Global Blowing Agent Market Size, Share, and COVID-19 Impact Analysis, By Product (Hydrocarbons, Hydrofluorocarbons [HFC], Hydro Chlorofluorocarbons [HCFC], and Others), By Foam Type (Polyurethane Foam, Polystyrene Foam, Phenolic Foam, Polypropylene Foam, Polyethylene Foam, and Others), By Application (Building and Construction, Automotive, Bedding, and Furniture, Appliances, Packaging, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: Chemicals & MaterialsGlobal Blowing Agent Market Insights Forecasts to 2033.

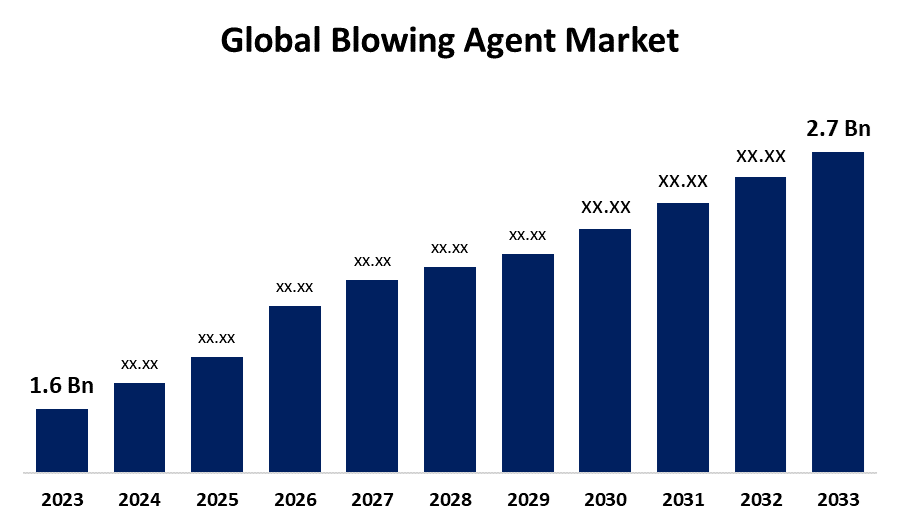

- The Global Blowing Agent Market Size was Valued at USD 1.6 Billion in 2023.

- The Market Size is Growing at a CAGR of 5.37% from 2023 to 2033.

- The Worldwide Blowing Agent Market Size is Expected to Reach USD 2.7 Billion by 2033.

- North America is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Blowing Agent Market Size is Anticipated to Exceed USD 2.7 Billion by 2033, Growing at a CAGR of 5.37% from 2023 to 2033.

Market Overview

Chemical additives known as blowing agents are used to release gases while thermoplastics are being produced. Stated differently, blowing agents can form a cellular structure during the foaming process. Three different types of blowing agents exist: liquid, gas, and solid. Physical and chemical blowing agents are the two categories of blowing agents. Chemical blowing agents come into two categories: exothermic and endothermic, based on the heat that is added to or released in the extruder while manufacturing the polymer material. Azodicarbonamide (ADC), the most significant exothermic chemical blowing agent, breaks down into endothermic molecules and releases ammonia and nitrogen while producing heat. Sodium bicarbonate, ammonium bicarbonate, and sodium borate are examples of chemical blowing agents. When they break down, they produce carbon dioxide, which cools the system. Blowing agents provide polymer materials with several qualities, such as weight reduction, impact strength, thermal insulation, and sound insulation. As a result, they are used in a variety of industries that need lightweight foamed polymer materials, including electronics, automotive, furniture, construction, and packaging. An increase in demand from the automotive sector is the main driver of the market growth rate. The market's growth rate will be positively and immediately impacted by growing industrialization as well as rising investment in technological advancements and upgrades.

Report Coverage

This research report categorizes the market for the global blowing agent market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global blowing agent market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global blowing agent market.

