Brazil Biofuel Market Size, Share, By Feedstock (Sugarcane, Corn, Vegetable Oils, Others) By Fuel Type (Ethanol, Biodiesel, Biogas, Others) By Application (Transportation, Power Generation, Others) By Technology (First Generation, Second Generation, Third Generation), Brazil Biofuel Market Insights, Industry Trend, Forecasts to 2035

Industry: Chemicals & MaterialsBrazil Biofuel Market Insights Forecasts to 2035

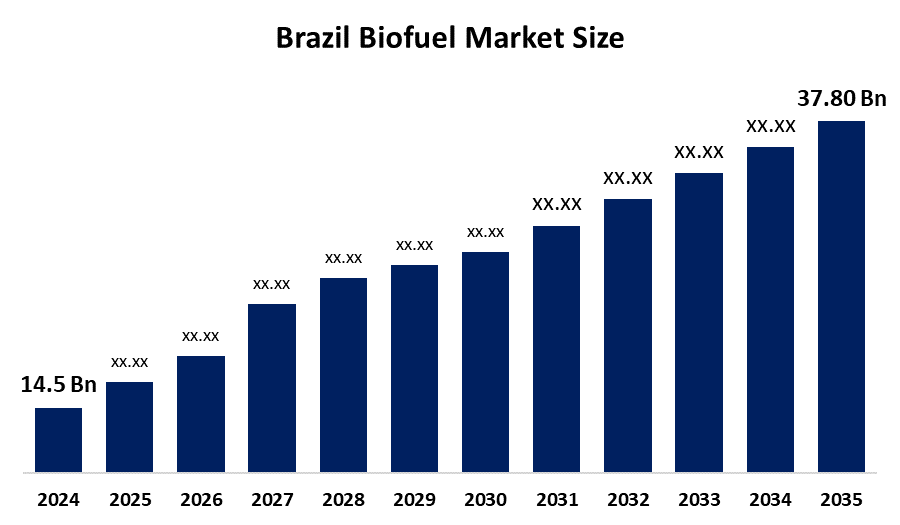

- Brazil Biofuel Market Size 2024: USD 14.5 Billoin

- Brazil Biofuel Market Size 2035: USD 37.80 Billion

- Brazil Biofuel Market CAGR 2024: 9.1%

- Brazil Biofuel Market Segments: Feedstock, Fuel Type, Application, Technology

Get more details on this report -

Biofuel is a renewable energy source derived through the conversion of living matter, such as plants, trees, algae, and animal waste, into usable fuel. It is a cleaner alternative to fossil fuels and can be used for the same purposes as petrol, diesel, or other fossil fuels, i.e., in vehicles, electricity, and heating. Since biofuels emit fewer pollutants and are made from renewable resources, the use of biofuels leads to a sustainable form of energy. Besides, the Brazilian biofuel market is expanding due to various factors such as the government policies and incentives that support the industry; rising demand for ethanol and biodiesel, technological innovations that enhance productivity, and the increasing preference of consumers for clean energy to protect the environment and save resources.

Brazil biofuel market is thriving with multi-fold growth, mainly due to the significant governmental initiatives that play a catalytic role in its expansion. The introduction of policies provides a warm welcome for producers, thus nurturing innovation and confidence. Breaks in the form of tax incentives and subsidies attract not only capital but also the will for research and development, leading to technology upgrades and cost effectiveness. Mandates financed by the government agencies give priority to biofuel usage, thus generating momentum for the market and laying the foundations for the growth of the infrastructure. The concerted effort among the lawmakers, industry players, and environmentalists to pave the way for sustainable development, hence fostering the symbiotic relationship between economic boom and nature conservation, is an exemplification of productive dialogue. By embracing renewable energy sources, Brazil is not only positioning itself as a world leader in the biofuel sector but also making it a hotbed for investments and a renovated arena for sustainable development.

