Brazil Aesthetic Devices Market Size, Share, By Type of Device (Energy-Based Aesthetic Device, Non-Energy-Based Aesthetic Device), By Application (Skin Resurfacing and Tightening, Body Contouring and Cellulite Reduction, Hair Removal, Tattoo Removal, Breast Augmentation, Other), and By End User (Hospitals, Clinics, Home Settings), Brazil Aesthetic Devices Market Insights, Industry Trend, Forecasts to 2035

Industry: HealthcareBrazil Aesthetic Devices Market Insights Forecasts to 2035

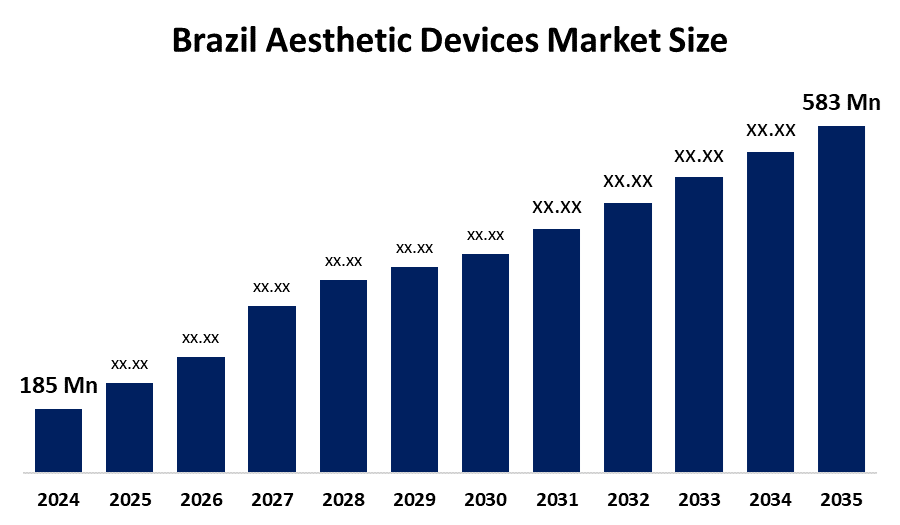

- Brazil Aesthetic Devices Market Size 2024: USD 185 Mn

- Brazil Aesthetic Devices Market Size 2035: USD 583 Mn

- Brazil Aesthetic Devices Market CAGR 2024: 11%

- Brazil Aesthetic Devices Market Segments: Type of Device, Application, End User.

Get more details on this report -

Aesthetic devices are specialized medical and cosmetic instruments designed to enhance physical appearance by treating skin, hair, and body concerns. They are widely used for procedures such as skin rejuvenation, wrinkle reduction, fat removal, body contouring, hair removal, acne treatment, and facial enhancement in hospitals, dermatology clinics, and aesthetic centers. Furthermore, the aesthetic devices market is growing mainly because more people want safe, quick, and non-surgical beauty treatments. Improved technology, better treatment results, shorter recovery time, and increasing focus on personal appearance are encouraging wider adoption.

A recent survey revealed a 3.4% global increase, with plastic surgeons performing 34.9 million aesthetic procedures in 2023, including 15.8 million surgical and 19.1 million nonsurgical treatments worldwide. Moreover, advances in technology are making procedures safer, quicker, and more effective, which is encouraging more people to opt for aesthetic treatments. A growing middle-class population with rising disposable income is enabling greater access to these devices, while the geriatric population is boosting demand for anti-aging solutions, including wrinkle reduction, skin rejuvenation, and body contouring. The influence of social media and the widespread promotion of beauty standards are further propelling interest in aesthetic treatments, with clinics and practitioners expanding their offerings to cater to a diverse clientele seeking both surgical and non-surgical solutions.

