Global Benzene Market Size, Share, and COVID-19 Impact Analysis, By Production Process (Catalytic Reforming, Steam Cracking, and Others), By End User (Ethyl Benzene, Alkyl Benzene, Cumene, Cyclohexane, Nitrobenzene, and Others), and by Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: Chemicals & MaterialsGlobal Benzene Market Insights Forecasts to 2035

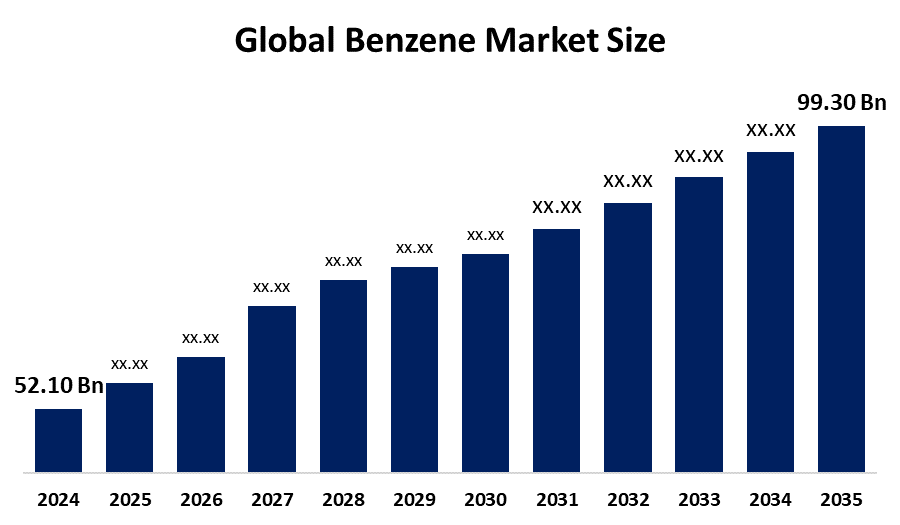

- The Global Benzene Market Size Was Estimated at USD 52.10 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 6.04% from 2025 to 2035

- The Worldwide Benzene Market Size is Expected to Reach USD 99.30 Billion by 2035

- North America is expected to grow the fastest during the forecast period.

Get more details on this report -

According to a research report published by Spherical Insights and Consulting, The Global Benzene Market Size was worth around USD 52.10 Billion in 2024, Growing to USD 55.28 Billion in 2025, and is predicted to grow to around USD 99.30 Billion by 2035 with a compound annual growth rate (CAGR) of 6.04% from 2025 to 2035. The benzene market has several opportunities, such as the growing demand for benzene derivatives in developing nations, improvements in production technology, growth in the construction and automotive industries, and the creation of sustainable substitutes to satisfy changing legal and environmental requirements.

Global Benzene Market Forecast and Revenue Size

- 2024 Market Size: USD 52.10 Billion

- 2025 Market Size: USD 55.28 Billion

- 2035 Projected Market Size: USD 99.30 Billion

- CAGR (2025-2035): 6.04%

- Asia Pacific: Largest market in 2024

- North America: Fastest growing market

Key Market Insights

- Asia Pacific is expected to account for the largest share in the benzene market during the forecast period.

- In terms of production process, the catalytic reforming segment is projected to lead the benzene market throughout the forecast period

- In terms of end user, the ethyl benzene segment captured the largest portion of the market

Benzene Market Growth Factors

- Growing Interest in Products Made of Styrene: The demand for benzene-derived styrene is driven by the growing usage of polystyrene in consumer electronics, building, and packaging.

- Growth in the Automotive Industry: The market is expanding due to the use of benzene derivatives in automotive parts, such as nylon and synthetic rubber.

- Improvement of the Petrochemical Industry: Benzene production and consumption rise as a result of expanding petrochemical facilities, particularly in China and India.

- Growing Demand for Consumer Products: Benzene is utilized in the production of resins, plastics, and detergents, all of which are extensively utilized in consumer products.

Report Coverage

This research report categorizes the benzene market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyzes the key growth drivers, opportunities, and challenges influencing the benzene market. Recent market developments and competitive strategies, such as expansion, type launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyzes their core competencies in each sub-segment of the benzene market.

