Global Blood Coagulation Testing Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Consumables and Instruments), By Application (Prothrombin Time, Activated Partial Thromboplastin, Thrombin Time, and Activated Clotting Time), By End-Use (Hospitals, Clinical, Laboratories, Point-of-Care Testing, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: HealthcareGlobal Blood Coagulation Testing Market Insights Forecasts to 2035

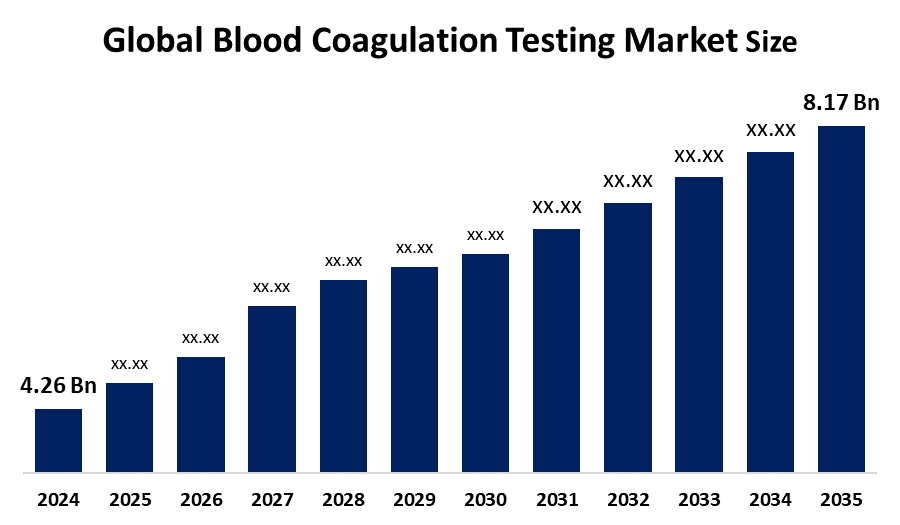

- The Global Blood Coagulation Testing Market Size Was Estimated at USD 4.26 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 6.1% from 2025 to 2035

- The Worldwide Blood Coagulation Testing Market Size is Expected to Reach USD 8.17 Billion by 2035

- Asia Pacific is expected to grow the fastest during the forecast period.

Get more details on this report -

According to a research report published by Spherical Insights and Consulting, The Global Blood Coagulation Testing Market Size was worth around USD 4.26 billion in 2024 and is predicted to grow to around USD 8.17 billion by 2035 with a compound annual growth rate (CAGR) of 6.1% from 2025 to 2035. The market for blood coagulation tests is expanding with the increasing incidence of cardiovascular and blood diseases, a growing geriatric population, progress in diagnostic technology, and increased awareness of preventive care. Also, the demand for point-of-care testing and personalized medicine drives market growth.

Market Overview

The Global Blood Coagulation Testing Market Size refers to the industry dealing with diagnostic products and equipment used to measure the coagulation of the blood. Such tests are crucial in treating and diagnosing conditions, including hemophilia, deep vein thrombosis, liver disorders, and during surgery, where there is a possibility of bleeding. Blood coagulation tests quantify factors such as prothrombin time (PT), activated partial thromboplastin time (aPTT), and fibrinogen to determine clotting ability. The growth in the market is spurred by the upsurge in cardiovascular diseases, rising surgical interventions, and an aging population with an increased vulnerability to clotting disorders. In addition, the rising awareness of prevention and health care and the prevalence of increasing chronic diseases are driving demand for precise and timely coagulation testing. Advances in technology, including point-of-care testing equipment, lab-on-a-chip technology, and auto analysers, have helped to improve the speed and accuracy of tests, optimizing patient care.

