Brazil Acrylonitrile Butadiene Styrene Market Size, Share, By Processing Technology (Injection Molding, Extrusion, And Blow Molding), By Source (Virgin ABS And Recycled ABS), And Brazil Acrylonitrile Butadiene Styrene Market Insights, Industry Trend, Forecasts to 2035.

Industry: Chemicals & MaterialsBrazil Acrylonitrile Butadiene Styrene Market Insights Forecasts to 2035

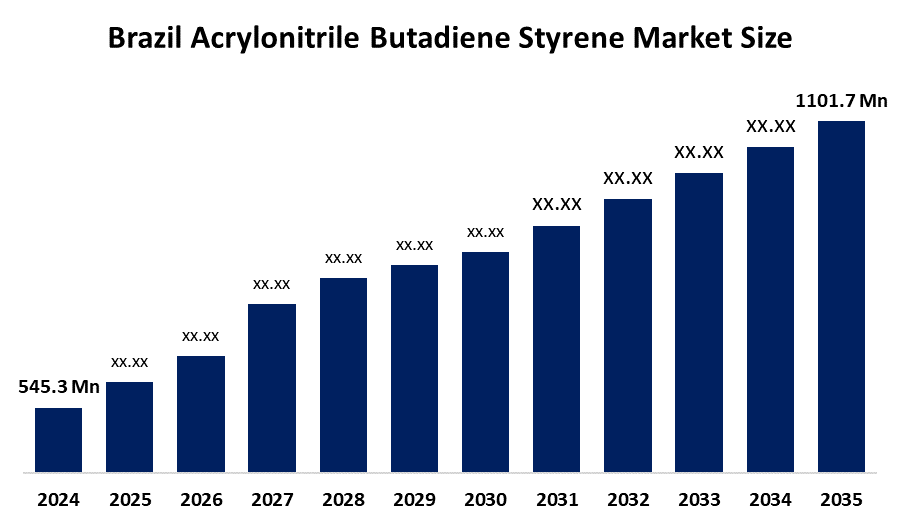

- Brazil Acrylonitrile Butadiene Styrene Market 2024: USD 545.3 Mn

- Brazil Acrylonitrile Butadiene Styrene Market Size 2035: USD 1101.7 Mn

- Brazil Acrylonitrile Butadiene Styrene Market CAGR 2024: 6.6%

- Brazil Acrylonitrile Butadiene Styrene Market Segments: Processing Technology and Source

Get more details on this report -

The Brazil acrylonitrile butadiene styrene (ABS) market encompasses a sector that produces a type of thermoplastic polymer or hard plastic compound that is made from acrylonitrile, butadiene, and styrene polymers. As there are many grades of ABS available, they each offer different levels of impact resistance as well as mechanical strength and ease of processing. ABS is widely used to manufacture lightweight, durable products in end-use applications include automotive parts, consumer products such as TVs, kitchen appliances and construction materials.

The acrylonitrile butadiene styrene in Brazil is backed by government support, including the MOVER Program, introduced in June 2024 to incentivize automotive industry modernization and sustainability. By a major ABS end-use sector: production of vehicles in Brazil grew by 9.7% in 2024, reaching approximately 2.5 million units and positioning the country as the eighth-largest vehicle producer globally. This strong automotive output underpins sustained demand for ABS in structural and interior vehicle components, reinforcing the polymer’s importance to industrial output and material consumption trends.

As technology advances, Brazilian acrylonitrile butadiene styrene olefin providers are now using advanced injection molding and extrusion technologies used by domestic manufacturers to produce components that have greater dimensional tolerances, improved surface finishes, and enhanced mechanical properties, in response to the demand for precision parts from the automotive and electronics industries. Additionally, by utilizing Industry 4.0 technologies such as automated quality control, real-time monitoring, and predictive maintenance, production efficiency has increased and waste has decreased; while research on sustainable ABS blends with recycled content is in line with emerging circular and environmental economy trends within Brazil market.

Brazil Acrylonitrile Butadiene Styrene Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 545.3 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR Of 6.6% |

| 2035 Value Projection: | USD 1101.7 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 209 |

| Tables, Charts & Figures: | 141 |

| Segments covered: | By Processing Technology,By Source |

| Companies covered:: | LG Chem Ltd., SABIC, BASF SE, Trinseo, Formosa Chemicals & Fibre Corporation, Covestro AG, Toray Industries, Inc., Lotte Chemical Corporation, Arkema,and Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Market Dynamics of the Brazil Acrylonitrile Butadiene Styrene Market:

The Brazil acrylonitrile butadiene styrene market is driven by the expanding automotive manufacturing base, strong push toward lightweight and fuel-efficient vehicles, strong support by government programs that encourage low-emission and advanced vehicles, continued growth of the consumer electronics appliance markets, rising incomes, rapid urbanization, continued infrastructure development and construction activity, and global trends toward circular materials and environmentally informed product design further propel the market growth.

