Brazil Air Defense System Market Size, Share, By Type (Missile Defence System, Anti Aircraft System, Counter Unmanned Aerial Systems, Counter Rocket, Artillery and Mortar Systems), By Range (Long Range, Medium Range, and Short), Brazil Air Defense System Market Insights, Industry Trend, Forecasts to 2035

Industry: Aerospace & DefenseBrazil Air Defense System Market Size Insights Forecasts to 2035

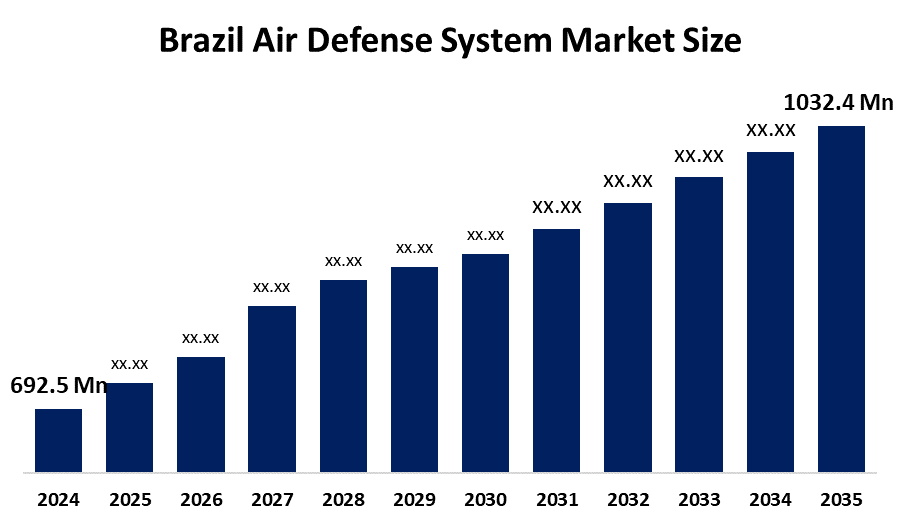

- Brazil Air Defense System Market Size 2024: USD 692.5 Mn

- Brazil Air Defense System Market Size 2035: USD 1032.4 Mn

- Brazil Air Defense System Market CAGR 2024: 3.7%

- Brazil Air Defense System Market Segments: Type and Range

Get more details on this report -

The Brazil Air Defense System Market Size includes radar, missile, command-and-control, and surveillance technologies that are employed by the military of Brazil to spot, monitor, and eliminate air threats. This system is intended for the safeguarding of the national airspace, crucial infrastructures, as well as frontiers and important functions against planes, rockets and drones.

Brazil is in the process of negotiations with Italy and MBDA to acquire the Enhanced Modular Air Defense Solutions (EMADS) system, which is a medium-range mobile air defense system that will cover the aerial defense in layers and protect the most valuable assets significantly.

The Brazilian government proposed a reallocation of nearly 40 billion reais ( $6.9 billion) within the budget for 2025 with the purpose of balancing priorities such as pensions, social support, and subsidies. In Brazil, the defense budget for 2025 is approximately US $23.5 billion, which shows the ongoing financial support for the military and modernizing initiatives. The government revealed a significant fiscal austerity measure for 2025 in order to comply with the new fiscal regulations, which included 20.7 billion reais being frozen and 10.6 billion reales being blocked in expenditure in order to reach a zero primary deficit.

Increased funding for layered air defense, radar modernisation, and medium range missile systems provide excellent chances for cooperation between foreign original equipment manufacturers (OEMs) and local firms. The rising emphasis on domestic defense production and technology transfer is also a factor that would contribute to the expansion of the market in the long run.

Market Dynamics of the Brazil Air Defense System Market:

The Brazil air defense system market is driven by rising concerns over airspace security, border surveillance needs, and protection of critical infrastructure and major events. Ongoing military modernization programs, increased defense budgets, adoption of advanced radar and missile technologies, and government emphasis on strengthening indigenous defense manufacturing and strategic partnerships are further accelerating market growth.

