Global Blood Screening Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Instruments and Reagents & Kits), By Technology (NAT Technology and Immunoassays), By End-User (Blood Banks And Hospitals), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: HealthcareGlobal Blood Screening Market Insights Forecasts to 2033

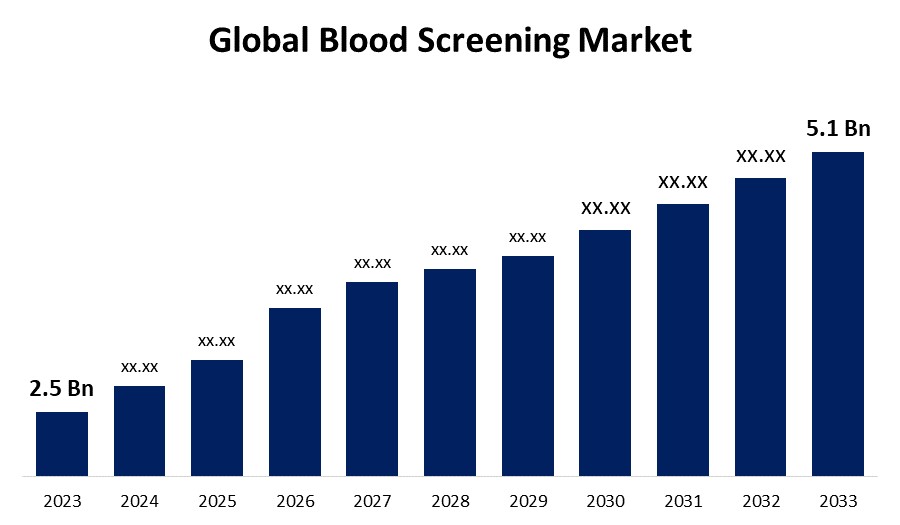

- The Global Blood screening Market Size was Valued at USD 2.5 Billion in 2023

- The Market Size is Growing at a CAGR of 7.39% from 2023 to 2033

- The Worldwide Blood Screening Market Size is Expected to Reach USD 5.1 Billion by 2033

- Asia Pacific is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Blood Screening Market Size is Anticipated to Exceed USD 5.1 Billion by 2033, Growing at a CAGR of 7.39% from 2023 to 2033.

Market Overview

Blood screening is a test done on a sample of blood to measure the amount of certain substances in the blood or to count different types of blood cells. The objective of blood screening is to detect markers of infection to prevent the release of infected blood and blood components for clinical use. Blood screening strategies are designed to assure the safety of blood units, but should not be used for notifying blood donors of reactive test results. The screening of donated blood and the quarantine of blood and blood components represent critical processes that should be followed to ensure that blood units are safe. WHO recommends that all blood donations be screened for evidence of infection before the release of the blood and its components for clinical or manufacturing use. Microbiological blood screening is mandatory for evaluating HIV, hepatitis B and C, and syphilis to ensure safe blood for transfusion. The donated blood is tested for ABO and RhD to ensure the safety and compatibility of the transfusion for the patient. Donor screening is conducted by federal and state regulations, as well as AABB Standards, to protect the safety of the donor, and to ensure the safety, purity, and potency of the blood collection.

Report Coverage

This research report categorizes the market for the global blood screening market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global blood screening market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global blood screening market.

Global Blood Screening Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 2.5 Billion |

| Forecast Period: | 2023 - 2033 |

| Forecast Period CAGR 2023 - 2033 : | 7.39% |

| 2033 Value Projection: | USD 5.1 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 245 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Product Type, By Technology, By End-User, By Region |

| Companies covered:: | Bio-Rad Laboratories, Inc., Danaher (Beckman Coulter, Inc.), DiaSorin S.p.A., Grifols, S.A., Thermo Fisher Scientific, Inc., F. Hoffmann-La Roche, Abbott Laboratories, Inc., Hologic, Becton, Dickinson and Company, QUOTIENT, Ortho Clinical Diagnostics, Alive DX, Siemens AG, Avioq, Inc., and Others |

| Pitfalls & Challenges: | Covid 19 Impact Challanges, Future, Growth and Analysis |

Get more details on this report -

Driving Factors

The increasing number of blood donations owing to the initiatives taken by the government and non-government organizations leads to the increasing demand for blood screening resulting in driving the market for blood screening. The rising awareness about the safety of blood by various government and non-government organizations is contributing to the market growth. Accident cases require more blood as well as chronic disease like cancer, chemotherapy requires a huge amount of blood. Thus, the rising incidence of accidents and the prevalence of chronic diseases such as cancer are responsible for driving the market. The increasing demand for blood for treatment which subsequently leads to the adoption of blood screening tests.

