Global BMI Machine Market Size, Share, And COVID-19 Impact Analysis, By Product Type (Portable BMI Machines and Stationary BMI Machines), By Application (Hospitals, Fitness Centers, Home Use, Clinics, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, And Africa), Analysis and Forecast 2025 - 2035

Industry: HealthcareGlobal BMI Machine Market Insights Forecasts to 2035

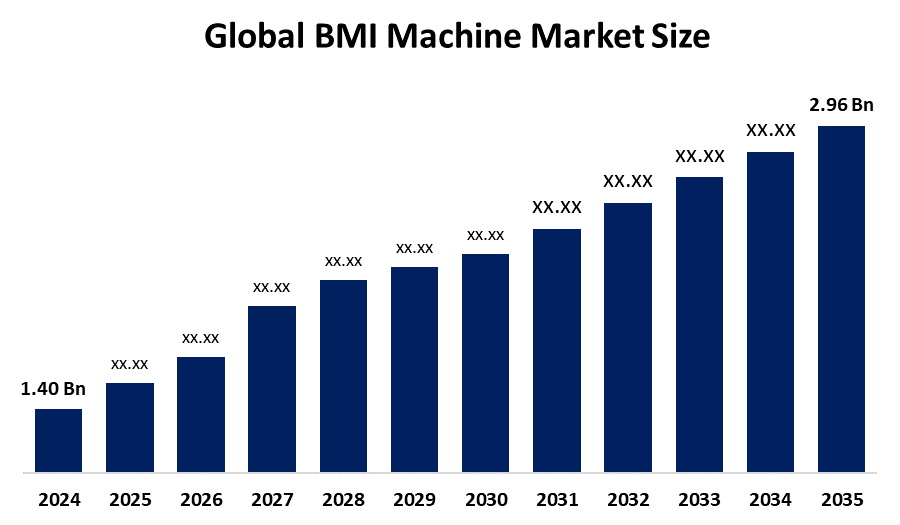

- The Global BMI Machine Market Size Was Estimated at USD 1.40 billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 7.04% from 2025 to 2035

- The Worldwide BMI Machine Market Size is Expected to Reach USD 2.96 billion by 2035

- North America is expected to grow the fastest during the forecast period.

Get more details on this report -

According to a research report published by Spherical Insights and Consulting, the global BMI machine market size was worth around USD 1.40 billion in 2024 and is predicted to grow to around USD 2.96 billion by 2035 with a compound annual growth rate (CAGR) of 7.04% from 2025 to 2035. Growing health consciousness, growing fitness industries, acceptance of preventative healthcare, technical improvements, and growing demand for precise body composition analysis solutions all present significant growth opportunities for the BMI machine market.

Market Overview

The commercial and technological sector dedicated to the development, production, distribution, and sale of devices intended to measure and analyze body composition metrics, mainly Body Mass Index, along with additional parameters like body fat percentage, muscle mass, visceral fat, and basal metabolic rate, is known as the BMI (Body Mass Index) machine market. In order to evaluate a person's health and nutritional condition correctly, these devices are often utilized in healthcare establishments, fitness centers, wellness clinics, research institutions, and home environments. These devices, which comprise portable bioimpedance analyzers and stationary scales, improve the ability to measure visceral fat distribution, body fat, and muscle mass, thus enabling non-invasive, real-time assessments in clinical, fitness, and home environments. Policy-driven adoption is highlighted by government initiatives, such as India's 2025 statewide rollout of AI-integrated health kiosks with BMI modalities for 65+ biometric assessments under public wellness campaigns. The market for BMI machines is mostly growing due to increased awareness of one's own fitness and health. Additionally, technological developments in medical equipment and the increasing ubiquity of digital health solutions are important drivers of machine market growth.

Report Coverage

This research report categorizes the BMI machine market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the BMI machine market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyzes their core competencies in each sub-segment of the BMI machine market.