The Brazil air defense system market is restrained by budget constraints, high acquisition and maintenance costs, lengthy procurement cycles, and dependence on foreign technology, which can delay system integration and limit the rapid deployment of advanced air defense capabilities.

The future of the Brazil air defense system market looks really positive since it will be supported by defense modernization, purchase of medium range air defense systems, radar improvements, and the insistence on local production, technological know how, and international defense collaboration.

Market Segmentation

The Brazil Air Defense System Market share is classified into type and range.

By Type:

The Brazil air defense system market is divided by type into missile defence system, anti aircraft system, counter unmanned aerial systems, counter rocket, artillery and mortar systems. Among these, the missile defense system segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. Missile defense systems deliver long and medium range threat interception, integrated radar and command and control capabilities and are among the priorities in Brazil's defense modernization programs that aim to safeguard the national airspace, strategic infrastructure, and large population centres.

By Range:

The Brazil air defense system market is divided by range into long range, medium range, and short range. Among these, the medium range segment accounted the market share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. Medium-range systems are favoured by Brazil’s defense budget as they offer great flexibility in covering various aerial threats, such as planes, missiles, and drones and at the same time, their costs are manageable. Moreover, these systems are in line with the country's mobility requirements and its recently adopted strategy of layered air defense.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the Brazil Air Defense System market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in Brazil Air Defense System Market:

- Embraer S.A.

- Avibras Industria Aeroespacial

- AEL Sistemas

- Atech

- Mac Jee

- IMBEL

- Kryptus

- Saab Sensores e Serviços Brasil

- Gespi Defense Systems

- Condor Tecnologias Nao Letais

- Others

Recent Developments in Brazil Air Defense System Market:

In November 2025, The Brazilian Air Force (FAB) conducted successful firings of the Meteor beyond-visual-range air-to-air missile from its Saab Gripen E fighter jets, boosting Brazil’s interceptor capability and long-range air defense deterrence.

In July 2025, Brazil halted negotiations with India for the Akash surface-to-air missile system and is moving forward with EMADS from Italy, reflecting shifting priorities to meet medium-range intercept needs.

In December 2025, The Brazilian Air Force and South Korea’s Innospace are preparing to launch the HANBIT-Nano rocket, strengthening Brazil’s space launch capabilities and defense tech base.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the Brazil, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the Brazil air defense system market based on the below mentioned segments:

Brazil Air Defense System Market, By Type

- Missile Defence System

- Anti Aircraft System

- Counter Unmanned Aerial Systems

- Counter Rocket

- Artillery and Mortar Systems

Brazil Air Defense System Market, By Range

- Long Range

- Medium Range

- Short Range

Frequently Asked Questions (FAQ)

-

Q: What is the Brazil air defense system market size?A: Brazil air defense system market is expected to grow from USD 692.5 million in 2024 to USD 1032.4 million by 2035, growing at a CAGR of 3.7% during the forecast period 2025-2035.

-

Q: What are the key growth drivers of the market?A: Market growth is driven by the rising concerns over airspace security, border surveillance needs, and protection of critical infrastructure and major events. Ongoing military modernization programs, increased defense budgets, adoption of advanced radar and missile technologies, and government emphasis on strengthening indigenous defense manufacturing and strategic partnerships are further accelerating market growth.

-

Q: What factors restrain the Brazil air defense system market?A: Constraints include the budget constraints, high acquisition and maintenance costs, lengthy procurement cycles, and dependence on foreign technology, which can delay system integration and limit the rapid deployment of advanced air defense capabilities.

-

Q: How is the market segmented by range type?A: The market is segmented into missile defence system, anti aircraft system, counter unmanned aerial systems, counter rocket, artillery and mortar systems.

-

Q: Who are the key players in the Brazil air defense system market?A: Key companies include Embraer S.A., Avibras Indústria Aeroespacial, AEL Sistemas, Atech, Mac Jee, IMBEL, Kryptus, Saab Sensores e Serviços Brasil, Gespi Defense Systems, Condor Tecnologias Não-Letais

-

Q: Who are the target audiences for this market report?A: The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Need help to buy this report?