Global Bioprocess Automation Market Size, Share, and COVID-19 Impact Analysis, Russia-Ukraine War Impact, Tariff Analysis, By Type of Controllers (Upstream controllers, Downstream controller, and Bioprocess control software), Scale of Operation (Preclinical, Clinical operations, and Commercial operations), By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: HealthcareGlobal Bioprocess Automation Market Insights Forecasts To 2035

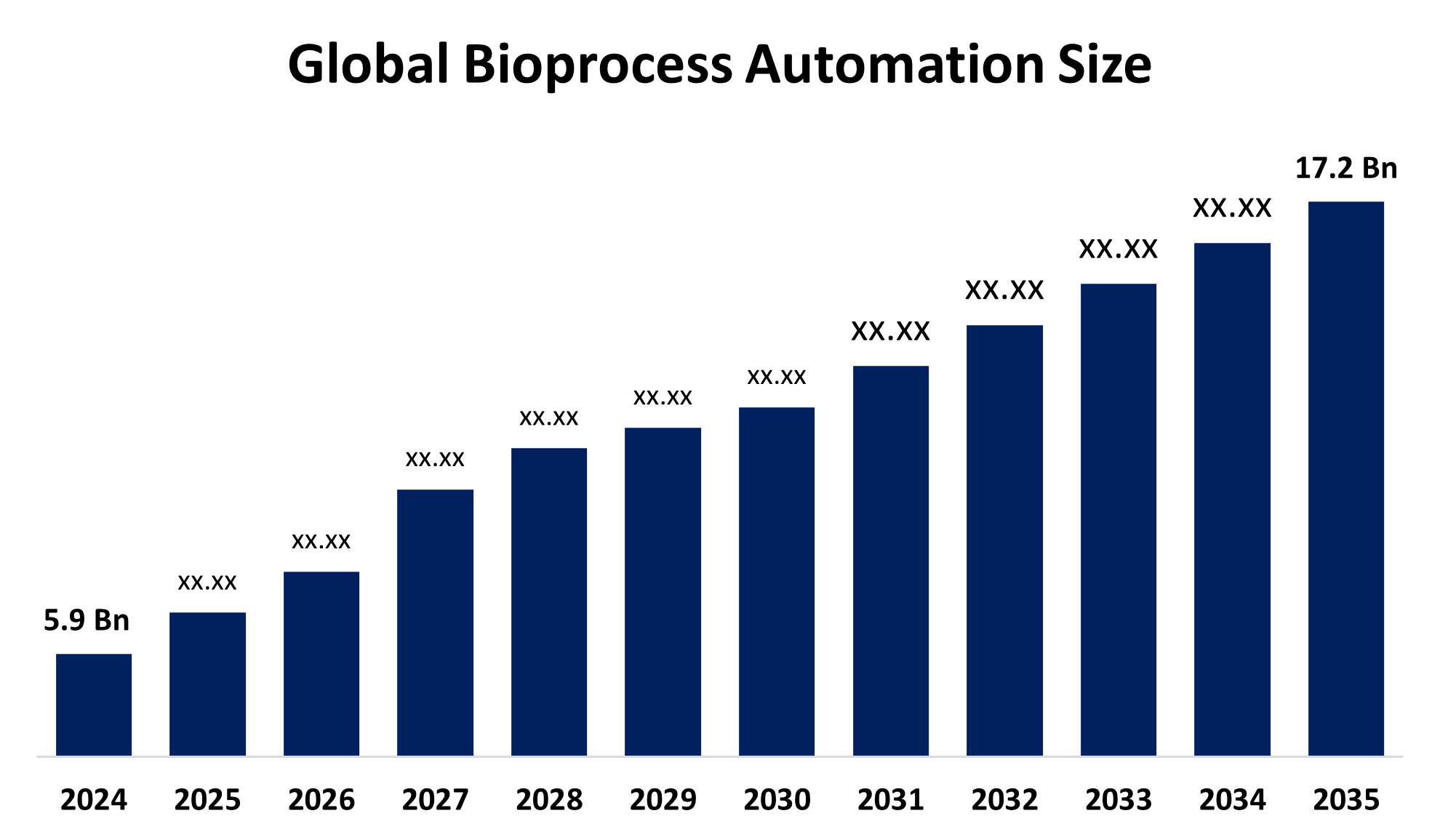

- The Global Bioprocess Automation Market Size Was Estimated at USD 5.9 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 10.22% from 2025 to 2035