The availability of innovative devices, such as laser-based systems, energy-based devices, and advanced injectables, is also a key factor driving market growth in Brazil. The research and development activities of the manufacturers are inculcating the development of user-friendly, versatile devices catering to the needs of consumers as well as healthcare professionals. Medical tourism in Brazil, which is well-known for its high-quality aesthetic procedures at relatively affordable prices, is attracting international clients, further boosting market expansion. As per ISAPS, the U.S. led globally with 6.1 million aesthetic procedures in 2023, followed by Brazil with 3.3 million, ranking first in surgical procedures (2.1 million), alongside high plastic surgeon counts in Japan, China, India, and South Korea. Additionally, regulatory support and certifications for safe and effective devices are enhancing consumer confidence in aesthetic treatments. Furthermore, awareness campaigns and training programs for healthcare professionals are contributing to better adoption of these devices, ensuring improved outcomes and higher satisfaction rates. This combination of cultural, economic, and technological factors is significantly shaping the growth trajectory of the Brazil aesthetic devices market.

Brazil Aesthetic Devices Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 185 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 11% |

| 2035 Value Projection: | USD 583 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 185 |

| Tables, Charts & Figures: | 95 |

| Segments covered: | By Type of Device, By Application, By End User |

| Companies covered:: | Cutera, Galderma, Sisram Medical (Alma Lasers), Merz Pharma, AbbVie (Allergan Aesthetics), Bausch Health (Bausch + Lomb), Candela Medical, Cynosure (Hologic), Lumenis Be, and others key players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Market Dynamics of the Brazil Aesthetic Devices Market:

The Brazil aesthetic devices market is driven by a strong beauty-conscious culture and high acceptance of cosmetic procedures. Rising demand for minimally invasive treatments, increasing disposable income, and a growing middle-class population support market growth. Technological advancements in laser-based and energy-based devices improve safety and treatment outcomes. Additionally, expanding medical tourism, the influence of social media beauty trends, and wider availability of aesthetic clinics across urban areas further boost the adoption of aesthetic devices.

The Brazil aesthetic devices market faces restraints due to high treatment and device costs, limiting access for price-sensitive consumers. Strict regulatory approvals, shortage of skilled professionals, and risks related to side effects or improper use also restrict market growth, especially in smaller clinics and rural areas.

The Brazil aesthetic devices market presents strong opportunities due to the growing demand for non-invasive and affordable cosmetic treatments. Expanding medical tourism, increasing adoption of advanced laser and energy-based technologies, and rising awareness among younger consumers support growth. Untapped potential in tier-2 cities, growth of medical spas, and partnerships between global manufacturers and local clinics further create new opportunities for market expansion.

Market Segmentation

The Brazil Aesthetic Devices Market share is classified into the type of device, application, and end user.

By Type of Device:

The Brazil Aesthetic Devices market is divided by type of device into energy-based aesthetic devices and non-energy-based aesthetic devices. Among these, the energy-based aesthetic devices segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. Energy-based aesthetic devices dominate due to their wide use in non-invasive and minimally invasive procedures such as skin rejuvenation, hair removal, body contouring, and fat reduction. These devices offer effective results with minimal downtime, which strongly appeals to consumers. Continuous technological advancements, higher safety profiles, and growing preference for laser, radiofrequency, and ultrasound treatments in aesthetic clinics further support the dominance of energy-based devices in Brazil.

By Application:

The Brazil Aesthetic Devices market is divided by application into skin resurfacing and tightening, body contouring and cellulite reduction, hair removal, tattoo removal, breast augmentation, and other. Among these, the skin resurfacing and tightening segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. Skin resurfacing and tightening dominate because of the high demand for non-invasive treatments that address wrinkles, acne scars, pigmentation, and skin aging. These procedures are widely accepted across different age groups and offer visible results with minimal downtime. Advanced laser and radiofrequency technologies, combined with Brazil’s strong beauty culture and growing awareness of skin health, have increased the popularity of skin rejuvenation treatments in clinics and medical spas.