Blowing Agent Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 1.6 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 5.37% |

| 2033 Value Projection: | USD 2.7 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Product, By Foam Type, By Application, By Region |

| Companies covered:: | Solvay, Honeywell International Inc, Exxon Mobil Corporation, Daikin Industries, Ltd, Arkema, Linde plc, Haltermann Carless, Harp International Ltd, Foam Supplies, Inc, The Chemours Company, E.I DuPont de Nemours (DuPont), Marubeni Corporation, HCS Group GmbH, Guangzhou Jiangyan Chemical Co., Ltd, and Others Key Vendors. |

| Pitfalls & Challenges: | COVID-19 Empact,Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The automotive, building & construction, maritime, transportation, appliance, bedding & furniture, and packaging industries are the main drivers of the polymer foam market. The market for polymer foams is expanding, which makes it easier to utilize blowing agents and consequently influences how much of them are needed. Additionally, there will be a considerable need for blowing agents used in foam blowing due to the polymeric foam industry's continued expansion, increased consumer awareness of high-quality products, and its demand, particularly in South America, the Middle East & Africa, and Asia Pacific. The market is growing because of the rising level of living of the world's population. Additionally, the growth of the flooring and furnishings industry has been facilitated by the rise in purchasing power parity. On the other hand, increased blowing agent utilization is anticipated to support global market expansion.

Restraining Factors

The factors hampering the expansion of the market are the government restrictions that are becoming more stringent and the increased prices. The market's expansion is further hampered by the regular changes in blowing agent selection related to national and regional legislation, as well as environmental laws like the Montreal Protocol. Furthermore, the main goal and objective following the implementation of these rules and procedures is to reduce the harm done to the ozone layer by using various blowing agent types, such as HFCs and HCFCs.

Market Segmentation

The global blowing agent market share is classified into product, foam type, and application.

- The hydrocarbons segment is expected to hold the largest share of the global blowing agent market during the forecast period.

Based on the product, the global blowing agent market is divided into Hydrocarbons, Hydrofluorocarbons [HFC], Hydro Chlorofluorocarbons [HCFC], and Others. Among these, the hydrocarbons segment is expected to hold the largest share of the global blowing agent market during the forecast period. This is attributed to a variety of foam applications, such as packaging, refrigeration, building insulation, and automobile parts. They can be used for a variety of foam densities, qualities, and applications because of their adaptability. Because of their high blowing efficiency, hydrocarbons can produce foams with reliable qualities and characteristics. They are capable of efficiently expanding foam materials to produce the required performance and structural qualities.

- The polyurethane foam segment is expected to hold the dominant share of the global blowing agent market during the forecast period.

Based on the foam type, the global blowing agent market is divided into polyurethane foam, polystyrene foam, phenolic foam, polypropylene foam, polyethylene foam, and others. Among these, the polyurethane foam segment is expected to hold the dominant share of the global blowing agent market during the forecast period. This is attributed to its excellent insulating qualities, robustness, and adaptability. It is utilized in packing, automobile interiors, furniture padding, and building insulation, among other things. Numerous qualities, such as varied densities, levels of hardness, and degrees of flexibility, can be formed into polyurethane foam, which makes it appropriate for a wide range of applications in a variety of industries.

- The building and construction segment is expected to grow at the fastest-growing market share in the global blowing agent market during the forecast period.

Based on the application, the global blowing agent market is divided into building and construction, automotive, bedding and furniture, appliances, packaging, and others. Among these, the building and construction segment is expected to grow at the fastest-growing market share in the global blowing agent market during the forecast period. This is attributed to international growth in data centers, institutional buildings, warehouses, commercial offices, and SEZs. Excellent stress absorption and thermal insulation qualities. Increases in investment, housing demand, and urbanization have all contributed to a rise in construction output.

