Brazil Aerospace Foam Market Size, Share, and COVID-19 Impact Analysis, By Foam Type (Polyurethane Foam, Polyethylene Foam, Melamine Foam, Metal Foam, Polyimide Foam, Polyethylene Terephthalate Foam, Polyvinyl Chloride Foam, and Specialty High Performance Foam), By Application (Flight Deck Pads, Cabin Walls & Ceilings, Aircraft Seats, Aircraft Floor, and Others), and Brazil Aerospace Foam Market Size Insights, Industry Trend, Forecasts to 2035

Industry: Chemicals & MaterialsBrazil Aerospace Foam Market Size Insights Forecasts to 2035

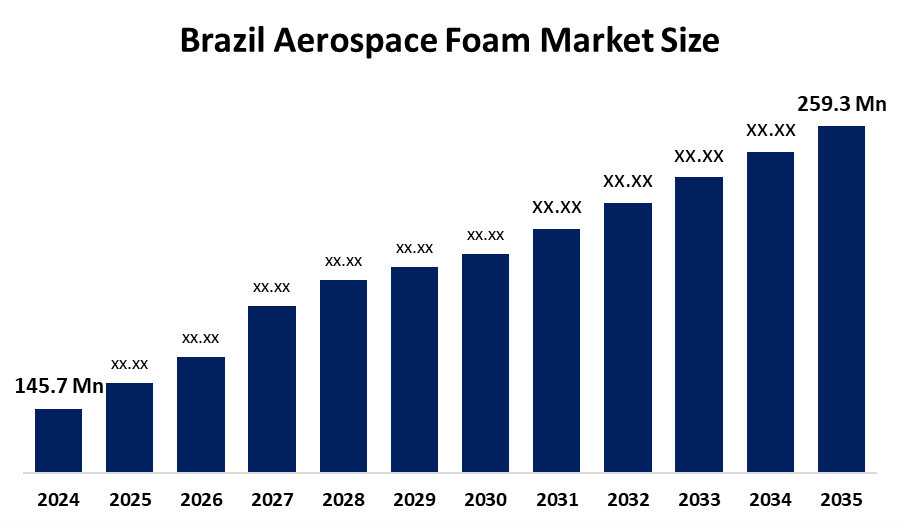

- The Brazil Aerospace Foam Market Size Was Estimated at USD 145.7 Million in 2024

- The Market Size is Expected to Grow at a CAGR of Around 5.38% from 2025 to 2035

- The Brazil Aerospace Foam Market Size is Expected to Reach USD 259.3 Million by 2035

Get more details on this report -

According to a Research Report Published by Spherical Insights & Consulting, The Brazil Aerospace Foam Market Size is anticipated to Reach USD 259.3 Million by 2035, Growing at a CAGR of 5.38% from 2025 to 2035. The aerospace foam market in Brazil is driven by expanding aircraft production, MRO expansion, fleet modernization, the need for lightweight and fire-resistant materials, increased defence spending, and the expanding usage of innovative foams for insulation, comfort, and safety.

Market Overview

The Brazil Aerospace Foam Market Size refers to the production and use of specialized lightweight, durable, and fire-resistant foam materials designed for aerospace applications. The foams find application in various aircraft systems that encompass seating areas and interior panels, insulation materials and vibration control systems, thermal and acoustic control systems, galley areas, flooring, and cargo liners. The system delivers passenger comfort while enhancing safety, decreasing aircraft mass, improving fuel efficiency, and meeting stringent aviation safety and performance standards.

The Brazilian aerospace foam market receives its strongest support through government programs, which provide financial assistance to aerospace manufacturing operations. The Nova Indústria Brasil program provides more than USD 22 billion to fund aerospace and defense projects. The BNDES organization offers export financing to Embraer and other aircraft manufacturers while providing R&D incentives and tax benefits, and innovation grants to support domestic production of advanced aerospace materials, which include specialty foams.

Recent developments in Brazil's aerospace foam sector include government-backed technological upgrades and investments through the New Industry Brazil initiative. The program supports materials innovation and developments of lightweight foam technology, which designers will use in aircraft interior systems and insulation materials. Local suppliers benefit from Embraer's advanced manufacturing and AI-driven material optimization. The growing aviation industry will create future business opportunities through bio-based recyclable foams, additive manufacturing, and defense material applications.

Report Coverage

This research report categorizes the market for the Brazil Aerospace Foam Market Size based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Brazil Aerospace Foam Market Size. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Brazil Aerospace Foam Market Size.

