Global Biocatalysis and Biocatalyst Market Size, Share, and COVID-19 Impact Analysis, By Type (Hydrolases, Oxidoreductases, and Transferases), By Application (Biofuel, Biopharmaceuticals, Detergents, and Food and Beverages), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: Chemicals & MaterialsGlobal Biocatalysis and Biocatalyst Market Insights Forecasts to 2035

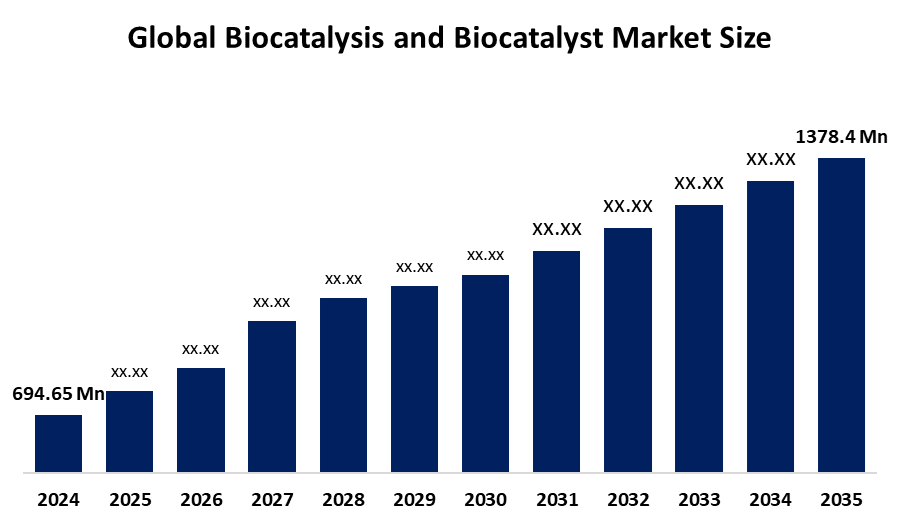

- The Global Biocatalysis and Biocatalyst Market Size Was Estimated at USD 694.65 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 6.43 % from 2025 to 2035

- The Worldwide Biocatalysis and Biocatalyst Market Size is Expected to Reach USD 1378.4 Million by 2035

- Asia Pacific is expected to grow the fastest during the forecast period.

Get more details on this report -

According to a research report published by Spherical Insights and Consulting, the global biocatalysis and biocatalyst market size was worth around USD 694.65 million in 2024 and is predicted to grow to around USD 1378.4 million by 2035 with a compound annual growth rate (CAGR) of 6.43 % from 2025 to 2035. Opportunities for sustainable production, less environmental impact, improved process efficiency, economical synthesis, growing pharmaceutical applications, and innovation in green chemistry-driven industrial transformations for manufacturing are all provided by biocatalysis and the biocatalyst market.

Market Overview

Biocatalysis is defined as the process by which biological catalysts, like isolated enzymes, whole cells, or microbial systems, are used to accelerate and control chemical reactions under mild, eco-friendly conditions. It can be said to be a more refined and efficient way of conducting reactions, that sometimes, even though it has excellent specificity, lower energy consumption, and fewer by-products formed, it takes the lead over the traditional chemical methods. Biocatalysis is one of the most common practices in pharmaceuticals, fine chemicals, and food technology, and it is also used in biofuels and environmental applications, thus contributing to sustainability and cost-efficient manufacturing. For Instance, in November 2024, AI-integrated platforms, Ecovyst, introduced their AlphaCat® silica for scalable biocatalysis. These advancements strengthen biocatalysis's role in promoting fair, effective, and environmentally sustainable production systems by hastening industry adoption. With the growing tendency in the food, chemical, and pharmaceutical industries toward more sustainable and ecologically friendly manufacturing practices, the market for biocatalysis and biocatalysts is progressively expanding. Further supporting market expansion are advancements in enzyme engineering and recombinant DNA technologies, which have expanded the variety and efficiency of biocatalysts for industrial applications.

Report Coverage

This research report categorizes the biocatalysis and biocatalyst market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the biocatalysis and biocatalyst market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyzes their core competencies in each sub-segment of the biocatalysis and biocatalyst market.

Global Biocatalysis and Biocatalyst Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 694.65 Million |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | CAGR of 6.43% |

| 2035 Value Projection: | USD 1378.4 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 105 |

| Segments covered: | By Type |

| Companies covered:: | AB Enzymes, BASF SE, Codexis Inc., DuPont de Nemours Inc., Dyadic International Inc., DSM, Lonza Group Ltd., Novozymes A/S, Sapporo Enzyme Co. Ltd., Soufflet Group, Others, and other players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The government policies that are supportive and the investments in green chemistry that are growing are also the factors that are driving the demand in the biocatalysis and biocatalyst market. Consumers are increasingly conscious, and there are global initiatives promoting the use of sustainable practices, which are the most important reason for the biocatalysis market to supply eco-friendly solutions in the desired amount. Biocatalysis and biocatalysts are increasingly accepted in the pharmaceutical, chemical, and food and beverage sectors due to the rising need for sustainable and efficient manufacturing processes. The market is driven by demand for green chemistry solutions, regulatory pressures to cut down on emissions, and constant improvements in enzyme engineering and bioprocessing techniques.

Restraining Factors

The rapid adoption and commercial scalability of biocatalytic solutions across various industries is restricted by a number of factors, including high development costs, limited stability of specific enzymes, technical difficulties in large-scale implementation, reliance on intricate optimization procedures, and limited substrate compatibility.