- The Worldwide Bioprocess Automation Market Size is Expected to Reach USD 17.2 Billion by

- 2035

- Asia Pacific is expected to grow the fastest during the forecast period.

Get more details on this report -

According to a research report published by Spherical Insights and Consulting, The Global Bioprocess Automation Market Size was valued at approximately USD 5.9 Billion in 2024 and is Projected to Grow from USD 6.5 Billion in 2025 to around USD 17.2 Billion by 2035 at a compound annual growth rate (CAGR) of 10.22% during the forecast period (2025–2035). Automation aids in real-time monitoring and control over bioprocessing workflow, enabling precise control of process parameters, with reduced risk of deviations. It is anticipated that the increasing prevalence of cancer & other chronic diseases, along with an increasing emphasis on personalized medicine, is supporting the market for bioprocess automation.

Global Bioprocess Automation Market Forecast and Revenue Outlook

- 2024 Market Size: USD 5.9 Billion

- 2035 Projected Market Size: USD 17.2 Billion

- CAGR (2025-2035): 10.22%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Market Overview

The bioprocess automation market is the industry encompassing the automated systems and services used for monitoring, controlling, and optimizing bioprocessing workflows, especially in biopharmaceutical manufacturing. Bioprocessing automation includes the use of advanced technologies such as robotics, sensors, and data analytics for managing bioproduction intricacies, addressing the need for biologics, streamlining production, and maintaining rigorous quality standards. Automated technologies, control systems, and software in bioprocessing are used for managing, monitoring, and optimizing biological production processes like fermentation, cell culture, and downstream processing. An increasing need for efficient and consistent production of biologics and vaccines is driving the growth of bioprocess automation. Further, integration of AI, machine learning, and digital twins in bioprocess 4.0 is enhancing efficiency with reduced costs.

The global market share is anticipated to be supported by expanding R&D efforts by major industry participants, like Sartorius Stedium Biotech, for driving innovation in bioprocess solutions. Further, there is an increasing collaborations and partnerships for promoting technological advancements in the bioprocessing industry. For instance, in June 2025, a Canada-UK collaboration is developing AI-powered bioreactors for revolutionizing biopharmaceutical manufacturing. There are opportunities in the developing market due to the increasing integration of AI and machine learning that aid in reducing human errors and accelerating development timelines, promoting next-generation biomanufacturing.

Key Market Insights

- North America is expected to account for the largest share in the Bioprocess Automation Market during the forecast period.