Brazil Aerospace Foam Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 145.7 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 5.38% |

| 2035 Value Projection: | USD 259.3 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Foam Type, By Application |

| Companies covered:: | Embraer, GRAMMER DO BRASIL LTDA, VIPOSA S.A., Allink Transportes Internacionais LTDA., Akaer Engenharia S.A., Graúna Aerospace LTDA, Saab Aeronáutica Montagens S.A., Advanced Composites Solutions, Volato Aeronaves e Compósitos Ltda, Avibras Indústria Aeroespacial S.A., and other key players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The aerospace foam market in Brazil is driven by the increased aircraft production need, demand for lightweight fireproof materials, MRO operations expansion, and modernized fleet systems. The defence and space sectors see growing budget allocations, which create higher demand for exceptional insulation materials that meet stringent safety regulations. Government support for aerospace manufacturing, together with developments in high-performance foam technologies, creates strong market growth opportunities.

Restraining Factors

The aerospace foam market in Brazil is mostly constrained by the expensive raw materials and mandatory aviation certification standards, the lack of domestic advanced foam manufacturing, the country's reliance on imported materials, and the prolonged time needed to obtain approval, which results in higher expenses and delays for new aerospace foam technology implementation.

Market Segmentation

The Brazil Aerospace Foam Market Size share is classified into foam type and application.

- The polyurethane foam segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Brazil Aerospace Foam Market Size is segmented by foam type into polyurethane foam, polyethylene foam, melamine foam, metal foam, polyimide foam, polyethylene terephthalate foam, polyvinyl chloride foam, and specialty high performance foam. Among these, the polyurethane foam segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. Excellent strength-to-weight ratio, fire resistance, durability, and adaptability in aviation seating, interiors, insulation, and noise-reduction applications are what propel its leadership. Embraer's high growth potential is further fueled by strong acceptance by aircraft manufacturers and MRO providers, particularly those who assist Embraer's production and fleet modernization.

- The aircraft seats segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period.

The Brazil Aerospace Foam Market Size is segmented by application into flight deck pads, cabin walls & ceilings, aircraft seats, aircraft floor, and others. Among these, the aircraft seats segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. High foam usage per aircraft, growing need for lightweight, fire-resistant, and comfortable seating materials, growing aircraft production and refurbishment activities spearheaded by Embraer, and growing MRO operations in Brazil are the main drivers of this supremacy.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Brazil Aerospace Foam Market Size, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Embraer

- GRAMMER DO BRASIL LTDA

- VIPOSA S.A.

- Allink Transportes Internacionais LTDA.

- Akaer Engenharia S.A.

- Graúna Aerospace LTDA

- Saab Aeronáutica Montagens S.A.

- Advanced Composites Solutions

- Volato Aeronaves e Compósitos Ltda

- Avibras Indústria Aeroespacial S.A.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the Brazil, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Brazil Aerospace Foam Market Size based on the below-mentioned segments:

Brazil Aerospace Foam Market Size, By Foam Type

- Polyurethane Foam

- Polyethylene Foam

- Melamine Foam

- Metal Foam

- Polyimide Foam

- Polyethylene Terephthalate Foam

- Polyvinyl Chloride Foam

- Specialty High Performance Foam

Brazil Aerospace Foam Market Size, By Application

- Flight Deck Pads

- Cabin Walls & Ceilings

- Aircraft Seats

- Aircraft Floor

- Others

Frequently Asked Questions (FAQ)

-

What is the Brazil aerospace foam market size?Brazil aerospace foam market size is expected to grow from USD 145.7 million in 2024 to USD 259.3 million by 2035, growing at a CAGR of 5.38% during the forecast period 2025-2035.

-

What are the key growth drivers of the market?Market growth is driven by increased aircraft production needs, demand for lightweight fireproof materials, MRO operations expansion, and modernized fleet systems.

-

What factors restrain the Brazil aerospace foam market?Constraints include the expensive raw materials and mandatory aviation certification standards, as well as the lack of domestic advanced foam manufacturing.

-

How is the market segmented by foam type?The market is segmented into polyurethane foam, polyethylene foam, melamine foam, metal foam, polyimide foam, polyethylene terephthalate foam, polyvinyl chloride foam, and specialty high performance foam.

-

Who are the key players in the Brazil aerospace foam market?Key companies include Embraer, GRAMMER DO BRASIL LTDA, VIPOSA S.A., Allink Transportes Internacionais LTDA., Akaer Engenharia S.A., Graúna Aerospace LTDA, Saab Aeronáutica Montagens S.A., Advanced Composites Solutions, Volato Aeronaves e Compósitos Ltda, Avibras Indústria Aeroespacial S.A., and Others.

-

Who are the target audiences for this market report?The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Need help to buy this report?