Global Bisphenol A Market Size, Share, and COVID-19 Impact Analysis, By Application (Polycarbonate Resins, Epoxy Resins, Unsaturated Polyester Resins, Flame Retardants, and Others), By End-Use Industry (Electricals and Electronics, Packaging, Automotive, Paint and Coatings, Building and Construction, Healthcare, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: Chemicals & MaterialsGlobal Bisphenol A Market Insights Forecasts to 2035

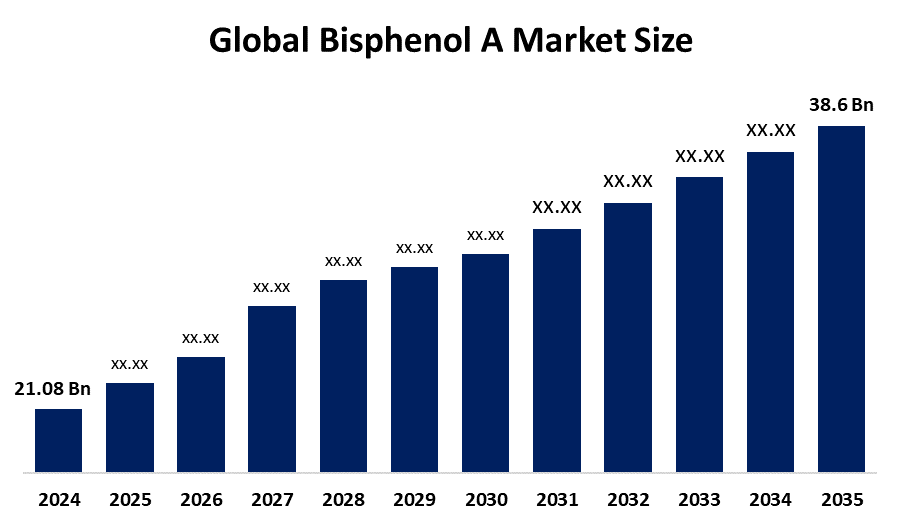

- The Global Bisphenol A Market Size Was Estimated at USD 21.08 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 5.65% from 2025 to 2035

- The Worldwide Bisphenol A Market Size is Expected to Reach USD 38.6 Billion by 2035

- North America is expected to grow the fastest during the forecast period.

Get more details on this report -

According to a research report published by Spherical Insights and Consulting, the global Bisphenol A market size was worth around USD 21.08 Billion in 2024 and is predicted to grow to around USD 38.6 Billion by 2035 with a compound annual growth rate (CAGR) of 5.65% from 2025 to 2035. The growing demand for bisphenol A is driven by its broad application in electronics and automotive industries, where it acts as a vital raw ingredient for epoxy resins and polycarbonate plastics, supporting lightweight, durable, and high-performance components, consequently propelling market expansion.

Market Overview

The global bisphenol A market involves the production, distribution, and application of BPA, a chemical primarily used in polycarbonate plastics and epoxy resins across automotive, construction, electronics, and packaging industries. The worldwide bisphenol A market is expanding significantly, mostly due to increased demand from the electronics, construction, and automotive sectors. BPA is widely utilised in the production of epoxy resins and polycarbonate plastics, which are used in items like computers, keyboards, LEDs, and 3D printed circuit boards. Because polycarbonate materials are strong, lightweight, and mass-producible, they are favoured over conventional glass and metals in the automotive industry, improving vehicle performance and fuel economy. Similar to this, epoxy resins are being used more and more in the electronics industry because of their superior mechanical strength, electrical insulation, and resistance to heat and chemicals. These qualities make them perfect for electronic encapsulation, printed circuit boards, and semiconductor packaging. The BPA market is rising as a result of its expanding use in important end-use sectors.

The bisphenol-A market is growing in a number of industries with rapid expansion. BPA-based polycarbonates are utilised in electronics and automobiles for thin-wall casings, interior trim, lightweight glazing, and EV battery housings. Low-residual and flame-retardant grades are being driven by regulatory constraints. Because BPA-based epoxies allow for longer, fatigue-resistant turbine blades, the need for epoxy-resin in wind energy is increasing. Offshore projects in China, the United States, and the North Sea are anticipated to significantly increase volumes. Capacity expansions in Asia-Pacific, especially in China, are bringing investment to the manufacture of epoxy and polycarbonate and reducing unit costs. Niche aerospace applications for high-temperature BPA derivatives support premium pricing and innovation, while ongoing R&D enhances automotive and industrial applications, sustaining market growth and technological advancement.

