Brazil Aluminium Cans Market Size, Share, and COVID-19 Impact Analysis, By Material Type (Aluminium Alloy and Recycled Aluminium), By Can Type (Two-Piece Cans and Three-Piece Can), By End-Use Industry (Beverages, Food Products, Pharmaceuticals, And Others), and Brazil Aluminium Cans Market Insights, Industry Trend, Forecasts to 2035

Industry: Food & BeveragesBrazil Aluminium Cans Market Insights Forecasts to 2035

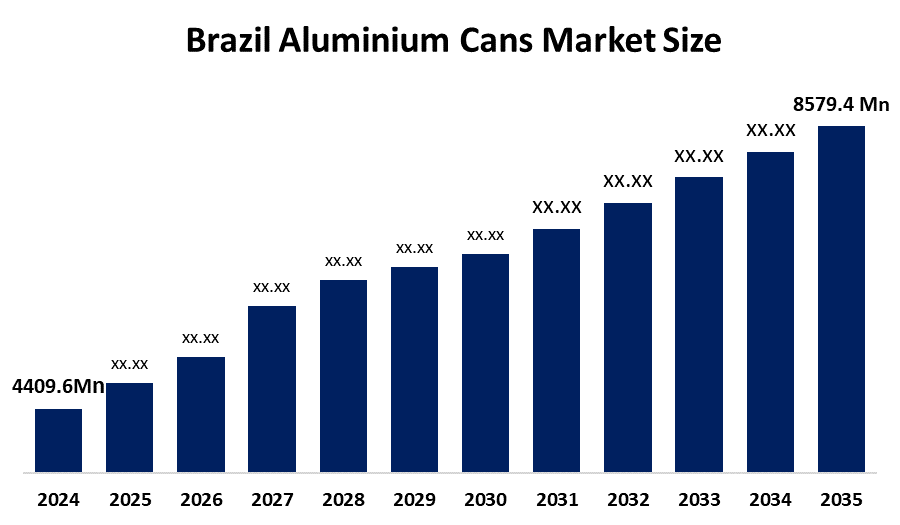

- The Brazil Aluminium Cans Market Size was estimated at USD 4409.6 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 6.24% from 2025 to 2035

- The Brazil Aluminium Cans Market Size is Expected to Reach USD 8579.4 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, The Brazil Aluminium Cans Market Size Is Anticipated To Reach USD 8579.4 Million By 2035, Growing at a CAGR of 6.24% from 2025 to 2035. The Brazil Aluminium Cans Market is driven by the an increase in consumption of ready-to-drink beverages, the demand for custom and premium packaging, e-commerce beverage distribution growth, and new applications for food canning; many of these canning businesses are likely growing as a result of technological advancements within the canning manufacturing industry, thus providing an opportunity for Brazilian can manufacturers to expand their production capabilities and increase operational efficiencies through an increase in manufacturing investments.

Market Overview

The aluminium can sector is the worldwide industry that makes, distributes, and sells aluminium cans that package mainly beverages such as energy drinks, soft drinks, beers, etc., based on their lightweight and recyclable characteristics, along with demand for sustainability. Additionally, the aluminium can industry shows tremendous potential due to the increased need for packaging that is eco-friendly, light-weight, and can be recycled endlessly. Examples of innovations in the aluminium can market consist of ultra-lightweight designs, cutting-edge barrier and BPA-free coating technology, smart and QR-code-enabled cans, rapid digital printing options for product customisation, faster methods of manufacturing, and more reuse of existing aluminium. All these developments also enable brands to save on costs, distinguish themselves from their competition, comply with laws and have the resources to reach their circular economy objectives.

The Aluminium Cans Market Size is supported by government incentives to promote recycling, such as the use of recyclable packaging materials and legislation to hold producers responsible for their packaging. For example, India's new regulations on packaging require businesses to use recyclable materials and to include recycled content in products they sell. Additionally, several countries have commenced using deposit return systems, which offer financial incentives for customers to return aluminium cans back into the supply chain. As a result, many nations are implementing national recycling goals, creating a larger demand for aluminium can collection, and contributing to the continued development of the circular economy.

Report Coverage

This research report categorizes the market for the Brazil aluminium cans market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Brazil aluminium cans market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Brazil aluminium cans market.