The Brazil acrylonitrile butadiene styrene market is restrained by the fluctuations in the prices of petroleum-based feedstocks, increased production costs, compressed producer margins, relies on imported monomer feedstocks, global price volatility, and stringent environmental regulations and policies that increase recycling content requirements.

The future of Brazil acrylonitrile butadiene styrene market is bright and promising, with versatile opportunities emerging from the automotive sector progressing toward electric vehicles and lighter cars, which leads to the need for certain specialized ABS grades used in both battery cases and thermal management systems. Companies may increase opportunities for exportation, as well as foreign investments, which would enhance the domestic ABS value stream. A growing focus on sustainability, as well as recycling of polymer products, is leading to more opportunities for new innovations that would provide differentiation opportunities throughout the global trends of circular materials and environmentally sound designed products while also expanding the markets for ABS products in those areas.

Market Segmentation

The Brazil Acrylonitrile Butadiene Styrene Market share is classified into processing technology and source.

By Processing Technology:

The Brazil acrylonitrile butadiene styrene market is divided by processing technology into injection molding, extrusion, and blow molding. Among these, the injection molding segment held the largest revenue market share in 2024 and is predicted to grow at a remarkable CAGR during the forecast period. Superior efficiency in mass producing complex, high precision, expanding automotive and consumer electronics sector, and provide cost effective solutions for manufacturers all contribute to the injection molding segment's largest share and higher spending on acrylonitrile butadiene styrene when compared to other processing technology.

By Source:

The Brazil acrylonitrile butadiene styrene market is divided by source into virgin ABS and recycled ABS. Among these, the virgin ABS segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. The virgin ABS segment dominates because of its consistent quality, provides superior performance in key industries, offers more competitive price, essential for high precision injection molding, and reduces the failure rates in manufacturing processes in Brazil.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the Brazil acrylonitrile butadiene styrene market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in Brazil Acrylonitrile Butadiene Styrene Market:

- LG Chem Ltd.

- SABIC

- BASF SE

- Trinseo

- Formosa Chemicals & Fibre Corporation

- Covestro AG

- Toray Industries, Inc.

- Lotte Chemical Corporation

- Arkema

- Others

Recent Developments in Brazil Acrylonitrile Butadiene Styrene Market:

In October 2025, Brazil’s president established mandatory reverse logistics systems for plastic packaging and implemented regulations on the minimum amount of recycled content in new packaging, expected to drive demand for recycled ABS and sustainable alternatives throughout Brazil.

In June 2024, Trinseo introduced new recycled content ABS and SAN resins (MAGNUM ECO+ and MAGNUM CR), which contains up to 60% chemically recycled styrene.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the Brazil, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Brazil acrylonitrile butadiene styrene market based on the below-mentioned segments:

Brazil Acrylonitrile Butadiene Styrene Market, By Processing Technology

- Injection Molding

- Extrusion

- Blow Molding

Brazil Acrylonitrile Butadiene Styrene Market, By Source

- Virgin ABS

- Recycled ABS

Frequently Asked Questions (FAQ)

-

Q: What is the Brazil acrylonitrile butadiene styrene market size?A: Brazil acrylonitrile butadiene styrene market is expected to grow from USD 545.3 million in 2024 to USD 1101.7 million by 2035, growing at a CAGR of 6.6% during the forecast period 2025-2035.

-

Q: What are the key growth drivers of the market?A: Market growth is driven by the expanding automotive manufacturing base, strong push toward lightweight and fuel-efficient vehicles, strong support by government programs that encourage low-emission and advanced vehicles, continued growth of the consumer electronics appliance markets, rising incomes, rapid urbanization, continued infrastructure development and construction activity, and global trends toward circular materials and environmentally informed product design further propel the market growth.

-

Q: What factors restrain the Brazil acrylonitrile butadiene styrene market?A: Constraints include the fluctuations in the prices of petroleum-based feedstocks, increased production costs, compressed producer margins, relies on imported monomer feedstocks, global price volatility, and stringent environmental regulations and policies that increase recycling content requirements.

-

Q: How is the market segmented by processing technology?A: The market is segmented into injection molding, extrusion, and blow molding.

-

Q: Who are the key players in the Brazil acrylonitrile butadiene styrene market?A: Key companies include LG Chem Ltd., SABIC, BASF SE, Trinseo, Formosa Chemicals & Fibre Corporation, Covestro AG, Toray Industries, Inc., Lotte Chemical Corporation, Arkema, and Others.

-

Q: Who are the target audiences for this market report?A: The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Need help to buy this report?