Global Biotin Market Size, Share, and COVID-19 Impact Analysis, By Product Form (Capsules, Tablets, Soft Gels, Liquid, Gummies, and Powders), By End-Use (Nutraceuticals, Food, Cosmetics & Personal Care, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035.

Industry: Specialty & Fine ChemicalsGlobal Biotin Market Insights Forecasts to 2035

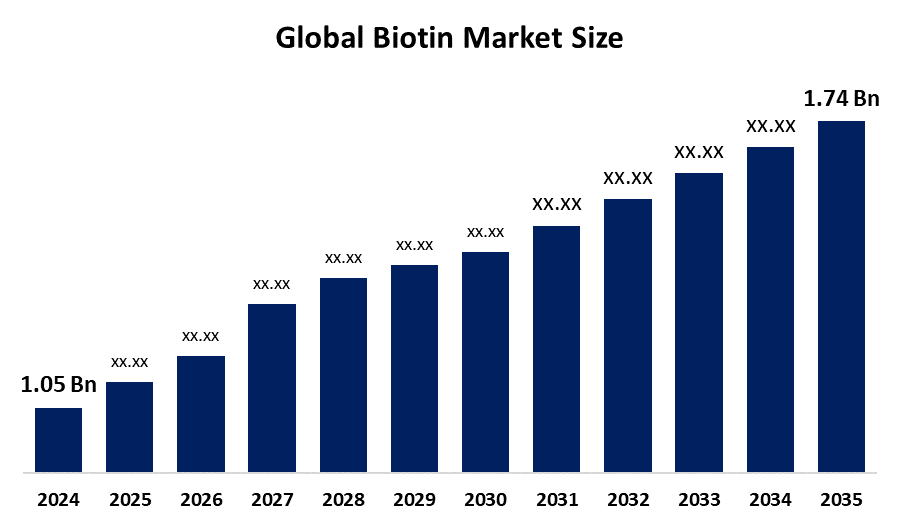

- The Global Biotin Market Size Was Estimated at USD 1.05 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 4.70% from 2025 to 2035

- The Worldwide Biotin Market Size is Expected to Reach USD 1.74 Billion by 2035

- Asia Pacific is expected to grow the fastest during the forecast period.

Get more details on this report -

Get more details on this report -

According to a research report published by Spherical Insights and Consulting, The Global Biotin Market Size was worth around USD 1.05 Billion in 2024 and is predicted to grow to around USD 1.74 Billion by 2035 with a compound annual growth rate (CAGR) of 4.70% from 2025 and 2035. The market for biotin has a number of opportunities to grow due to the growth in the biotin supplement market, with the growing awareness of biotin health benefits and demand in the beauty & wellness sectors.

Market Overview

The Global Biotin Market Size Refers to the industry for biotin, which is a water-soluble vitamin (B7), sold primarily as a dietary supplement for hair, skin, and nail health, as well as for its metabolic benefits. Biotin is one of the B vitamins, a group of essential dietary micronutrients, present in every living cell and is involved as a cofactor for enzymes in numerous metabolic processes, both in humans and in other organisms, primarily related to the biochemistry of fats, carbohydrates, and amino acids. It is an alternative medication used in managing and treating pathological hair conditions. The U.S. Food and Drug Administration recommend breastfeeding or pregnant patients take 5mcg to 35mcg per day. Some conditions, including genetic disorders of biotin deficiency, seborrheic dermatitis in infants, and surgical removal of the stomach, are driving the need for biotin.

Innovation and market expansion are anticipated as a result of major players' growing R&D efforts for analyzing the clinical efficacy of biotin for improving hair quantity and quality. Further, clinical trials are being conducted to investigate the efficacy of biotin supplementation for treating alopecia. The systematic metabolic engineering approaches for boosting microbial biotin production are driving a huge surge in the global biotin market.

Report Coverage

This research report categorizes the biotin market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the biotin market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the biotin market.

