Brazil Carbon Nanotubes Market Size, Share, and COVID-19 Impact Analysis, By Product (MWCNTs and SWCNTs), By Application (Polymers, Energy, Electrical & Electronics, and Others), and Brazil Carbon Nanotubes Market Insights, Industry Trend, Forecasts to 2035

Industry: Chemicals & MaterialsBrazil Carbon Nanotubes Market Insights Forecasts to 2035

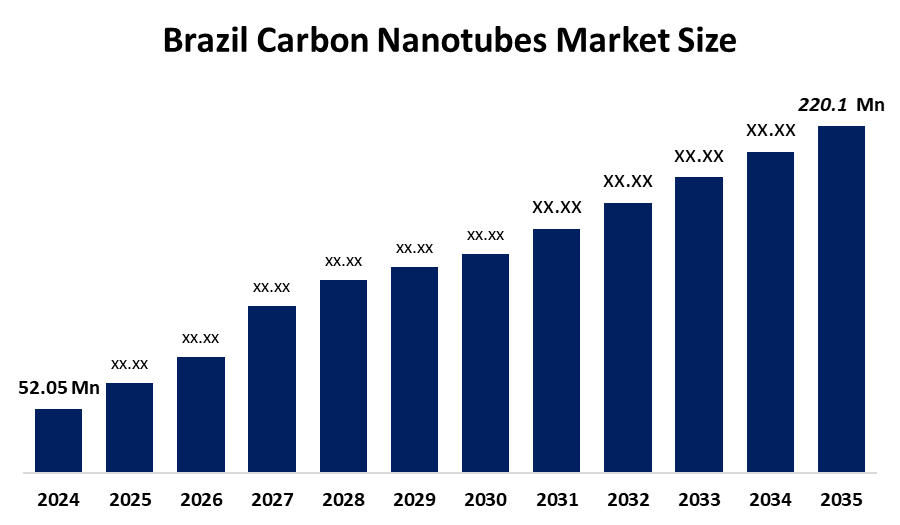

- The Brazil Carbon Nanotubes Market Size Was Estimated at USD 52.05 Million in 2024

- The Brazil Carbon Nanotubes Market Size is Expected to Grow at a CAGR of Around 14.01% from 2025 to 2035

- The Brazil Carbon Nanotubes Market Size is Expected to Reach USD 220.1 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, The Brazil Carbon Nanotubes Market Size is anticipated to reach USD 220.1 Million by 2035, Growing at a CAGR of 14.01% from 2025 to 2035. The Brazil carbon nanotube market is driven by growing demand from automotive, electronics, and energy storage industries; increasing use of lightweight and high-performance materials, and rising government and academic investments in nanotechnology and advanced materials research, supporting wider industrial adoption.

Market Overview

The Brazil carbon nanotubes (CNTs) market is the industry that deals with the creation, supply, and usage of carbon nanotubes, which are tiny tube-shaped materials with outstanding mechanical, electrical, and heat-resistant properties. CNTs find application in vehicle parts, electronic gadgets, batteries, aerospace, and advanced composites for increasing the strength, conductivity, and overall performance. The market consists of single-walled and multi-walled CNTs and covers the range of activities from R&D, production, and sales aimed at satisfying the demand for advanced, lightweight, and resistant materials in Brazil's industrial sectors.

Brazil’s adoption of the carbon nanotubes (CNTs) market is strongly tied to its growing industrial and technological needs, particularly in the automotive, electronics, and energy storage sectors, which serve a population of over 215 million people with rising demands for advanced, durable, and lightweight materials. Challenges such as vehicle emissions, energy inefficiency, and electronics performance limitations underscore the need for CNT-enabled innovations. Brazil’s automotive industry, producing over 2 million vehicles annually, and its expanding electronics and renewable energy markets highlight the strategic importance of CNTs for enhancing performance, reducing weight, and increasing energy efficiency, making this market essential for the country’s industrial competitiveness.

Report Coverage

This research report categorizes the market for the Brazil carbon nanotubes market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Brazil carbon nanotubes market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Brazil carbon nanotubes market.

