Brazil Auto Loan Market Size, Share, By Loan Type (New Vehicle Loans, Used Vehicle Loans, Lease Buyout Loans, Refinancing Loans), By Loan Term (Short-Term Loans (Up to 3 Years), Medium-Term Loans (3-5 Years), Long-Term Loans (Above 5 Years)), By Provider Type (Banks, Credit Unions, Non-Banking Financial Companies (NBFCs), Automobile Manufacturers’ Financial Services), Brazil Auto Loan Market Insights, Industry Trend, Forecasts to 2035

Industry: Banking & FinancialBrazil Auto Loan Market Size Insights Forecasts to 2035

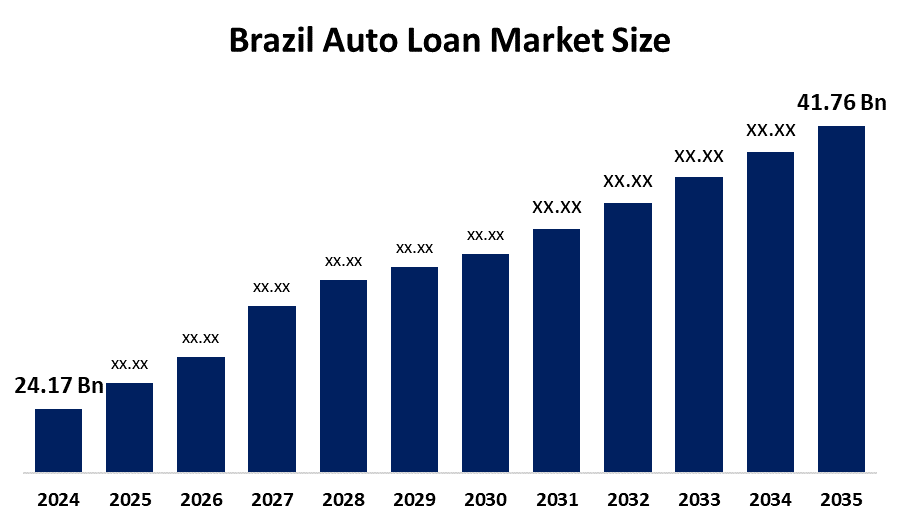

- Brazil Auto Loan Market Size 2024: USD 24.17 Bn

- Brazil Auto Loan Market Size 2035: USD 41.76 Bn

- Brazil Auto Loan Market CAGR 2024: 5.1%

- Brazil Auto Loan Market Segments: Loan Type, Loan Term, Provider Type

Get more details on this report -

An Auto Loan is a form of credit that is only applicable to the buying of a new vehicle, be it a car, a motorcycle, or a truck. The lender loans the money to the borrower, who pays it back in constant monthly installments over a certain period, usually with interest. The vehicle is most of the time the collateral that guarantees the lender the security until the debt is completely paid off. Also, the auto loan industry in Brazil continues to expand as the factors of vehicle demand, consumer disposable income, interest rates, financial services, and government incentives for auto financing play a significant role in boosting the sector's affordability and accessibility for car buyers.

Among these aspects, the increasing consumer disposable income through government initiatives is one of the main factors that facilitate the growth of the financing market and the auto loan sector in general. The government's tax cuts, the reduction of import duties on the automotive industry, and the implementation of the infrastructure investment programs that lead to a rise in vehicle demand and thus the need for financing are some of the most significant measures taken to boost the car financing business.

The quick evolution of financial technology services has a significant impact on the application and approval process for auto loans. Different online sources facilitate the process and thus shorten the time necessary to complete the procedure. A further improvement in customer experience and risk assessment also takes place. Genuine mobile banking adoption makes it simple and convenient for consumers to take care of their loans and make payments, thereby solving their needs and attracting more tech-savvy consumers to automotive financing solutions.

Some of the essential market trend changes that are leading a shift in the sector to explore are primarily related to the fast-growing consumer preference for online lending platforms, which enable more remarkable flexibility and transparency during the lending process. In addition, the accelerated adoption of electric vehicles.

Market Dynamics of the Brazil Auto Loan Market:

The Brazil auto loan market is driven by rising vehicle ownership, rapid urbanization, and an increasing middle-class population. Improved access to credit through banks and non-banking financial institutions, along with competitive interest rates and flexible repayment options, encourages consumers to opt for auto financing. Additionally, the growing popularity of used cars, digital loan approval processes, and partnerships between automakers and financial institutions further accelerate market growth across Brazil.

The Brazil auto loan market faces restraints from high interest rate volatility, strict credit approval criteria, and economic uncertainty affecting consumer confidence. Inflationary pressures and fluctuating fuel prices reduce vehicle affordability, limiting loan demand. Additionally, rising default risks, limited credit access for low-income consumers, and regulatory compliance requirements for financial institutions further challenge market growth and slow auto loan penetration across the country.