Get more details on this report -

Get more details on this report -

Driving Factors

The Biotin Market Size is primarily driven by the growing health & wellness trend and the significance of preventive healthcare. For instance, it was estimated that younger generations are estimated to spend more than $500 billion annually, growing at 4 to 5% each year. The incorporation of biotin in personal care & cosmetics product formulations, including hair conditioner, grooming aid, shampoo, and moisturizer, is driving the market. For instance, California Gold Nutrition BEAUTY was launched by iHerb, which is a leading global destination for health and wellness.

Restraining Factors

The Biotin Market Size is restricted by the limited scientific evidence regarding biotin’s effectiveness and reliance on alternative treatments or products with more established clinical evidence. Further, the concerns regarding adverse effects associated with excess biotin intake and fluctuating raw material prices are affecting the market.

Market Segmentation

The biotin market share is classified into product form and end-use.

The capsules segment accounted for the dominant market share in 2024 and is anticipated to grow at a significant CAGR of about 8.7% during the forecast period.

Based on the product form, the biotin market is divided into capsules, tablets, soft gels, liquid, gummies, and powders. Among these, the capsules segment accounted for the dominant market share in 2024 and is anticipated to grow at a significant CAGR of about 8.7% during the forecast period. Biotin capsule is a common type of oral medication and is fast-acting, tasteless, tamper-resistant, with higher drug absorption. For instance, Oziva Plant-based biotin Xtra capsules manufactured by Zywie Ventures Pvt. Ltd. are used for hair repair and regeneration. The popularity of capsule formulation due to its convenience, on-the-go biotin intake, is responsible for driving the market.

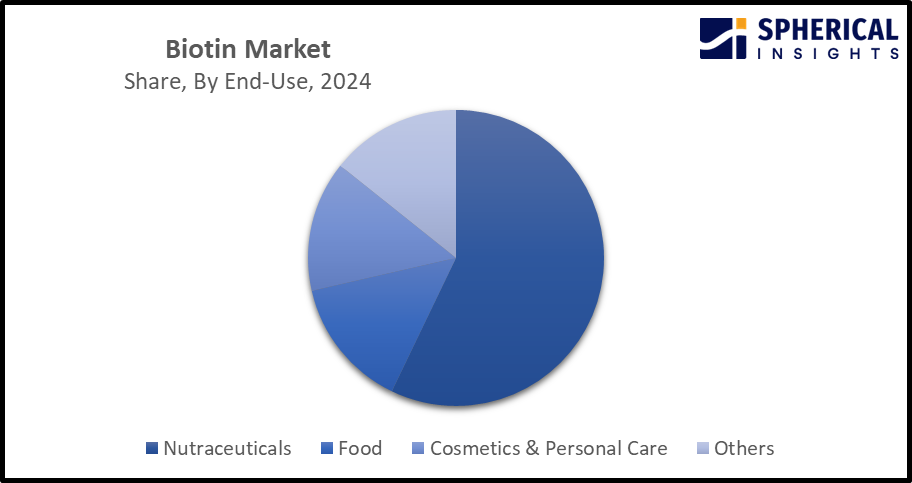

- The nutraceuticals segment dominated the market with the largest share of about 71.0% in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based on the end-use, the biotin market is divided into nutraceuticals, food, cosmetics & personal care, and others. Among these, the nutraceuticals segment dominated the market with the largest share of about 71.0% in 2024 and is projected to grow at a substantial CAGR during the forecast period. Biotin is used as an essential nutrient in some foods and as a dietary supplement. For instance, Biotrex Nutraceuticals’ Biotin supplements and GDM Nutraceuticals LLP BIOTIN 10,000 mcg+ are commercialized for supporting skin, nails, and hair health. An increasing adoption of biotin nutraceuticals, along with the expanding nutraceutical sector, is propelling the biotin market.

Regional Segment Analysis of the Biotin Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the Biotin market over the predicted timeframe.

