and others. Among these, the electronics segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is due to high level of feed consumption and the relatively short production cycle are both contributing factors to the segment's overall growth. In addition, there is growing demand for feed for both layers and broilers, which is also driving growth within this segment.

- The cereal segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Brazil Compound Feed Market Size is segmented by ingredients into cereal, cakes & meals, by-products, and supplements. Among these, the pulsed UV lasers segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The segmental growth is due to high demand for corn and other grain crops as the primary sources of energy used in animal feed. The benefit of having access to domestic cereal production and more cost-effective supply options continue to support the importance of this segment.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Brazil compound feed market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- BRF S.A.

- Cargill Brazil

- ADM do Brasil

- JBS S.A.

- Nutreco Brazil

- DSM Nutritional Products Brazil

- Evonik Brazil

- Alltech Brazil

- Copagril

- Cooperativa Aurora Alimentos

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at Brazil, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Brazil compound feed market based on the below-mentioned segments:

Brazil Compound Feed Market, By Animal Type

- Ruminants

- Poultry

- Swine

- Aquaculture

- Others

Brazil Compound Feed Market, By Ingredients

- Cereal

- Cakes & Meals

- By-Products

- Supplements

Frequently Asked Questions (FAQ)

-

What is the Brazil compound feed market size?Brazil compound feed market size is expected to grow from USD 9.45 billion in 2024 to USD 14.21 billion by 2035, growing at a CAGR of 3.78% during the forecast period 2025 to 2035

-

Who are the key players in the Brazil compound feed market?BRF S.A., Cargill Brazil, ADM do Brasil, JBS S.A., Nutreco Brazil, DSM Nutritional Products Brazil, Evonik Brazil, Alltech Brazil, Copagril, Cooperativa Aurora Alimentos, and Others are the key players in the Brazil compound feed market

-

Who are the target audiences for this market report?The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Need help to buy this report?