Global Biobanking Market Size, Share, and COVID-19 Impact Analysis, By Sample Storage (Blood, Cells & Tissue, Others), By Application (Regenerative Medicines, Life Sciences, Others), By Settings (Academic Medical Institutes, Pharmaceutical & Biotechnology Companies) and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2022 – 2032

Industry: HealthcareGlobal Biobanking Market Insights Forecasts to 2032

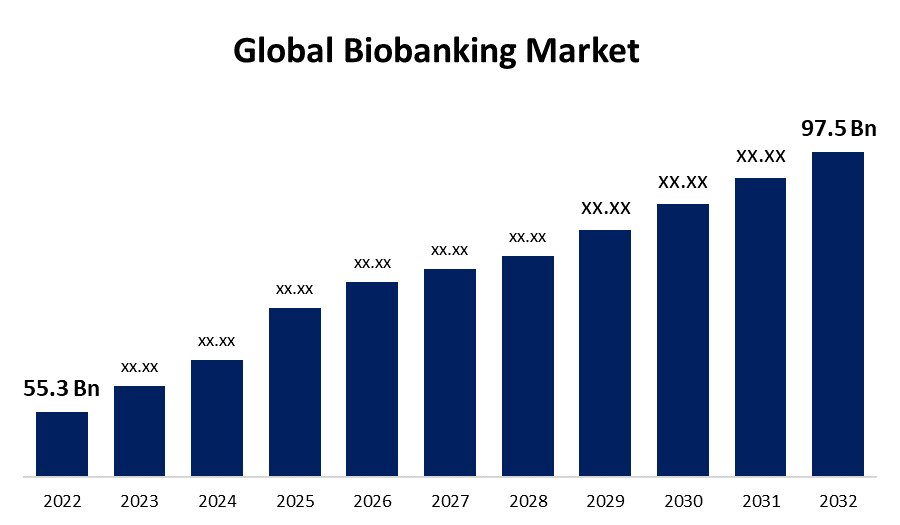

- The Global Biobanking Market Size was valued at USD 55.3 Billion in 2022.

- The Market Size is Growing at a CAGR of 5.8% from 2022 to 2032

- The Worldwide Biobanking Market Size is Expected To Reach USD 97.5 Billion by 2032

- North America is Expected To Grow the fastest during the forecast period

Get more details on this report -

The Global Biobanking Market Size is Expected To Reach USD 97.5 Billion by 2032, at a CAGR of 5.8% during the forecast period 2022 to 2032.

The biobanking market is an advanced market structure that uses technology to maintain and collect biological data, samples, and materials for future use. They also collect information about various diseases, try to find a cure and study the effects of multiple conditions. The growing number of applications for biobank samples has increased demand for biobanking equipment, resulting in market expansion during the forecast period. Moreover, the incorporation of advanced technologies, data analytics, and automation has transformed traditional biobanks into virtual biobanks, creating a transformative opportunity for the market. Globally, several types of biobanks are contributing to biobanking market growth, including disease-oriented biobanks, population-based biobanks, tissue banks, and blood banks. Growing investments in drug development, as well as the rising prevalence of catastrophic illnesses such as cancer, respiratory diseases, Alzheimer's disease, and others, are driving the growth of biobanking market.

Global Biobanking Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022: | USD 55.3 Billion |

| Forecast Period: | 2022-2032 |

| Forecast Period CAGR 2022-2032 : | 5.8% |

| 2032 Value Projection: | USD 97.5 Billion |

| Historical Data for: | 2018-2021 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Sample Storage, By Application, By Settings, By Region, and COVID-19 Impact Analysis. |