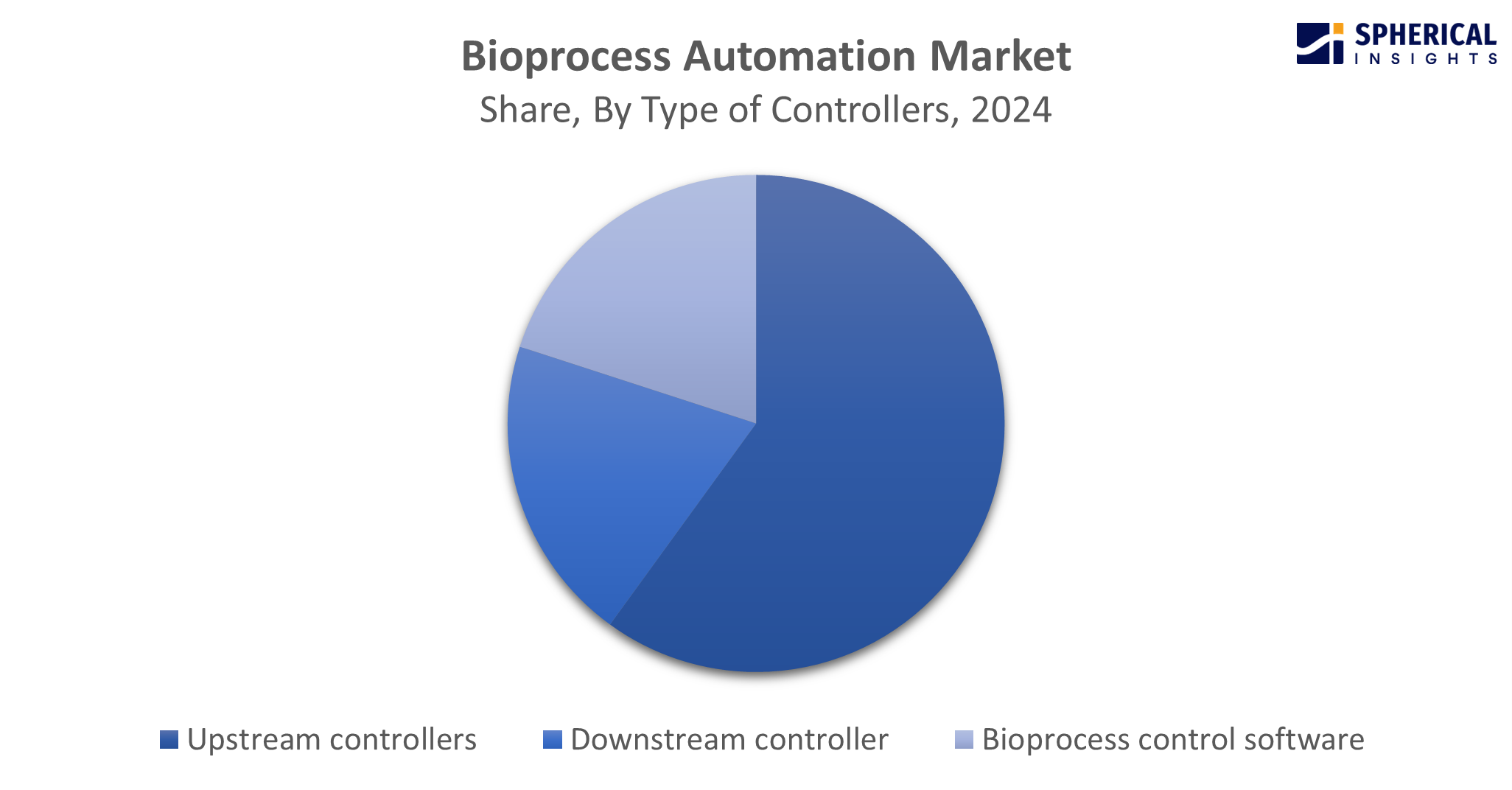

- In terms of type of controllers, the upstream controllers segment is projected to lead the bioprocess automation market throughout the forecast period

- In terms of scale of operation, the preclinical segment captured the largest portion of the market

Bioprocess Automation Market Trends

- AI-driven bioprocess optimization

- Increasing demand for single-use systems

- Rising contract development & manufacturing outsourcing

- Advent of Continuous & Hybrid Platforms

Report Coverage

This research report categorizes the bioprocess automation market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyzes the key growth drivers, opportunities, and challenges influencing the bioprocess automation market. Recent market developments and competitive strategies, such as expansion, type launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyzes their core competencies in each sub-segment of the bioprocess automation market.

