Brazil Commercial Vehicles Lubricants Market Size, Share, By Product Type (Engine Oils, Greases, Hydraulic Fluids, Transmission & Gear Oils), By Vehicle Type (Heavy Commercial Vehicles and Light Commercial Vehicles), Brazil Commercial Vehicles Lubricants Market Insights, Industry Trend, Forecasts to 2035.

Industry: Chemicals & MaterialsBrazil Commercial Vehicles Lubricants Market Size Insights Forecasts to 2035

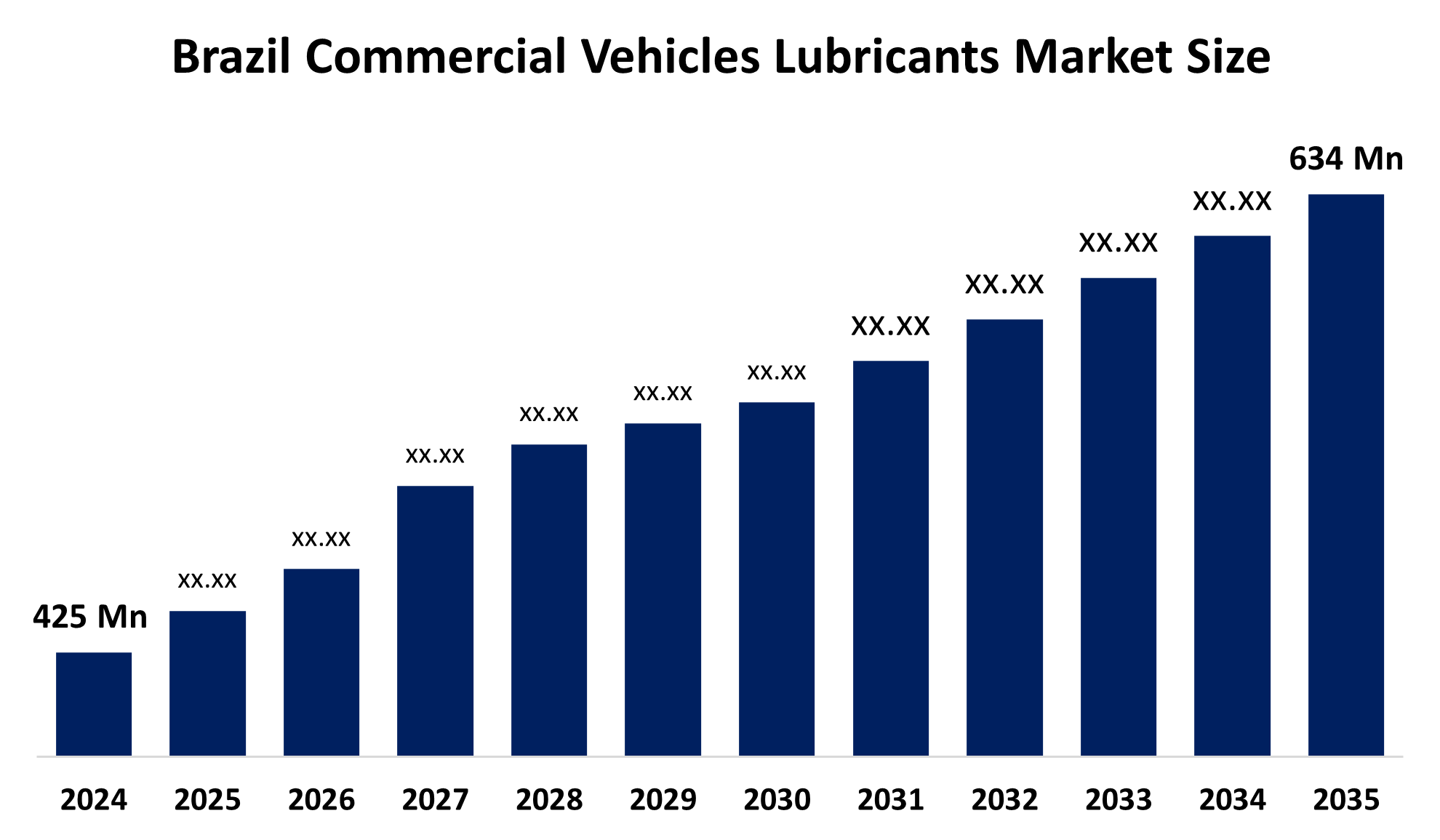

- Brazil Commercial Vehicles Lubricants Market Size 2024: USD 425 Mn

- Brazil Commercial Vehicles Lubricants Market Size 2035: USD 634 Mn

- Brazil Commercial Vehicles Lubricants Market CAGR 2024: 3.7%

- Brazil Commercial Vehicles Lubricants Market Segments: Product Type and Vehicle Type,

Get more details on this report -

Commercial vehicle lubricants are specialized oils and fluids designed to reduce friction, wear, and heat in heavy-duty engines, transmissions, and drivetrains. They ensure optimal performance, fuel efficiency, and engine longevity under high loads, long operating hours, and extreme conditions. These lubricants also protect against corrosion, sludge, and deposit formation, supporting the reliable operation of trucks, buses, and other commercial vehicles. Furthermore, The Brazil Commercial Vehicles Lubricants Market Size is driven by rising freight and logistics activities, increasing commercial vehicle sales, stringent emission regulations, demand for high-performance lubricants, and growing awareness of engine maintenance, boosting market adoption and growth.

The Brazilian government's investments in infrastructure, particularly road expansion and building, are directly driving up demand for commercial vehicles. R$35.6 billion was allotted for road infrastructure alone in 2023, with the expectation that the number of heavy-duty vehicles on the road will increase. This increased vehicle utilization will lead to higher lubricant consumption, as commercial vehicles require frequent maintenance to perform properly in these demanding conditions. Furthermore, the Brazilian government's investments in infrastructure, particularly road expansion and building, are directly driving