Global Benzene Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 52.10 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 6.04% |

| 2035 Value Projection: | USD 99.30 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 245 |

| Tables, Charts & Figures: | 121 |

| Segments covered: | By Production Process, By End User and by Region |

| Companies covered:: | Dow, BASF SE, LG Chem, INEOS Group, Royal Dutch Shell Plc, Reliance Industries Limited, China Petrochemical Corporation, Marathon Petroleum Corporation, LyondellBasell Industries Holdings B.V., Chevron Phillips Chemical Company LLC, Others, and |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving factors:

The demand for benzene is rising as a result of the growing demand for cars in many nations. The growing demand for benzene in the chemical and automotive industries is driving the expansion of the benzene market, highlighting its vital position in the manufacturing of numerous necessary products. The growing demand for benzene in the region is being driven by the expansion of the petrochemical industry in the United States and North America, as well as the availability of crude oil. The demand for benzene is anticipated to be bolstered by the continuous developments in automotive technology, especially in the areas of electric vehicles and lightweight materials.

Restraining Factor:

The benzene market is restricted by strict environmental laws, health worries about its carcinogenic properties, fluctuations in the price of crude oil, and growing consumer preference for bio-based substitutes. These variables taken together restrict benzene's production, range of applications, and long-term viability.

Market Segmentation

The global benzene market is divided into production process and end user.

Global Benzene Market, By Production Process:

What is the primary feedstock used in the catalytic reforming process for benzene production?

The catalytic reforming segment led the benzene market, generating the largest revenue share. The catalytic reforming segment is ascribed to the growing use of low-octane straight-run naphtha that contains naphthenes for the generation of high-octane aromatic benzene and low-sulfur fuel used in gasoline. Furthermore, hydrogen produced by catalytic reforming is utilized by hydroprocessing facilities to create clean fuels.

The steam cracking segment in the benzene market is expected to grow at the fastest CAGR over the forecast period. Naphtha or gas oil fraction, along with certain hydrocarbons like butane and propane, are utilized as feedstocks for steam cracking. It creates a greater variety of products and eliminates the need for the costly distillation procedure.

Global Benzene Market, By End User:

What is the primary function of ethyl benzene in the chemical industry?

The ethyl benzene segment held the largest market share in the benzene market. The crucial function of ethyl benzene as a main intermediary in the synthesis of styrene is reflected in this segment. Styrene is widely utilized in the production of polystyrene plastics, synthetic rubber, and resins, which are used in a wide range of industries, including consumer products, automotive, packaging, and construction.

The cumene segment in the Benzene market is expected to grow at the fastest CAGR over the forecast period. The growing demand for phenol and acetone, two important cumene derivatives, is the main factor propelling the cumene market. Plastics, adhesives, and coatings are all made with phenol, and the chemical and pharmaceutical industries use acetone as a solvent.

Regional Segment Analysis of the Global Benzene Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia Pacific Benzene Market Trends

Get more details on this report -

Where are the major benzene production facilities located within the Asia Pacific region?

Asia Pacific can be ascribed to the region's growing end-use industries, including the chemical, packaging, automotive, and pharmaceutical sectors. Growing petrochemical infrastructure, fast industrialization, and robust end-use industry demand are driving the Asia Pacific benzene market. Large-scale production facilities and sophisticated downstream processing skills enable nations like China, India, South Korea, and Japan to make significant contributions. In 2021, the Asia Pacific chemical industry contributed 7% of the world's GDP and around 45% of all chemical manufacturing worldwide, according to the International Institute for Sustainable Development (IISD).

What products are contributing to the increased use of benzene in China's building and automotive sectors?

The growing use of benzene in building and automotive items such as paints, flooring, fiberglass, adhesives, tires, and more is the cause of the rise in demand and imports in China. The vast petrochemical industry in China and the strong demand from downstream industries are the main drivers of the market. Ethylbenzene, cumene, and other derivatives used in rubber, plastics, resins, and synthetic fibers are all made from benzene, which is a crucial feedstock.

What are the primary derivatives synthesized from benzene in Japan?

The main use of Japan benzene is in the synthesis of derivatives such as cyclohexane, cumene, and styrene, which are necessary for the creation of synthetic fibers, resins, and plastics. The construction, electronics, and automotive industries are the main drivers of demand. Market stability is aided by Japan's emphasis on innovation, energy efficiency, and superior industrial techniques.

North America Benzene Market Trends

Who are the major contributors to the expansion of petrochemical infrastructure in North America?

The growth in North America is a result of the growing petrochemical, pharmaceutical, and packaging sectors, which are the product's main end customers. The region of North America benefits from growing investments in refining and chemical production capabilities, technical innovation, and sophisticated petrochemical infrastructure. In September 2025, Mexico's Petróleos Mexicanos (Pemex) announced its Petrochemical Boost Plan, which focuses on expanding Veracruz to increase benzene-linked production by 20% by 2028 in line with the country's energy self-sufficiency objectives.

