Global Biceps Tenodesis Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Suture Anchors, Interference Screws, Cortical Buttons, and Others), By Material (Bioabsorbable, Non-Absorbable, Metallic, and Others), By End User (Hospitals, Ambulatory Surgical Centers, Specialty Clinics, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: HealthcareGlobal Biceps Tenodesis Market Insights Forecasts to 2035

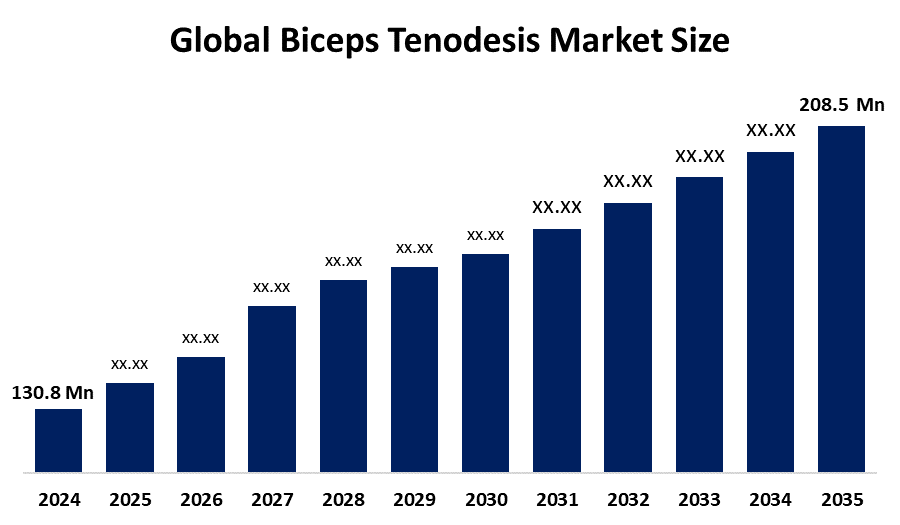

- The Global Biceps Tenodesis Market Size Was Estimated at USD 130.8 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 4.33% from 2025 to 2035

- The Worldwide Biceps Tenodesis Market Size is Expected to Reach USD 208.5 Million by 2035

- Asia Pacific is expected to grow the fastest during the forecast period.

Get more details on this report -

According to a research report published by Spherical Insights and Consulting, the global biceps tenodesis market size was worth around USD 130.8 million in 2024 and is predicted to grow to around USD 208.5 million by 2035 with a compound annual growth rate (CAGR) of 4.33% from 2025 and 2035. The market for biceps tenodesis has a number of opportunities to grow due to sports & overuse injuries, increasing elderly population, and a shift towards less invasive arthroscopic procedures.

Market Overview

The global biceps tenodesis industry is the market for surgical products and procedures that reattach or torn or damaged long head of the biceps tendon to the humerus bone. Biceps tenodesis refers to the treatment of biceps tendon tears caused by injury or overuse, as well as SLAP tears in the labrum, which is a cartilage lining the part of the shoulder joint. The procedure is recommended for people with biceps tendonitis who experience shoulder pain caused by inflammation that has not improved through nonsurgical treatment, as well as for people who need to regain strength and mobility in the shoulder after a biceps tendon tear.

Innovation and market expansion are anticipated as a result of major players' growing research activity for evaluating the biceps tenodesis for determining the suitable fixation site. The emergence of new techniques like the use of needle arthroscopy for managing biceps tenodesis, anticipated to drive a huge surge in the global biceps tenodesis market.

Report Coverage

This research report categorizes the biceps tenodesis market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Biceps Tenodesis market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the biceps tenodesis market.

Driving Factors

The market demand for biceps tenodesis is significantly driven by the prevalence of sports-related injuries and the increasing ageing population. For instance, as per the statistics from a 2019 prospective study on sports-related injury in a cohort of adolescent athletes, the average injury rate was 2.64 per 1000h while the percentage of injured subjects in 2019 was 40.4%. Further, biceps tenodesis is the preferred choice over tenotomy for patients older than 55 years with biceps tendinopathies to the same degree as young patients.

Restraining Factors

The biceps tenodesis market is restricted by the strict regulatory landscape involving the US Food and Drug Administration, the European Medicines Agency, and other regional authorities for biceps tenodesis devices. Further, the data privacy concerns and talent shortages in orthopedic surgery are challenging the biceps tenodesis market.