Market Segmentation

The Biocatalysis and Biocatalyst market share is classified into type and application.

- The hydrolases segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the type, the biocatalysis and biocatalyst market is divided into hydrolases, oxidoreductases, and transferases. Among these, the hydrolases segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The hydrolases segment includes the breakage of ester, peptide, and glycosidic bonds, which are essential for bioprocessing and chemical synthesis. Hydrolases are useful in the manufacturing of medicines, detergents, and biofuels due to their wide substrate specificity and gentle operating conditions.

- The biofuel segment accounted for the highest market revenue in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the application, the biocatalysis and biocatalyst market is divided into biofuel, biopharmaceuticals, detergents, and food and beverages. Among these, the biofuel segment accounted for the highest market revenue in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The increasing focus on renewable energy and the application of biocatalysts to improve fuel conversion efficiency are driving the biofuel market. Higher yield and purity bioethanol, biodiesel, and biogas can be produced from biomass by selective hydrolysis and transesterification reactions made available by enzyme-based technologies.

Get more details on this report -

Regional Segment Analysis of the Biocatalysis and Biocatalyst Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the biocatalysis and biocatalyst market over the predicted timeframe.

North America is anticipated to hold the largest share of the biocatalysis and biocatalyst market over the predicted timeframe. The manufacturers of chemicals, pharmaceuticals, and enzymes that actively incorporate biocatalytic processes into production systems are concentrated in the North America region. The market is further enhanced by supportive regulatory frameworks that encourage low-emission and sustainable manufacturing practices. A variety of strategies are responsible for the widespread application of biocatalysis and biocatalysts in the US. The strong biotechnology industry encourages research and innovation, which propels the use of biocatalysts across a range of industries. The U.S. Department of Energy's AI-driven biotechnology platform, which was presented at Pacific Northwest National Laboratory in December 2025, is one example of a government launch that allots funds for independent biological discovery to improve national energy security and innovation.

Get more details on this report -

Asia Pacific is expected to grow at a rapid CAGR in the biocatalysis and biocatalyst market during the forecast period. Growing industrialization, growing government support for biotechnology developments, and growing demand for sustainable manufacturing are the main drivers of the Asia Pacific area. Enzyme production, bioprocess development, and large-scale biomanufacturing infrastructure are receiving substantial investments from nations including China, India, Japan, and South Korea. The usage of biocatalyst in a variety of applications is further fueled by government initiatives that support sustainable practices and green technologies. Enzyme diffusion and single-atom catalysis breakthroughs for industrial scalability are encouraged by government initiatives, including China's 2025 biotechnology sustainability goals and the Asia-Pacific Congress on Catalysis held in December 2025.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the biocatalysis and biocatalyst market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- AB Enzymes

- BASF SE

- Codexis Inc.

- DuPont de Nemours Inc.

- Dyadic International Inc.

- DSM

- Lonza Group Ltd.

- Novozymes A/S

- Sapporo Enzyme Co. Ltd.

- Soufflet Group

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In November 2025, Innovate UK launched the Biomedical Catalyst 2025, offering £25 million for SME-led enzyme therapeutics R&D, while Microvi’s DOE-supported biocatalysis project advances biogas-to-chemicals conversion and sustainable waste valorization.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the biocatalysis and biocatalyst market based on the below-mentioned segments:

Global Biocatalysis and Biocatalyst Market, By Type

- Hydrolases

- Oxidoreductases

- Transferases

Global Biocatalysis and Biocatalyst Market, By Application

- Biofuel

- Biopharmaceuticals

- Detergents

- Food and Beverages

Global Biocatalysis and Biocatalyst Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the biocatalysis and biocatalyst market over the forecast period?The global biocatalysis and biocatalyst market is projected to expand at a CAGR of 6.43% during the forecast period.

-

2. What is the market size of the biocatalysis and biocatalyst market?The global biocatalysis and biocatalyst market size is expected to grow from USD 694.65 million in 2024 to USD 1378.4 million by 2035, at a CAGR of 6.43 % during the forecast period 2025-2035.

-

3. Which region holds the largest share of the biocatalysis and biocatalyst market?North America is anticipated to hold the largest share of the biocatalysis and biocatalyst market over the predicted timeframe.

-

4. Who are the top 10 companies operating in the global biocatalysis and biocatalyst market?AB Enzymes, BASF SE, Codexis Inc., DuPont de Nemours Inc., Dyadic International Inc., DSM, Lonza Group Ltd., Novozymes A/S, Sapporo Enzyme Co. Ltd., Soufflet Group, and Others.

-

5. What factors are driving the growth of the biocatalysis and biocatalyst market?The rising use of economical, environmentally friendly biocatalytic processes, rising pharmaceutical and chemical applications, improvements in enzyme engineering, regulatory support for green chemistry, and growing demand for sustainable production

-

6. What are the market trends in the biocatalysis and biocatalyst market?Integration of AI and computational enzyme design, expansion in pharmaceuticals and specialty chemicals, scalable industrial biocatalysis, emphasis on eco-friendly production, and strategic collaborations between biotechnology firms and manufacturers.

-

7. What are the main challenges restricting the wider adoption of the biocatalysis and biocatalyst market?High development and production costs, enzyme instability under industrial conditions, scale-up complexities, limited substrate compatibility, and technical difficulties in integrating biocatalysts into existing manufacturing processes

Need help to buy this report?