Regional Segment Analysis of the Global Blowing Agent Market

- North America (U.S., Canada, Mexico)

- Europe (Global, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

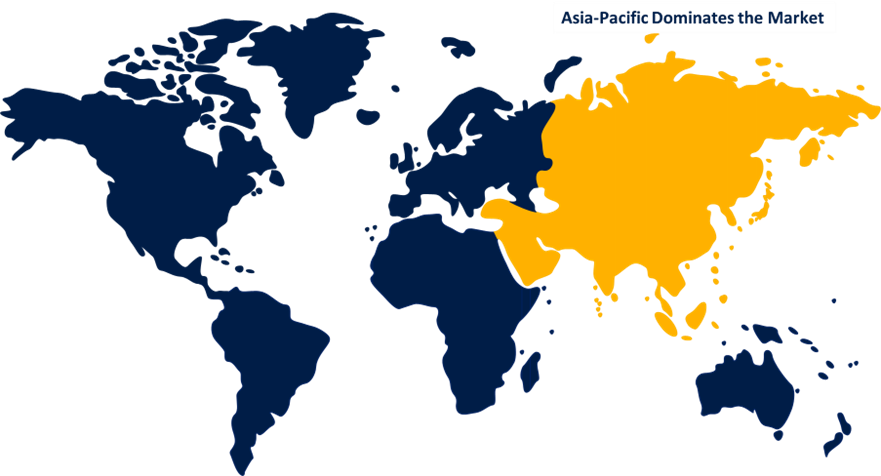

Asia-Pacific is anticipated to hold the largest share of the global blowing agent market over the predicted timeframe.

Get more details on this report -

Asia-Pacific is anticipated to hold the largest share of the global blowing agent market over the predicted timeframe. Growing consumer demand for frozen, snack, and microwave foods as well as personalized packaging. leading the market as a result of the growth and development of many end-user industries in this region, the acceleration of industrialization, and the rise in polymer foam production. It is expected that this area will continue to hold this position in the years to come. Furthermore, Asia Pacific is the leader in the production of blowing agents, with China being the main contributor.

North America is expected to grow the fastest during the forecast period. The growth of the market is driven by several variables, including rising end-use industry demand, shifting laws, and improvements in technology. High-performance insulation materials are becoming more and more in demand in North America due to strict building requirements and energy efficiency laws. Blowing agents are essential for improving the thermal insulation qualities of foam materials used in construction, which helps save energy and complies with laws like LEED and ENERGY STAR certification.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global blowing agent market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Solvay

- Honeywell International Inc

- Exxon Mobil Corporation

- Daikin Industries, Ltd

- Arkema

- Linde plc

- Haltermann Carless

- Harp International Ltd

- Foam Supplies, Inc

- The Chemours Company

- E.I DuPont de Nemours (DuPont)

- Marubeni Corporation

- HCS Group GmbH

- Guangzhou Jiangyan Chemical Co., Ltd

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In December 2023, The expansion of BASF's Geismar, Louisiana site's capacity to produce essential specialty amines is completed. Consequently, BASF would have an increased capacity to manufacture its principal polyether amines and amine catalysts, which are sold under the Lupragen and Baxxodur trademarks. Blowing agents are classified as Lupragen items.

Market Segment

This study forecasts revenue at regional, and country levels from 2022 to 2033. Spherical Insights has segmented the global blowing agent market based on the below-mentioned segments:

Global Blowing Agent Market, By Product

- Hydrocarbons

- Hydrofluorocarbons [HFC]

- Hydro Chlorofluorocarbons [HCFC]

- Others

Global Blowing Agent Market, By Foam Type

- Polyurethane Foam

- Polystyrene Foam

- Phenolic Foam

- Polypropylene Foam

- Polyethylene Foam

- Others

Global Blowing Agent Market, By Application

- Building and Construction

- Automotive

- Bedding and Furniture

- Appliances

- Packaging

- Others

Global Blowing Agent Market, By Region

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1.What are the blowing agents?Chemical additives known as blowing agents are used to release gases while thermoplastics are being produced. Stated differently, blowing agents can form a cellular structure during the foaming process.

-

2.What are the segments of the blowing agent market?The market is segmented into product, foam type, and application.

-

3.What is the value of the blowing agent market in 2023?In 2023, the global market for blowing agents market was estimated to be worth USD 1.6 billion.

Need help to buy this report?