There are several new technologies that have come about in the areas of feedstock harvesting, pre-treatment, hydrolysis, and fermentation, processes aimed at enhancing biofuel yields and reducing production costs. As an example, Renare (a sub-project of the flagship project H2Giga, funded by the Federal Ministry of Education and Research) invented a technology to get more ethanol yields from sugarcane bagasse and straw. Besides that, companies are becoming more engrossed in the production of cellulosic ethanol from the waste biomass through enzymatic hydrolysis, which has the potential to raise the output. These technological advancements have been instrumental in the expansion of the Brazil biofuels industry.

Brazil Biofuel Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 14.5 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 9.1% |

| 2035 Value Projection: | USD 37.80 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 112 |

| Segments covered: | By Feedstock, By Fuel Type, By Application, By Technology |

| Companies covered:: | Raizen S.A., Cosan S.A., Brasil Biofuels, BP Bunge Bioenergia S.A., Atvos Agroindustrial Investimentos S A, Humberg Agribrasil Comércio e Exportacao de Graos S.A., GranBio, BSBIOS, Petrobras Biocombustível S.A., Others key players. |

| Pitfalls & Challenges: | COVID-19 Impact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Market Dynamics of the Brazil Biofuel Market:

The Brazil biofuel market is driven by strong government support, including policies, tax incentives, subsidies, and blending mandates that encourage production and consumption. Brazil’s large-scale ethanol and biodiesel production meets both domestic and export demand, boosting market growth. Rising environmental concerns and the push for cleaner fuels increase adoption. Technological advancements enhance production efficiency and reduce costs. Additionally, biofuels improve energy security by reducing reliance on fossil fuels, while favorable market conditions attract domestic and foreign investments, further fueling expansion.

The Brazil biofuel market faces restraints such as high production costs, limited availability of feedstock, and competition from cheap fossil fuels. Fluctuating raw material prices and seasonal dependency affect consistent supply. Additionally, inadequate infrastructure for storage and distribution, along with regulatory challenges and environmental concerns over land use, can slow market growth and limit large-scale adoption of biofuels.

The Brazil biofuel market offers significant opportunities due to the growing global demand for renewable and sustainable energy sources. Expansion in advanced biofuels, such as second-generation ethanol and biodiesel, can enhance production efficiency and reduce environmental impact. Investment in modern technology and infrastructure can improve supply chain management and storage capabilities. Export potential to countries seeking cleaner energy further boosts growth prospects. Additionally, partnerships between government, industry players, and research institutions create scope for innovation, policy support, and long-term sustainability, strengthening Brazil’s position as a global biofuel leader.

Market Segmentation

The Brazil Biofuel Market share is classified into feedstock, fuel type, application, and technology.

By Feedstock:

The Brazil Biofuel market is divided by feedstock into sugarcane, corn, vegetable oils, and others. Among these, the sugarcane segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. Sugarcane dominates because of the country’s ideal tropical climate and vast arable land suitable for its cultivation. It offers high ethanol yield per hectare, making production cost-effective and efficient. Brazil has a well-established infrastructure for harvesting, processing, and distributing sugarcane ethanol. Additionally, strong government policies and blending mandates support sugarcane-based biofuels, ensuring consistent demand for both domestic consumption and international exports, solidifying its leading market position.

By Fuel Type:

The Brazil Biofuel market is divided by fuel type into ethanol, biodiesel, biogas, and others. Among these, the ethanol segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. Ethanol dominates due to the country’s extensive sugarcane cultivation, which provides a highly efficient and cost-effective feedstock. Government policies, including blending mandates and incentives, strongly promote ethanol use in transportation, ensuring consistent demand. Brazil’s well-developed production, distribution, and export infrastructure further supports market growth. High consumer acceptance of ethanol-fueled vehicles and the fuel’s environmental benefits, such as lower greenhouse gas emissions, reinforce its preference over biodiesel, biogas, and other biofuels, making it the leading fuel segment.