Market Segmentation

The biceps tenodesis market share is classified into product type, material, and end user.

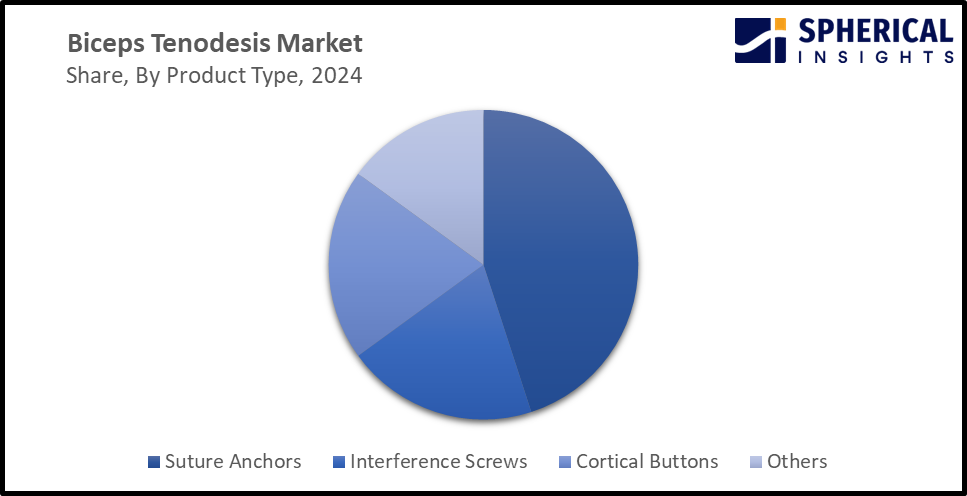

- The suture anchors segment dominated the market with the largest market revenue share of nearly 40-70% in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based on the product type, the biceps tenodesis market is divided into suture anchors, interference screws, cortical buttons, and others. Among these, the suture anchors segment dominated the market with the largest market revenue share of nearly 40-70% in 2024 and is projected to grow at a substantial CAGR during the forecast period. In the procedure, suture anchors are inserted through the subclavian portal, then through the biceps tendon, and into the bone. The increased popularity of suture anchor in arthroscopy treatments, owing to their superior strength, is contributing to driving the segmental market growth.

Get more details on this report -

- The bioabsorbable segment accounted for a significant market share of about 20-40% in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the material, the biceps tenodesis market is divided into bioabsorbable, non-absorbable, metallic, and others. Among these, the bioabsorbable segment accounted for a significant market share of about 20-40% in 2024 and is anticipated to grow at a significant CAGR during the forecast period. Using bioabsorbable screw fixation, arthroscopic biceps tenodesis is possible, giving good clinical results in cases of isolated pathologic biceps tendon or a cuff tear. Use of bioabsorbable materials reduces the risk of postoperative complications and promotes natural healing.

- The hospitals segment accounted for the largest market revenue share of nearly 55% in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the end user, the biceps tenodesis market is divided into hospitals, ambulatory surgical centers, specialty clinics, and others. Among these, the hospitals segment accounted for the largest market revenue share of nearly 55% in 2024 and is anticipated to grow at a significant CAGR during the forecast period. Biceps tenodesis procedure carried out as a part of other surgeries, like shoulder surgery, or purely performed for addressing a disorder in the biceps tendon. The strong preferences and perceptions for biceps tenodesis, along with a substantial uptick in consumption in the hospitals sector, are propelling the segmental market growth.

Regional Segment Analysis of the Biceps Tenodesis Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the biceps tenodesis market over the predicted timeframe.

North America is anticipated to hold the largest share about 40-50% in the biceps tenodesis market over the predicted timeframe. The market ecosystem in North America is strong due to the presence of orthopaedic startups. The market for biceps tenodesis has been driven by the region's increasing demand for advanced healthcare services and well-established healthcare infrastructure. The U.S. is dominating the North America biceps tenodesis market, accounting for about 90% share during the projected period, driven by an increasing geriatric population, minimally invasive procedures, and tendon related injuries in sports & other events.

