Global Biopesticides Market Size, Share, and COVID-19 Impact Analysis, By Product Type (BioHerbicides, Bio Insecticides, Bionematicides, BioFungicides, and Others), By Application (Seed Treatment, Foliar Spray, and Soil Spray), By Source (Biochemicals, Microbials, and Beneficial Insects), and By Crop Type (Grains & Oil Seeds, Fruits & vegetables, Cereals, and Others), By Form (Dry and Liquid), by Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2021 - 2030

Industry: AgricultureGlobal Biopesticides Market Insights Forecasts to 2030

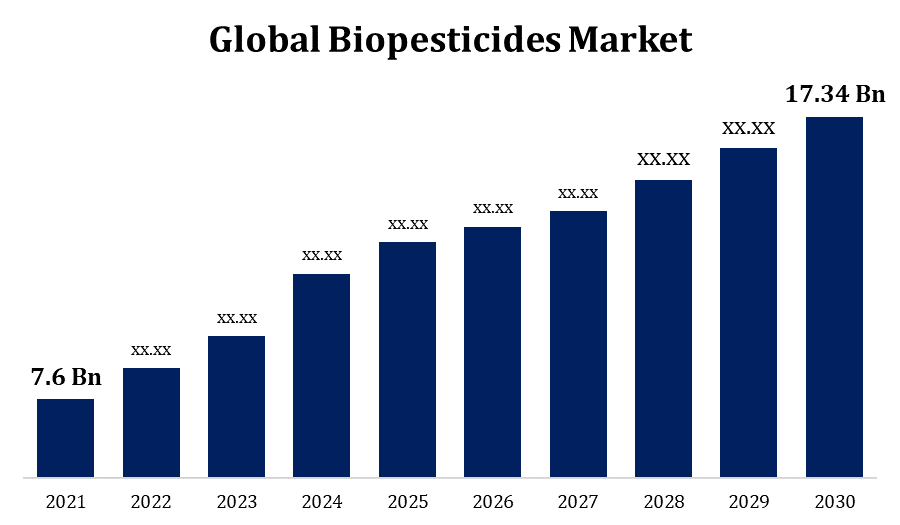

- The global Biopesticides market was valued at USD 7.6 billion in 2021.

- The market is growing at a CAGR of 9.6% from 2021 to 2030

- The global Biopesticides market is expected to reach USD 17.34 billion by 2030

- The Asia Pacific is expected to grow the fastest during the forecast period

The global Biopesticides market is expected to reach USD 17.34 billion by 2030, at a CAGR of 9.6% during the forecast period 2021 to 2030. The Biopesticides market has been growing owing to the increasing applications of medical tubes. Furthermore, the increasing concern for healthcare facilities and stringent regulatory and sustainability mandates propel the market’s growth.

Get more details on this report -

Market Overview

Biopesticides are specific forms of pesticides made from natural substances like bacteria, animals, plants, and minerals. The common pests that attack pulses, commercial crops, grains, oil seeds, cereals, ornamental crops, fruits, and vegetables are managed and controlled by applying these microbe-based biopesticides. Canola oil and baking soda are two examples of biopesticides that have pesticide uses. The Central Insecticides Board and Registration Committee currently have 970 biopesticide products registered (CIBRC). Seed treatments and soil supplements are two key growth areas for biopesticides. Controlling soil-borne fungal infections that cause seed rots, damping-off, root rot, and seedling blights requires using fungicidal and bio fungicidal seed treatments. Both fungal pathogens on the seed's surface and those that are inside the seed can be controlled with their help. The Environmental Protection Agency (EPA) in the United States oversees controlling pesticides to ensure they don't negatively impact people or the environment. All regulatory actions about biopesticides are handled by the EPA's Biopesticides and Pollution Prevention Division (BPPD). The enormous costs involved in developing new synthetic crop protection chemicals have led to fierce competition among the major players in the biopesticides sector. The protracted delay in introducing chemical pesticides allows major industries to develop more environmentally friendly alternatives, which has increased the demand for biopesticides. One of the main disadvantages of biological goods is that they have a limited shelf life and a high risk of contamination. Other problematic factors that affect their shelf life include culture mediums, the physiological state of the microorganisms when harvested, sunlight exposure, temperature management during storage, and water activity. The development of microbial and RNA interference (RNAi) technologies by major businesses like Bayer AG (Germany) enables farmers to use better alternatives for applying biological products and opening new market prospects.

