Global Biological Implants Market Size, Share, and COVID-19 Impact Analysis, By Product (Autografts, Allografts, and Xenografts), By Application (Cardiovascular Implants, Orthopedic Implants, and Other Soft Tissue Implants), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035.

Industry: HealthcareGlobal Biological Implants Market Insights Forecasts to 2035

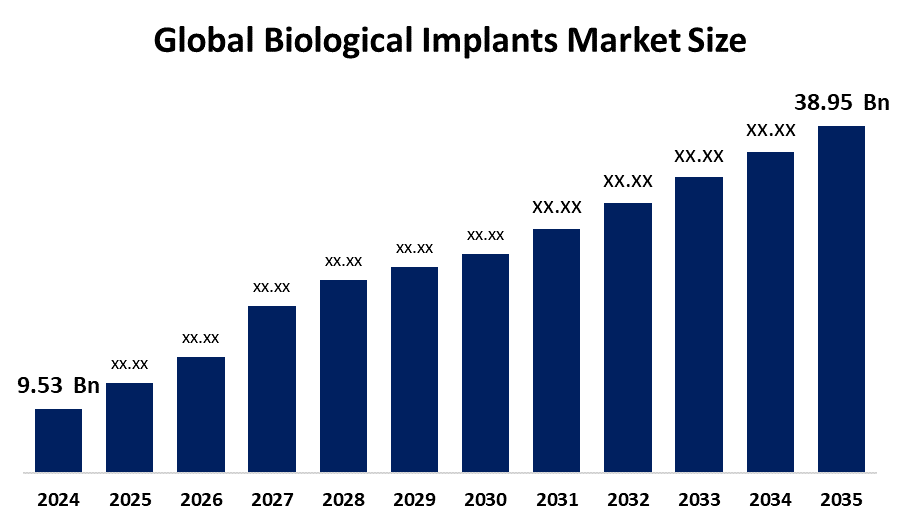

- The Global Biological Implants Market Size Was Estimated at USD 9.53 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 13.65 % from 2025 to 2035

- The Worldwide Biological Implants Market Size is Expected to Reach USD 38.95 Billion by 2035

- Asia Pacific is expected to grow the fastest during the forecast period.

Get more details on this report -

According to a research report published by Spherical Insights and Consulting, the global biological implants market size was worth around USD 9.53 billion in 2024 and is predicted to grow to around USD 38.95 billion by 2035 with a compound annual growth rate (CAGR) of 13.65 % from 2025 to 2035. The market for biological implants has a lot of opportunities driven by developments in regenerative medicine, rising orthopedic and cardiovascular implant demand, the incorporation of smart biomaterials, and developing applications in customized healthcare solutions.

Market Overview

The term biological implants market includes the activities of research, development, and manufacturing, as well as the marketing and selling of medical devices and materials that are meant to take over, assist, or improve the activities of sick or injured biological tissues and organs. The biological implants market includes medical devices that are made from biocompatible, biosynthetic materials like collagen, tissue-engineered scaffolds, and advanced polymers, which are created to replace, support, or augment damaged biological structures, in turn restoring the physiological functions in orthopedic, cardiovascular, dental, and neurological applications. The U.S. government launched key regulatory initiatives as the FDA launched Breakthrough Device Designation for Bioretec’s magnesium-based RemeOs™ DrillPin, while CMS launched expanded Medicare coverage for 66 skin substitute products, effective January 2026. Developments in the field of regenerative medicine, which focus on a range of therapeutic approaches like using bio-based materials and biologics to target the underlying cause of an illness, have spurred a new trend that has led to an increase in the adoption of these products, which is one of the key factors driving the biological implants market growth.

Report Coverage

This research report categorizes the biological implants market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the biological implants market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyzes their core competencies in each sub-segment of the biological implants market.

