Brazil Ammonia Market Size, Share, and COVID-19 Impact Analysis, By Type (Liquid and Gas), By End Use (Agriculture, Textile, Mining, Pharmaceutical, Refrigeration, and Others), and Brazil Ammonia Market Insights, Industry Trend, Forecasts to 2035

Industry: Chemicals & MaterialsBrazil Ammonia Market Insights Forecasts to 2035

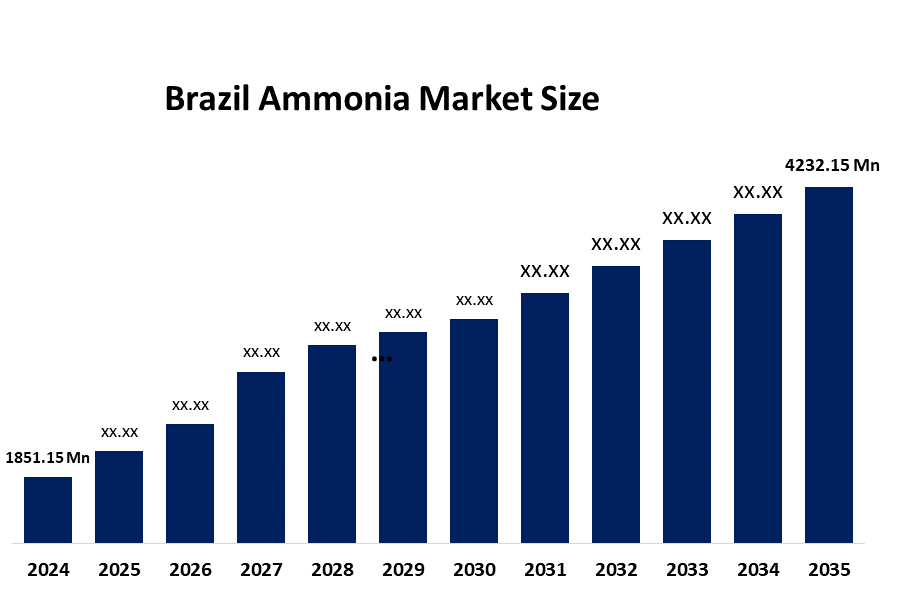

- The Brazil Ammonia Market Size Was Estimated at USD 1,851.15 Million in 2024

- The Brazil Ammonia Market Size is Expected to Grow at a CAGR of Around 7.81% from 2025 to 2035

- The Brazil Ammonia Market Size is Expected to Reach USD 4,232.15 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, The Brazil Ammonia Market Size is anticipated to reach USD 4,232.15 Million by 2035, Growing at a CAGR of 7.81% from 2025 to 2035. The Brazil ammonia market is driven by strong demand from the agricultural sector, as ammonia is a key input for nitrogen-based fertilizers supporting large-scale crop production. Growth in industrial chemicals, a rising focus on food security, and increasing investments in low-carbon and green ammonia, aligned with Brazil’s renewable energy potential, further support market expansion.

Market Overview

The Brazil ammonia market refers to the production, import, distribution, and consumption of ammonia across Brazil for use in fertilizers, chemicals, mining, refrigeration, pharmaceuticals, and emerging energy applications. The market includes conventional ammonia, largely supporting agriculture, as well as low-carbon and green ammonia, driven by Brazil’s renewable energy resources and sustainability initiatives.

Brazil’s large population and world-leading agribusiness drive strong demand for ammonia, a critical input for nitrogen-based fertilizers used in crops such as soy, corn, and sugarcane. Fertilizer deliveries in Brazil have reached over 35 million tonnes, supported by expanding planting areas and increased crop intensification, while imports remain high, signaling persistent demand for ammonia and related products. Brazil aims to reduce its reliance on imported fertilizers, which are currently critical for its agriculture, by boosting domestic production and sustainable alternatives, reflecting the market’s strategic need.

The Brazilian government and industry are increasingly supporting ammonia market transformation, particularly toward low-carbon and renewable production. Major initiatives include Yara’s renewable-based ammonia production using biomethane, which reduces emissions by up to 75%, and flagship green ammonia projects such as the Green Energy Park, with a planned capacity of 2.1 million t/year and an investment of USD 4.5 billion. Additionally, the UGF integrated project, backed by a BRL 6 billion investment, is advancing green hydrogen, ammonia, and fertilizer production, supported by tax incentives and state backing to strengthen competitiveness. These shifts align with Brazil’s broader industrial and ecological strategy to promote green fertilizers, generate jobs, and build export-oriented clean energy value chains.

