Global Bioplastics & Biopolymers Market Size, Share, and COVID-19 Impact By Type (Biodegradable, Non-Biodegradable/Biobased), By End User (Packaging, Consumer Goods, Automotive & Transportation, Textiles, Agriculture & Horticulture, Others), By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2022 – 2032.

Industry: Chemicals & MaterialsGlobal Bioplastics & Biopolymers Market Size Insights Forecasts to 2032

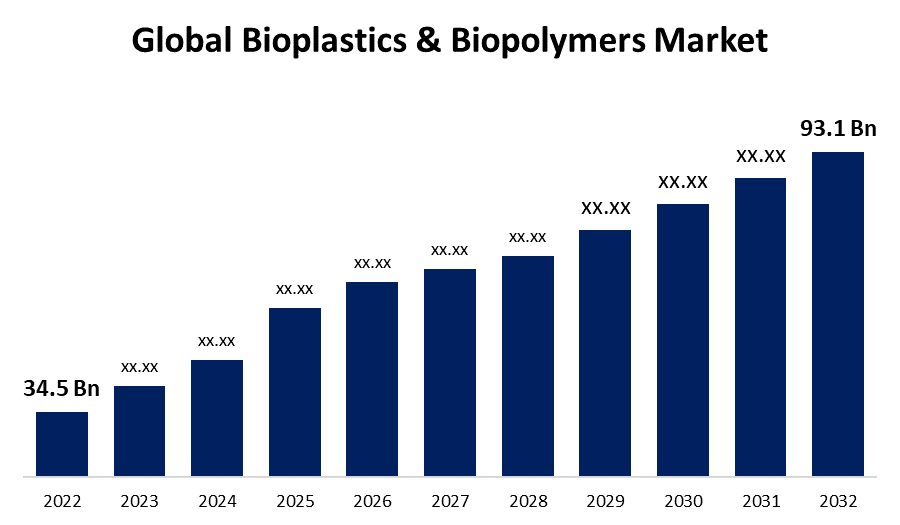

- The Bioplastics & Biopolymers Market Size was valued at USD 34.5 Billion in 2022.

- The Market Size is Growing at a CAGR of 11.3% from 2022 to 2032

- The Worldwide Bioplastics & Biopolymers Market Size is expected to reach USD 93.1 Billion by 2032

- Europe is expected to Grow the fastest during the forecast period

Get more details on this report -

The global Bioplastics & Biopolymers Market Size is expected to reach USD 93.1 Billion by 2032, at a CAGR of 11.3% during the forecast period 2022 to 2032.

Bioplastics and biopolymers are substances made from renewable resources like plants, algae, or microbes. They are thought to be more environmentally friendly than conventional plastics made from petroleum. Due to their potential to lessen the negative environmental effects of plastic manufacture and disposal, they have received attention and popularity. Due to rising environmental concerns, governmental regulations, and consumer demand for eco-friendly and sustainable products, the bioplastics and biopolymers Market Size has seen substantial expansion in recent years. Bioplastics are employed in a variety of industries, including as packaging, manufacturing, textiles, and consumer goods. In addition to being used in a variety of products in place of traditional plastics, biopolymers are also being used in the medical industry.

Impact of COVID 19 On Global Bioplastics and Biopolymers Market Size

The bioplastics and biopolymers business, like many others, saw supply chains disrupted. The production and shipment of raw materials and completed goods were delayed as a result of lockdowns, travel restrictions, and plant closures around the world. In industries like automotive and hospitality, which are major consumers of bioplastics and biopolymers for products like automobile components and food packaging, the pandemic resulted in decreased demand for non-essential commodities. Sales and production in several industries were momentarily impacted by the decline in demand. On the other side, during the pandemic there was a rise in the need for packaging materials, particularly for food and medical supplies. As customers became more mindful about cleanliness, bioplastics and biopolymers, which are known for their biodegradability and sustainability, gained popularity in the packaging sector.

Global Bioplastics & Biopolymers Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022: | USD 34.5 Billion |

| Forecast Period: | 2022-2032 |

| Forecast Period CAGR 2022-2032 : | 11.3% |

| 2032 Value Projection: | USD 93.1 Billion |

| Historical Data for: | 2018-2021 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Type, By End User, by Region and COVID-19 Impact. |

| Companies covered:: | NatureWorks (US), Braskem (Brazil), BASF (Germany), Total Corbion (Netherlands), Novamont (Italy), Biome Bioplastics (UK), Mitsubishi Chemical Holding Corporation (Japan), Biotec (Germany), Toray Industries (Japan), Plantic Technologies (Australia), and other key vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth & Analysis. |

Get more details on this report -

Key Market Size Drivers

Sustainable and environmentally friendly items were becoming more and more popular with consumers. Bioplastics and biopolymers were viewed as more ethical options, particularly in sectors like consumer goods and food packaging. Beyond packaging, bioplastics and biopolymers are finding use in a variety of fields, such as agriculture, automotive, textiles, and medical equipment. The expansion of the Market Size was being driven by this application diversity. Investments were being given to businesses in the bioplastics and biopolymers sector to increase manufacturing capacity and create new goods. This investment was promoting Market Size Growth and innovation. While Asia-Pacific and Latin America were exhibiting rising interest and Growth potential, Europe and North America were the first regions to use bioplastics. The Market Size was also Growing internationally.

