Global Biotechnology Market Size, Share, and COVID-19 Impact Analysis, By Technology (Nanobiotechnology, DNA Sequencing, Cell-based Assays, Fermentation, PCR Technology, Chromatography, Tissue Engineering & Regeneration, and Others), By Application (Health, Bioinformatics, Food & Agriculture, Natural Resources & Environment, and Industrial Processing), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: HealthcareGlobal Biotechnology Market Insights Forecasts to 2035

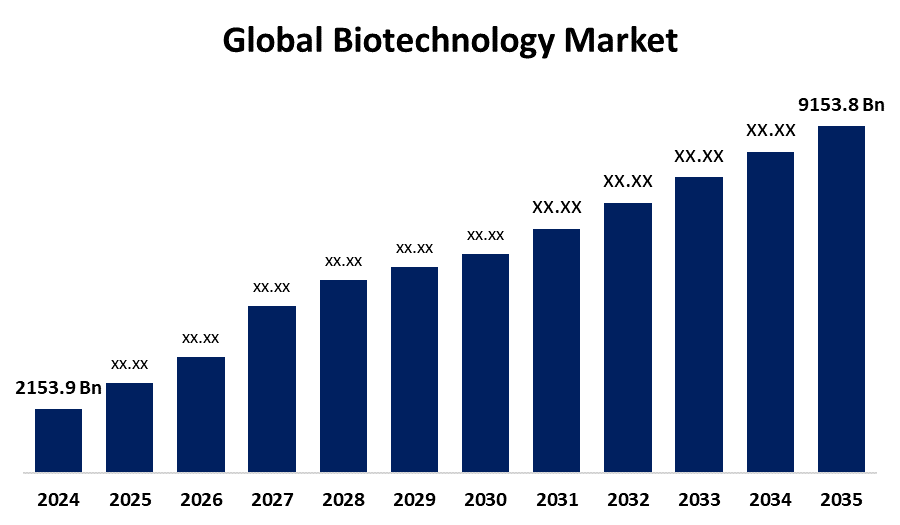

- The Global Biotechnology Market Size Was Estimated at USD 2153.9 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 14.06% from 2025 to 2035

- The Worldwide Biotechnology Market Size is Expected to Reach USD 9153.8 Billion by 2035

- Asia Pacific is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The global Biotechnology Market Size was worth around USD 2153.9 Billion in 2024 and is predicted to grow to around USD 9153.8 Billion by 2035 with a compound annual growth rate (CAGR) of 14.06% from 2025 and 2035. The global biotechnology market is propelled by the rise in orphan drug formulations and the expanding use of personalised medicine are creating new opportunities for biotechnology applications and propelling the entry of creative and up-and-coming biotechnology firms.

Market Overview

Biotechnology is a multidisciplinary area that combines engineering and biological sciences to create goods and technologies that enhance agriculture, human health, and the environment. It entails working with living things or their constituent parts, like genes, proteins, and cells, to produce practical uses. Artificial intelligence is rapidly transforming the biotech industry by transforming processes such as drug discovery, protein engineering, and genomics. Product illustrations of these transformations are generative AI for new drug candidates, predictive machine learning models for molecular interactions, and predictive tools for both clinical trial design and biomarker selection. Furthermore, as traditional news reports show, AI-designed therapies can go from bench to bedside in roughly one-third of the time of a conventional therapeutic design process. This variety of AI technology is capable of accelerating R&D, reducing costs, and increasing the probability of success. A recent example that supports this is SandboxAQ releasing a dataset of 5.2 million synthetic 3D molecules. This synthetic 3D molecules dataset was used to train and optimize existing AI drug–protein binding prediction models and is publicly available.

In the UK, non-medical bioscience research is funded by the Biotechnology and Biological Sciences Research Council. BBSRC supports university departments and scientific research institutes as part of UK Research and Innovation, advancing biotechnology. By streamlining rules and boosting investment, the EU biotech and biomanufacturing initiative seeks to modernise the biotechnology sector. The goal of this project is to make Europe more competitive in the global biotech industry.

Report Coverage

This research report categorizes the biotechnology market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the biotechnology market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the biotechnology market.

Driving Factors

The growth of the global biotechnology market is boosted because it includes a wide range of fields, chief among them being molecular biology, genetic engineering, and biochemistry. Every year, new products and technologies are developed in a variety of industries, including industrial biotechnology, agriculture, and medicine. Growing markets in countries like China, Japan, and India are being characterised by favourable government initiatives that are fuelling international investment and the growth of the biotechnology sector. These government initiatives seek to improve reimbursement guidelines, establish uniform clinical research frameworks, provide clarity on the drug regulatory pathways, and initiate product approvals in a timely manner, creating opportunities for significant growth in the industry.

