Global Biopesticides and Biofertilizers Market Size, Share, and COVID-19 Impact Analysis, By Type (Bioinsecticides, Biofungicides, Bionematicides, Bioherbicides, and Others), By Formulation (Liquid and Dry) and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035.

Industry: AgricultureGlobal Biopesticides and Biofertilizers Market Insights Forecasts to 2035

- The Global Biopesticides and Biofertilizers Market Size Was Estimated at USD 8.2 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 10.54% from 2025 to 2035

- The Worldwide Biopesticides and Biofertilizers Market Size is Expected to Reach USD 24.7 Billion by 2035

- Asia-Pacific is expected to grow the fastest during the forecast period.

Get more details on this report -

According to a research report published by Spherical Insights and Consulting, the global biopesticides and biofertilizers market size was worth around USD 8.2 billion in 2024 and is predicted to grow to around USD 24.7 Billion by 2035 with a compound annual growth rate (CAGR) of 10.54% from 2025 to 2035. The market is expanding at a great pace because of the rise in consumer demand for sustainable farming, increased suspicion about the environmental and health effects of chemical inputs, the fast progress in microbial and plant-based technologies, and the implementation of government incentives for organic and eco-friendly farming that are supportive.

Market Overview

The Biopesticides and Biofertilizers Market Size on a global scale is the marketplace that produces and uses various natural substances for enhancing plants’ growth and protecting them from insects, diseases, and lack of nutrients. Among the different types of biopesticides, there are microbial, botanical, and biochemical agents, etc. The market is mainly powered by the increasing worldwide demand for eco-friendly farming, growing chemical pesticide hazard awareness, and government measures that support organic farming. The entry of advanced technologies, including the development of new microbial formulations and the adoption of precision farming, are significant factors that also contribute to the market growth. The increase in the world population and the concerns regarding food security are pushing the demand for more eco-friendly ways of crop protection and soil enhancement, thus the biopesticides and biofertilizers market is expected to experience substantial growth during the forecast period.

Report Coverage

This research report categorizes the Biopesticides and Biofertilizers Market Size based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the biopesticides and biofertilizers market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the biopesticides and biofertilizers market.

Global Biopesticides and Biofertilizers Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 8.2 Billion |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | CAGR of 10.54% |

| 2035 Value Projection: | USD 24.7 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 90 |

| Segments covered: | By Product Type, By Application |

| Companies covered:: | , Bayer CropScience, BASF SE, Syngenta AG, Novozymes A/S, UPL Limited, Marrone Bio Innovations, Koppert Biological Systems, Certis USA, Rizobacter Argentina S.A., T. Stanes & Company Ltd.,and other players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The Market for Biopesticides and Biofertilizers is experiencing expansion due to the increasing consumer demand for organic food and sustainable agriculture, as these products facilitate eco-friendly farming practices. The use of biopesticides and biofertilizers is also supported by government incentives and subsidies that promote organic farming and the reduction of chemical inputs.

Restraining Factors

The Market for Biopesticides and Biofertilizers worldwide is subject to several factors that restrain its growth, namely the expensive production, short lifespan, variable performance in fields, unawareness among farmers, hard regulatory approvals, and the slow adoption compared to chemicals.

Market Segmentation

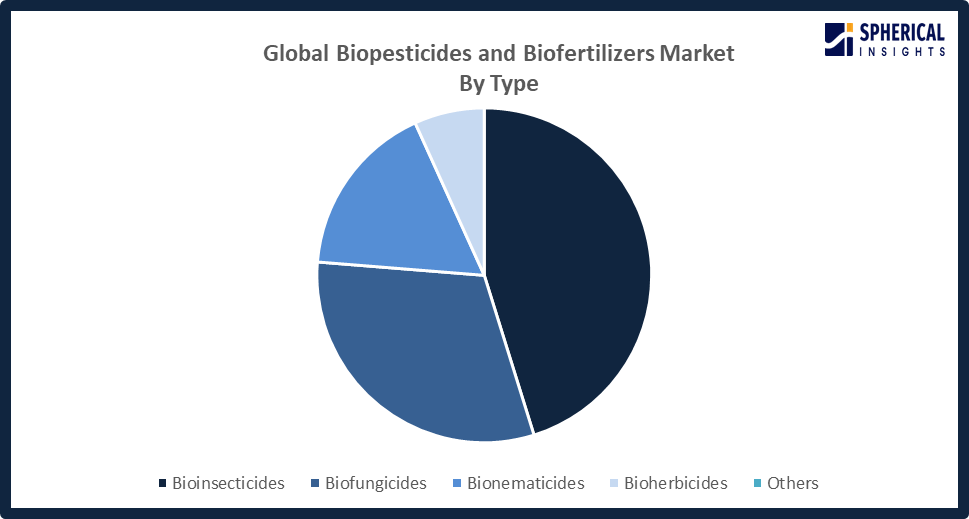

The biopesticides and biofertilizers market share is classified into type and formulation.