Key Market Size Challenges

The cost of production is one of the biggest issues facing the industry for bioplastics and biopolymers. Comparatively speaking to conventional plastics generated from fossil fuels, bioplastics are typically more expensive to make. A significant challenge is lowering production costs while maintaining product quality. It's possible that bioplastics won't always perform and last as well as conventional polymers. This may limit their use in sectors where high-performance materials are necessary. The availability of suitable feedstock, such as corn, sugarcane, or algae, is necessary for the synthesis of bioplastics. Supply chain difficulties and price instability may result from competition for these resources between the food industry and other businesses. It can be difficult to persuade customers to pick bioplastics over conventional plastics.

Market Size Segmentation

Type Insights

Biodegradable segment holds the highest Market Size share over the forecast period

On the basis of type, the global Bioplastics & Biopolymers Market Size is segmented into Biodegradable, Non-Biodegradable/Biobased. Among these, the biodegradable segment holds the highest Market Size share over the forecast period. The desire for biodegradable substitutes has Grown as a result of Growing awareness of the negative environmental effects of conventional plastics, which can take centuries to degrade. Given that they spontaneously decompose into non-toxic components, biodegradable polymers are viewed as a more environmentally friendly alternative. The availability and diversity of biodegradable products on the Market Size have increased as a result of significant investments made by the plastics industry's major players in the development and production of biodegradable polymers. The usage of biodegradable plastics in a variety of products, including as packaging, textiles, medical equipment, and agriculture, is a key factor in the Market Size's expansion.

End User Insights

Packaging is dominating the Market Size with the largest Market Size share over the forecast period

On the basis of end user, the global Bioplastics & Biopolymers Market Size is segmented into Packaging, Consumer Goods, Automotive & Transportation, Textiles, Agriculture & Horticulture, Others. Among these, the packaging is dominating the Market Size with the largest Market Size share over the forecast period. As part of their corporate sustainability objectives, businesses are employing more and more bioplastics and biopolymers in their packaging. Making use of sustainable packaging can improve a company's brand image and show that it is dedicated to environmental responsibility. Currently, bioplastics and biopolymers are used in a variety of packaging applications, including food packaging, cosmetics, personal care items, and more. The Growth of the industry has been aided by this Market Size diversity. To fulfil the Growing demand from the packaging sector, many producers have invested in increasing their bioplastic and biopolymer production capacities. Retailers and e-commerce businesses have started sustainable packaging initiatives, which use bioplastics and biopolymers to lessen the impact of packaging materials on the environment.