Which benzene derivatives are driving market growth in the United States?

The United States takes the lead due to its large supplies of shale gas, which offer inexpensive feedstock. The market is growing as a result of the growing usage of benzene derivatives, such as cumene and styrene, in the manufacturing of synthetic fibers, resins, and plastics. The U.S. Department of Health & Human Services reports that benzene is one of the top 20 chemicals produced in the nation and is utilized extensively.

What role does the petrochemical industry play in the growth of Canada's benzene market?

The Canadian benzene market is expanding steadily thanks to the nation's established petrochemical industry and rising demand from end-use sectors like packaging, building, and automobiles. The main application for benzene is the synthesis of derivatives such as cyclohexane, cumene, and styrene, which are necessary for the production of synthetic fibers, resins, and plastics.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global benzene market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Worldwide Top Key Players in The Benzene Market Include

- Dow

- BASF SE

- LG Chem

- INEOS Group

- Royal Dutch Shell Plc

- Reliance Industries Limited

- China Petrochemical Corporation

- Marathon Petroleum Corporation

- LyondellBasell Industries Holdings B.V.

- Chevron Phillips Chemical Company LLC

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent development

- In July 2025, the Dalian Commodity Exchange officially announced benzene futures and options. At 9:00 am, benzene futures trading started, and at 9:00 pm, options trading followed. On the first trading day, four futures contracts were introduced: BZ2603, BZ2604, BZ2605, and BZ2606.

- In June 2024, A long-term supply deal for chemically recycled circular benzene made from post-consumer end-of-life plastics was announced by BASF and Encina Development Group, LLC (Encina), a producer of ISCC PLUS certified circular chemicals. As BASF incorporates more chemically recycled, circular-based raw materials into its production processes, the collaboration represents a turning point in sustainable procurement. The chemically recycled benzene will be used by BASF for its extensive line of Ccycled products.

- In October 2023, CPC, the top petrochemical business in Taiwan, has announced a tender for the purchase of 6,300 metric tons of benzene, with delivery scheduled for December. A defined delivery timetable is in place, and the overall shipment volume is established at a significant 30,000 metric tons. The first part, which makes up half of the overall volume, will be delivered in the first half of December, and the rest will be shipped in the second half of the same month.

- In January 2023, Reliance Industries collaborated with the multinational chemical corporation BASF to transform the Indian market by producing superior benzene products. The goal of this strategic alliance is to create cutting-edge benzene-based solutions that will increase productivity and reduce the effects on the environment.

Market Segment

This study forecasts revenue at the global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the benzene market based on the following segments:

Global Benzene Market, By Production Process

- Catalytic Reforming

- Steam cracking

- Others

Global Benzene Market, By End User

- Ethyl Benzene

- Alkyl Benzene

- Cumene

- Cyclohexane

- Nitrobenzene

- Others

Global Benzene Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the benzene market over the forecast period?The global benzene market is projected to expand at a CAGR of 6.04% during the forecast period.

-

2. What is the market size of the benzene market?The global benzene market size is expected to grow from USD 52.10 billion in 2024 to USD 99.30 billion by 2035, at a CAGR 6.04% of during the forecast period 2025-2035.

-

3. Which region holds the largest share of the benzene market?Asia Pacific is anticipated to hold the largest share of the benzene market over the predicted timeframe.

-

4. Who are the top companies operating in the global benzene market?Dow, BASF SE, LG Chem, INEOS Group, Royal Dutch Shell Plc, Reliance Industries Limited, China Petrochemical Corporation, Marathon Petroleum Corporation, LyondellBasell Industries Holdings B.V., Chevron Phillips Chemical Company LLC, and others.

-

5. What factors are driving the growth of the benzene market?The growth of the benzene market is driven by rising demand for derivatives, expanding end-use industries, industrialization in emerging economies, and advancements in petrochemical production technologies and infrastructure.

-

6. What are market trends in the benzene market?Growing investments in petrochemical capacity, a move toward integrated production facilities, an increase in demand from Asia-Pacific, and technological advancements for cleaner, more effective manufacturing methods are some of the major trends in the benzene market.

-

7. What are the main challenges restricting wider adoption of the Benzene market?Strict environmental laws, toxicity-related health risks, crude oil price volatility, and the growing demand for sustainable and bio-based chemical alternatives are the primary challenges limiting the benzene market.

Need help to buy this report?