Future opportunities exist in emerging markets with developing healthcare infrastructure and in a combination of AI and machine learning for improved diagnostics. The transition to self-monitoring and home-based devices also paves the way for long-term disease management and personalized medicine, and with it, the blood coagulation testing market becomes an integral element of contemporary healthcare. The major market players, including Siemens Healthineers, F. Hoffmann-La Roche Ltd., Abbott Laboratories, and Sysmex Corporation, are always putting efforts into R&D to come up with higher-level diagnostic solutions. CLIA regulatory changes for point-of-care testing (POCT) came into effect in January 2025 to improve testing quality outside laboratory settings. Major revisions affect Proficiency Testing (PT), Personnel Qualifications, and Technical Consultant (TC) requirements, making standards more stringent for non-lab environments and ensuring more consistent diagnostic results in various healthcare settings.

Report Coverage

This research report categorizes the blood coagulation testing market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the blood coagulation testing market. Recent market developments and competitive strategies, such as expansion, type launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the blood coagulation testing market.

Global Blood Coagulation Testing Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 4.26 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 6.1% |

| 2035 Value Projection: | USD 4.26 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 140 |

| Segments covered: | By Product Type, By Application |

| Companies covered:: | Roche Diagnostics, Abbott Laboratories, Siemens Healthineers, Thermo Fisher Scientific Inc., Sysmex Corporation, Micropoint Biosciences, Danaher Corporation, Medtronic, Helena Laboratories, Werfen, HORIBA, Ltd., Nihon Kohden Corporation, and Others, Key Players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The increasing incidence of cardiovascular disorders and thrombotic diseases globally, driving demand for rapid and reliable diagnosis, is propelling the blood coagulation testing market. Improving awareness regarding blood clotting conditions and increasing usage of anticoagulant drugs necessitate periodic monitoring, increased test use. Breakthroughs in technology, in the form of automated analyzers and point-of-care devices, improve efficiency and accessibility. Furthermore, growth in the geriatric population and increasing rates of surgeries and cancer also drive market expansion. Supportive government policies encouraging early detection and preventive medicine further fuel demand, rendering blood coagulation testing critical for effectively managing bleeding and clotting disorders.

Restraining Factors

The Market Size for Blood Coagulation Testing is constrained by expensive advanced diagnostic devices, poor access in low-resource areas, unavailability of skilled professionals, strict regulatory guidelines, and possible inaccuracies in point-of-care testing. In addition to that, competing diagnostic methods and low awareness in some regions prevent wide adoption and market expansion.

Market Segmentation

The blood coagulation testing market share is classified into product type, application, and end-use.

- The consumables segment dominated the market in 2024, approximately 68% and is projected to grow at a substantial CAGR during the forecast period.

Based on the product type, the blood coagulation testing market is divided into consumables and instruments. Among these, he consumables segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The consumables segment dominated the blood coagulation testing market due to the steady requirement for reagents, test kits, and disposable materials required for performing coagulation tests. Moreover, growing patient volumes, increasing prevalence of blood disorders, and the requirement for continuous monitoring with anticoagulant therapies further enhance the steady requirement for consumables.

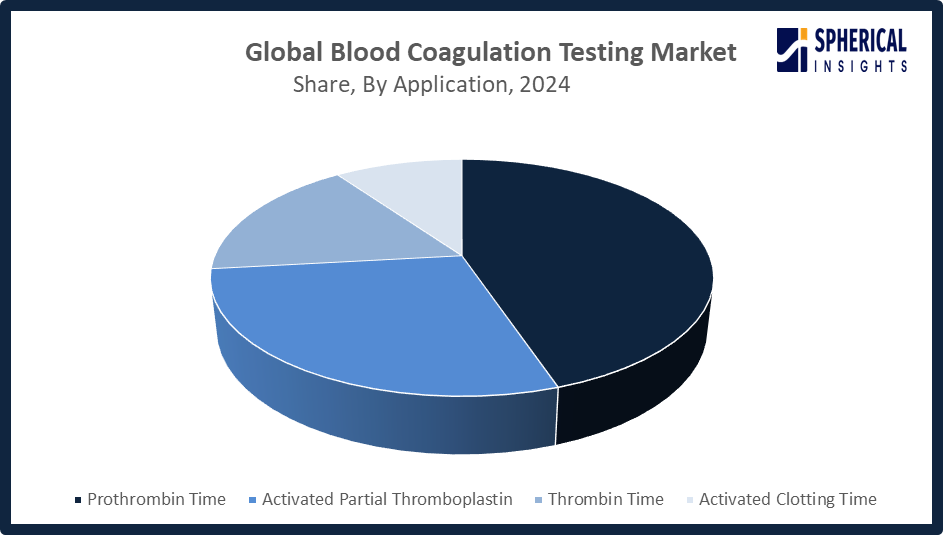

- The prothrombin time segment accounted for the largest share in 2024, approximately 45% and is anticipated to grow at a significant CAGR during the forecast period.

