Global Bio-LNG Market Size, Share, and COVID-19 Impact Analysis, By Source Type (Organic Household Waste, Organic Industrial Waste, and Municipal Waste), By Application (Transportation Fuel, Power Generation, and Others), and by Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035.

Industry: Consumer GoodsGlobal Bio-LNG Market Insights Forecasts to 2035

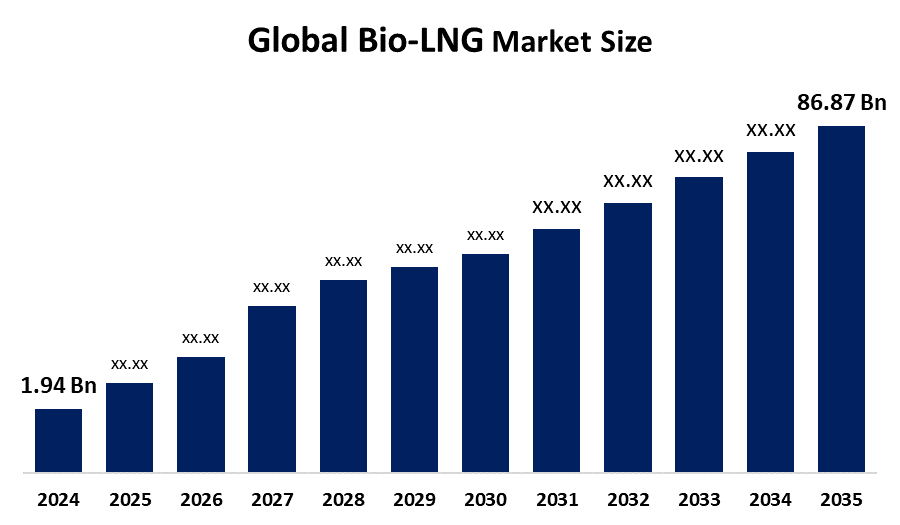

- The Global Bio-LNG Market Size Was Estimated at USD 1.94 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 41.29 % from 2025 to 2035

- The Worldwide Bio-LNG Market Size is Expected to Reach USD 86.87 Billion by 2035

- North America is expected to grow the fastest during the forecast period.

Get more details on this report -

According to a research report published by Spherical Insights and Consulting, The Global bio-LNG Market Size Was Worth Around USD 1.94 Billion In 2024 And Is Predicted To Grow To Around USD 86.87 Billion By 2035 With a Compound Annual Growth Rate (CAGR) of 41.29% from 2025 to 2035. The bio-LNG market offers opportunities driven by decarbonization goals, rising demand for renewable transport fuels, waste-to-energy projects, government incentives, and expansion of LNG infrastructure worldwide.

Market Overview

Bio-LNG (biomethane liquefied natural gas) is a renewable fuel produced by upgrading biogas from agricultural waste, food waste, and municipal solid waste and then liquefying it for storage and transport. The market is gaining traction due to strong driving factors such as decarbonization targets, rising demand for sustainable fuels in heavy-duty transport, and the need to reduce reliance on fossil fuels. Supportive government initiatives, including renewable energy mandates, tax incentives, carbon credit schemes, and funding for waste-to-energy projects, are accelerating adoption. Regions such as Europe and Asia Pacific are actively promoting bio-LNG for trucks and maritime applications. Recent developments include new bio-LNG production plants, expanded refueling infrastructure, and partnerships between energy companies and logistics operators.

Report Coverage

This research report categorizes the Bio-LNG Market Size based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the bio-LNG market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyzes their core competencies in each sub-segment of the bio-LNG market.

Global Bio-LNG Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 1.94 Billion |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | CAGR of 41.29% |

| 2035 Value Projection: | USD 86.87 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 90 |

| Segments covered: | By Product Type, By Application |

| Companies covered:: | Linde plc Nordsol Flogas Britain Ltd. MEGA a.s. AXEGAZ T&T TotalEnergies Titan LNG DBG Group B.V. BoxLNG Pvt. Ltd. Shell Plc And Other Key players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The growth of the Bio-LNG Market Size is driven by increasing focus on reducing greenhouse gas emissions, especially in heavy-duty transportation and shipping. Rising adoption of circular economy practices, utilization of organic waste, and energy security concerns further support market expansion. Favorable government policies, renewable fuel mandates, carbon reduction targets, and financial incentives encourage investment in bio-LNG production and infrastructure. Additionally, advancements in biogas upgrading and liquefaction technologies are improving efficiency and scalability.

Restraining Factors

High initial capital investment, limited bio-LNG production capacity, inadequate refueling infrastructure, feedstock supply challenges, and complex regulatory approvals restrain widespread adoption and slow market growth.

Market Segmentation

The bio-LNG market share is classified into source type and application.