| Companies covered:: | UK Biobank, ProMedDx, IBBL, ASKION, Thermo Fisher Scientific Inc., Medizinische Universität Graz, Shanghai Zhangjiang Biobank, Isenet Biobanking, Hamilton Company, Brooks Life Sciences, QIAGEN N.V., ASKION GmbH, PHC Holdings Corporation, Ziath Ltd., Azenta, Inc., and Other Key Vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Biobanking provides a facility to conserve cord blood stem cells to proliferate market potential. Cord blood is the blood that remains in a baby's umbilical cord after birth. It is the most abundant source of stem cells for clinical research that is conserved and processed. Cord blood conservation is in high demand in the field of biobanking, which will likely increase the biobanking market potential during the forecast period. Furthermore, the introduction of cord blood stem cell biobanking is significantly driving the biobanking market. Additionally, there is a launch of software for virtual biobanking to fuel biobanking market growth. This market has experienced a rapid evolution during the forecast period. The integration of advanced technologies with the biobanking system is the primary market driver at the moment. Virtual biobanking is currently revolutionizing the biobanking system by reducing time constraints and allowing researchers to conduct research more smoothly. Virtual biobanking is helping biobanks increase revenue, thereby increasing market’s value and propelling biobanking market growth.

Restraining Factors

The high cost of automated equipment is expected to limit market growth. An automated storage system requires a significant initial investment. Additionally, to the initial investment, ongoing maintenance and operational costs, such as software updates, repairs, and training, must be considered. Moreover, patient misconceptions about biobanking can have an impact on market growth. These variables are likely to have an impact on the biobanking market overall value over the forecast period.

Market Segmentation

By Sample Storage Insights

The blood segment is expected to hold the largest share of the global biobanking market during the forecast period.

Based on the sample storage, the global biobanking market is classified into blood, cells & tissue, and others. Among these, the blood segment is expected to hold the largest share of the biobanking market during the forecast period. Blood sample collection, storage, and distribution are growing mainly in developing countries due to an increase in the number of infectious diseases and demand for curative measures. Blood samples are important biological samples because they contain DNA and RNA, both of which are used in research. As a result, blood samples are mostly requested at the biobank by pharmaceutical companies and academic medical institutions.

By Application Insights

The life science segment is witnessing significant CAGR growth over the forecast period.

Based on the application, the biobanking market is segmented into regenerative medicines, life sciences, and others. Among these, the life science segment is dominating the market with the largest revenue share over the forecast period. The dominance is attributed to an increase in the supply of sample distribution to academic institutions and pharmaceutical R&D for clinical applications. Scientists are facing pressure due to the increasing prevalence of complex diseases and the need for curative measures. Further, the regenerative medicine segment is expected to expand at a faster CAGR during the forecast period. Furthermore, research and pharmaceutical companies across the world have joined forces to conduct clinical trials of regenerative medicines for a wide range of applications.

By Settings Insights

The academic medical institute segment is witnessing significant CAGR growth over the forecast period.

Based on the settings, the biobanking market is segmented into academic medical institutes, and pharmaceutical & biotechnology companies. Among these, the academic medical institutes segment is dominating the market with the largest revenue share over the forecast period. The dominance is attributed to factors such as increased R&D investments and a growing requirement for multiple samples to carry out research activities. The increasing number of cases of cancer, Alzheimer's disease, and other diseases necessitates more curative measures, which encourages research. As a result, medical institutions' establishment of biobanks has aided in the generation of higher market value. As a result of the adoption of advanced technologies and the establishment of biobanks, biobanks at pharmaceutical and biotechnology companies have a significant market share.