Biological Implants Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 9.53 Billion |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | CAGR of 13.65% |

| 2035 Value Projection: | USD 9.53 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 103 |

| Segments covered: | By Application, By Region |

| Companies covered:: | ATEC Spine, Inc, AbbVie Inc., Artivion, Inc, Auto Tissue Berlin GmbH, BioPolymer GmbH & Co KG, BioTissue, Baxter, CONMED Corporation, Edwards Lifesciences Corporation, Implandata Ophthalmic Products GmbH, Integra LifeSciences, Johnson & Johnson Private Limited, LifeCell International Pvt. Ltd., Maxigen Biotech Inc., and Others Players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The aging of the world's population, which necessitates more restorative operations, as well as the rising incidence of chronic illnesses, including osteoarthritis and cardiovascular disorders, are the main factors driving the biological implants market's growth. The soft tissue grafts are used in numerous complicated operations, like breast, thoracic, and abdominal wall reconstructions. In order to maintain, enhance, or replace a biological structure that is absent or damaged, tissues or devices known as bioimplants are placed into the human body. One of these reasons is the development of "Technological Advancements in Biomaterials and Manufacturing" and the factor of "Increasing Incidence of Chronic and Degenerative Conditions." These elements work together to drive market growth.

Restraining Factors

The market for biological implants is hampered by a number of problems, including high product costs, strict regulatory approvals, the possibility of implant rejection or complications, restricted reimbursement in some areas, and technological complexity.

Market Segmentation

The biological implants market share is classified into product and application.

- The xenografts segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the product, the biological implants market is divided into autografts, allografts, and xenografts. Among these, the xenografts segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. Transplants of living cells, tissues, or organs from one species to a different one, for example, from animals to humans, are known as xenografts. The field of xenotransplantation is expected to expand due to the numerous advances and discoveries in genetic engineering, as well as a greater understanding of cross-species incompatibilities.

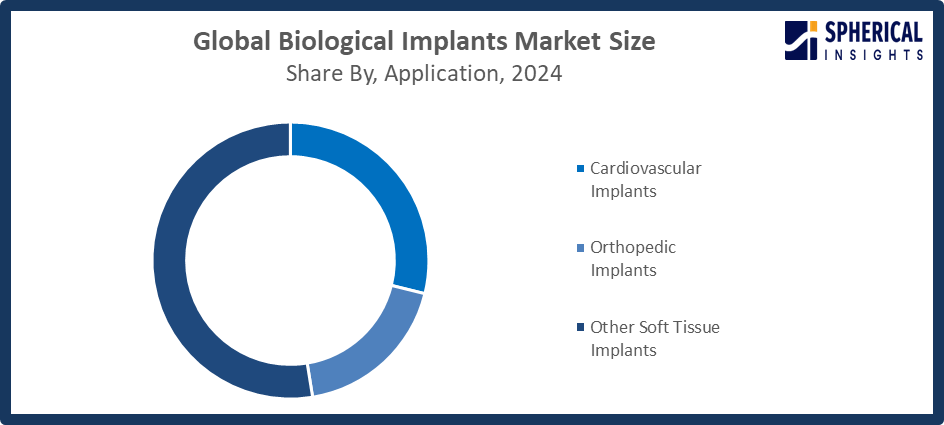

- The soft tissue implants segment accounted for the highest market revenue in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the application, the biological implants market is divided into cardiovascular implants, orthopedic implants, and other soft tissue implants. Among these, the soft tissue implants segment accounted for the highest market revenue in 2024 and is anticipated to grow at a significant CAGR during the forecast period. Soft tissue biological implants are used in many different medical procedures to replace or repair lost or damaged soft tissue in the body. Compared to synthetic materials, soft tissue biological implants are more biocompatible with the recipient's body.

Get more details on this report -

Regional Segment Analysis of the Biological Implants Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the biological implants market over the predicted timeframe.

North America is anticipated to hold the largest share of the biological implants market over the predicted timeframe. The region is expected to hold a significant portion of the market due to the growing incidence of chronic illnesses; the availability of better healthcare infrastructure is the primary factor driving this growth. The region benefits from an aging population with growing orthopedic, cardiovascular, and dental healthcare needs, as well as a well-established regulatory framework and extensive expertise in regenerative medicine. A favorable regulatory framework, supported by agencies such as the U.S. Food and Drug Administration (FDA), ensures product safety and efficacy, strengthening market confidence and fostering innovation. In July 2025, top US medical technology companies unveiled prototypes of AI-integrated bionic limbs to enhance personalized mobility and remote supervision.