Asia Pacific is expected to grow at a rapid CAGR ranging from 9-10% in the biceps tenodesis market during the forecast period. The Asia Pacific area has a thriving market for biceps tenodesis due to its rapid urbanization, healthcare infrastructure, and increasing disposable income. Furthermore, the growth of healthcare infrastructure and new technology penetration is contributing to propel the biceps tenodesis market. China is dominating the Asia Pacific biceps tenodesis market, in terms of revenue, owing to the increasing ageing population and government initiatives supporting local medical device manufacturing.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the biceps tenodesis market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Arthrex, Inc.

- Smith & Nephew plc

- Stryker Corporation

- Johnson & Johnson (DePuy Synthes)

- Zimmer Biomet Holdings, Inc.

- Conmed Corporation

- Medtronic plc

- B. Braun Melsungen AG

- Parcus Medical, LLC

- Orthomed S.A.S.

- Wright Medical Group N.V.

- Biotek (Chetan Meditech Pvt. Ltd.)

- Karl Storz SE & Co. KG

- Integra LifeSciences Holdings Corporation

- Teknimed S.A.S.

- Linvatec Corporation

- Tulpar Medical Solutions

- GPC Medical Ltd.

- Shandong Weigao Group Medical Polymer Co., Ltd.

- Smiths Medical (ICU Medical, Inc.)

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In September 2023, Acuitive Technologies, Inc. announced the FDA 510(k) Clearance of CITRELOCK DUO Fixation Device for biceps tenodesis. The new fixation device provides surgeons with a differentiated design via a tendon-friendly spiral thread featuring a next-generation resorbable technology, known as CITREGEN, that has unique molecular and mechanical properties for orthopedic surgical applications.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the biceps tenodesis market based on the below-mentioned segments:

Global Biceps Tenodesis Market, By Product Type

- Suture Anchors

- Interference Screws

- Cortical Buttons

- Others

Global Biceps Tenodesis Market, By Material

- Bioabsorbable

- Non-Absorbable

- Metallic

- Others

Global Biceps Tenodesis Market, By End User

- Hospitals

- Ambulatory Surgical Centers

- Specialty Clinics

- Others

Global Biceps Tenodesis Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the market size of the biceps tenodesis market?The global biceps tenodesis market size is expected to grow from USD 130.8 Million in 2024 to USD 208.5 Million by 2035, at a CAGR of 4.33% during the forecast period 2025-2035.

-

2. Which region holds the largest share of the biceps tenodesis market?North America is anticipated to hold the largest share of the biceps tenodesis market over the predicted timeframe.

-

3. What is the forecasted CAGR of the Global Biceps tenodesis Market from 2024 to 2035?The market is expected to grow at a CAGR of around 4.33% during the period 2024–2035.

-

4. Who are the top companies operating in the Global Biceps tenodesis Market?Key players include Arthrex, Inc., Smith & Nephew plc, Stryker Corporation, Johnson & Johnson (DePuy Synthes), Zimmer Biomet Holdings, Inc., Conmed Corporation, Medtronic plc, B. Braun Melsungen AG, Parcus Medical, LLC, Orthomed S.A.S., Wright Medical Group N.V., Biotek (Chetan Meditech Pvt. Ltd.), Karl Storz SE & Co. KG, Integra LifeSciences Holdings Corporation, Teknimed S.A.S., Linvatec Corporation, Tulpar Medical Solutions, GPC Medical Ltd., Shandong Weigao Group Medical Polymer Co., Ltd., and Smiths Medical (ICU Medical, Inc.).

-

5. Can you provide company profiles for the leading biceps tenodesis manufacturers?Yes. For example, Arthrex, Inc. is a global medical device company and leader in new product development and medical education in orthopedics and has pioneered the field of arthroscopy and developed more than 1,000 innovative products and surgical procedures each year to advance minimally invasive orthopedics worldwide. Smith & Nephew plc is a British multinational medical equipment manufacturing company headquartered in Watford, England, and is an international producer of advanced wound management products, arthroscopy products, trauma and clinical therapy products, and orthopaedic reconstruction products.

-

6. What are the main drivers of growth in the biceps tenodesis market?The prevalence of sports-related injuries and the increasing ageing population are major market growth drivers of the biceps tenodesis market.

-

7. What challenges are limiting the biceps tenodesis market?strict regulatory landscape, data privacy concerns, and talent shortage remain key restraints in the biceps tenodesis market.

Need help to buy this report?