Regional Insights

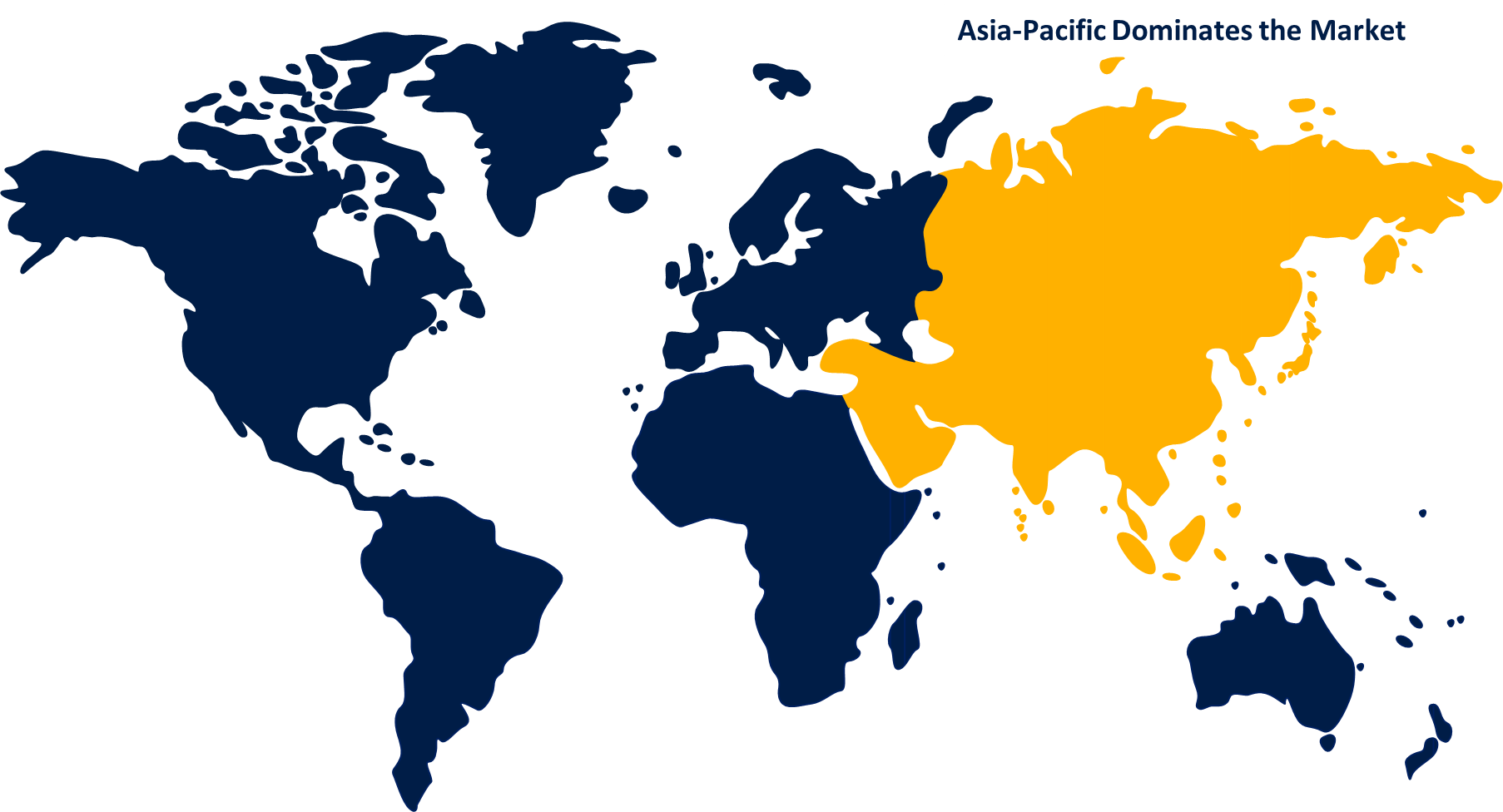

Asia Pacific is dominating the Market Size over the forecast period

Get more details on this report -

Asia Pacific is dominating the Market Size with the largest Market Size share over the forecast period. One of the world's largest-Growing Market Sizes for bioplastics and biopolymers was the APAC area. The Market Size expanded as a result of factors like the big population, rising environmental consciousness, and helpful government regulations. Consumers in the APAC area are becoming more environmentally conscious, which has resulted in a Growing preference for sustainable and eco-friendly goods, such as biodegradable and compostable packaging made of bioplastics. India, Thailand, and Vietnam are examples of nations with sizable agricultural sectors that have investigated using agricultural biomass as a feedstock for the manufacture of bioplastics. This lessened the reliance on feedstock derived from fossil fuels. In the APAC area, the packaging industry dominated the end-user Market Size for bioplastics. The use of biodegradable and biobased materials has significantly increased, particularly in food packaging.

Europe is witnessing the fastest Market Size Growth over the forecast period. In Europe, the adoption of bioplastics was greatly influenced by the packaging sector. Businesses in the area were utilising bioplastics for food packaging, drink containers, and other uses to satisfy sustainability objectives and legal requirements. Corn, sugarcane, potato starch, and cellulose from wood are just a few of the feedstocks that Europe has been employing to make bioplastics. Regional availability and sustainability factors are frequently taken into account while choosing a feedstock.

Recent Market Size Developments

- In April 2021, The global leader in espresso handling and packaging, IMA Coffee, was listed by NatureWorks as another crucial company. This company aims to increase demand for high-quality biodegradable K-cups in North America.

List of Key Companies

- NatureWorks (US)

- Braskem (Brazil)

- BASF (Germany)

- Total Corbion (Netherlands)

- Novamont (Italy)

- Biome Bioplastics (UK)

- Mitsubishi Chemical Holding Corporation (Japan)

- Biotec (Germany)

- Toray Industries (Japan)

- Plantic Technologies (Australia)

Market Size Segment

This study forecasts revenue at global, regional, and country levels from 2019 to 2032. Spherical Insights has segmented the global Bioplastics & Biopolymers Market Size based on the below-mentioned segments:

Bioplastics & Biopolymers Market Size, Type Analysis

- Biodegradable

- Non-Biodegradable/Biobased

Bioplastics & Biopolymers Market Size, End Use Analysis

- Packaging

- Consumer Goods

- Automotive & Transportation

- Textiles

- Agriculture & Horticulture

- Others

Bioplastics & Biopolymers Market Size, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the Market Size size of Bioplastics & Biopolymers Market Size?The global Bioplastics & Biopolymers Market Size is expected to Grow from USD 34.5 Billion in 2022 to USD 93.1 Billion by 2032, at a CAGR of 11.3% during the forecast period 2022-2032.

-

2. Who are the key Market Size players of Bioplastics & Biopolymers Market?Some of the key market players of NatureWorks (US), Braskem (Brazil), BASF (Germany), Total Corbion (Netherlands), Novamont (Italy), Biome Bioplastics (UK), Mitsubishi Chemical Holding Corporation (Japan), Biotec (Germany), Toray Industries (Japan), Plantic Technologies (Australia).

-

3. Which segment hold the largest market share?Packaging segment holds the largest market share is going to continue its dominance.

-

4. Which region is dominating the Bioplastics & Biopolymers Market?Asia Pacific is dominating the Bioplastics & Biopolymers Market with the highest market share.

Need help to buy this report?