Brazil Aluminium Cans Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 4409.6 Million |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | CAGR of 6.24% |

| 2035 Value Projection: | USD 8579.4 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 90 |

| Segments covered: | By Product Type, By Application |

| Companies covered:: | Ardagh Metal Packaging SA Ordinary Shares, Kian Joo Can Factory, Ball Corp, Toyo Seikan Group Holdings Ltd, Crown Holdings Inc, and Other key Players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The Brazil Aluminium Cans Market Size is driven by the increasing demand for recyclable packaging; this is especially true in relation to the beverage market including soft drinks, beer, and energy beverages. As such, many companies are switching from non-recyclable packaging to aluminium cans as they offer lightweight and strong, effective barriers while providing companies with reduced transportation costs and lowered carbon footprints due to their lightweight characteristics. Urbanisation, Convenience Consumption, Shelf life, and excellent Barrier Protection along with legislation pertaining to packaging and increased recycling infrastructure have all contributed positively toward the growth of the aluminium cans market on global scale.

Restraining Factors

The Brazil Aluminium Cans Market Size is restrained by the raised production costs and adversely impacted profit margins for suppliers and customers. The main factors that inhibit market growth include high energy consumption during aluminium smelting, relying upon a reliable supply of scrap aluminium, competition from glass and PET packaging, the considerable financial investment required to establish canning lines, and economic downturns causing reductions in overall beverage consumption.

Market Segmentation

The Brazil aluminium cans market share is classified into material type, can type, and end-use industry.

- The recycled aluminium segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Brazil Aluminium Cans Market is segmented by material type into aluminium alloy and recycled aluminium. Among these, the electronics segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is due to its high recycling rate of cans, therefore providing a plentiful supply of scrap. This helps to lower the cost of producing recycled aluminium compared to new aluminium, as well as producing less carbon dioxide, uses less energy and helps to support sustainable development and environmental performance standards in producing cans on a mass scale.

- The two-piece cans segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

The Brazil Aluminium Cans Market t is segmented by can type into two-piece cans and three-piece can. Among these, the pulsed UV lasers segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The segmental growth is due to they are a popular choice for consumers due to their low weight and cost, making them efficient for packing drinks/packages of many servings. Compared to three-piece cans, two-piece cans have an added manufacturing benefit of less material, greater strength, barrier, faster production speed, and less waste, which are all appealing because they represent sustainable solutions for most drink consumers.

- The beverages segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Brazil Aluminium Cans Market is segmented by end-use industry into beverages, food products, pharmaceuticals, and others. Among these, the electronics segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is due to there is a big potential for aluminium cans to be used in Brazil's beer and soda markets. There is also an emphasis on convenience with shopping for beverages. An aluminium can provide excellent carbonation retention, very quick cooling times, portable packaging, and nearly total recyclability. These advantages lead to large volume production of beverage products using aluminium cans.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Brazil aluminium cans market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Ardagh Metal Packaging SA Ordinary Shares

- Kian Joo Can Factory

- Ball Corp

- Toyo Seikan Group Holdings Ltd

- Crown Holdings Inc

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at Brazil, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Brazil Aluminium Cans Market based on the below-mentioned segments:

Brazil Aluminium Cans Market, By Material Type

- Aluminium Alloy

- Recycled Aluminium

Brazil Aluminium Cans Market, By Can Type

- Two-Piece Cans

- Three-Piece Cans

Brazil Aluminium Cans Market, By End-Use Industry

- Beverages

- Food Products

- Pharmaceuticals

Frequently Asked Questions (FAQ)

-

What is the Brazil aluminium cans market size?Brazil Aluminium Cans Market is expected to grow from USD 4409.6 million in 2024 to USD 8579.4 million by 2035, growing at a CAGR of 6.24% during the forecast period 2025-2035.

-

Who are the key players in the Brazil aluminium cans market?Ardagh Metal Packaging SA Ordinary Shares, Kian Joo Can Factory, Ball Corp, Toyo Seikan Group Holdings Ltd, Crown Holdings Inc, and Others are the key players in the Brazil aluminium cans market.

-

Who are the target audiences for this market report?The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Need help to buy this report?