Report Coverage

This research report categorizes the bisphenol A market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the bisphenol A market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the bisphenol A market.

Global Bisphenol A Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 21.08 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 5.65% |

| 2035 Value Projection: | USD 38.6 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 242 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Application, By End-Use Industry |

| Companies covered:: | Covestro AG, SABIC, Chang Chun Group, Mitsui Chemical Inc, Nan Ya Plastics Corporation, Altivia, China National Bluestar (Group) Co. Ltd, Mitsubishi Chemical Corporation, HEXION INC, LG Chem, And Other Plays |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Growing EV sales are one of the main factors propelling the bisphenol-A (BPA) market, which is driving automakers to use polycarbonate housings, lightweight glazing, and interior components. Growth is further fuelled by the need for thin-wall casings, display lenses, and heat-dissipation components in electronics. The use of BPA-based epoxy for turbine blades is rising as wind energy installations expand, but Asia-Pacific capacity expansions, especially in China, reduce production costs and improve availability. Low-residual and flame-retardant grades are encouraged by regulatory limits. High-temperature BPA derivatives' niche aerospace uses promote premium pricing and R&D, which also helps the automotive and industrial industries and propels market growth.

Restraining Factors

The bisphenol-Regulatory restrictions, like the European Commission's 2025 ban on all food-contact products, can limit a market by lowering legacy demand and hastening the transition to bio-based substitutes. Furthermore, unstable feedstock prices for phenol and acetone, which are caused by refinery maintenance and varying petrol cracks, squeeze margins, especially for non-integrated producers. This forces smaller players to reduce capacity, tighten credit, and manage supply-side risks, which restricts the growth of the market as a whole.

Market Segmentation

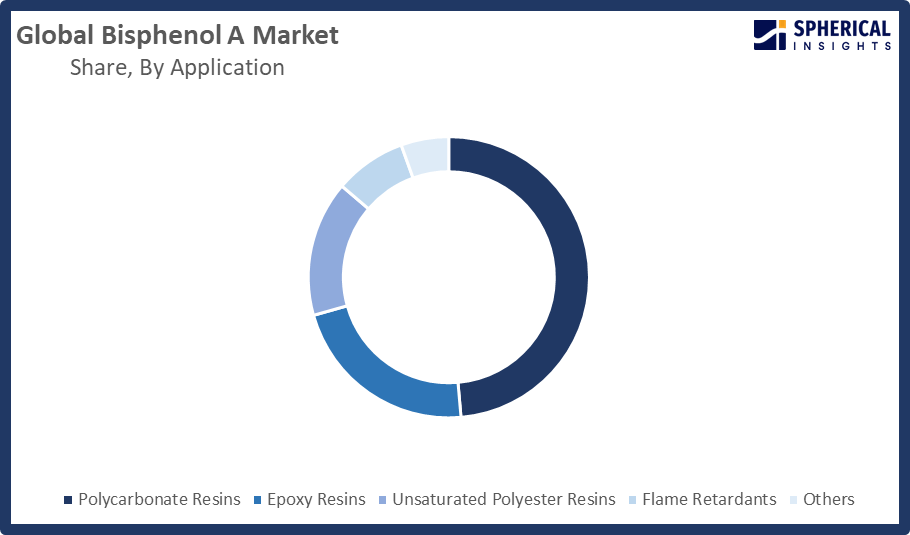

The Bisphenol A market share is classified into application and end-use industry.

- The polycarbonate resins segment dominated the market in 2024, approximately 49.7% and is projected to grow at a substantial CAGR during the forecast period.

Based on the application, the bisphenol A market is divided into polycarbonate resins, epoxy resins, unsaturated polyester resins, flame retardants, and others. Among these, the polycarbonate resins segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. These resins offer superior clarity, heat resistance, and impact resistance. Safety eyewear, ballistic-resistant windows, medical equipment, and food packaging are all made of polycarbonates. Because of its low cost and ability to be produced in large quantities, polycarbonate is an ideal substitute for materials like metal and glass. Consequently, these elements are in charge of this segment's increasing market growth.

Get more details on this report -

- The electricals and electronics segment accounted for the largest share in 2024, approximately 25.6% and is anticipated to grow at a significant CAGR during the forecast period.

