Global Bisphenol S Market Size, Share, and COVID-19 Impact Analysis, By Application (Plastic Manufacturing, Thermal Paper, Epoxy Resins, Personal Care Products, and Others), By End User (Automotive, Electronics, Packaging, Healthcare, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035.

Industry: Chemicals & MaterialsGlobal Bisphenol S Market Insights Forecasts to 2035

- The Global Bisphenol S Market Size Was Estimated at USD 475.75 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 5.7 % from 2025 to 2035

- The Worldwide Bisphenol S Market Size is Expected to Reach USD 875.20 Million by 2035

- North America is expected to grow the fastest during the forecast period.

Get more details on this report -

According to a research report published by Spherical Insights and Consulting, The Global Bisphenol S Market Size was valued at around USD 475.75 Million in 2024 and is predicted to grow to around USD 875.20 Million by 2035 with a compound annual growth rate (CAGR) of 5.7 % from 2025 to 2035. Opportunities in the bisphenol S market include the growing need for BPA substitutes, the need to comply with regulations, the expansion of the plastics sector, the growth of thermal paper applications, and the growing use of coatings and resins.

Market Overview

The production, distribution, and use of bisphenol S (BPS), a synthetic phenolic compound (C22H10O4S) that serves as the main substitute for Bisphenol A (BPA) in polycarbonate plastics, epoxy resins, thermal paper coatings, and water-dispersible polymers, are all included in the global ecosystem known as the bisphenol S (BPS) market. BPS is frequently utilized in the manufacturing of polycarbonates owing to its chemical stability, heat resistance, and durability. The US has mandated that starting in January 2026, warning labels be placed on products containing BPS that declare its reproductive toxicity in line with the Proposition 65 listings. Additionally, California's Safer Food Packaging Act (AB 1148, 2025) has ruled that no Bisphenol A or no bisphenol will be allowed in the food packaging sector. Due to growing health concerns about bisphenol A (BPA), there is a growing need for BPS as a replacement for BPA in a variety of applications. The bisphenol S market growth is further fueled by the ongoing development of BPS applications across various industries.

Report Coverage

This research report categorizes the bisphenol S market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the bisphenol S market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyzes their core competencies in each sub-segment of the bisphenol S market.

Global Bisphenol S Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 475.75 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 5.7% |

| 2035 Value Projection: | USD 875.20 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 95 |

| Segments covered: | By Application, By End User |

| Companies covered:: | BASF SE, Changzhou Changyu Chemical Co., Ltd., Changzhou Tianhua Pharmaceutical Co., Ltd., Honshu Chemical Industry Co., Ltd., Jiangsu Aolunda High-Tech Industry Co., Ltd., Jiangsu Danhua Group Co., Ltd., Jiangsu Zhongdan Group Co., Ltd., Mitsubishi Chemical Corporation, Nantong Baisheng Chemical Co., Ltd., Nantong Baokai Chemical Co., Ltd., Nantong Chem-Tech Co., Ltd., Nantong Huashun Chemical Co., Ltd., Nantong Reagent Chemical Co., Ltd., Nantong Volant-chem Corp., Others, and Key Players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Growing awareness of BPA's detrimental effects on the environment and human health is a key driver of the bisphenol S market. Another important factor propelling the BPS industry is the global expansion of the automotive and electronics sectors. BPS is being utilized more and more in the electronics industry to produce polycarbonate plastics and epoxy resins, which are essential parts of making electronic devices. Furthermore, industrial demand, environmental concerns, health and safety laws, and advancements in material science contribute to the bisphenol S market.

Restraining Factors

Growing health and environmental concerns, more regulatory scrutiny, possible toxicity hazards, high production costs, and a growing industry preference for safer or bio-based alternative materials are all reasons that have restricted the market for bisphenol S.

Market Segmentation

The bisphenol S market share is classified into application and end user.

- The thermal paper segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the application, the bisphenol S market is divided into plastic manufacturing, thermal paper, epoxy resins, personal care products, and others. Among these, the thermal paper segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. A different significant application of BPS is thermal paper, which is typically used to create labels and receipts. Growing health and environmental concerns about BPA exposure are a major factor in the switch from BPA to BPS in thermal paper manufacture. BPS is a good substitute for thermal paper applications since it provides comparable performance qualities to BPA, such as strong thermal stability and printability.

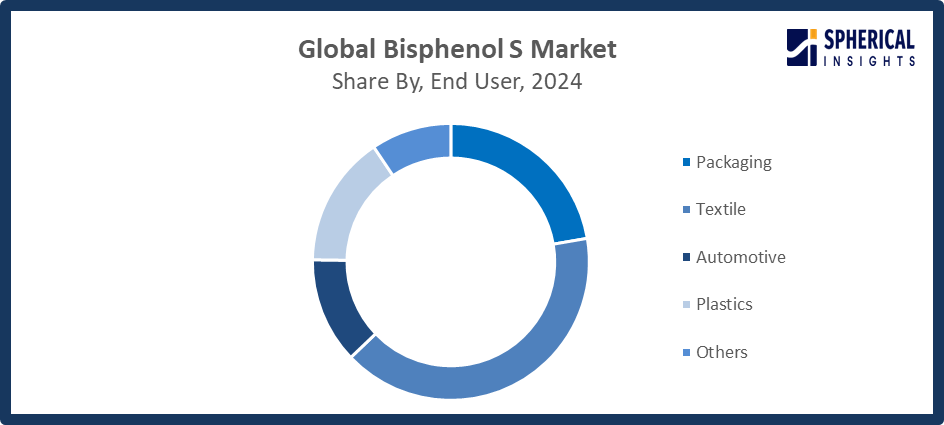

- The packaging segment accounted for the highest market revenue in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the end user, the bisphenol S market is divided into automotive, electronics, packaging, healthcare, and others. Among these, the packaging segment accounted for the highest market revenue in 2024 and is anticipated to grow at a significant CAGR during the forecast period. BPS-based materials are growing in popularity as customer attitudes change toward safer and greener packaging options. Another major user of BPS is the packaging sector, especially when it comes to the manufacture of robust and protective packaging materials.