Get more details on this report -

Asia Pacific is expected to grow at a rapid CAGR in the biological implants market during the forecast period. Asia Pacific is rising as a result of the region's expanding population, which has led to an alarming number of traffic accidents and an increase in the prevalence of orthopedic ailments, among other things. Market acceptance is being accelerated by favorable government initiatives, increased availability of new implants, and growing awareness of improved treatment choices. In addition to the Production Linked Incentive program, which allots Rs 3,420 crore until 2027, the Indian government launched a Rs 500 crore MedTech initiative in November 2024 to support domestic manufacturing and international exports.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the biological implants market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- ATEC Spine, Inc

- AbbVie Inc.

- Artivion, Inc

- Auto Tissue Berlin GmbH

- BioPolymer GmbH & Co KG

- BioTissue

- Baxter

- CONMED Corporation

- Edwards Lifesciences Corporation

- Implandata Ophthalmic Products GmbH

- Integra LifeSciences

- Johnson & Johnson Private Limited

- LifeCell International Pvt. Ltd.

- Maxigen Biotech Inc.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In November 2025, MIT researchers launched a breakthrough in biological implants with microscopic wireless “circulartronics,” enabling noninvasive, self-implanting bioelectronic devices for treating neurological diseases, with human trials planned within three years.

- In March 2025, Medline UNITE launched a synthetic ligament augmentation implant for biological implants applications, enhancing tendon and ligament repair through open-weave, non-resorbable materials designed to promote tissue growth and improved outcomes in foot and ankle procedures.

- In August 2024, CollPlant Biotechnologies and Stratasys announced a pre-clinical study of 3D-bioprinted regenerative breast implants, leveraging rhCollagen bioinks to support natural tissue growth, vascularization, and gradual biodegradation for reconstructive and aesthetic biological implant applications.

- In June 2024, Bioretec Ltd. announced successful U.S. clinical outcomes for its biodegradable RemeOs™ trauma screw, demonstrating complete fracture healing, seamless surgical integration, and bone replacement without removal surgeries, advancing orthopedic biological implant solutions.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the biological implants market based on the below-mentioned segments:

Global Biological Implants Market, By Product

- Autografts

- Allografts

- Xenografts

Global Biological Implants Market, By Application

- Cardiovascular Implants

- Orthopedic Implants

- Other Soft Tissue Implants

Global Biological Implants Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the biological implants market over the forecast period?The global biological implants market is projected to expand at a CAGR of 13.65% during the forecast period.

-

2. What is the market size of the biological implants market?The global biological implants market size is expected to grow from USD 9.53 billion in 2024 to USD 38.95 billion by 2035, at a CAGR of 13.65 % during the forecast period 2025-2035.

-

3. Which region holds the largest share of the biological implants market?North America is anticipated to hold the largest share of the Biological Implants market over the predicted timeframe.

-

4. Who are the top 10 companies operating in the global biological implants market?ATEC Spine, Inc., AbbVie Inc., Artivion, Inc., Auto Tissue Berlin GmbH, BioPolymer GmbH & Co KG, BioTissue, Baxter, CONMED Corporation, Edwards Lifesciences Corporation, Implandata Ophthalmic Products GmbH, Integra LifeSciences, Johnson & Johnson Private Limited, LifeCell International Pvt. Ltd., Maxigen Biotech Inc., and Others.

-

5. What factors are driving the growth of the biological implants market?Growing chronic illnesses, an aging population, improvements in biomaterials, an increase in surgical procedures, and a growing need for minimally invasive and regenerative therapy options are all factors driving the biological implants industry.

-

6. What are the market trends in the biological implants market?Adoption of bioresorbable implants, developments in tissue engineering, growing usage of 3D printing technology, customized implant solutions, and growing applications in regenerative and reconstructive medicine are some trends.

-

7. What are the main challenges restricting the wider adoption of the biological implants market?High implant costs, strict regulations, the possibility of implant rejection or problems, restricted reimbursement coverage, and technological complexity impeding broad clinical use are some of the main challenges.

Need help to buy this report?