Brazil Airbag Systems Market Size, Share, By Airbag Type (Curtain, Front, Knee, and Others), By Automobile Type (Passenger Vehicle, Commercial Vehicle, Bus, Truck), By End Consumer (OEMs, After-Market), Brazil Airbag Systems Market Insights, Industry Trend, Forecasts to 2035.

Industry: Automotive & TransportationBrazil Airbag Systems Market Insights Forecasts to 2035

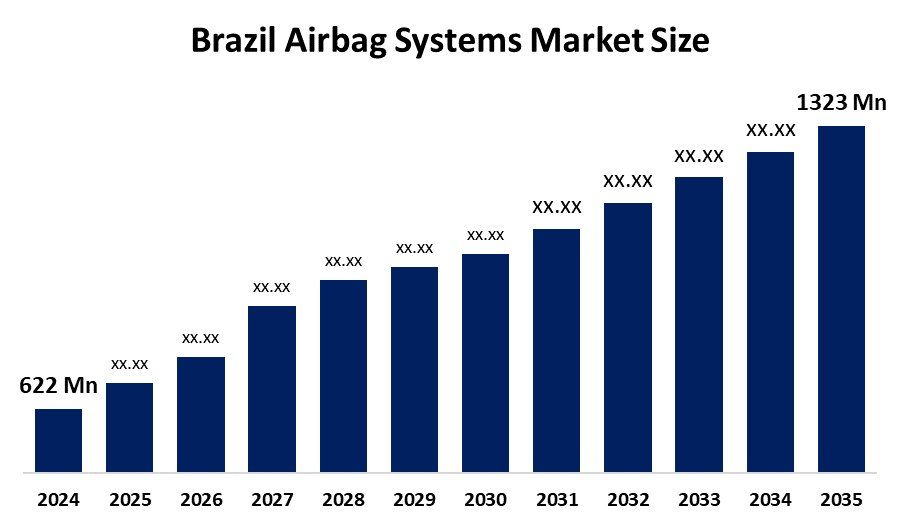

- Brazil Airbag Systems Market Size 2024: USD 622 Mn

- Brazil Airbag Systems Market Size 2035: USD 1323 Mn

- Brazil Airbag Systems Market CAGR 2024: 7.1%

- Brazil Airbag Systems Market Segments: Airbag Type, Automobile Type, and End Consumer.

Get more details on this report -

Airbag systems are one of the most common safety devices in vehicles designed to protect people in the event of an accident. These are cushions that take only a few seconds to fill up with gas and thus prevent the passenger from being hurt by the steering wheel, the dashboard, or the windows. In combination with seat belts, airbags reduce the likelihood of injuries to the minimum and thus make car transport safer for the whole community. The Brazilian airbag systems market is growing, largely because of increased vehicle production, stricter safety regulations, road accident awareness, and demand for advanced safety features. Consumers prefer vehicles equipped with airbags, thus promoting demand and encouraging manufacturers to use the latest airbag technology. The expanding middle class in Brazil, with a higher disposable income and a preference for safer vehicles, is another reason for the market growth. Besides that, the fast urbanization trend, which leads to higher vehicle usage, is also a growth factor. The growth of the market is also supported by the rising sales of luxury vehicles that usually come with advanced airbag systems.

Additionally, as more and more consumers are opting for vehicles with complete safety features, the airbag systems market is being further enhanced. The upsurge in vehicle production and sales in Brazil, which is a direct cause for the increase in airbag system sales, is also a major factor behind the market expansion. Furthermore, the rising foreign direct investment (FDI) in the automotive sector of Brazil is expanding the market for safety features such as airbags. In addition, the rapid globalizing of Brazilian automotive brands not only promotes the brand in the world but also requires vehicle producers to comply with international safety standards, which stimulates the market growth as well.

The government, by imposing strict regulations that require at least one frontal airbag in new vehicles, is a main factor in the increase of the airbag systems market in Brazil, and the population is also protected. The mandates push automakers to comply and invest in better safety features. Moreover, technology innovation is growing the market with intelligent, more adaptive airbag systems, upgraded sensors, AI-driven deployment logic, and new designs that both improve crash protection and comply with the safety standards of the future. On the whole, regulation and tech progress conjointly result in safer vehicles and market expansion.

Brazil Airbag Systems Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 622 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 7.1% |

| 2035 Value Projection: | USD 1323 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 177 |

| Tables, Charts & Figures: | 105 |

| Segments covered: | By Airbag Type, By Automobile Type, By End Consumer |

| Companies covered:: | Autoliv Inc., ZF Friedrichshafen AG, Hyundai Mobis Co., Ltd., Continental AG, Joyson Safety Systems, Toyoda Gosei Co., Ltd., Nihon Plast Co., Ltd., Daicel Corporation, Robert Bosch GmbH, and Others key vendors |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Market Dynamics of the Brazil Airbag Systems Market:

The Brazil airbag systems market is driven by increasing vehicle production, rising consumer awareness of road safety, and strict government regulations mandating airbag installation in new cars. Growing demand for advanced safety features, such as multi-stage and side airbags, also fuels market growth. Additionally, urbanization, rising disposable income, and technological innovations like smart sensors and adaptive deployment systems encourage automakers to equip more vehicles with airbags, boosting overall adoption and strengthening the market’s expansion.