Report Coverage

This research report categorizes the market for the Brazil ammonia market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Brazil ammonia market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Brazil ammonia market.

Brazil Ammonia Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 1,851.15 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 7.81% |

| 2035 Value Projection: | USD 4,232.15 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 95 |

| Segments covered: | By Type, By End Use |

| Companies covered:: | Yara International ASA, Petrobras (Petróleo Brasileiro S.A.), CF Industries Holdings, Inc., Nutrien Ltd., Mosaic Company, BASF SE, SABIC, Nitrochem, Unigel, Fertilab, Vale S.A., OCI N.V., Others, and Key Players. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The Brazil ammonia market is driven by strong fertilizer demand from the agriculture sector, supporting key crops like soybeans, corn, and sugarcane, along with growing use in industrial chemicals, refrigeration, and pharmaceuticals. Expansion is further supported by low-carbon and green ammonia initiatives, backed by Brazil’s renewable energy resources and government sustainability policies.

Restraining Factors

The Brazil ammonia market is restrained by high production and operational costs, particularly for low-carbon and green ammonia, due to expensive technology and renewable energy requirements. Fluctuating natural gas prices, stringent environmental regulations, and the capital-intensive nature of ammonia plants and storage infrastructure also limit market growth.

Market Segmentation

The Brazil ammonia market share is classified into type and end use.

- The liquid segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Brazil ammonia market is segmented by type into liquid and gas. Among these, the liquid segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The liquid segment is growing because liquid ammonia is easier to store, transport, and handle in bulk, making it ideal for fertilizer production, industrial applications, and export logistics. Its widespread use across agriculture and chemicals, along with increasing adoption in low-carbon and green ammonia projects, continues to drive market growth.

- The agriculture segment dominated the market in 2024 and is anticipated to grow at a substantial CAGR during the forecast period.

The Brazil ammonia market is segmented by end use into agriculture, textile, mining, pharmaceutical, refrigeration, and others. Among these, the agriculture segment dominated the market in 2024 and is anticipated to grow at a substantial CAGR during the forecast period. The agriculture segment is growing because ammonia is a critical raw material for nitrogen-based fertilizers, which are essential for increasing crop yields and ensuring food security in Brazil. Strong demand for staple crops like soybeans, corn, and sugarcane, along with the country’s focus on agricultural exports, continues to drive sustained ammonia consumption.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Brazil ammonia market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Yara International ASA

- Petrobras (Petróleo Brasileiro S.A.)

- CF Industries Holdings, Inc.

- Nutrien Ltd.

- Mosaic Company

- BASF SE

- SABIC

- Nitrochem

- Unigel

- Fertilab

- Vale S.A.

- OCI N.V.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the France, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Brazil ammonia market based on the below-mentioned segments:

Brazil Ammonia Market, By Type

- Liquid

- Gas

Brazil Ammonia Market, By End Use

- Agriculture

- Textile

- Mining

- Pharmaceutical

- Refrigeration

- Others

Frequently Asked Questions (FAQ)

-

1.What is the Brazil ammonia market size in 2024?The Brazil ammonia market size was estimated at USD 1,851.15 million in 2024.

-

2.What is the projected market size of the Brazil ammonia market by 2035?The Brazil ammonia market size is expected to reach USD 4,232.15 million by 2035.

-

3.What is the CAGR of the Brazil ammonia market?The Brazil ammonia market size is expected to grow at a CAGR of around 7.81% from 2024 to 2035.

-

4.What are the key growth drivers of the Brazil ammonia market?The Brazil ammonia market is driven by strong demand from the agricultural sector, as ammonia is a key input for nitrogen-based fertilizers supporting large-scale crop production. Growth in industrial chemicals, a rising focus on food security, and increasing investments in low-carbon and green ammonia, aligned with Brazil’s renewable energy potential, further support market expansion.

-

5.Which end-use segment dominated the market in 2024?The agriculture segment dominated the market in 2024.

-

6.What segments are covered in the Brazil ammonia market report?The Brazil ammonia market is segmented on the basis of type and end use.

-

7.Who are the key players in the Brazil ammonia market?Key companies include Yara International ASA, Petrobras (Petróleo Brasileiro S.A.), CF Industries Holdings, Inc., Nutrien Ltd., Mosaic Company, BASF SE, SABIC, Nitrochem, Unigel, Fertilab, Vale S.A., OCI N.V., and others.

-

8.Who are the target audiences for this market report?The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Need help to buy this report?