Based on the end-use industry, the bisphenol A market is divided into electricals and electronics, packaging, automotive, paint and coatings, building and construction, healthcare, and others. Among these, the electricals and electronics segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. BPA is widely used in this industry to make epoxy and polycarbonate resins, which are essential portions of electrical and electronic assemblies, parts, and housings. The necessity for robust, heat-resistant materials in appliances, consumer electronics, and componentry is what is driving demand in this market.

Regional Segment Analysis of the Bisphenol A Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia Pacific is anticipated to hold the largest share with approximately 60.3% of the Bisphenol A market over the predicted timeframe.

Asia Pacific is anticipated to hold the largest share of the bisphenol A market over the predicted timeframe. Mainly because end-user industries are so prevalent and because they need bisphenol A. The upward market expansion has also been linked to increased automotive production and sales. Epoxy and polycarbonate resins are widely employed in the production of different automotive components. The increase in building projects in nations like China, India, and Japan has also fuelled the bisphenol A market's expansion. China bisphenol market to the extensive usage of epoxy and polycarbonate resins in the automotive and construction industries, a market is anticipated to expand quickly in the upcoming years.

Get more details on this report -

North America is expected to grow the fastest market share with approximately 20.5% at a rapid CAGR in the bisphenol A market during the forecast period. Growing demand from companies that use BPA to produce thermal paper, epoxy resins for coatings, and polycarbonate plastics is driving this increased trend. The acceptance of BPA-based products is significantly influenced by the region's strong manufacturing infrastructure and developments in chemical processes.

Europe is expected to grow at a rapid CAGR in the bisphenol A market during the forecast period. Europe bisphenol A market was identified as a lucrative region in this industry due to the strong presence of key industry players and a well-developed infrastructure. With the growth in the construction industry, the demand for epoxy resins required to manufacture adhesives, paints has increased. Many companies are using polycarbonate resins and epoxy resins as an alternative to glass and metals.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the bisphenol A market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Covestro AG

- SABIC

- Chang Chun Group

- Mitsui Chemical Inc

- Nan Ya Plastics Corporation

- Altivia

- China National Bluestar (Group) Co. Ltd

- Mitsubishi Chemical Corporation

- HEXION INC

- LG Chem

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the bisphenol A market based on the below-mentioned segments:

Global Bisphenol A Market, By Application

- Polycarbonate Resins

- Epoxy Resins

- Unsaturated Polyester Resins

- Flame Retardants

- Others

Global Bisphenol A Market, By End-Use Industry

- Electricals and Electronics

- Packaging

- Automotive

- Paint and Coatings

- Building and Construction

- Healthcare

- Others

Global Bisphenol A Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

What is the CAGR of the Bisphenol A market over the forecast period?The global Bisphenol A market is projected to expand at a CAGR of 5.65% during the forecast period.

-

What is the market size of the Bisphenol A market?The global Bisphenol A market size is expected to grow from USD 21.08 Billion in 2024 to USD 38.6 Billion by 2035, at a CAGR of 5.65% during the forecast period 2025-2035.

-

Which region holds the largest share of the Bisphenol A market?Asia Pacific is anticipated to hold the largest share of the Bisphenol A market over the predicted timeframe.

-

Who are the top 10 companies operating in the global Bisphenol A market?Covestro AG, SABIC, Chang Chun Group, Mitsui Chemical Inc, Nan Ya Plastics Corporation, Altivia, China National Bluestar (Group) Co. Ltd, Mitsubishi Chemical Corporation, HEXION INC, and LG Chem.

-

What factors are driving the growth of the Bisphenol A market?The growing need for epoxy resins and polycarbonate plastics in the construction, automotive, and electronics sectors is fuelling the expansion of the bisphenol A industry. Global infrastructure initiatives, rising consumer electronics manufacturing, and increased use in food packaging all increase market demand, while industrial coatings and adhesives applications support expansion.

-

What are the market trends in the Bisphenol A market?The bisphenol High-performance plastics are becoming more widely used, automotive and electronic components are becoming more popular, epoxy coatings are becoming more and more popular, and emerging economies are expanding. The industry is also being shaped by advancements in BPA-based materials and changes in regulations towards safer substitutes.

-

What are the main challenges restricting wider adoption of the Bisphenol A market?The bisphenol A market faces challenges from health and environmental concerns, stringent regulations, rising demand for BPA-free alternatives, and public awareness about potential toxicity, limiting its wider adoption globally.

Need help to buy this report?