Global Biopesticides Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2021 |

| Market Size in 2021: | USD 7.6 Billion |

| Forecast Period: | 2021 - 2030 |

| Forecast Period CAGR 2021 - 2030 : | 9.6% |

| 2030 Value Projection: | USD 17.34 Billion |

| Historical Data for: | 2017 - 2020 |

| No. of Pages: | 197 |

| Tables, Charts & Figures: | 137 |

| Segments covered: | By Product Type, By Application, By Source, By Crop Type, By Form, by Region |

| Companies covered:: | AgBioChem, Inc., Ajay Bio-Tech Ltd., BASF SE, Amit Biotech Pvt. Ltd., Marrone Bio innovation, Arizona Biological Control, Inc., AgBiTech Pty Ltd., Bayer AG, kemin industries, Andermatt Biocontrol AG, Novozymes A/S. |

| Growth Drivers: | The bio-insecticide segment dominated the market with the largest market share |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Report Coverage

This research report categorizes the market for Biopesticides based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Biopesticides market. Recent market developments and competitive strategies such as expansion, product launch and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segments of the Biopesticides market.

Segmentation Analysis

- In 2021, the bio-insecticide segment dominated the market with the largest market share of 24.6% and market revenue of 0.49 billion.

Based on the Product, the biopesticides market is categorized into BioHerbicides, Bio Insecticides, Bionematicides, BioFungicides, and Others. In 2021, the bio-insecticide segment dominated the market with the largest market share of 24.6% and market revenue of 0.49 billion. Due to their greater effectiveness, the bio-insecticide market is expected to grow at a significant CAGR as the emphasis is shifting towards bioinsecticides from traditional insecticides. The market demand has also been supported by the product's positive outlook in agriculture, particularly concerning protecting plants and crops from destructive insects.

- In 2021, the foliar spray segment dominated the market with the largest market share of 42.6% and market revenue of 0.85 billion

Based on Application, the Biopesticides Market is categorized into seed treatment, foliar spray, and soil spray. In 2021, the foliar spray segment dominated the market with the largest market share of 42.6% and market revenue of 0.85 billion. The foliar spray segment is expected to account for the largest revenue in the market as foliar spray application is becoming more popular because of the immediate plant response and superior efficiency. The need for biopesticides is boosted by the growing use of foliar spray for crop protection due to the simple availability of spray ingredients and ease of application.

- In 2021, the microbial segment dominated the market with the largest market share of 48.7% and market revenue of 0.97 billion

Based on source, the market is segmented into biochemicals, microbials, and beneficial insects. In 2021, the microbial segment dominated the market with the largest market share of 48.7% and market revenue of 0.97 billion. The microbial segment is likely to account for higher CAGR during a forecast period due to the advancement in the microbiology sector. Microbial products are made up of the organisms or metabolites they generate on their own. Additionally, microbial pesticide residues are non-toxic and safe to employ at all phases of plantation development, which promotes the growth of the microbial biopesticide market.

- In 2021, the fruits and vegetable segment dominated the market with the largest market share of 39.8% and market revenue of 0.79 billion

Based on crop, the biopesticide market is classified into grains & oil seeds, fruits & vegetables, cereals, and others. In 2021, the fruits and vegetable segment dominated the market with the largest market share of 39.8% and market revenue of 0.79 billion. The fruits and vegetables are sub-segmented into grapes, apples, potatoes, and others. The cereal segment is anticipated to grow at a high CAGR due to increased demand for organic cereals. The surge in the cultivation of cereals is present as it is considered a staple food that boosts segment growth.

- In 2021, the liquid segment dominated the market with the largest market share of 59.8% and market revenue of 1.19 billion

Based on form, the biopesticide market is bifurcated into dry and liquid. In 2021, the liquid segment dominated the market with the largest market share of 59.8% and market revenue of 1.19 billion. There are liquid and dry formulations of biopesticides. The liquid formulation currently dominates the market and will likely do so throughout the forecast period. This is because liquid formulas are practical and simple to use. The demand for liquid formulations is being driven by an increase in the foliar mode of administration and vice versa. In most cases, liquid formulations are sprayed, which results in the even application of biopesticides. Additionally, they are more effective because liquid formulations make the microbial active components more viable than dry ones. As a result, they are anticipated to grow more quickly over the forecast period.