Global Bioprocess Automation Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024 : | USD 5.9 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 10.22 % |

| 2035 Value Projection: | USD 17.2 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Type of Controllers, Scale of Operation and By Region |

| Companies covered:: | Cytiva Lifesciences, Thermo Fisher Scientific, Sepragen, Repligen, Applikon Biotechnology, Sartorius, Solaris Biotech, Sysbiotech, Merck KGaA, Corning, Danaher, Thermo Fisher, Emerson, Eppendorf, 3Bar Biologics, Lonza Group AG, Others, and |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis. |

Get more details on this report -

Driving factors: Increasing demand for biologics and focus on personalized medicine are driving the bioprocess automation market

The bioprocess automation market is driven by the growing demand for biologics that require complex and precise manufacturing processes. An increasing prevalence of cancer & other chronic diseases leads to the surging need for therapies and treatments, especially cell-based therapies such as CAR-T cells, which ultimately propel the market demand for bioprocess automation. An increasing emphasis on personalized medicine is responsible for driving the manufacturing of patient-specific therapies such as cell and gene therapies, organoids, and regenerative treatments, propelling the market demand.

Restraining Factor: The increased cost of bioprocessing equipment and stringent regulatory requirements

One of the main factors restraining the bioprocess automation market is the need to manage hazardous extractable and leachable products present in the equipment. Further, the high capital investments and strict regulatory requirements are challenging the bioprocess automation market.

Market Segmentation

The global bioprocess automation market is divided into type of controllers and scale of operation.

Global Bioprocess Automation Market, By Type of Controllers:

Why upstream controllers segment to capture the largest revenue share in 2024?

Get more details on this report -

The upstream controllers segment held the largest revenue share in 2024, due to the growing adoption of upstream bioprocessing, along with an increasing demand for biologics, biosimilars, and advanced cell & gene therapies. Upstream controllers in bioprocessing are used during the stage from cell line development and cultivation to culture expansion of the cells through harvest.

The bioprocess controller segment is anticipated to grow at a rapid CAGR during the forecast period. This is attributed to the growing need for efficient and scalable biomanufacturing processes, with increasing demand for advanced bioprocess automation. Bioprocess controller systems aid in managing, controlling, and optimizing various stages in bioprocessing, such as fermentation, purification, and formulation.

Global Bioprocess Automation Market, By Scale of Operation:

Why did the preclinical segment dominate the bioprocess automation market in 2024?

The preclinical segment dominated the bioprocess automation market with a significant share in 2024. This is due to the growing emphasis on early-stage drug development, along with the surging demand for rapid, cost-effective testing of biologics. In bioprocessing, therapeutic substances, including vaccines, monoclonal antibodies, and gene therapy vectors, are produced from the use of live biological substances and their components.

The commercial segment is anticipated to grow at the fastest CAGR during the forecast period, as automation in commercial applications aids in providing consistent quality, compliance, and reduced time-to-market in large-scale facilities.

Regional Segment Analysis of the Global Bioprocess Automation Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America Bioprocess Automation Market Trends

Why is North America leading the global bioprocess automation market, and what factors are responsible for its dominance?

North America is leading the bioprocess automation market with the largest share over the forecast period. The North American region's supremacy includes the presence of leading biopharmaceutical companies and advanced R&D infrastructure, along with the adoption of innovative technologies. Further, an integration of cloud-based platforms and AI for enhancing data-driven decision-making and predictive analytics contributes to propelling market growth.

is the U.S. maintaining its leading position in the North America bioprocess automation market?

U.S. is positioned as a leader in the North America market, due to the growing need for high-throughput and precision bioprocessing solutions, along with increased investment in R&D by key players like Sartorius, GE Healthcare, and Danaher. Further, an increase in personalized medicine and biologics, with the supportive regulatory frameworks, is driving the market demand for bioprocess automation.

Why is the Asia Pacific region expected to have the fastest CAGR, and what factors are responsible for rapid growth in the bioprocess automation market?

Asia Pacific is expected to grow at the fastest CAGR in the global bioprocess automation market during the forecast period. Several factors, including the increased investment in biotechnology research and expanding biopharmaceutical manufacturing capabilities, are driving the bioprocess automation market in the region. Further, an increasing production of biopharmaceuticals such as recombinant proteins and vaccines is contributing to supporting the market demand for bioprocess automation.