Based on the application, the blood coagulation testing market is divided into prothrombin time, activated partial thromboplastin, thrombin time, and activated clotting time. Among these, the prothrombin time segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The prothrombin time segment growth is attributed to its significant role in surveillance of anticoagulant-treated patients, identification of bleeding disorders, and treatment of liver diseases. Growing awareness regarding coagulation disorders and the universal use of PT tests in hospitals and clinics also drives market growth.

Get more details on this report -

- The hospitals segment accounted for the highest market revenue in 2024, approximately 52% and is anticipated to grow at a significant CAGR during the forecast period.

Based on the application, the blood coagulation testing market is divided into hospitals, clinical, laboratories, point-of-care testing, and others. Among these, the hospitals segment accounted for the highest market revenue in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The hospitals segment growth is due to the considerable patient volume, sophisticated diagnostic facilities, and the essential application of coagulation monitoring during surgical, emergency, and intensive care cases. Growing hospital investments in advanced laboratory devices and enhanced awareness regarding coagulation diseases also lead to the expansion of the segment.

Regional Segment Analysis of the Blood Coagulation Testing Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the blood coagulation testing market over the predicted timeframe.

North America is anticipated to hold the largest share of the blood coagulation testing market over the predicted timeframe. North America is anticipated to maintain the 38% share of the blood coagulation testing market during the forecast period, fueled by sophisticated healthcare infrastructure, high incidence of cardiovascular diseases, and increasing awareness of coagulation disorders. The United States dominates the region, powered by widespread hospital networks, well-developed diagnostic laboratories, and robust government funding for healthcare innovation and research. Besides, the existence of large industry players and extensive use of modern technologies, including point-of-care testing devices, makes the market expand. An aging population also leads to increased demand for frequent coagulation monitoring and management.

Get more details on this report -

Asia Pacific is expected to grow at a rapid CAGR in the blood coagulation testing market during the forecast period. Asia Pacific is rapidly growing in the blood coagulation testing market through the forecast period, with an approximate 30% market share, due to rising healthcare investments, growing awareness of coagulation disorders, and increasing access to sophisticated diagnostic technologies. China and India are some of the key countries, with their large populations, developing healthcare infrastructure, and initiatives by the government to improve medical services. Economic development across these nations is conducive to augmented healthcare expenditure, with the increasing prevalence of chronic diseases and aging populations further fueling demand for effective coagulation testing and monitoring technologies.

Europe's expansion of the blood coagulation testing market is stimulated by robust healthcare infrastructures, significant medical research spending, and regulatory incentives for advanced diagnostics. Germany, the UK, and France are among the leaders in having well-developed hospitals and laboratories implementing innovative testing technologies. The aging population has a greater demand for coagulation monitoring, and the continued evolution of new diagnostic products and government support for preventive healthcare continue to drive regional market growth.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the blood coagulation testing market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Roche Diagnostics

- Abbott Laboratories

- Siemens Healthineers

- Thermo Fisher Scientific Inc.

- Sysmex Corporation

- Micropoint Biosciences

- Danaher Corporation

- Medtronic

- Helena Laboratories

- Werfen

- HORIBA, Ltd.

- Nihon Kohden Corporation

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In July 2025, Werfen expanded the GEM Premier 7000 with the iQM3 blood gas testing system to Europe after success in North America. It’s the first to integrate hemolysis detection at point-of-care, reducing errors and delivering results in 45 seconds for faster clinical decisions.

- In July 2025, Siemens Healthineers launched the CN-3000 and CN-6000 Hemostasis Systems in Canada after Health Canada approval. These systems offer a broad range of routine and specialty coagulation assays, helping laboratories identify clotting abnormalities and providing comprehensive solutions for diagnosing bleeding and thrombotic disorders.