By Application:

The Brazil Biofuel market is divided by application into transportation, power generation, and others. Among these, the transportation segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. The transportation segment dominates because most biofuels, particularly ethanol and biodiesel, are primarily produced for use in vehicles. Government blending mandates and incentives encourage the adoption of biofuels in cars, buses, and trucks, while Brazil’s large fleet of flex-fuel vehicles ensures high consumer acceptance. Well-established production, distribution, and fueling infrastructure support a consistent supply. Additionally, the environmental benefits of biofuels, such as reduced greenhouse gas emissions, make transportation the most significant and widely adopted application compared to power generation and other uses.

By Technology:

The Brazil Biofuel market is divided by technology into first-generation, second-generation, and third-generation. Among these, the first-generation segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. First-generation biofuels dominate because they are produced from readily available crops like sugarcane and corn, which thrive in Brazil’s favorable climate and fertile land. The production processes are well-established, cost-effective, and supported by extensive infrastructure for harvesting, processing, and distribution. Strong government policies, blending mandates and incentives, further promote their use. High consumer acceptance, especially for ethanol in flex-fuel vehicles, ensures steady demand. In contrast, second- and third-generation biofuels, such as advanced cellulosic or algae-based fuels, are still emerging, less commercially viable, and produced on a smaller scale.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the Brazil biofuel market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in Brazil Biofuel Market:

- Raizen S.A.

- Cosan S.A.

- Brasil Biofuels

- BP Bunge Bioenergia S.A.

- Atvos Agroindustrial Investimentos S A

- Humberg Agribrasil Comércio e Exportacao de Graos S.A.

- GranBio

- BSBIOS

- Petrobras Biocombustível S.A.

- Others

Recent Developments in Brazil Biofuel Market:

In October 2022, Raízen (an integrated energy company that is among the largest private business groups in Brazil) announced the launch of BioD2, a second-generation biodiesel with a lower carbon footprint. This supports sustainability goals in the transportation sector.

In November 2020, Ipiranga (a Brazil-based fuel company and subsidiary of Ultra) partnered with Raízen to launch BioRumo, a renewable diesel produced from vegetable oil. This expanded renewable fuel options for the transportation sector.

In November 2021, Brasil Biofuels (BBF), a Brazilian palm oil producer, has announced plans to establish Brazil's first hydrotreated vegetable oil (HVO) plant following a supply agreement with Vibra Energia, Brazil's largest fuel distributor. The factory, located in the Manaus free-trade zone in Amazonas state, will begin operations in January 2025, with a production capacity of around 500 million liters per year.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the Brazil, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Brazil biofuel market based on the below-mentioned segments:

Brazil Biofuel Market, By Feedstock

- Sugarcane

- Corn

- Vegetable Oils

- Others

Brazil Biofuel Market, By Fuel Type

- Ethanol

- Biodiesel

- Biogas

- Others

Brazil Biofuel Market, By Application

- Transportation

- Power Generation

- Others

Brazil Biofuel Market, By Technology

- First Generation

- Second Generation

- Third Generation

Frequently Asked Questions (FAQ)

-

Q1: What are biofuels? Biofuels are renewable fuels produced from organic materials like sugarcane, corn, vegetable oils, and animal waste, used as alternatives to fossil fuels.

-

Q2: Which biofuel is most used in Brazil? Ethanol, primarily produced from sugarcane, is the dominant biofuel in Brazil.

-

Q3: What drives the Brazil biofuel market? Key drivers include government incentives, blending mandates, large-scale ethanol and biodiesel production, environmental concerns, and energy security.

-

Q4: What are the main challenges? High production costs, limited feedstock availability, competition from fossil fuels, and infrastructure limitations restrain growth.

-

Q5: What are the growth opportunities? Advanced biofuels, technological innovations, export potential, and partnerships between government and industry offer major growth opportunities.

-

Q6: Which feedstock is dominant in Brazil? Sugarcane is the leading feedstock due to high yield, cost efficiency, and well-established infrastructure.

-

Q7: Which application leads the market? Transportation dominates, as ethanol and biodiesel are widely used in vehicles supported by flex-fuel technology and government policies.

Need help to buy this report?