By End User:

The Brazil Aesthetic Devices market is divided by end user into hospitals, clinics, and home settings. Among these, the clinics segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. Clinics dominate because most cosmetic procedures are performed in specialized dermatology and aesthetic clinics rather than hospitals. Clinics offer advanced non-invasive treatments, shorter waiting times, and personalized services, which attract a large number of consumers. They also adopt new aesthetic technologies faster and provide cost-effective procedures. Brazil’s strong network of private cosmetic clinics and medical spas further supports the dominance of this end-user segment.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the Brazil aesthetic devices market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in Brazil Aesthetic Devices Market:

- Cutera

- Galderma

- Sisram Medical (Alma Lasers)

- Merz Pharma

- AbbVie (Allergan Aesthetics)

- Bausch Health (Bausch + Lomb)

- Candela Medical

- Cynosure (Hologic)

- Lumenis Be

- Others

Recent News in Brazil Aesthetic Devices Market:

November 2024, ViOL expanded its presence in Brazil through a partnership with ENTERA, showcasing Sylfirm X at Conecta Experience 2024 and hosting the Sylfirm X Global Symposium, enhancing its reach among Brazilian dermatology and plastic surgery professionals while promoting advanced Korean aesthetic technology.

In March 2023, Galderma introduced FACE by Galderma™, an augmented reality-powered tool for real-time visualization of injectable treatment outcomes. This innovation enhances patient consultations, enabling personalized treatment plans and boosting confidence in aesthetic procedures, marking a significant advancement in the integration of technology within the aesthetic dermatology market.

In June 2022, GC Aesthetics® announced its expansion into Brazil, reintroducing The Round Collection™ breast implants with ANVISA certification. Leveraging proven safety and performance, the company aims to meet growing demand in the second-largest breast augmentation market, enhancing its position as a leading provider of aesthetic medical solutions globally.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the Brazil, regional, and country levels from 2020 to 2035. spherical insights has segmented the Brazil aesthetic devices market based on the below-mentioned segments:

Brazil Aesthetic Devices Market, By Type of Device

- Energy-Based Aesthetic Device

- Non-Energy-Based Aesthetic Device

Brazil Aesthetic Devices Market, By Application

- Skin Resurfacing and Tightening

- Body Contouring and Cellulite Reduction

- Hair Removal

- Tattoo Removal

- Breast Augmentation

- Other

Brazil Aesthetic Devices Market, By End User

- Hospitals

- Clinics

- Home Settings

Frequently Asked Questions (FAQ)

-

Q1: What are aesthetic devices?Aesthetic devices are medical or cosmetic instruments used to improve appearance through procedures like skin rejuvenation, hair removal, body contouring, and wrinkle reduction.

-

Q2: Which type of aesthetic device dominates in Brazil?Energy-based devices, such as lasers, radiofrequency, and ultrasound systems, dominate due to high demand for non-invasive treatments.

-

Q3: Which application segment is the largest?Skin resurfacing and tightening are the leading applications, driven by consumer demand for anti-aging and skin improvement procedures.

-

Q4: Who are the main end users?Clinics, particularly dermatology and cosmetic clinics, are the primary end users, followed by hospitals; home-use devices are growing but hold a smaller share.

-

Q1: What are aesthetic devices?Aesthetic devices are medical or cosmetic instruments used to improve appearance through procedures like skin rejuvenation, hair removal, body contouring, and wrinkle reduction.

-

Q2: Which type of aesthetic device dominates in Brazil?Energy-based devices, such as lasers, radiofrequency, and ultrasound systems, dominate due to high demand for non-invasive treatments.

-

Q3: Which application segment is the largest?Skin resurfacing and tightening are the leading applications, driven by consumer demand for anti-aging and skin improvement procedures.

-

Q4: Who are the main end users?Clinics, particularly dermatology and cosmetic clinics, are the primary end users, followed by hospitals; home-use devices are growing but hold a smaller share.

Need help to buy this report?