The Brazil airbag systems market faces restraints from the high costs of advanced airbag technologies, which can increase vehicle prices. Limited awareness of airbag benefits in some regions and the prevalence of older vehicles without modern safety features also slow adoption. Additionally, complex installation and maintenance requirements may discourage smaller automakers from incorporating advanced airbag systems.

The Brazil airbag systems market presents significant opportunities due to increasing demand for vehicle safety, rising adoption of advanced technologies, and growing consumer awareness of accident protection. Expanding automotive production, especially in electric and luxury vehicles, creates potential for advanced airbag integration. Furthermore, innovations like smart airbags, side-curtain systems, and pedestrian protection airbags offer growth prospects. Collaborations between automakers and technology providers, along with government incentives for safer vehicles, can further accelerate market expansion and open new revenue streams.

Market Segmentation

The Brazil Airbag Systems Market share is classified into airbag type, automobile type, and end consumer.

By Airbag Type:

The Brazil Airbag Systems market is divided by airbag type into curtain, front, knee, and others. Among these, the front segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. The front airbag segment dominates the market because it is mandatory in new vehicles under government safety regulations. Front airbags provide essential protection for drivers and front-seat passengers during frontal collisions, which are the most common type of accidents. Their lower cost compared to advanced airbag types and easy integration into vehicles also support widespread adoption. As a result, automakers prioritize front airbags, making them the most installed and widely accepted airbag system in Brazil.

By Automobile Type:

The Brazil Airbag Systems market is divided by automobile type into passenger vehicles, commercial vehicles, buses, truck. Among these, the passenger vehicle segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. The passenger vehicle segment dominates the market because passenger cars account for the largest share of vehicle production and sales in the country. Government safety regulations mandate airbags mainly for passenger vehicles, ensuring widespread installation. Rising consumer awareness about road safety and increasing preference for safer cars further support this dominance. In contrast, commercial vehicles, buses, and trucks have slower adoption of airbags due to higher costs and less strict safety requirements, limiting their market share.

By End Consumer:

The Brazil Airbag Systems market is divided by end consumer into OEMs and after-market. Among these, the OEMs segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. The OEM segment dominates because airbags are primarily installed at the manufacturing stage to comply with strict government safety regulations. OEM-fitted airbags ensure proper system integration, higher reliability, and adherence to safety standards. Consumers also prefer factory-installed safety features over aftermarket options due to better performance and warranty coverage. In contrast, aftermarket airbag installation is limited because of high costs, technical complexity, and safety concerns, making OEMs the leading end consumers in the market.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the Brazil airbag systems market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in Brazil Airbag Systems Market:

- Autoliv Inc.

- ZF Friedrichshafen AG

- Hyundai Mobis Co., Ltd.

- Continental AG

- Joyson Safety Systems

- Toyoda Gosei Co., Ltd.

- Nihon Plast Co., Ltd.

- Daicel Corporation

- Robert Bosch GmbH

- Others

Recent News in Brazil Airbag Systems Market:

In September 2023, Autoliv, Inc. debuted an upgraded exterior airbag system with the goal of reducing pedestrian and bike collisions. This mechanism deploys outside the car and provides additional protection during an accident. Such innovations are in line with the increasing emphasis on road safety and regulatory compliance in the global automobile market.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the Brazil, regional, and country levels from 2020 to 2035. Spherical insights has segmented the Brazil airbag systems market based on the below-mentioned segments:

Brazil Airbag Systems Market, By Airbag Type

- Curtain

- Front

- Knee

- Others

Brazil Airbag Systems Market, By Automobile Type

- Passenger Vehicle

- Commercial Vehicle

- Bus

- Truck

Brazil Airbag Systems Market, By End Consumer

- OEMs

- After-Market

Frequently Asked Questions (FAQ)

-

1. Why are airbags important in vehicles?They reduce injury risk by cushioning occupants during sudden collisions.

-

2. Are airbags mandatory in Brazil?Yes, frontal airbags are compulsory in new passenger vehicles.

-

3. Which vehicles use airbags the most?Passenger cars use airbags more widely than buses, trucks, or commercial vehicles.

-

4. Is the aftermarket important for airbags?No, most airbags are installed by manufacturers at the production stage.

-

5. What trends are shaping this market?Advanced sensor technology and demand for enhanced vehicle safety features.

Need help to buy this report?