- The organic household waste segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the source type, the Bio-LNG Market Size is divided into organic household waste, organic industrial waste, and municipal waste. Among these, the organic household waste segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. Organic household waste leads due to its continuous availability, lower collection costs, and high biodegradability, enabling efficient biogas production. Meanwhile, municipal waste is projected to grow rapidly as governments strengthen waste management systems, promote waste-to-energy projects, and invest in large-scale bio-LNG plants to support circular economy goals.

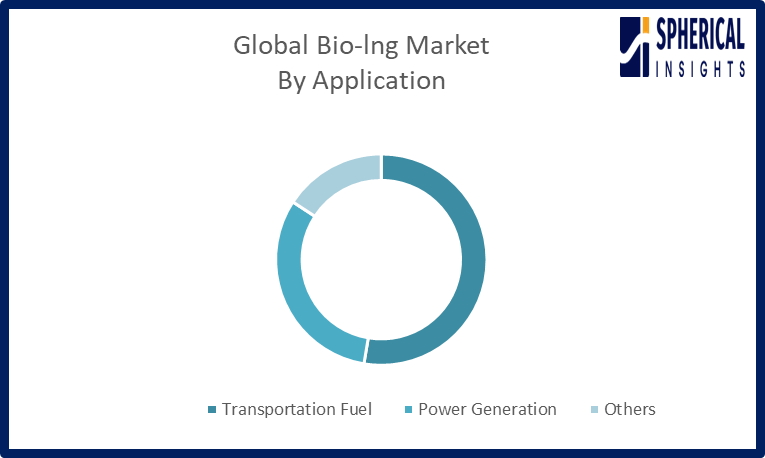

- The transportation fuel segment accounted for the highest market revenue in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the application, the Bio-LNG Market Size is divided into transportation fuel, power generation, and others. Among these, the transportation fuel segment accounted for the highest market revenue in 2024 and is anticipated to grow at a significant CAGR during the forecast period. This dominance is driven by the increasing use of bio-LNG as a clean, low-carbon alternative for heavy-duty vehicles, trucks, buses, and maritime transport, supported by stringent emission regulations and expanding refueling infrastructure.

Get more details on this report -

Regional Segment Analysis of the Bio-LNG Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Europe is anticipated to hold the largest share of the bio-LNG market over the predicted timeframe.

Europe is anticipated to hold the largest share of the Bio-LNG Market Size over the predicted timeframe. Europe is expected to dominate the bio-LNG market due to stringent carbon emission regulations, strong renewable energy targets, and advanced waste-to-energy infrastructure. Supportive government incentives, widespread adoption of bio-LNG in heavy-duty transport, and early investments by energy companies further strengthen regional market leadership.

Get more details on this report -

North America is expected to grow at a rapid CAGR in the bio-LNG market during the forecast period. North America is projected to grow at a rapid CAGR in the bio-LNG market due to rising investments in renewable natural gas projects, increasing demand for low-carbon transportation fuels, and supportive federal and state policies. Expanding waste-to-energy initiatives, fleet decarbonization goals, and growing bio-LNG infrastructure further drive market growth.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the bio-LNG market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Linde plc

- Nordsol

- Flogas Britain Ltd.

- MEGA a.s.

- AXEGAZ T&T

- TotalEnergies

- Titan LNG

- DBG Group B.V.

- BoxLNG Pvt. Ltd.

- Shell Plc

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the bio-LNG market based on the below-mentioned segments:

Global Bio-LNG Market, By Source Type

- Organic Household Waste

- Organic Industrial Waste

- Municipal Waste

Global Bio-LNG Market, By Application

- Transportation Fuel

- Power Generation

- Others

Global Bio-LNG Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the bio-LNG market over the forecast period?The global bio-LNG market is projected to expand at a CAGR of 41.29% during the forecast period.

-

2. What is the market size of the bio-LNG market?The global bio-LNG market size is expected to grow from USD 1.94 billion in 2024 to USD 86.87 billion by 2035, at a CAGR of 41.29 % during the forecast period 2025-2035

-

3. Which region holds the largest share of the bio-LNG market?Asia Pacific is anticipated to hold the largest share of the bio-LNG market over the predicted timeframe

-

4. Who are the top 10 companies operating in the global bio-LNG market?Linde plc, Nordsol, Flogas Britain Ltd., MEGA a.s., AXEGAZ T&T, TotalEnergies, Titan LNG, DBG Group B.V., BoxLNG Pvt. Ltd., and Shell Plc.

-

5. What factors are driving the growth of the bio-LNG market?Growth is driven by decarbonization goals, renewable fuel mandates, waste-to-energy adoption, demand for clean transport fuels, and supportive government incentives.

-

6. What are the market trends in the bio-LNG market?Key trends include expanding refueling infrastructure, modular liquefaction plants, fleet bio-LNG adoption, public-private partnerships, and increased waste feedstock utilization

-

7. What are the main challenges restricting the wider adoption of the bio-LNG market?High capital costs, limited production capacity, feedstock availability issues, inadequate refueling infrastructure, regulatory complexity, and slow commercialization restrict wider bio-LNG adoption.

Need help to buy this report?