What are the key drivers behind the significant market expansion in China?

China market is significantly expanding in the Asia Pacific region, due to the significant investment in biomanufacturing infrastructure, with a rising focus on innovative therapies. With the rapid expansion of the biopharmaceutical industry, the surging need for minimizing contamination risks in biologics production is driving the need for single-use bio-processing systems, which contributes to propelling the market demand.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global bioprocess automation market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Worldwide Top Key Players In The Bioprocess automation market Include

- Cytiva Lifesciences

- Thermo Fisher Scientific

- Sepragen

- Repligen

- Applikon Biotechnology

- Sartorius

- Solaris Biotech

- Sysbiotech

- Merck KGaA

- Corning

- Danaher

- Thermo Fisher

- Emerson

- Eppendorf

- 3Bar Biologics

- Lonza Group AG

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent development

- In March 2025, Prendio-BioProcure, announced the launch of its most advanced set of capabilities to date, enabling cost savings, further workflow automation, and supplier intelligence to R&D-driven organizations.

- In February 2025, the Cultivated B announced the launch of multi-channel biosensors that would set benchmarks in monitoring growth and metabolism of cell culture and fermentation processes.

- In January 2025, Sartorius and McMaster University have opened a 1,600 square foot bioprocess research facility in Hamilton, Ontario, about 38 miles south of Toronto. The automation laboratory, located at the university’s Faculty of Engineering, is a training and development hub for bioprocess modelling, simulation, and advanced control.

- In December 2024, Sartorius Stedim Biotech opened its new Center for Bioprocess Innovation in Marlborough, Massachusetts. This state-of-the-art facility is designed to foster collaboration, co-development, and learning on-site with customers and other external innovation partners, applying Sartorius' latest technologies in real-life bioprocess workflows.

Market Segment

This study forecasts revenue at the global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the bioprocess automation market based on the following segments:

Global Bioprocess Automation Market, By Type of Controllers

- Upstream controllers

- Downstream controller

- Bioprocess control software

Global Bioprocess Automation Market, By Scale of Operation

- Preclinical

- Clinical operations

- Commercial operations

Global Bioprocess Automation Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the market size of the bioprocess automation market?The global bioprocess automation market size is expected to grow from USD 5.9 Billion in 2024 to USD 17.2 Billion by 2035, at a CAGR of 10.22% during the forecast period 2025-2035.

-

2. Which region holds the largest share of the bioprocess automation market?North America is anticipated to hold the largest share of the bioprocess automation market over the predicted timeframe.

-

3. What is the forecasted CAGR of the Global Bioprocess automation Market from 2024 to 2035?The market is expected to grow at a CAGR of around 10.22% during the period 2024–2035.

-

4. Who are the top companies operating in the Global Bioprocess Automation Market?Key players include Cytiva Lifesciences, Thermo Fisher Scientific, Sepragen, Repligen, Applikon Biotechnology, Sartorius, Solaris Biotech, Sysbiotech, Merck KGaA, Corning, Danaher, Thermo Fisher, Emerson, Eppendorf, 3Bar Biologics, and Lonza Group AG.

-

5. Can you provide company profiles for the leading bioprocess automation manufacturers?Yes. For example, Cytiva Lifesciences is a global biotechnology leader dedicated to helping customers discover and commercialize the next generation of therapeutics. Thermo Fisher Scientific is the world leader in serving science, with annual revenue of approximately $40 billion.

-

6. What are the main drivers of growth in the bioprocess automation market?An increasing prevalence of cancer & other chronic diseases and emphasis on personalized medicine are major market growth drivers of the bioprocess automation market.

-

7. What challenges are limiting the bioprocess automation market?Increased cost of bioprocessing equipment and stringent regulatory requirements remain key restraints in the bioprocess automation market.

Need help to buy this report?