Restraining Factors

The global biotechnology market faces obstacles like the complexity of operating in numerous jurisdictions with different regulatory environments, which is challenging for international biotech companies.

Market Segmentation

The biotechnology market share is classified into technology and application.

- The DNA sequencing segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based on the technology, the biotechnology market is divided into nanobiotechnology, DNA sequencing, cell-based assays, fermentation, PCR technology, chromatography, tissue engineering & regeneration, and others. Among these, the DNA sequencing segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The segment is driven by the assimilation of advanced DNA sequencing technologies and decreasing sequencing costs. Applications of sequencing in better understanding diseases have risen due to government funding for genetic research.

- The health segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the application, the biotechnology market is divided into health, bioinformatics, food & agriculture, natural resources & environment, and industrial processing. Among these, the health segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The segmental growth is propelled by the increasing burden of diseases, widening access to agri-biotech and bio-services, as well as fulfilling technology frontiers in the bio-industrial field. There have also been meaningful advances in artificial intelligence, machine learning, as well as big data that are expected to further augment the growth of the segment. These advances are expected to encourage the adoption of bioinformatics applications, especially in the food and beverage sector.

Regional Segment Analysis of the Biotechnology Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the biotechnology market over the predicted timeframe.

Get more details on this report -

North America is anticipated to hold the largest share of the biotechnology market over the predicted timeframe. The North American region has been driving the growth because of the presence of significant competition, reputational R&D initiatives, and increased expenditures on health care. The region also benefits from a large uptake of platforms related to cell biology, proteomics, and genomics, so the adoption of life sciences applications is already driving a fast acceleration. Growth in the regional market is expected from the increasing burden of chronic diseases and the increased use of personalised medicine applications to treat life-threatening conditions.

Asia Pacific is expected to grow at a rapid CAGR in the biotechnology market during the forecast period. The Asia Pacific region has expanded due to a combination of positive government initiatives, infrastructure growth from leading companies in the market, and increasing investments and improvements in healthcare infrastructure, which are complementary factors driving the industry's regional growth. For instance, in February 2022, Moderna Inc. announced it would be creating four new subsidiaries in Malaysia, Singapore, Hong Kong, and Taiwan, and is furthering its geographical expansion of commercial capabilities in Asia. In addition, the market is expected to grow with biopharmaceutical collaborations, including the collaborative partnership between Kiniksa Pharmaceuticals and Huadong Medicine for the development and commercialisation of Kiniksa's ARCALYST and mavrilimumab in the Asia Pacific region.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the biotechnology market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- AstraZeneca

- Gilead Sciences, Inc.

- Bristol-Myers Squibb

- Sanofi

- Biogen

- Abbott Laboratories

- Pfizer, Inc.

- Amgen Inc.

- Novo Nordisk A/S

- Merck KGaA

- Johnson & Johnson Services, Inc.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In October 2023, Gilead Sciences, Inc. and Assembly Biosciences collaborated to create advanced therapeutics for severe viral diseases.

- In September 2023, Merck KGaA announced collaborations with BenevolentAI and Exscientia, leveraging artificial intelligence for drug discovery in oncology, neurology, and immunology, with the potential to produce innovative candidates for clinical development.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the biotechnology market based on the following segments:

Global Biotechnology Market, By Technology

- Nanobiotechnology

- DNA Sequencing

- Cell-based Assays

- Fermentation

- PCR Technology

- Chromatography

- Tissue Engineering & Regeneration

- Others

Global Biotechnology Market, By Application

- Health

- Bioinformatics

- Food & Agriculture

- Natural Resources & Environment

- Industrial Processing

Global Biotechnology Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the Biotechnology market over the forecast period?The global Biotechnology market is projected to expand at a CAGR of 14.06% during the forecast period.

-

2. What is the market size of the Biotechnology market?The global Biotechnology market size is expected to grow from USD 2153.9 billion in 2024 to USD 9153.8 billion by 2035, at a CAGR of 14.06% during the forecast period 2025-2035.

-

3. Which region holds the largest share of the Biotechnology market?North America is anticipated to hold the largest share of the Biotechnology market over the predicted timeframe.

Need help to buy this report?