up demand for commercial vehicles. R$35.6 billion was allotted for road infrastructure alone in 2023, with the expectation that the number of heavy-duty vehicles on the road will increase. This increased vehicle utilization will lead to higher lubricant consumption, as commercial vehicles require frequent maintenance to perform properly in these demanding conditions.

Market Dynamics of the Brazil Commercial Vehicles Lubricants Market:

The Brazil Commercial Vehicles Lubricants Market Size is primarily driven by the expanding transportation and logistics sector, fueled by increased trade and e-commerce activities. Growing commercial vehicle sales, particularly trucks and buses, create higher demand for engine and transmission lubricants. Stringent government regulations on emissions and environmental standards push the adoption of advanced, high-performance lubricants. Additionally, rising awareness among fleet operators about vehicle maintenance, fuel efficiency, and engine longevity encourages frequent lubricant usage, further propelling market growth across Brazil.

The Brazil Commercial Vehicles Lubricants Market Size faces restraints from fluctuating crude oil prices, which affect production costs. Additionally, the high cost of premium synthetic lubricants and competition from low-cost alternatives limit adoption. Lack of awareness about proper lubricant maintenance in smaller fleets and challenging economic conditions can further hinder market growth, restraining overall industry expansion.

The Brazil Commercial Vehicles Lubricants Market Size presents significant opportunities due to the growing adoption of advanced synthetic and semi-synthetic lubricants that enhance engine efficiency and longevity. Expansion in the logistics and e-commerce sectors increases demand for reliable fleet maintenance solutions. Additionally, rising government initiatives promoting cleaner fuels and stricter emission standards encourage the use of high-performance lubricants. Technological advancements, such as smart lubricants and IoT-based monitoring systems, offer new avenues for product innovation and market differentiation, driving future growth.