Brazil Carbon Nanotubes Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 52.05 Million |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | CAGR of 14.01% |

| 2035 Value Projection: | USD 220.1 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 90 |

| Segments covered: | By Product |

| Companies covered:: | NanoView Nanotecnologia, Oxiteno, Nanocyl SA, OCSiAl, Arkema SA, Carbon Solutions, Inc., CNano Technology Co., Ltd., LG Chem, Cabot Corporation, Resonac Holdings Corp, Toray Industries, Inc., Cheap Tubes, Inc., and Other key players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The Brazil carbon nanotube market is primarily driven by factors such as the growing use of automotive, electronics, and energy storage sectors. The production of lightweight and high-performance materials and robust government-sponsored R&D and technological advancements that help broaden the use of carbon nanotubes (CNT) in different industries.

Restraining Factors

The Brazil carbon nanotube market is restrained due to the high production and raw material costs, complex manufacturing processes, and limited availability for large-scale commercial use. On top of that, without standards, concerns over safety, and a cautious approach by industries toward usage, the market is slow to penetrate widely.

Market Segmentation

The Brazil carbon nanotubes market share is classified into product and application.

- The MWCNTs segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Brazil carbon nanotubes market is segmented by product into MWCNTs and SWCNTs. Among these, the MWCNTs segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The MWCNTs segment is growing because multi-walled carbon nanotubes offer superior mechanical strength, thermal stability, and electrical conductivity at a lower cost compared to single-walled CNTs. Their wide applicability in automotive composites, electronics, and energy storage devices drives strong demand in Brazil’s industrial and technological sectors.

- The electrical & electronics segment dominated the market in 2024 and is anticipated to grow at a substantial CAGR during the forecast period.

The Brazil carbon nanotubes market is segmented by application into polymers, energy, electrical & electronics, and others. Among these, the electrical & electronics segment dominated the market in 2024 and is anticipated to grow at a substantial CAGR during the forecast period. The electrical & electronics segment is growing because carbon nanotubes enhance conductivity, thermal management, and miniaturization in electronic components, making them ideal for sensors, flexible circuits, batteries, and high-performance devices. Rising demand for advanced electronics and energy-efficient devices in Brazil drives the dominance and growth of this segment.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Brazil carbon nanotubes market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- NanoView Nanotecnologia

- Oxiteno

- Nanocyl SA

- OCSiAl

- Arkema SA

- Carbon Solutions, Inc.

- CNano Technology Co., Ltd.

- LG Chem

- Cabot Corporation

- Resonac Holdings Corp

- Toray Industries, Inc.

- Cheap Tubes, Inc.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the Brazil, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Brazil carbon nanotubes market based on the below-mentioned segments:

Brazil Carbon Nanotubes Market, By Product

- MWCNTs

- SWCNTs

Brazil Carbon Nanotubes Market, By Application

- Polymers

- Energy

- Electrical & Electronics

- Others

Frequently Asked Questions (FAQ)

-

1. What is the Brazil carbon nanotubes market size in 2024?The Brazil carbon nanotubes market size was estimated at USD 52.05 million in 2024.

-

2. What is the projected market size of the Brazil carbon nanotubes market by 2035?The Brazil carbon nanotubes market size is expected to reach USD 220.1 million by 2035.

-

3. What is the CAGR of the Brazil carbon nanotubes market?The Brazil carbon nanotubes market size is expected to grow at a CAGR of around 14.01% from 2024 to 2035.

-

4. What are the key growth drivers of the Brazil carbon nanotubes market?The Brazil carbon nanotube market is driven by growing demand from automotive, electronics, and energy storage industries; increasing use of lightweight and high-performance materials; and rising government and academic investments in nanotechnology and advanced materials research, supporting wider industrial adoption.

-

5. Who are the key players in the Brazil carbon nanotubes market?Key companies include NanoView Nanotecnologia, Oxiteno, Nanocyl SA, OCSiAl, Arkema SA, Carbon Solutions, Inc., CNano Technology Co., Ltd., LG Chem, Cabot Corporation, Resonac Holdings Corp, Toray Industries, Inc., Cheap Tubes, Inc., and others.

-

6. Who are the target audiences for this market report?The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Need help to buy this report?