Global BMI Machine Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 1.40 Billion |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | CAGR of 7.04% |

| 2035 Value Projection: | USD 2.96 Billion |

| Historical Data for: | 2020–2023 |

| No. of Pages: | 244 |

| Tables, Charts & Figures: | 100 |

| Segments covered: | By Product Type, By Application |

| Companies covered:: | Adidas AG, Apple Inc., Beurer GmbH, BodyTrace, Inc., Fitbit Inc., Garmin Ltd., Huawei Technologies Co., Ltd., iHealth Labs Inc., Jawbone, Nokia Corporation, Omron Healthcare, Polar Electro Oy, Qardio, Inc., Tanita Corporation, AndOthers Players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Increased expenditures in healthcare infrastructure and growing government programs encouraging wellness and preventative healthcare are contributing to industry growth. The rising prevalence of obesity-related health problems globally and the growing awareness of fitness and health among a variety of demographics are responsible for the BMI machine market's expansion. Personalized healthcare management is made possible by the BMI machines' smart features and software capabilities, which enable real-time data tracking and a smooth connection with electronic health records. The market for BMI machines is expected to increase steadily as patient-centric treatment becomes more important and chronic diseases become more common.

Restraining Factors

The market for BMI machines is restricted by a number of problems, including expensive equipment costs, low awareness in developing nations, inconsistent accuracy, a lack of standardization, regulatory restrictions, and reliance on technology infrastructure.

Market Segmentation

The BMI machine market share is classified into product type and application.

- The portable BMI machines segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the product type, the BMI machine market is divided into portable BMI machines and stationary BMI machines. Among these, the portable BMI machines segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The ease of use and convenience of portable BMI machines are becoming more and more popular, especially for personal and home-based applications. The demand for portable BMI devices has been further increased by the growing trend of home fitness equipment, which was prompted by the global health crisis and the lockdowns that followed.

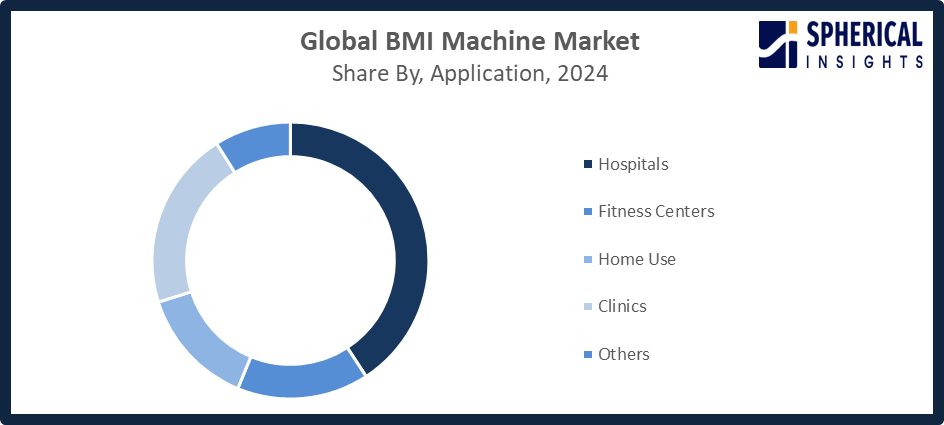

- The Hospitals segment accounted for the highest market revenue in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the application, the BMI machine market is divided into hospitals, fitness centers, home use, clinics, and others. Among these, the Hospitals segment accounted for the highest market revenue in 2024 and is anticipated to grow at a significant CAGR during the forecast period. BMI machines are mostly used by healthcare facilities, such as hospitals and clinics, for patient monitoring and health assessments. Healthcare professionals in hospitals can better manage patients' health and create successful treatment plans when they can deliver precise and consistent BMI measurements.

Get more details on this report -

Regional Segment Analysis of the BMI Machine Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia Pacific is anticipated to hold the largest share of the BMI machine market over the predicted timeframe.

