Global BOPP Films Market Size By Type (Bags and Pouches, Tapes, Wraps, Labels), By Application (Food, Pharmaceutical, Beverage, Tobacco, Personal Care) By Region, And Segment Forecasts, By Geographic Scope And Forecast 2022-2032.

Industry: Advanced MaterialsGlobal BOPP Films Market Size Insights Forecasts to 2032

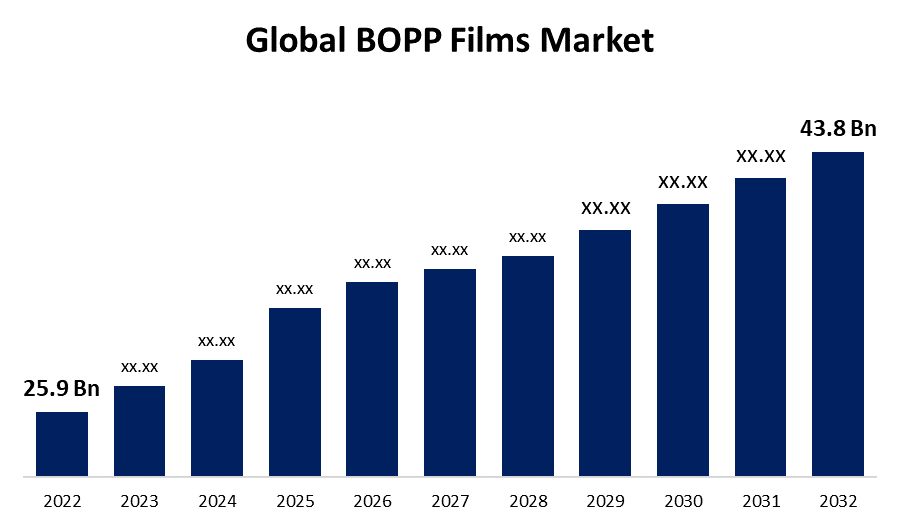

- The BOPP Films Market Size was valued at USD 25.9 Billion in 2022.

- The Market Size is Growing at a CAGR of 6.1% from 2022 to 2032

- The Worldwide BOPP Films Market Size is expected to reach USD 43.8 Billion by 2032

- Asia Pacific is expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global BOPP Films Market Size is expected to reach USD 43.8 Billion by 2032, at a CAGR of 6.1% during the forecast period 2022 to 2032.

BOPP films are winning the packaging battles, especially in the food and beverage industry. Their great transparency makes products appear alluring on the shelf, and their barrier qualities keep things fresh. The market may be booming with technological innovations, potentially in the form of coatings or treatments that improve the barrier qualities or printing capabilities of the films. Given the market's global reach, geopolitical and economic variables may be influencing movements. While established markets concentrate on product diversity, emerging markets could be the engine of Growth. BOPP films are produced of polypropylene, so changes in the cost of this raw material could have an effect on the market. Companies may be developing strategies to lessen the effects of such changes.

BOPP Films Market Price Analysis

Polypropylene is the main raw material used to make BOPP films. Variations in the cost of producing BOPP films could be directly impacted by changes in the price of polypropylene on the international market. Pay attention to the oil and gas sector since it affects the creation of polypropylene. Price changes may result from improvements made to the production process or the creation of new and superior BOPP films. A corporation may charge a premium if it releases cutting-edge technology that improves film qualities. Geopolitical conflicts, trade policies, and tariffs all have the potential to affect the supply chain and prices. Keep an eye out for any significant worldwide developments that might have an impact on commerce. Future BOPP film pricing may require a delicate balancing act.

BOPP Films Market Opportunity Analysis

There is probably a sizable possibility for BOPP films given the ongoing expansion of the e-commerce sector and the demand for effective packaging solutions. They may become a popular option for businesses trying to improve the packaging of their products because of their adaptability and protective attributes. There is a great opportunity for manufacturers to invest in the creation of eco-friendly BOPP films as the globe shifts towards sustainability. This can entail looking into bio-based materials, recyclable alternatives, or even improvements to the way these films are recycled. A smart strategy could be to look into potential areas where there is a Growing need for packaging materials. By adapting to local regulations and tastes, businesses may be better positioned to succeed in a variety of markets.

Global BOPP Films Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022: | USD 25.9 Billion |

| Forecast Period: | 2022-2032 |

| Forecast Period CAGR 2022-2032 : | 6.1% |

| 2032 Value Projection: | USD 43.8 Billion |

| Historical Data for: | 2018-2021 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Type, By Application, By Region and COVID 19 Impact. |

| Companies covered:: | Cosmo Films Limited (India), Taghleef Industries (UAE), CCL Industries (Canada), Jindal Poly Films (India), Sibur Holdings (Russia), Zhejiang Kinlead Innovative Materials (China), Inteplast Group (US), Poligal S.A. (Spain), Uflex Ltd. (India), Polinas (Turkey), Polibak (Turkey), Toray Industries (Japan), and other key vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth & Analysis. |

Get more details on this report -

Market Dynamics

BOPP Films Market Dynamics

Adoption of high-end technology devices

The use of nanotechnology in the production of BOPP films may produce films with better strength, antibacterial characteristics, and barrier properties. These cutting-edge features might be able to satisfy changing demands for high-performance packaging across numerous industries. Modern digital printing techniques could provide BOPP films with options for personalization. The Growing trend of personalised and aesthetically pleasing packaging might be catered to by high-resolution printing, variable data printing, and fast changes in printing designs. Devices using cutting-edge technology can help make production practises more environmentally friendly. Modern equipment and automation can optimise resource use, cut waste, and improve sustainability overall, in line with the rising demand for environmentally friendly packaging options. With the help of sensors and analytics, equipment failure predictions may be made, allowing for preventive maintenance and lowering the chance of production interruptions.