The Brazil auto loan market presents strong opportunities driven by digital lending platforms, fintech expansion, and faster online loan approvals. Growing demand for used and electric vehicles opens new financing segments. Increasing financial inclusion and alternative credit scoring models enable lenders to reach underserved consumers. Additionally, partnerships between automakers, dealers, and financial institutions, along with customized loan products and flexible repayment plans, create significant growth potential and improve customer accessibility across Brazil.

Market Segmentation

The Brazil Auto Loan Market share is classified into loan type, loan term, and provider type.

By Loan Type:

The Brazil Auto Loan market is divided by loan type into new vehicle loans, used vehicle loans, lease buyout loans, and refinancing loans. Among these, the new vehicle loans segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. New vehicle loans dominate due to strong consumer preference for purchasing new cars, attractive financing offers from automakers and banks, warranty benefits, and promotional interest rates. Additionally, partnerships between dealerships and financial institutions make new vehicle loans more accessible, supporting higher loan volumes compared to used vehicle, refinancing, and lease buyout loans.

By Loan Term:

The Brazil Auto Loan market is divided by loan term into short-term loans (up to 3 years), medium-term loans (3–5 years), and long-term loans (above 5 years). Among these, the medium-term loans (3–5 years) segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. Medium-term auto loans of three to five years dominate because they strike an optimal balance between monthly affordability and total borrowing cost. Consumers can manage repayments without stretching finances, while lenders face lower default risk compared to longer tenures. This loan term aligns well with average vehicle ownership cycles in Brazil and is widely promoted by banks and dealerships through competitive interest rates, flexible repayment structures, and bundled insurance or maintenance offers, further boosting adoption.

By Provider Type:

The Brazil Auto Loan market is divided by provider type into banks, credit unions, non-banking financial companies (NBFCs), and automobile manufacturers’ financial services. Among these, the banks segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. Banks dominate due to their strong financial stability, wide customer base, and extensive distribution networks across urban and semi-urban areas. They offer competitive interest rates, longer repayment tenures, and flexible loan structures supported by digital platforms. Banks also benefit from established relationships with automobile dealers and manufacturers, enabling faster loan approvals. Additionally, higher consumer trust, regulatory compliance strength, and the ability to manage credit risk effectively reinforce banks’ leading position in the market.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the Brazil auto loan market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in Brazil Auto Loan Market:

- Banco do Brasil

- Caixa Econômica Federal

- Itaú Unibanco

- Banco Bradesco

- Santander Brasil

- Banco Votorantim (BV)

- Banco Safra

- Banco Pan

- Volkswagen Financial Services Brasil

- Others

Recent Developments in Brazil Auto Loan Market:

In August 2023, JPMorgan Chase & Co. raised its ownership in C6, a prominent Brazilian digital bank, from 40% to 46%. Through this strategic cooperation, Brazilian consumers can enjoy comprehensive digital auto finance solutions, including credit evaluation, credit review, and payment solutions.

In July 2024, Carflip, a Brazil-based company, modified its innovative car subscription model to align with evolving consumer preferences by introducing flexible, subscription-based vehicle options.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the Brazil, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the Brazil auto loan market based on the below-mentioned segments:

Brazil Auto Loan Market, By Loan Type

- New Vehicle Loans

- Used Vehicle Loans

- Lease Buyout Loans

- Refinancing Loans

Brazil Auto Loan Market, By Loan Term

- Short-Term Loans (Up to 3 Years)

- Medium-Term Loans (3–5 Years)

- Long-Term Loans (Above 5 Years)

Brazil Auto Loan Market, By Provider Type

- Banks

- Credit Unions

- Non-Banking Financial Companies (NBFCs)

- Automobile Manufacturers’ Financial Services

Frequently Asked Questions (FAQ)

-

1. What is an auto loan? An auto loan is a financial product that helps consumers purchase new or used vehicles by borrowing funds from banks or financial institutions and repaying them in monthly installments with interest.

-

2. Which segment dominates the Brazil auto loan market? New vehicle loans dominate the market due to strong consumer preference, attractive financing schemes, and partnerships between automakers and lenders.

-

3. Who are the major providers of auto loans in Brazil? Banks dominate the market, followed by NBFCs and automobile manufacturers’ financial services.

-

4. What loan term is most preferred by borrowers? Medium-term loans (3–5 years) are most preferred as they balance affordable monthly payments and lower overall interest costs.

-

5. Are auto loans available for used vehicles in Brazil? Yes, used vehicle loans are widely available and are growing due to lower vehicle prices and increasing demand from cost-conscious buyers.

-

6. What factors drive the growth of the Brazil auto loan market? Rising vehicle ownership, digital lending platforms, improved credit access, and competitive interest rates are key growth drivers.

-

7. What are the main challenges faced by auto loan providers? High interest rate volatility, credit risk, economic uncertainty, and strict regulatory requirements are major challenges.

-

8. How is digital lending impacting auto loans in Brazil? Digital platforms enable faster approvals, simplified documentation, and wider reach, improving customer experience and market penetration.

Need help to buy this report?