Belgium Ethylene Vinyl Acetate Market Size, Share, By Form (Foams, Films, Emulsions, And Pellets), By Distribution Channel (Direct To Manufacturer, Specialized Industrial Distributors, And Online Network), And Belgium Ethylene Vinyl Acetate Market Size Insights, Industry Trend, Forecasts to 2035

Industry: Chemicals & MaterialsBelgium Ethylene Vinyl Acetate Market Size Insights Forecasts to 2035

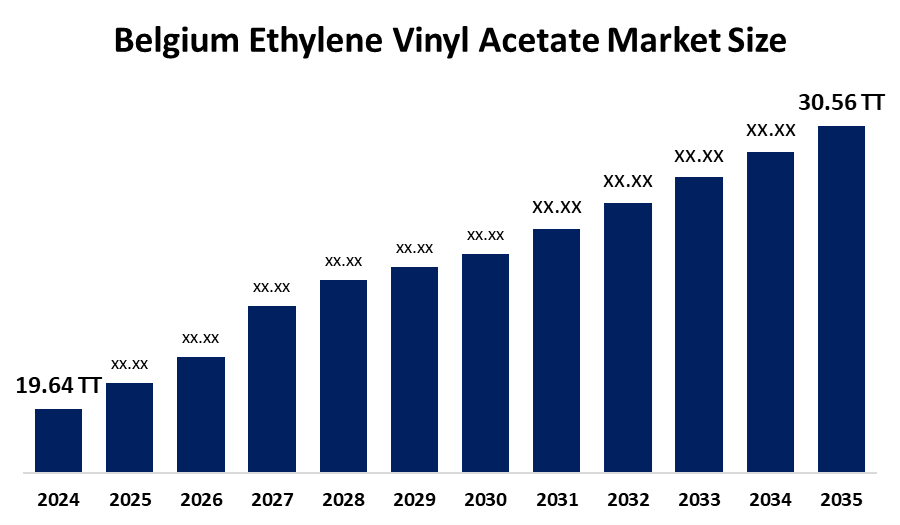

- Belgium Ethylene Vinyl Acetate Market Size 2024: 19.64 Thousand Tonnes

- Belgium Ethylene Vinyl Acetate Market Size 2035: 30.56 Thousand Tonnes

- Belgium Ethylene Vinyl Acetate Market Size CAGR 2024: 4.1%

- Belgium Ethylene Vinyl Acetate Market Size Segments: Form and Distribution Channel

Get more details on this report -

The Belgium Ethylene Vinyl Acetate Market Size includes the production, import, distribution, and use of EVA copolymers in the Belgian economy. EVA is a copolymer of ethylene and vinyl acetate that has excellent flexibility, toughness, and adhesion properties, as well as resistance to ultraviolet rays and other environmental stresses. This combination makes EVA very well suited for use in numerous applications such as packaging films, adhesives, foams, and encapsulants for solar photovoltaic modules. In addition to growing demand in the packaging and industrial sectors, demand for EVA in these applications is largely attributed to increased use in renewable energy markets, specifically solar power in Belgium.

The ethylene vinyl acetate in Belgium are backed by government support, including the Belgian energy policy and related funding schemes have led to rapid growth in solar installations, making PV a significant driver of EVA encapsulation demand. According to the International Energy Agency’s PVPS National Survey Report, Belgium reached around 11.7 GW of cumulative solar PV capacity by the end of 2024, making solar an increasingly important part of the national energy mix and contributing to over 10% of total electricity consumption that indirectly bolsters demand for EVA.

As technology advances, Belgium’s ethylene vinyl acetate providers are now using new types of EVA resin that are being used primarily to create products that meet different needs for the end-users. Many of these formulations have been developed based on the specific needs of the user including enhanced UV resistance, greater flexibility for use with footwear and flexible packaging, and increased durability for use in photovoltaic encapsulation. These production methods generally employ the most up to date extrusion, co-extrusion, and compounding technologies so that the products produced are more consistent and perform at a higher level and can better comply with the latest regulations related to reduce environmental impact and greater recyclability.

Belgium Ethylene Vinyl Acetate (EVA) Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | 19.64 Thousand Tonnes |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 4.1% |

| 2035 Value Projection: | 30.56 Thousand Tonnes |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 230 |

| Tables, Charts & Figures: | 115 |

| Segments covered: | By Form, By Distribution Channel |

| Companies covered:: | Dow Inc., ExxonMobil Corporation, LyondellBasell Industries, Arkema S.A., TP Polymer Private Limited, SABIC, LG Chem Ltd., Borealis AG, TotalEnergies, Solventis Ltd., Wacker Chemie AG, Indis NV, Chemieuro, and other key players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Market Dynamics of the Belgium Ethylene Vinyl Acetate Market Size:

The Belgium Ethylene Vinyl Acetate Market Size is driven by the growing solar photovoltaic installations, continued expansion, strong packaging industry demand, expansion of footwear and foam applications, rising preference for high-performance adhesives and sealants, ongoing innovation in EVA grades with improved UV resistance, elasticity, and durability, and supportive government policies promoting renewable energy and sustainability across industrial sectors in Belgium.