Restraints & Challenges

Unstable quality standards of the BOPP Films

Consistent quality control is crucial for manufacturers of BOPP films to maintain their reputation. Inconsistencies or incidents of poor quality can damage the reputation of the entire sector. The expansion of the market can be harmed by negative publicity. Consumer trust might be damaged by inconsistent quality. BOPP films may cause unhappiness among producers and end users if they perform inconsistently or fall short of required specifications. To continue market Growth, trust must be established and kept. Higher rates of rework and product rejection may be caused by unstable quality. As a result, supply networks are disrupted and operational expenses for firms rise. It may produce inefficiencies that impede the expansion of the market as a whole. The supply chain may get disrupted by quality inconsistencies.

Regional Forecasts

North America Market Statistics

Get more details on this report -

North America is anticipated to dominate the BOPP Films market from 2023 to 2032. Due to the varied industries present in the region, such as those in the food and beverage, pharmaceutical, and consumer goods sectors, the market for BOPP films in North America is likely sizable. The market is probably expanding steadily as a result of things like rising demand for flexible packaging options and improvements in film technology. BOPP films are probably widely used in North America for a variety of purposes, including as food packaging, labels, adhesive tapes, and industrial packaging. The videos' adaptability makes them appropriate for a variety of businesses and goods.

Asia Pacific Market Statistics

Asia Pacific is witnessing the fastest market Growth between 2023 to 2032. The demand for BOPP films in packaging and other applications is probably going to increase as a result of a Growing middle class and rising consumer expenditure. The demand for BOPP films is probably being driven by the ongoing industrialisation and urbanisation in numerous nations throughout the Asia-Pacific. Urban living and increased industry operations both increase the demand for effective and adaptable packaging solutions. The increase of e-commerce in the area is probably boosting demand for flexible packaging products like BOPP films. The demand for safe and attractive packaging for online retail is definitely a factor in the market's expansion.

Segmentation Analysis

Insights by Type

The Bags and Pouches segment accounted for the largest market share over the forecast period 2023 to 2032. The expansion of bags and pouches created using BOPP films is significantly fueled by the global trend towards flexible packaging. These packaging formats satisfy the needs of both customers and manufacturers by providing variety, lightweight characteristics, and ease. There is an increasing demand for safe and aesthetically pleasing packaging as e-commerce Grows. In addition to providing durability and safety during transit, bags and pouches constructed with BOPP films are well suited for this use since they enable innovative and insightful printing. Bags and pouches produced from BOPP films are probably gaining popularity in the pharmaceutical sector. Pharmaceutical products can benefit from the necessary protection offered by these films, which also guarantee the integrity of the products' contents and compliance with safety regulations.

Insights by Application

Pharmaceutical segment is witnessing the fastest market Growth over the forecast period 2023 to 2032. Pharmaceutical medicines frequently need to be shielded from moisture, gases, and other outside influences in order to maintain their efficacy. Pharmaceuticals' shelf lives can be extended by using BOPP films because of their superior barrier qualities, which create a protective layer. Blister packs, sachets, and pouches, among other packaging styles, can all be made with BOPP films. Pharmaceutical firms can select packaging options that best meet the unique needs of their products because to their flexibility. The pharmaceutical sector is Growing on a global scale, and emerging markets have a big part to play in this expansion. The need for premium packaging materials like BOPP films is projected to rise as the healthcare infrastructure in these areas Grows.

Recent Market Developments

- In March 2021, Oben Group on acquiring Poligal Group. The purchase comprises BOPP and CPP manufacturing facilities in Portugal and Poland, business offices in Germany, and a sizable sales and distribution network across all of Europe.

Competitive Landscape

Major players in the market

- Cosmo Films Limited (India)

- Taghleef Industries (UAE)

- CCL Industries (Canada)

- Jindal Poly Films (India)

- Sibur Holdings (Russia)

- Zhejiang Kinlead Innovative Materials (China)

- Inteplast Group (US)

- Poligal S.A. (Spain)

- Uflex Ltd. (India)

- Polinas (Turkey)

- Polibak (Turkey)

- Toray Industries (Japan)

Market Segmentation

This study forecasts revenue at global, regional, and country levels from 2023 to 2032.

BOPP Films Market, Type Analysis

- Bags and Pouches

- Tapes

- Wraps

- Labels

BOPP Films Market, Application Analysis

- Food

- Pharmaceutical

- Beverage

- Tobacco

- Personal Care

BOPP Films Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- South America

- Brazil

- Argentina

- Colombia

- Middle East & Africa

- UAE

- Saudi Arabia

- South Africa

Frequently Asked Questions (FAQ)

-

1. What is the market size of the BOPP Films Market?The global BOPP Films Market is expected to Grow from USD 25.9 Billion in 2023 to USD 43.8 Billion by 2032, at a CAGR of 6.1% during the forecast period 2023-2032.

-

Who are the key market players of the BOPP Films Market?Some of the key market players of market are Oben GroCosmo Films Limited (India), Taghleef Industries (UAE), CCL Industries (Canada), Jindal Poly Films (India), Sibur Holdings (Russia), Zhejiang Kinlead Innovative Materials (China), Inteplast Group (US), Poligal S.A. (Spain), Uflex Ltd. (India), Polinas (Turkey), Polibak (Turkey), Toray Industries (Japan)

-

Which segment holds the largest market share?Pharmaceutical segment holds the largest market share and is going to continue its dominance

-

Which region is dominating the BOPP Films Market?orth America is dominating the BOPP Films Market with the highest market share.

Need help to buy this report?