Restraining Factors

The high cost of instruments and inadequate infrastructure for blood screening are limiting the market growth. The rising cases of transfusion-transmissible infections and the prevalence of HIV, hepatitis B, C, and syphilis in emerging countries like India, China, and Africa are limiting the market growth.

Market Segmentation

The global blood screening market share is classified into product type, technology, and end-user.

- The reagents & kits segment accounted for the largest market share in 2023.

Based on the product type, the global blood screening market is categorized into instruments and reagents & kits. Among these, the reagents & kits segment accounted for the largest market share in 2023. Reagents and kits are highly consumed for blood screening due to their affordability and portability. The growing demand for reagents and kits owing to the increasing blood transfusions leads to propel market growth.

- The NAT technology segment dominated the market with the largest revenue share in 2023.

Based on the technology, the global blood screening market is categorized into NAT technology and immunoassays. Among these, the NAT technology segment dominated the market with the largest revenue share in 2023. NAT technology is used to determine HIV and hepatitis C virus RNA in the blood-donor population. Thus, the increasing number of blood donations surges the market demand for blood screening in NAT technology.

- The blood banks segment dominated the market with the largest revenue share in 2023.

Based on the end-user, the global blood screening market is categorized into blood banks and hospitals. Among these, the blood banks segment dominated the market with the largest revenue share in 2023. Organ transplantation and the growing number of blood donations are responsible for propelling the market. Further, there are rising partnerships between blood centers and clinical laboratories that are fueling the market growth for blood screening.

Regional Segment Analysis of the Global Blood Screening Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the global blood screening market over the predicted timeframe.

Get more details on this report -

North America is projected to hold the largest share of the global blood screening market over the forecast period. The increasing number of blood donation camps with the adoption of the blood screening process and

greater patient affordability are propelling the market growth. The growing prevalence of chronic disease conditions in the region is driving the market. Further, the rising initiatives for awareness about blood safety among the people are responsible for market expansion in the region. The rising cost of healthcare investments and the presence of well-developed healthcare systems are responsible for driving the market growth of blood screening.

Asia Pacific is expected to grow at the fastest CAGR growth of the global blood screening market during the forecast period. The growing awareness among the people about blood donations is also responsible for escalating the market demand. The growing investments in the development of advanced technology are anticipated to enhance the market growth. Furthermore, the growing adoption of newly launched blood screening instruments and the high costs of blood sampling are propelling the market in the region.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global blood screening market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Bio-Rad Laboratories, Inc.

- Danaher (Beckman Coulter, Inc.)

- DiaSorin S.p.A.

- Grifols, S.A.

- Thermo Fisher Scientific, Inc.

- F. Hoffmann-La Roche

- Abbott Laboratories, Inc.

- Hologic

- Becton, Dickinson and Company

- QUOTIENT

- Ortho Clinical Diagnostics

- Alive DX

- Siemens AG

- Avioq, Inc.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- ·In May 2023, Bio-Rad enabled Laboratory Excellence in Immunohematology with the launch of the IH-500 NEXT Fully Automated System for ID-Cards.

- In February 2023, Thermo Fisher Scientific launched PCR kits for the infectious disease section in India.

- In June 2022, Grifols Procleix Plasmodium Assay received a CE mark, a first for malaria blood screening.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the global blood screening market based on the below-mentioned segments:

Global Blood Screening Market, By Product Type

- Instruments

- Reagents & Kits

Global Blood Screening Market, By Technology

- NAT Technology

- Immunoassays

Global Blood Screening Market, By End-User

- Blood Banks

- Hospitals

Global Blood Screening Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the global blood screening market over the forecast period?The global blood screening market is projected to expand at a CAGR of 7.39% during the forecast period.

-

2. What is the projected market size & growth rate of the global blood screening market?The global blood screening market was valued at USD 2.5 Billion in 2023 and is projected to reach USD 5.1 Billion by 2033, growing at a CAGR of 7.39% from 2023 to 2033.

-

3. Which region is expected to hold the highest share in the global blood screening market?The North America region is expected to hold the highest share of the global blood screening market.

Need help to buy this report?