- In June 2025, Sysmex Corporation received FDA 510(k) clearance for its Automated Blood Coagulation Analyzer CN-6000 and five related reagents. This approval allows Sysmex to prepare for its U.S. market launch and pursue clearance for the CN-3000 analyzer and additional reagents to expand its hemostasis testing business.

- In September 2024, Sysmex launched the HISCL HIT IgG Assay Kit in Japan for detecting IgG antibodies linked to heparin-induced thrombocytopenia (HIT). Compatible with CN-6500/CN-3500 analyzers, it offers high sensitivity and specificity, reducing false positives and improving HIT diagnosis speed and testing efficiency.

- In February 2024, Roche launched three new coagulation tests for oral Factor Xa inhibitors, apixaban, edoxaban, and rivaroxaban, in CE mark countries. These tests aid clinical decisions for patients on direct oral anticoagulants, helping prevent stroke, embolism, and venous thromboembolism in conditions like atrial fibrillation and cardiovascular diseases.

- In March 2023, Sysmex signed a global supply agreement with Siemens Healthineers to exchange hemostasis instruments and reagents as original equipment manufacturers. Both companies will market these products under their brands, covering blood clotting disorder testing, bleeding risk management, and anticoagulant therapy monitoring.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the blood coagulation testing market based on the below-mentioned segments:

Global Blood Coagulation Testing Market, By Product Type

- Consumables

- Instruments

Global Blood Coagulation Testing Market, By Application

- Prothrombin Time

- Activated Partial Thromboplastin

- TimeThrombin Time

- Activated Clotting Time

Global Blood Coagulation Testing Market, By End-Use

- Hospitals

- Clinical

- Laboratories

- Point-of-Care Testing

- Others

Global Blood Coagulation Testing Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1.What is the CAGR of the blood coagulation testing market over the forecast period?The global blood coagulation testing market is projected to expand at a CAGR of 6.1% during the forecast period.

-

2.What is the market size of the blood coagulation testing market?The global blood coagulation testing market size is expected to grow from USD 4.26 billion in 2024 to USD 8.17 billion by 2035, at a CAGR of 6.1% during the forecast period 2025-2035.

-

3.The global blood coagulation testing market size is expected to grow from USD 4.26 billion in 2024 to USD 8.17 billion by 2035, at a CAGR of 6.1% during the forecast period 2025-2035. 3. Which region holds the largest share of the blood coagulation testing market?North America is anticipated to hold the largest share of the blood coagulation testing market over the predicted timeframe.

-

4.Who are the top 10 companies operating in the global blood coagulation testing market?The major players operating in the blood coagulation testing market are Roche Diagnostics, Abbott Laboratories, Siemens Healthineers, Thermo Fisher Scientific Inc., Sysmex Corporation, Micropoint Biosciences, Danaher Corporation, Medtronic, Helena Laboratories, Werfen, HORIBA, Ltd., Nihon Kohden Corporation, and Others.

-

5.What is the blood coagulation testing market?The blood coagulation testing market is a global industry focused on the diagnostic tests and analysers used to measure the blood's ability to clot.

-

6.What factors are driving the growth of the blood coagulation testing market?The blood coagulation testing market is driven by the rising prevalence of cardiovascular and blood clotting disorders, an aging global population, and the increased use of anticoagulant therapies. Additionally, market growth is fueled by technological advancements like automation and point-of-care testing, which improve accuracy and accessibility.

-

7.What are the market trends in the blood coagulation testing market?Market trends in blood coagulation testing include rising diagnoses of bleeding and cardiovascular disorders, advancements in point-of-care (POC) and automated testing technologies, and an aging population.

-

8.What are the main challenges restricting wider adoption of the blood coagulation testing market?The wider adoption of the blood coagulation testing market is restricted by high costs, issues with reimbursement, and the need for specialized training. Challenges with standardizing results, especially for point-of-care (POC) devices, and stringent, time-consuming regulations also limit market expansion.

Need help to buy this report?