Regional Segment Analysis of the Biopesticides Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Get more details on this report -

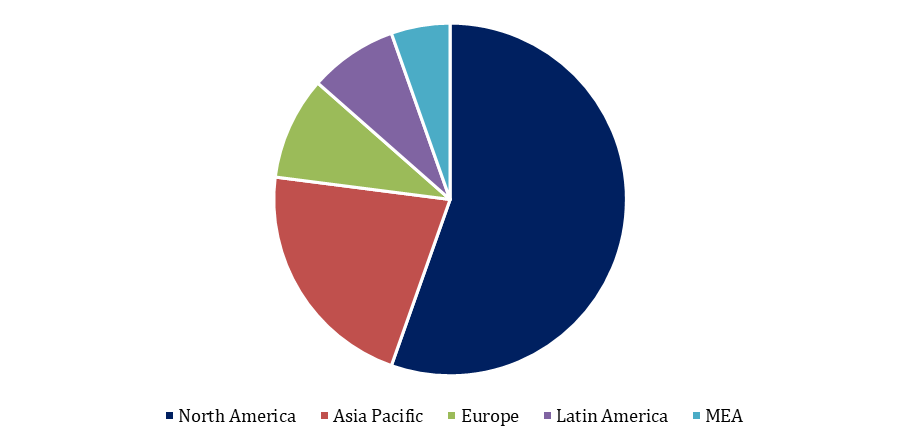

North America emerged as the largest market for the global Biopesticides market, with a market share of around 36.7% and 0.7 billion of the market revenue in 2021.

- North America emerged as the largest market for the global Biopesticides market, with a market share of around 36.7% and 0.7 billion of the market revenue in 2021. North America held the largest share in the market in 2021. One of the main factors influencing the market's adoption is the decline of conventional products due to registration or product performance concerns. Numerous businesses, including FMC Corporation and Marrone Bio Innovations, are concentrating on research to develop products with superior active ingredients.

- The Asia-Pacific market is expected to grow at the fastest CAGR between 2021 and 2030 due to the presence of large agricultural operations in developing countries such as China and India. Also, the accessibility of numerous variants of predator and microbial biopesticides for distinct insects, pests, and contaminants that consumers favor for protecting their crops. Moreover, the surge in demand for biopesticides in the agricultural sector of Asia-Pacific propels the demand for biopesticide products.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global Biopesticides market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Market Players:

AgBioChem, Inc.

Ajay Bio-Tech Ltd.

BASF SE

Amit Biotech Pvt. Ltd.

Marrone Bio innovation

Arizona Biological Control, Inc.

AgBiTech Pty Ltd.

Bayer AG

kemin industries

Andermatt Biocontrol AG

Novozymes A/S.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Third-party knowledge providers

- Value-Added Resellers (VARs)

Recent Development

- In June 2021, Marrone Bio innovation partnered with a Canada-based ATP Nutrition to deliver Stargus Bio fungicide on Canadian broadacre crops.

- In April 2020, Novozyme and Syngenta, announced the launch of a new bio fungicide termed TAEGRO in European and Latin American markets.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2021 to 2030. Spherical Insights has segmented the global Biopesticides market based on the below-mentioned segments:

Biopesticides Market, By Product

- BioHerbicides

- Bio Insecticides

- Bionematicides

- BioFungicides

- Others

Biopesticides Market, By Application

- Seed Treatment

- Foliar Spray

- Soil Spray

Biopesticides Market, By Crop

- Grains & Oil Seeds

- Fruits & vegetables

- Cereals

- Others

Biopesticides Market, By Form

- Dry

- Liquid

Biopesticides Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of Middle East & Africa

Frequently Asked Questions (FAQ)

-

What is the market size of the global Biopesticides market?As per Spherical Insights, the size of the Biopesticides market was valued at USD 2.0 Billion in 2021 to USD 5.19 Billion by 2030.

-

What is the market growth rate of the global Biopesticides market?The global Biopesticides market is growing at a CAGR of 11.2% during the forecast period 2021-2030.

-

Which region dominates the global Biopesticides market?North America emerged as the largest market for Biopesticides.

-

What is the significant driving factor for the Biopesticides market?The increasing rules and regulations by the government for eco-friendly inputs will influence the market's growth.

-

Which factor is limiting the growth of the Biopesticides market?Low shelf life could hamper the market growth.

-

What is an opportunity for the Biopesticides market?The rising demand for organic food will provide considerable opportunities to the market.

-

Who are the key players in the global Biopesticides market?Key players of the Biopesticides market are BASF SE, Indigo Ag, Agrolink, Bayer Crop Science, Certis USA LLC, Koppert Biological Systems, Marrone Bio Innovations, Valent Biosciences LLC, Seipasa SA, Corteva Agriscience, CairoChem, Chema Industries, Novozymes, and Bio Intrant.

Need help to buy this report?