Regional Insights

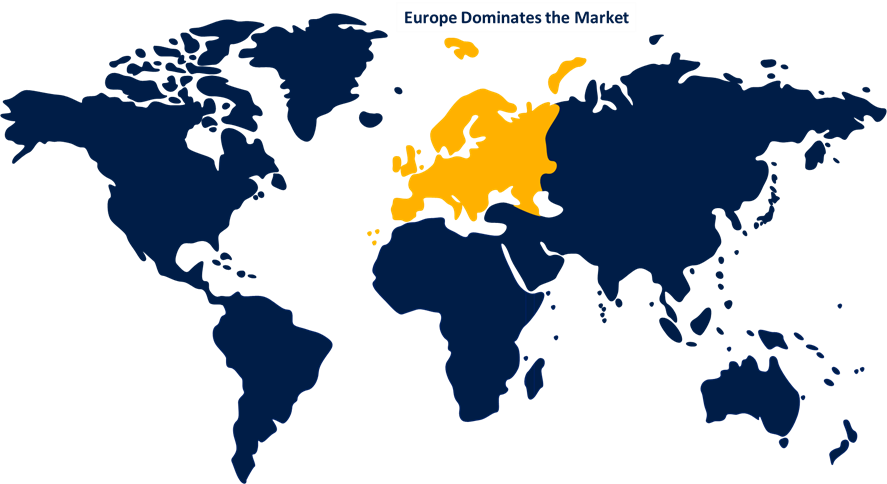

Europe dominates the market with the largest market share over the forecast period.

Get more details on this report -

Europe is dominating the market share over the forecast period. The presence of well-established biobanks in Nordic countries such as Sweden, Norway, Denmark, and others is attributed to this dominance. According to an article published in Global Engage, a producer of conferences and summits for the Life Science and pharmaceutical sectors, more than 40% of Iceland's population has contributed DNA, which is safely and privately stored in biobanks. Such contributions, as well as an increasing supply of samples, are increasing the market size of the European biobank market. Furthermore, European pharmaceuticals' ongoing R&D efforts are one of the factors contributing to the region's growth during the forecast period.

The North America market is expected to grow at the fastest rate during the forecast period, because of the numerous clinical trials conducted by research institutions and pharmaceutical companies. Additionally, the growing use of virtual biobanks enabled by technological advances expanded the biobanking market in North America. Moreover, there is a widespread acceptance of storing specimens such as cord blood in the United States. Furthermore, increased public awareness of the benefits of biobanking and increased R&D investments in stem cell research drive the growth of companies that provide cord blood preservation services, which in turn drives the growth of the biobanking market.

List of Key Market Players

- UK Biobank

- ProMedDx

- IBBL

- ASKION

- Thermo Fisher Scientific Inc.

- Medizinische Universität Graz

- Shanghai Zhangjiang Biobank

- Isenet Biobanking

- Hamilton Company

- Brooks Life Sciences

- QIAGEN N.V.

- ASKION GmbH

- PHC Holdings Corporation

- Ziath Ltd.

- Azenta, Inc.

Key Market Developments

- In May 2022, Phenomix Sciences (Phenomix) began its Biobanking registry and results investigation. The registry will assess variability in obesity treatment response by collecting patients' DNA, hormones, metabolomics, and behavioral assessments regarding treatment outcomes. The Phenomix Sciences Obesity Platform contains 20 billion unique data points, which will be enhanced by the collected data.

- In March 2021, The United Kingdom Biobank announced the addition of new data to their database from a study that measures a variety of circulation metabolomics biomarkers. Nightingale Health, a Finnish company specializing in blood biomarker technology, conducted the trials with 120,000 participants.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2022 to 2032. Spherical Insights has segmented the global biobanking market based on the below-mentioned segments:

Biobanking Market, Sample Storage Analysis

- Blood

- Cells & Tissue

- Others

Biobanking Market, Application Analysis

- Regenerative Medicines

- Life Sciences

- Others

Biobanking Market, Settings Analysis

- Academic Medical Institutes

- Pharmaceutical & Biotechnology Companies

Biobanking Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the biobanking market over the forecast period?The biobanking market is projected to expand at a CAGR of 5.8% during the forecast period.

-

2. What is the projected market size & growth rate of the biobanking market?The biobanking market was valued at USD 55.3 Billion in 2022 and is projected to reach USD 97.5 Billion by 2032, growing at a CAGR of 5.8% from 2022 to 2032.

-

3. Which region is expected to hold the highest share in the biobanking market?The Europe region is expected to hold the highest share of the biobanking market.

Need help to buy this report?