Get more details on this report -

Regional Segment Analysis of the Bisphenol S Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia Pacific is anticipated to hold the largest share of the bisphenol S market over the predicted timeframe.

Asia Pacific is anticipated to hold the largest share of the bisphenol S market over the predicted timeframe. The Asia Pacific region is seeing fast urbanization, increased industrialization, and a rise in the need for epoxy resins and high-performance plastics in a variety of end-use sectors. The need for BPS has increased due to notable industrial expansion in nations like South Korea, China, and Japan. The introduction of BPS as a compliant substitute was indirectly accelerated in July 2025 when China's National Center for Food Safety Risk Assessment introduced a draft modification to GB 9685 that reduced the migration limits of bisphenol A (BPA) in food-contact products to 0.05 mg/kg.

Get more details on this report -

North America is expected to grow at a rapid CAGR in the bisphenol S market during the forecast period. The growing healthcare and packaging sectors in North America, where sustainability and safety are crucial, are major drivers of BPS adoption. The region's cutting-edge technical environment fosters innovation in BPS applications, which propels market expansion. The Safer Food Packaging Act (AB 1148) of California, which forbade bisphenols, including BPS, in packaging, was passed in 2025 and sparked pre-compliance research in bio-based formulations.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the bisphenol S market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- BASF SE

- Changzhou Changyu Chemical Co., Ltd.

- Changzhou Tianhua Pharmaceutical Co., Ltd.

- Honshu Chemical Industry Co., Ltd.

- Jiangsu Aolunda High-Tech Industry Co., Ltd.

- Jiangsu Danhua Group Co., Ltd.

- Jiangsu Zhongdan Group Co., Ltd.

- Mitsubishi Chemical Corporation

- Nantong Baisheng Chemical Co., Ltd.

- Nantong Baokai Chemical Co., Ltd.

- Nantong Chem-Tech Co., Ltd.

- Nantong Huashun Chemical Co., Ltd.

- Nantong Reagent Chemical Co., Ltd.

- Nantong Volant-chem Corp.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In December 2025, California OEHHA officially launched the listing of Bisphenol S (BPS) under Proposition 65 as a female reproductive toxicant, following DARTIC’s findings confirming scientifically valid evidence of its reproductive toxicity.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the bisphenol S market based on the below-mentioned segments:

Global Bisphenol S Market, By Application

- Plastic Manufacturing

- Thermal Paper

- Epoxy Resins

- Personal Care Products

- Others

Global Bisphenol S Market, By End User

- Automotive

- Electronics

- Packaging

- Healthcare

- Others

Global Bisphenol S Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1.What is the CAGR of the bisphenol S market over the forecast period?The global bisphenol S market is projected to expand at a CAGR of 5.7% during the forecast period.

-

2.What is the market size of the bisphenol S market?The global bisphenol S market size is expected to grow from USD 475.75 million in 2024 to USD 875.20 million by 2035, at a CAGR of 5.7 % during the forecast period 2025-2035.

-

3.Which region holds the largest share of the bisphenol S market?Asia Pacific is anticipated to hold the largest share of the bisphenol S market over the predicted timeframe.

-

4.Who are the top companies operating in the global bisphenol S market?BASF SE, Changzhou Changyu Chemical Co., Ltd., Changzhou Tianhua Pharmaceutical Co., Ltd., Honshu Chemical Industry Co., Ltd., Jiangsu Aolunda High-Tech Industry Co., Ltd., Jiangsu Danhua Group Co., Ltd., Jiangsu Zhongdan Group Co., Ltd., Mitsubishi Chemical Corporation, Nantong Baisheng Chemical Co., Ltd., Nantong Baokai Chemical Co., Ltd., Nantong Chem-Tech Co., Ltd., Nantong Huashun Chemical Co., Ltd., Nantong Reagent Chemical Co., Ltd., Nantong Volant-chem Corp., and Others.

-

5.What factors are driving the growth of the bisphenol S market?The bisphenol S market growth is driven by increasing demand for epoxy resins, safer chemical alternatives, industrialization, expanding applications in electronics, automotive, construction, and rising awareness regarding health and environmental sustainability.

-

6.What are the market trends in the bisphenol S market?The replacement of Bisphenol A with Bisphenol S, growing use in high-performance plastics, expanding R&D projects, regulatory compliance, and greater use in consumer goods, electronics, and construction industries are some of the major market developments.

-

7.What are the main challenges restricting the wider adoption of the bisphenol S market?Strict laws, health and safety issues, high manufacturing costs, little awareness in emerging markets, and technological obstacles in large-scale industrial applications hinder the market adoption of bisphenol S.

Need help to buy this report?