The Belgium Ethylene Vinyl Acetate Market Size is restrained by the fluctuating raw material costs, increased production costs and compress margins, intensifying environmental regulations around plastics and polymer waste, recycling and sustainability compliance measures, and competitive pressures from alternative materials.

The future of Belgium Ethylene Vinyl Acetate Market Size is bright and promising, with versatile opportunities emerging from the continuous trend towards energy transition and sustainability. The expansion of photovoltaic solar power capacity in both Belgium and Europe has created significant demand for high quality EVA encapsulants. EVA grades that are both recyclable and bio-based will find new opportunity to support the circular economy with medical devices and advanced construction materials, as EVA's properties can help in both of these areas. These innovative solutions will result in the growth of the EVA market in Belgium.

Market Segmentation

The Belgium Ethylene Vinyl Acetate Market Size share is classified into form and distribution channel.

By Form:

The Belgium Ethylene Vinyl Acetate Market Size is divided by form into foams, films, emulsions, and pellets. Among these, the films segment held the largest revenue market share in 2024 and is predicted to grow at a remarkable CAGR during the forecast period. Booming renewable energy sector for solar cell encapsulation, heavily used in flexible packaging, superior transparency, and high demand from pharmaceuticals with strong sealing properties all contribute to the films segment’s largest share and higher spending on ethylene vinyl acetate segment when compared to other form.

By Distribution Channel:

The Belgium Ethylene Vinyl Acetate Market Size is divided by distribution channel into direct to manufacturer, specialized industrial distributors, and online network. Among these, the direct to manufacturer segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. The direct to manufacturer segment dominates because of high need for localized logistics, technical support for diverse applications, enabling efficient supply chain solutions, and the capacity to handle smaller and varied orders in Belgium.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the Belgium Ethylene Vinyl Acetate Market Size, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in Belgium Ethylene Vinyl Acetate Market Size:

- Dow Inc.

- ExxonMobil Corporation

- LyondellBasell Industries

- Arkema S.A.

- TP Polymer Private Limited

- SABIC

- LG Chem Ltd.

- Borealis AG

- TotalEnergies

- Solventis Ltd.

- Wacker Chemie AG

- Indis NV

- Chemieuro

- Others

Recent Developments in Belgium Ethylene Vinyl Acetate Market Size:

In May 2025, Borealis launched a renewables-based EVA solution for footwear midsoles as part of its Bornewables portfolio. The product was manufactured from waste and residue streams, offered a 45% lower carbon footprint compared to fossil-based alternatives, aimed at high-performance and sustainable footwear, which is a key market in Europe including Belgium.

In September 2024, new ISCC PLUS-certified biomass EVA from partners like Dow-Mitsui became more available as a drop-in replacement for conventional EVA, supporting European manufacturers aimed for Scope 3 emission reductions.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the Belgium, regional, and country levels from 2020 to 2035. Spherical Innsights has segmented the Belgium Ethylene Vinyl Acetate Market Size based on the below-mentioned segments:

Belgium Ethylene Vinyl Acetate Market Size, By Form

- Foams

- Films

- Emulsions

- Pellets

Belgium Ethylene Vinyl Acetate Market Size, By Distribution Channel

- Direct to Manufacturer

- Specialized Industrial Distributors

- Online Network

Frequently Asked Questions (FAQ)

-

What is the Belgium Ethylene Vinyl Acetate Market Size?Belgium Ethylene Vinyl Acetate Market Size is expected to grow from 19.64 thousand tonnes in 2024 to 30.56 thousand tonnes by 2035, growing at a CAGR of 4.1% during the forecast period 2025-2035.

-

What are the key growth drivers of the market?Market growth is driven by the growing solar photovoltaic installations, continued expansion, strong packaging industry demand, expansion of footwear and foam applications, rising preference for high-performance adhesives and sealants, ongoing innovation in EVA grades with improved UV resistance, elasticity, and durability, and supportive government policies promoting renewable energy and sustainability across industrial sectors in Belgium.

-

What factors restrain the Belgium Ethylene Vinyl Acetate Market Size?Constraints include the fluctuating raw material costs, increased production costs and compress margins, intensifying environmental regulations around plastics and polymer waste, recycling and sustainability compliance measures, and competitive pressures from alternative materials.

-

How is the market segmented by form?The market is segmented into foams, films, emulsions, and pellets.

-

Who are the key players in the Belgium Ethylene Vinyl Acetate Market Size?Key companies include Dow Inc., ExxonMobil Corporation, LyondellBasell Industries, Arkema S.A., TP Polymer Private Limited, SABIC, LG Chem Ltd., Borealis AG, TotalEnergies, Solventis Ltd., Wacker Chemie AG, Indis NV, Chemieuro, and Others.

-

Who are the target audiences for this market report?The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Need help to buy this report?