North America is anticipated to hold the largest share of about 35% in the biotin market over the predicted timeframe. The increasing research studies on biotin for mitigating manganese-associated neurological conditions are anticipated to propel the market demand. For instance, a research article published by ScienceSignalling identified changes in biotin metabolism as underlying Mn neurotoxicity and Parkinson pathology in flies. The market ecosystem in North America is strong, with the presence of nutraceuticals Tech startups like Zoe, focusing on personalized nutrition programs. The demand for Biotin has been driven by the growing health benefits of biotin supplements and the importance of healthcare. United States is leading the North America biotin market, with a significant share of about 80.0% in 2024, driven by the country’s leading wellness economy, with an increasing adoption of personalized nutrition.

Get more details on this report -

Get more details on this report -

Asia Pacific is expected to grow at a rapid CAGR of about 8.0% to 10.9% in the biotin market during the forecast period. The Asia Pacific area has a thriving market for biotin due to the increasing need for biotin in dietary supplements and functional foods. Further, emphasis on advancing the production of biotin is propelling market growth. For instance. In January 2022, Danish biotech company Biosyntia and the Munich-based WACKER Group announced the signing of a contract to develop a large-scale production process for fermentation-based biotin. China is dominating the biotin market in the Asia Pacific region, with about 32.2% regional revenue share, due to the growing biotin demand in dietary supplements, functional foods, and personal products, along with investment in high-purity biotin extraction & formulation technologies.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations companies involved within the biotin market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Zhejiang Medicine

- Anhui Tiger Biotech

- SDM

- Hegno

- Kexing Biochem

- NUH

- DSM

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In July 2025, Giovanni Eco Chic Beauty, known as a hair care brand of the entertainment industry for its backstage popularity with pro stylists at the Emmys, Oscars, GRAMMYS, Tonys and 70 other productions, has added 6 biotin and collagen-enriched haircare products to their product catalogue.

- In May 2025, iHerb, a leading global destination for health and wellness, announced the launch of California Gold Nutrition BEAUTY, a new holistic self-care line made with premium ingredients promoting wellness from the inside out.

Global Biotin Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 1.74 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 4.70% |

| 2035 Value Projection: | USD 1.05 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 140 |

| Segments covered: | By Product For, By Region |

| Companies covered:: | Zhejiang Medicine, Anhui Tiger Biotech, SDM, Hegno, Kexing Biochem, NUH, DSM, Zhejiang Medicine, Anhui Tiger Biotech, SDM, Hegno, Kexing Biochem, NUH, DSM, Others, and Key Players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the biotin market based on the below-mentioned segments:

Global Biotin Market, By Product Form

- Capsules

- Tablets

- Soft Gels

- Liquid

- Gummies

- Powders

Global Biotin Market, By End-Use

- Nutraceuticals

- Food

- Cosmetics & Personal Care

- Others

Global Biotin Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the market size of the biotin market?The global biotin market size is expected to grow from USD 1.05 Billion in 2024 to USD 1.74 Billion by 2035, at a CAGR of 4.70% during the forecast period 2025-2035.

-

2. Which region holds the largest share of the biotin market?North America is anticipated to hold the largest share of the biotin market over the predicted timeframe.

-

3. What is the forecasted CAGR of the Global Biotin Market from 2024 to 2035?The market is expected to grow at a CAGR of around 4.70% during the period 2024–2035.

-

4. Who are the top companies operating in the Global Biotin Market?Key players include Zhejiang Medicine, Anhui Tiger Biotech, SDM, Hegno, Kexing Biochem, NUH, and DSM.

-

5. Can you provide company profiles for the leading biotin manufacturers?Yes. For example, Zhejiang Medicine is a large-scale joint stock pharmaceutical company that develops, manufactures, and commercialises biological drugs, pharmaceutical intermediates. Anhui Tiger Biotech is a holding subsidiary of China BBCA Group Corporation, dedicated to the R&D, production and sales of products including vitamins.

-

6. What are the main drivers of growth in the biotin market?Growing health & wellness trend and significance of preventive healthcare, as well as biotin integration in personal care & cosmetics products, are major market growth drivers of the biotin market.

-

7. What challenges are limiting the biotin market?The availability of alternative products with strong clinical evidence and fluctuating raw material prices remains a key restraint in the biotin market.

Need help to buy this report?