- The bioinsecticides segment dominated the market in 2024, approximately 45% and is projected to grow at a substantial CAGR during the forecast period.

Based on the type, the Biopesticides and Biofertilizers Market Size is divided into bioinsecticides, biofungicides, bionematicides, bioherbicides, and others. Among these, the bioinsecticides segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The factors that are promoting growth include their efficiency in pest control, lower resistance development risk as compared to chemical insecticides, and their collaboration with integrated pest management (IPM) programs. Additionally, the increasing worries about the environmental impact and health hazards of synthetic pesticides have also contributed to the preference for bioinsecticides in both conventional and organic farming, thus strengthening their position in the biopesticide market.

Get more details on this report -

- The dry segment accounted for the largest share in 2024, approximately 55% and is anticipated to grow at a significant CAGR during the forecast period.

Based on the formulation, the biopesticides and biofertilizers market is divided into liquid and dry. Among these, the dry segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The segment is expanding because it has a longer shelf life, is easy to store and transport, is economical, is suitable for large-scale farming, can be used with the existing fertilizer application equipment, and performs uniformly even in different environmental conditions, thus being the favored option for farmers practicing sustainable agriculture.

Regional Segment Analysis of the biopesticides and biofertilizers Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the biopesticides and biofertilizers market over the predicted timeframe.

North America is anticipated to hold the largest share of the biopesticides and biofertilizers market over the predicted timeframe. The market share is influenced by various elements such as the high degree of knowledge and usage of sustainable farming techniques, strict government regulations mandating the use of environment-friendly inputs, and large amounts of money spent on agricultural research and development (R&D). On top of that, the already existing organic farming industries and the consumer's preference for organic and sustainable food products are the main drivers of the market expansion.

Get more details on this report -

Asia-Pacific is expected to grow at a rapid CAGR in the biopesticides and biofertilizers market during the forecast period. The expansion of agricultural activities is the main reason behind the demand increase for organic and chemical-free produce, supportive government policies, and rising farmer awareness. Moreover, technological advancements in bioformulations and the growing adoption of sustainable and eco-friendly farming practices also contribute to the situation.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the biopesticides and biofertilizers market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Bayer CropScience

- BASF SE

- Syngenta AG

- Novozymes A/S

- UPL Limited

- Marrone Bio Innovations

- Koppert Biological Systems

- Certis USA

- Rizobacter Argentina S.A.

- T. Stanes & Company Ltd.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In March 2024, U.S. crop biologicals had shown strong environmental promise but faced adoption challenges due to performance trust issues and cost concerns, even as interest in sustainable agricultural inputs and biological solutions for crop protection grew among farmers and industry stakeholders.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the biopesticides and biofertilizers market based on the below-mentioned segments:

Global Biopesticides and Biofertilizers Market, By Type

- Bioinsecticides

- Biofungicides

- Bionematicides

- Bioherbicides

- Others

Global Biopesticides and Biofertilizers Market, By Formulation

- Liquid

- Dry

Global Biopesticides and Biofertilizers Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1.What is the CAGR of the biopesticides and biofertilizers market over the forecast period?The global biopesticides and biofertilizers market is projected to expand at a CAGR of 10.54% during the forecast period.

-

2.What is the market size of the biopesticides and biofertilizers market?The Global Biopesticides and Biofertilizers Market Size is expected to grow from USD 8.2 Billion in 2024 to USD 24.7 Billion by 2035, at a CAGR of 10.54% during the forecast period 2025-2035

-

3.Which region holds the largest share of the biopesticides and biofertilizers market?North America is anticipated to hold the largest share of the biopesticides and biofertilizers market over the predicted timeframe.

-

4.Who are the top 10 companies operating in the global biopesticides and biofertilizers market?Bayer CropScience, BASF SE, Syngenta AG, Novozymes A/S, UPL Limited, Marrone Bio Innovations, Koppert Biological Systems, Certis USA, Rizobacter Argentina S.A., T. Stanes & Company Ltd., Others.

-

5.What are the market trends in the biopesticides and biofertilizers market?The biopesticides and biofertilizers market's key trends are characterized by an increase in the demand for organic farming, technological innovations in bioformulations, more government support, sustainable agriculture adoption, and a rise in awareness of chemical-free crop protection methods

Need help to buy this report?