Asia Pacific is anticipated to hold the largest share of the BMI machine market over the predicted timeframe. Growing middle-class populations, expanding health consciousness, and rising disposable incomes are the main drivers of the region's expansion. The demand for BMI devices is rising as a result of the rise in exercise culture and health consciousness in nations like China and India. With a CAGR of 9.5%, China is in the lead, followed by India at 8.8%. The appeal of BMI devices is further increased by the incorporation of cutting-edge capabilities like AI, IoT connectivity, and mobile health applications. Government initiatives that address the 30% adult obesity prevalence include Indonesia's 2025 statewide "Birthday Health Checkup" program, which uses community kiosks to screen over 8 million individuals for diabetes, hypertension, and BMI. Institutional procurement is further stimulated by China's "Healthy China 2030" strategy, which requires BMI-integrated public screenings in urban areas.

North America is expected to grow at a rapid CAGR in the BMI machine market during the forecast period. The region is expanding as a result of both the increasing demand for home-based health monitoring systems and the increasing adoption of cutting-edge medical technologies. The region benefits from advanced healthcare infrastructure, widespread usage of digital health technologies, and a high penetration of fitness centers and wellness programs. Additionally, frequent body composition monitoring is aggressively promoted by corporate wellness programs and government health efforts, which raises market demand. Aggressive chronic illness countermeasures are indicated by government initiatives such as the "Make America Healthy Again" (MAHA) Commission, which was established in February 2025 and directs federal BMI screening expansions in Medicare/Medicaid for nearly 30 million beneficiaries.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the BMI machine market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Adidas AG

- Apple Inc.

- Beurer GmbH

- BodyTrace, Inc.

- Fitbit Inc.

- Garmin Ltd.

- Huawei Technologies Co., Ltd.

- iHealth Labs Inc.

- Jawbone

- Nokia Corporation

- Omron Healthcare

- Polar Electro Oy

- Qardio, Inc.

- Tanita Corporation

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In March 2024, InBody launched the InBody 380 and 580 BMI Machine, delivering advanced muscle analysis, precise body fat measurement, and revolutionary segmental insights to help members achieve health and fitness goals.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the BMI machinemarket based on the below-mentioned segments:

Global BMI Machine Market, By Product Type

- Portable BMI Machines

- Stationary BMI Machines

Global BMI Machine Market, By Application

- Hospitals

- Fitness Centers

- Home Use

- Clinics

- Others

Global BMI Machine Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the BMI machine market over the forecast period?The global BMI machine market is projected to expand at a CAGR of 7.04% during the forecast period.

-

2. What is the market size of the BMI machine market?The global BMI Machine market size is expected to grow from USD 1.40 billion in 2024 to USD 2.96 billion by 2035, at a CAGR of 7.04% during the forecast period 2025-2035.

-

3. Which region holds the largest share of the BMI machine market?Asia Pacific is anticipated to hold the largest share of the BMI machine market over the predicted timeframe.

-

4. Who are the top 10 companies operating in the global BMI machine market?Adidas AG, Apple Inc., Beurer GmbH, BodyTrace, Inc., Fitbit Inc., Garmin Ltd., Huawei Technologies Co., Ltd., iHealth Labs Inc., Jawbone, Nokia Corporation, Omron Healthcare, Polar Electro Oy, Qardio, Inc., Tanita Corporation, and Others.

-

5. What are the market trends in the BMI machine market?The market for BMI machines is seeing trends including IoT and AI integration, portable smart devices, remote monitoring, individualized health tracking, and growing use in the wellness, healthcare, and fitness industries.

-

6. What are the main challenges restricting the wider adoption of the BMI machine market?High gadget prices, inconsistent accuracy, little awareness in developing countries, legislative restrictions, reliance on technology infrastructure, worries about data privacy, and measurement consistency are some of the challenges that are preventing broader implementation.

Need help to buy this report?