Brazil Commercial Vehicles Lubricants Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 425 million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 3.7% |

| 2035 Value Projection: | USD 634 million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 195 |

| Tables, Charts & Figures: | 102 |

| Segments covered: | By Product Type, By Vehicle Type |

| Companies covered:: | xxonMobil Corporation, Iconic Lubrificantes, Petrobras, Petronas Lubricants International, Royal Dutch Shell Plc, Gulf Oil International, Lucheti Lubrificantes, Marcio Benedito Vecchi EIRELI, TotalEnergies, and Other Key Players |

| Pitfalls & Challenges: | and COVID-19 Impact Analysis |

Get more details on this report -

Market Segmentation

The Brazil commercial vehicles lubricants market share is classified into product type and vehicle type.

By Product Type:

The Brazil Commercial Vehicles Lubricants Market Size is divided by product type into engine oils, greases, hydraulic fluids, transmission & gear oils. Among these, the engine oils segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. Engine oils dominate because they are critical for maintaining engine performance, reducing wear, and preventing overheating under heavy-duty operations. With the growth of freight, logistics, and commercial vehicle fleets, consistent engine maintenance becomes essential. Fleet operators prioritize engine oils to enhance fuel efficiency, extend engine life, and comply with emission standards. Compared to greases, hydraulic fluids, and transmission oils, engine oils are required more frequently and in larger volumes, driving their market dominance.

By Vehicle Type:

The Brazil Commercial Vehicles Lubricants Market Size is divided by vehicle type into heavy commercial vehicles and light commercial vehicles. Among these, the heavy commercial vehicles segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. Heavy commercial vehicles (HCVs) dominate because they operate under demanding conditions, including long hauls, heavy loads, and continuous engine operation. These vehicles require frequent maintenance and higher volumes of engine oils, transmission fluids, and greases to ensure performance, fuel efficiency, and engine longevity. Additionally, the expanding logistics, construction, and public transportation sectors increase HCV deployment, further boosting lubricant consumption. In contrast, light commercial vehicles have lower usage intensity and lubricant requirements, making HCVs the primary market driver.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the Brazil Commercial Vehicles Lubricants Market Size, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in Brazil Commercial Vehicles Lubricants Market:

- xxonMobil Corporation

- Iconic Lubrificantes

- Petrobras

- Petronas Lubricants International

- Royal Dutch Shell Plc

- Gulf Oil International

- Lucheti Lubrificantes

- Marcio Benedito Vecchi EIRELI

- TotalEnergies

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the Brazil, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Brazil Commercial Vehicles Lubricants Market Size based on the below-mentioned segments:

Brazil Commercial Vehicles Lubricants Market, By Product Type

- Engine Oils

- Greases

- Hydraulic Fluids

- Transmission & Gear Oils

Brazil Commercial Vehicles Lubricants Market, By Vehicle Type

- Heavy Commercial Vehicles

- Light Commercial Vehicles

Frequently Asked Questions (FAQ)

-

1. What are commercial vehicle lubricants?Commercial vehicle lubricants are specialized oils and fluids for engines, transmissions, and drivetrains of trucks, buses, and other heavy vehicles to reduce friction, wear, and heat.

-

2. Which lubricant type dominates the market?Engine oils dominate due to their essential role in maintaining engine performance and longevity in heavy-duty commercial vehicles.

-

3. Which vehicle type drives demand?Heavy commercial vehicles (HCVs) lead the demand because of higher operating loads and more frequent maintenance requirements.

-

4. What factors are driving market growth?Growth is driven by expanding logistics, increasing commercial vehicle sales, stricter emission regulations, and rising awareness of fleet maintenance.

-

5. What are the market restraints?High costs of premium lubricants, fluctuating crude oil prices, and low awareness among smaller fleets can restrain market growth.

-

6. What opportunities exist in the market?Opportunities include synthetic and semi-synthetic lubricants, smart monitoring technologies, and increased demand from logistics and e-commerce sectors

Need help to buy this report?